Inflation eases to 3.9 percent in December | ABS-CBN

ADVERTISEMENT

Welcome, Kapamilya! We use cookies to improve your browsing experience. Continuing to use this site means you agree to our use of cookies. Tell me more!

Inflation eases to 3.9 percent in December

Inflation eases to 3.9 percent in December

ABS-CBN News

Published Jan 05, 2024 09:11 AM PHT

|

Updated Jan 05, 2024 05:44 PM PHT

But PSA notes rice prices rising faster

But PSA notes rice prices rising faster

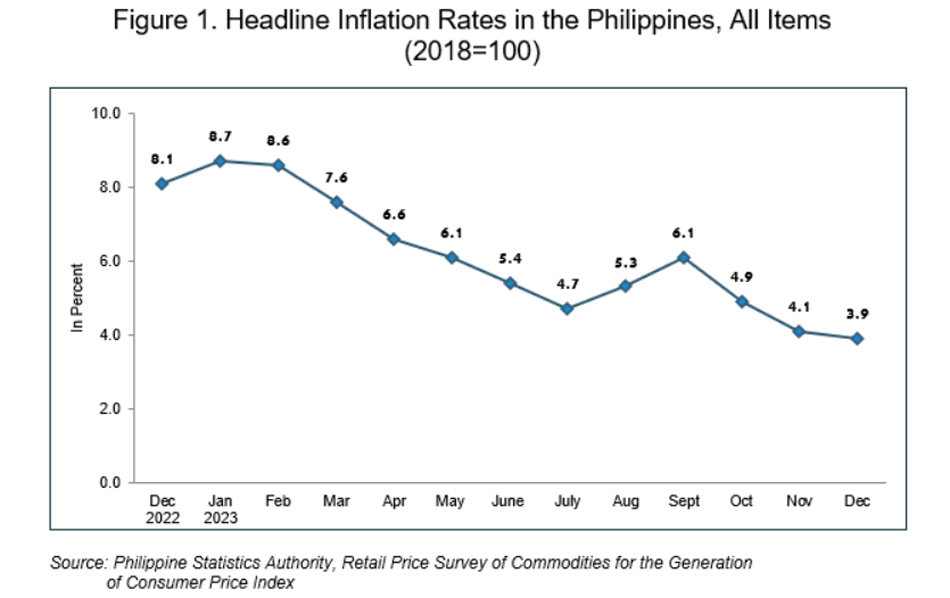

MANILA (UPDATE) — Inflation eased to 3.9 percent in December 2023, the state statistics bureau said on Friday.

MANILA (UPDATE) — Inflation eased to 3.9 percent in December 2023, the state statistics bureau said on Friday.

The Philippine Statistics Authority said this was slower than the 4.1 percent clip seen in November and was the lowest inflation rate in the past year.

The Philippine Statistics Authority said this was slower than the 4.1 percent clip seen in November and was the lowest inflation rate in the past year.

This also brought the average inflation for 2023 to 6 percent.

This also brought the average inflation for 2023 to 6 percent.

The figure was within the 3.6 to 4.4 percent range forecast by the Bangko Sentral ng Pilipinas, and was finally within the target range of 2 to 4 percent set by economic managers.

The figure was within the 3.6 to 4.4 percent range forecast by the Bangko Sentral ng Pilipinas, and was finally within the target range of 2 to 4 percent set by economic managers.

ADVERTISEMENT

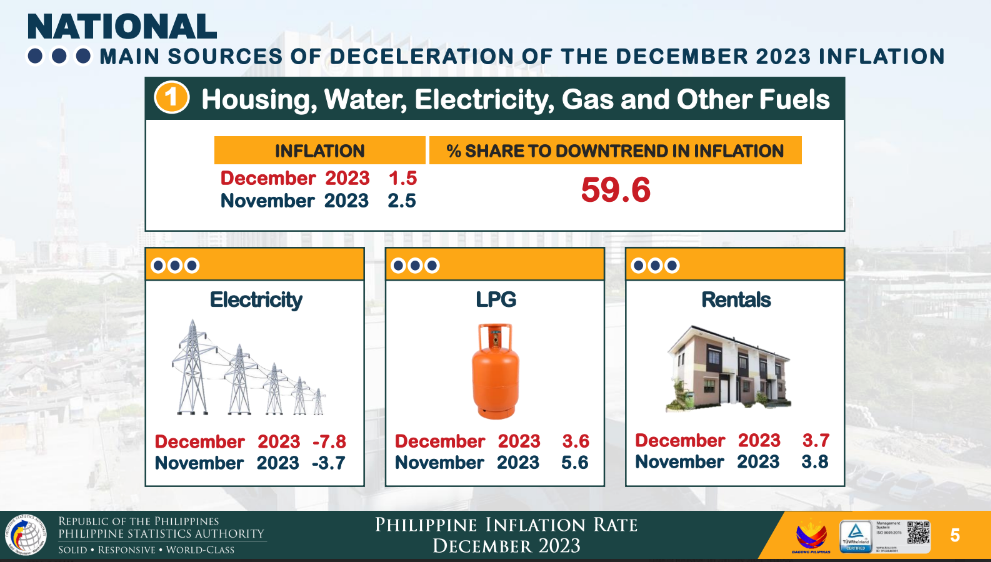

Inflation eased last month primarily due to the lower year-on-year growth in the index of housing, water, electricity, gas and other fuels, the PSA said.

Inflation eased last month primarily due to the lower year-on-year growth in the index of housing, water, electricity, gas and other fuels, the PSA said.

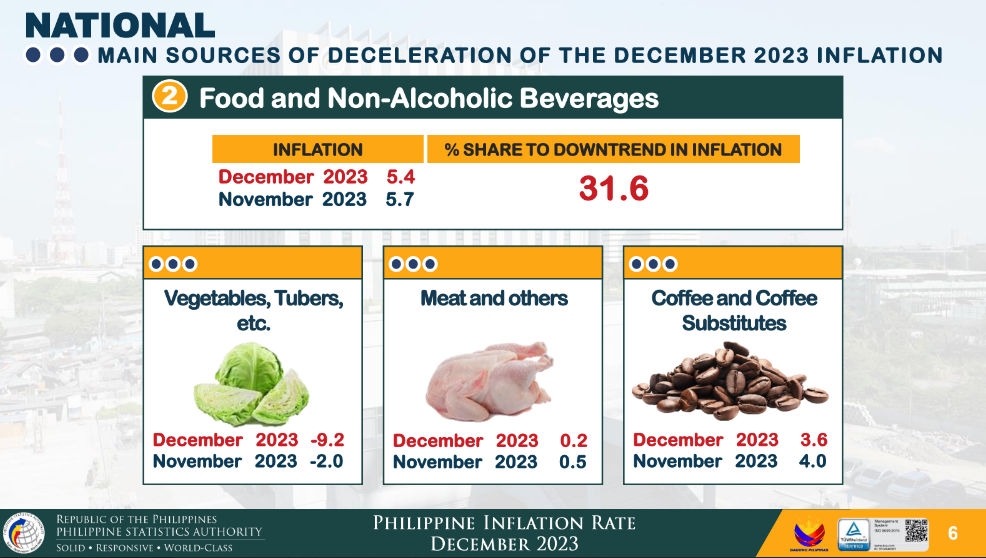

Food prices also increased at a slower rate in December at a 5.5 percent clip, compared to 5.8 percent in December and 10.6 percent in December 2022.

Food prices also increased at a slower rate in December at a 5.5 percent clip, compared to 5.8 percent in December and 10.6 percent in December 2022.

The PSA however also noted that “rice inflation increased further to 19.6 percent during the month from 15.8 percent in November 2023.”

The PSA however also noted that “rice inflation increased further to 19.6 percent during the month from 15.8 percent in November 2023.”

National Statistician Dennis Mapa said this is the highest monthly rice inflation recorded in the country since the 22.9 percent posted in March 2009.

National Statistician Dennis Mapa said this is the highest monthly rice inflation recorded in the country since the 22.9 percent posted in March 2009.

Mapa said that prices of regular milled rice averaged P48.50 nationwide in December, up from P46.73 in November.

Mapa said that prices of regular milled rice averaged P48.50 nationwide in December, up from P46.73 in November.

ADVERTISEMENT

Well-milled rice, meanwhile, was at P53.82, up from P51.99 a month prior.

Well-milled rice, meanwhile, was at P53.82, up from P51.99 a month prior.

The price of special rice was also up at P63.08 from P61.47 in November.

The price of special rice was also up at P63.08 from P61.47 in November.

The Department of Trade and Industry meanwhile noted the phenomenon of "shrinkflation" wherein the size or quantity of a product becomes smaller while the price remains the same.

The Department of Trade and Industry meanwhile noted the phenomenon of "shrinkflation" wherein the size or quantity of a product becomes smaller while the price remains the same.

Mapa acknowledged that base effects played a role in December's slower inflation numbers. He noted, however, that the prices of some commodities --like vegetables, oils and fats, and electricity-- did drop last month.

Mapa acknowledged that base effects played a role in December's slower inflation numbers. He noted, however, that the prices of some commodities --like vegetables, oils and fats, and electricity-- did drop last month.

"Malaki rin yung weight ng vegetables natin sa ating basket so negative siya which is good, at then yung electricity na negative din," he said.

"Malaki rin yung weight ng vegetables natin sa ating basket so negative siya which is good, at then yung electricity na negative din," he said.

ADVERTISEMENT

President Ferdinand Marcos Jr. said he is elated at the country's lower inflation numbers.

President Ferdinand Marcos Jr. said he is elated at the country's lower inflation numbers.

“Natutuwa akong ibalita na bumaba pa ang inflation rate sa bansa noong Disyembre 2023 sa 3.9 percent—ang pinakamababa noong nakaraang taon, mula sa 4.1 percent para sa Nobyembre 2023,” he said.

“Natutuwa akong ibalita na bumaba pa ang inflation rate sa bansa noong Disyembre 2023 sa 3.9 percent—ang pinakamababa noong nakaraang taon, mula sa 4.1 percent para sa Nobyembre 2023,” he said.

A survey by Pulse Asia in September showed that inflation was the most urgent concern of Filipinos.

A survey by Pulse Asia in September showed that inflation was the most urgent concern of Filipinos.

The PSA noted that inflation for the bottom 30 percent of Philippine households was at 5 percent in December.

The PSA noted that inflation for the bottom 30 percent of Philippine households was at 5 percent in December.

The statistics bureau said this is because food and non-alcoholic beverages prices went up 7.4 percent, while transportation costs went up by 1.5 percent for the said income group.

The statistics bureau said this is because food and non-alcoholic beverages prices went up 7.4 percent, while transportation costs went up by 1.5 percent for the said income group.

ADVERTISEMENT

Economic think-tank IBON Foundation said this means the government’s policies to address high inflation have not done much for the poorest Filipinos, who are burdened more with high prices.

Economic think-tank IBON Foundation said this means the government’s policies to address high inflation have not done much for the poorest Filipinos, who are burdened more with high prices.

National Economic and Development Authority (NEDA) Secretary Arsenio Balisacan said Executive Order No. 50, which extended the Most Favored Nation (MFN) reduced tariff rates for key agricultural commodities, remains important as rice prices soar.

National Economic and Development Authority (NEDA) Secretary Arsenio Balisacan said Executive Order No. 50, which extended the Most Favored Nation (MFN) reduced tariff rates for key agricultural commodities, remains important as rice prices soar.

"The Interagency Committee on Inflation and Market Outlook will closely monitor the situation and propose further temporary tariff adjustments if necessary," he said.

"The Interagency Committee on Inflation and Market Outlook will closely monitor the situation and propose further temporary tariff adjustments if necessary," he said.

Balisacan also noted that the panel will push for trade measures that will reduce non-tariff barriers.

Balisacan also noted that the panel will push for trade measures that will reduce non-tariff barriers.

The Bangko Sentral ng Pilipinas (BSP), meanwhile, noted that higher transport charges, electricity rates, oil prices, and higher food prices due to strong El Niño conditions may keep inflation up.

The Bangko Sentral ng Pilipinas (BSP), meanwhile, noted that higher transport charges, electricity rates, oil prices, and higher food prices due to strong El Niño conditions may keep inflation up.

ADVERTISEMENT

The central bank said the Monetary Board will keep monetary policy settings sufficiently tight until a sustained downtrend in inflation becomes evident.

The central bank said the Monetary Board will keep monetary policy settings sufficiently tight until a sustained downtrend in inflation becomes evident.

The BSP kept the country’s benchmark target reverse repurchase rate (RRP) steady at 6.5 percent in their December meeting.

The BSP kept the country’s benchmark target reverse repurchase rate (RRP) steady at 6.5 percent in their December meeting.

BSP Governor Eli Remolona Jr. has said interest rates are unlikely to be cut while inflation remains above the target range.

BSP Governor Eli Remolona Jr. has said interest rates are unlikely to be cut while inflation remains above the target range.

Professor Ramon Clarete of the University of the Philippines School of Economics said the low December inflation print isn't yet a stable sign that inflation is on a downtrend.

Professor Ramon Clarete of the University of the Philippines School of Economics said the low December inflation print isn't yet a stable sign that inflation is on a downtrend.

"It is not yet a stable forecast because of the developments, just now for example there is this fear for a wider war in the Middle East.," he said.

"It is not yet a stable forecast because of the developments, just now for example there is this fear for a wider war in the Middle East.," he said.

ADVERTISEMENT

"So that one actually is a risk that we will be grappling with over the next few months."

"So that one actually is a risk that we will be grappling with over the next few months."

He noted, however, that he is optimistic about food prices being manageable for 2024.

He noted, however, that he is optimistic about food prices being manageable for 2024.

"I am actually optimistic for the rest of the items because the food price inflation that we went through, a year, 2 years ago after the COVID, I think the logistics situation has improved a lot. And even productivity is increasing," he said.

"I am actually optimistic for the rest of the items because the food price inflation that we went through, a year, 2 years ago after the COVID, I think the logistics situation has improved a lot. And even productivity is increasing," he said.

Clarete, however, said he thinks there has been a mismatch of approaches in containing inflation in the last 2 years.

Clarete, however, said he thinks there has been a mismatch of approaches in containing inflation in the last 2 years.

"For me the major reason for that is not so much management of aggregate supply and demand that the Monetary Board usually will address. I think it’s more, and I think the BSP knows this, that we had some problems on food supply and logistics, and that needs to be addressed," he said.

"For me the major reason for that is not so much management of aggregate supply and demand that the Monetary Board usually will address. I think it’s more, and I think the BSP knows this, that we had some problems on food supply and logistics, and that needs to be addressed," he said.

ADVERTISEMENT

"No amount of demand management by the Monetary Board can address that until we can go back to our productivity and efficiency, logistics.," he added.

"No amount of demand management by the Monetary Board can address that until we can go back to our productivity and efficiency, logistics.," he added.

ADVERTISEMENT

ADVERTISEMENT