Inflation slows to 4.1 percent in November | ABS-CBN

Welcome, Kapamilya! We use cookies to improve your browsing experience. Continuing to use this site means you agree to our use of cookies. Tell me more!

Inflation slows to 4.1 percent in November

Inflation slows to 4.1 percent in November

ABS-CBN News

Published Dec 05, 2023 09:07 AM PHT

|

Updated Dec 05, 2023 02:25 PM PHT

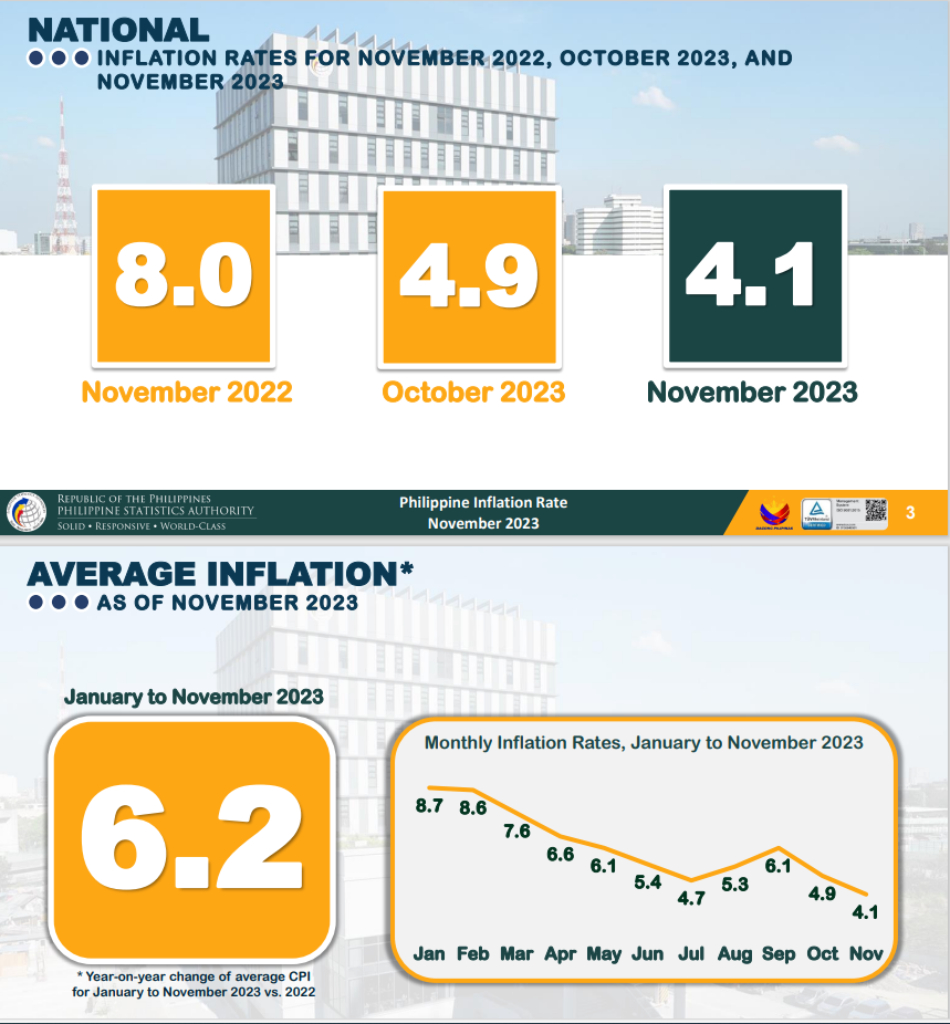

MANILA (UPDATE) — Inflation eased to 4.1 percent in November amid slower increases in food prices, and lower transport costs as fuel prices fell, the state statistics bureau said on Tuesday.

MANILA (UPDATE) — Inflation eased to 4.1 percent in November amid slower increases in food prices, and lower transport costs as fuel prices fell, the state statistics bureau said on Tuesday.

This was slower than the 4.9 percent clip seen in October, the Philippine Statistics Authority said. It was also within the 4 to 4.8 percent range forecast by the Bangko Sentral ng Pilipinas.

This was slower than the 4.9 percent clip seen in October, the Philippine Statistics Authority said. It was also within the 4 to 4.8 percent range forecast by the Bangko Sentral ng Pilipinas.

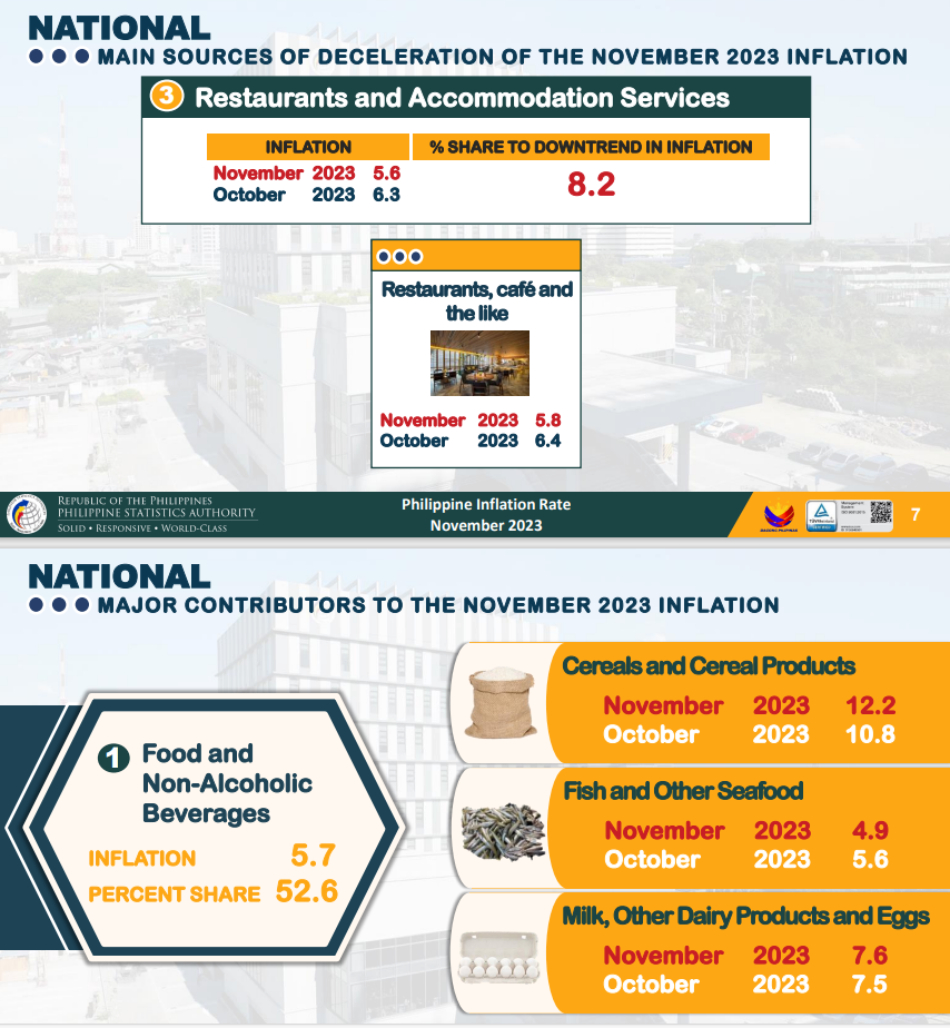

The PSA noted the lower year-on-year growth rate of the heavily-weighted food and non-alcoholic beverages at 5.7 percent in November from 7 percent in October.

The PSA noted the lower year-on-year growth rate of the heavily-weighted food and non-alcoholic beverages at 5.7 percent in November from 7 percent in October.

National Statistician Claire Dennis Mapa, however, noted that rice prices increased between October and November.

National Statistician Claire Dennis Mapa, however, noted that rice prices increased between October and November.

ADVERTISEMENT

Mapa said the average price of regular milled rice went up from P45.42 in October to P46.73 in November.

Mapa said the average price of regular milled rice went up from P45.42 in October to P46.73 in November.

Well milled rice prices, meanwhile, went up from P51 to P51.99. Special rice prices also climbed to P61.47 from P60.95.

Well milled rice prices, meanwhile, went up from P51 to P51.99. Special rice prices also climbed to P61.47 from P60.95.

"Na-compensate naman doon sa ibang mga items like kanina, sabi ko, bumaba yung meat, bumaba yung fish, bumaba yung vegetables and other items," he said.

"Na-compensate naman doon sa ibang mga items like kanina, sabi ko, bumaba yung meat, bumaba yung fish, bumaba yung vegetables and other items," he said.

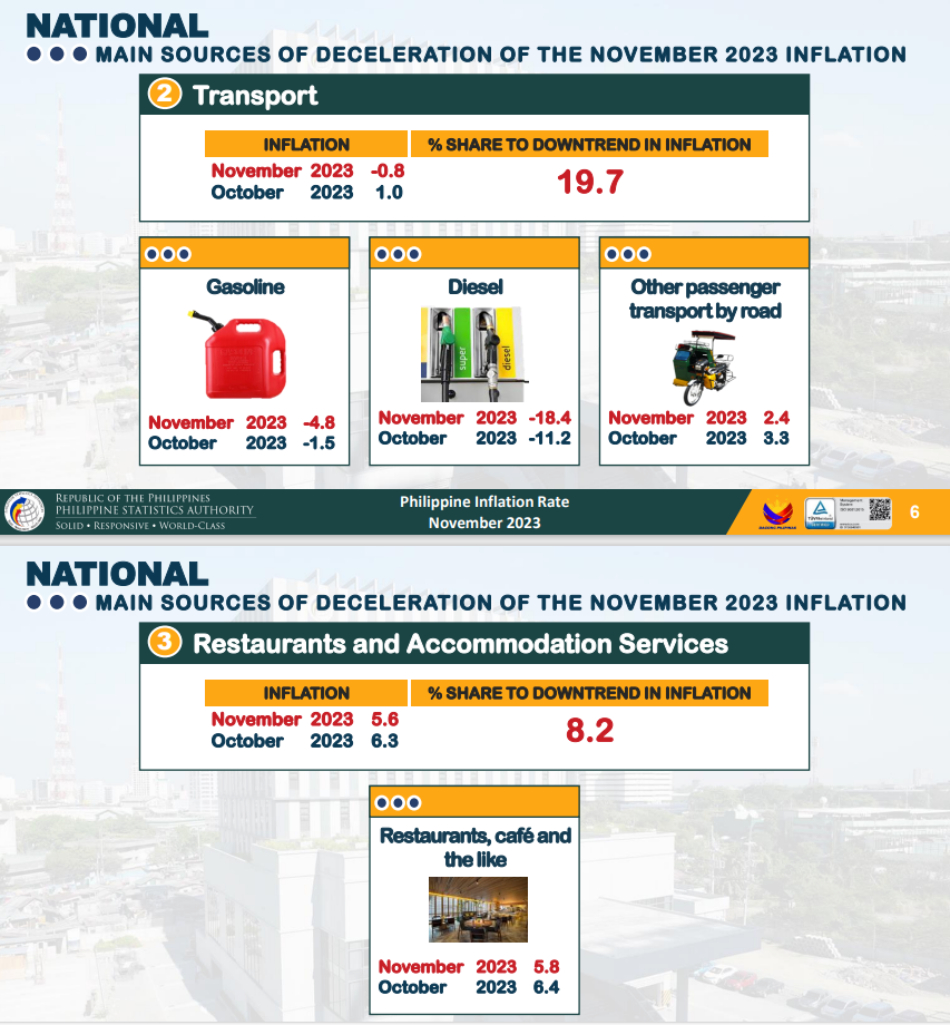

“This was followed by transport with 0.8 percent annual decrease from 1 percent annual growth in October 2023,” the agency said in a statement.

“This was followed by transport with 0.8 percent annual decrease from 1 percent annual growth in October 2023,” the agency said in a statement.

November’s slower inflation clip brought the 11-month average to 6.2 percent, which was still above the government target of 2 to 4 percent inflation.

November’s slower inflation clip brought the 11-month average to 6.2 percent, which was still above the government target of 2 to 4 percent inflation.

“Core inflation, which excludes selected food and energy items, decelerated further to 4.7 percent in November 2023 from 5.3 percent in the previous month,” the PSA added.

“Core inflation, which excludes selected food and energy items, decelerated further to 4.7 percent in November 2023 from 5.3 percent in the previous month,” the PSA added.

The average core inflation from January to November 2023 to 6.8 percent, the agency added.

The average core inflation from January to November 2023 to 6.8 percent, the agency added.

Inflation hit a 14-year peak of 8.7 percent in January as food and fuel prices surged.

Inflation hit a 14-year peak of 8.7 percent in January as food and fuel prices surged.

A survey by Pulse Asia in September showed that inflation was the most urgent concern of Filipinos.

A survey by Pulse Asia in September showed that inflation was the most urgent concern of Filipinos.

Economic Planning Secretary Arsenio Balisacan said government needs to continue monitoring the prices of goods amid continued price pressures coming from geopolitical tensions and extreme weather situations.

Economic Planning Secretary Arsenio Balisacan said government needs to continue monitoring the prices of goods amid continued price pressures coming from geopolitical tensions and extreme weather situations.

“Effective implementation of these programs is crucial to minimize the impact of high prices on low-income households," he said.

“Effective implementation of these programs is crucial to minimize the impact of high prices on low-income households," he said.

Balisacan said the government is also implementing strategies and programs to improve local food production and supply and boost the productivity of our farmers by investing in irrigation, flood control, supply chain logistics, and climate change adaptation.

Balisacan said the government is also implementing strategies and programs to improve local food production and supply and boost the productivity of our farmers by investing in irrigation, flood control, supply chain logistics, and climate change adaptation.

The Bangko Sentral ng Pilipinas said higher transport charges, electricity rates, global oil prices, and higher-than-expected minimum wage adjustments in areas outside the National Capital Region may keep inflation high.

The Bangko Sentral ng Pilipinas said higher transport charges, electricity rates, global oil prices, and higher-than-expected minimum wage adjustments in areas outside the National Capital Region may keep inflation high.

It noted, however, that a weaker-than-expected global recovery and government measures to mitigate the effects of El Niño may bring down the inflation forecast.

It noted, however, that a weaker-than-expected global recovery and government measures to mitigate the effects of El Niño may bring down the inflation forecast.

"The Monetary Board deems it necessary to keep monetary policy settings sufficiently tight until a sustained downtrend in inflation becomes evident," the BSP said.

"The Monetary Board deems it necessary to keep monetary policy settings sufficiently tight until a sustained downtrend in inflation becomes evident," the BSP said.

The BSP kept its benchmark target reverse repurchase rate (RRP) steady as inflation eased in October, after making an off-cycle rate hike in a bid to tame soaring prices.

The BSP kept its benchmark target reverse repurchase rate (RRP) steady as inflation eased in October, after making an off-cycle rate hike in a bid to tame soaring prices.

University of Asia and the Pacific (UA&P) economist Victor Abola said he was surprised at how food inflation slowed down in November.

University of Asia and the Pacific (UA&P) economist Victor Abola said he was surprised at how food inflation slowed down in November.

"There may be a slight uptick in the sense that it won’t go as fast as we saw it in November, October-November, since we’re really looking at a high base from December to February of last year. Then, actually my forecast for the first quarter is that it’s going to go below 3 percent," he said.

"There may be a slight uptick in the sense that it won’t go as fast as we saw it in November, October-November, since we’re really looking at a high base from December to February of last year. Then, actually my forecast for the first quarter is that it’s going to go below 3 percent," he said.

"That’s because of the base effect. But I have to see the seasonally adjusted figures, that should help me get a better assessment of the trends."

"That’s because of the base effect. But I have to see the seasonally adjusted figures, that should help me get a better assessment of the trends."

Abola said he thinks the BSP may start cutting interest rates by the end of the first quarter.

Abola said he thinks the BSP may start cutting interest rates by the end of the first quarter.

"My own assessment is that the BSP will cut starting the first, end of the first quarter, because they were too aggressive in the first place. They didn’t wait for the October inflation slowdown," he said.

"My own assessment is that the BSP will cut starting the first, end of the first quarter, because they were too aggressive in the first place. They didn’t wait for the October inflation slowdown," he said.

"I think that it’s just right that they reverse that knee-jerk reaction which was unnecessary at that time, and wait for more data at that time," he added.

"I think that it’s just right that they reverse that knee-jerk reaction which was unnecessary at that time, and wait for more data at that time," he added.

ADVERTISEMENT

ADVERTISEMENT