Dissecting Data: Looking back at the Philippine economy in 2020 | ABS-CBN

ADVERTISEMENT

Welcome, Kapamilya! We use cookies to improve your browsing experience. Continuing to use this site means you agree to our use of cookies. Tell me more!

Dissecting Data: Looking back at the Philippine economy in 2020

Dissecting Data: Looking back at the Philippine economy in 2020

Warren de Guzman and Edson Guido,

ABS-CBN News

Published Dec 29, 2020 06:35 PM PHT

2020 was a record year, a year like no other, for all the wrong reasons.

2020 was a record year, a year like no other, for all the wrong reasons.

The Philippine economy averaged a growth rate of -10 percent in the first nine months of 2020, and we won’t know how the last quarter went until 2021.

The Philippine economy averaged a growth rate of -10 percent in the first nine months of 2020, and we won’t know how the last quarter went until 2021.

The Philippine government’s Development Budget Coordination Committee however has lowered its GDP growth forecast for 2020 to between -8.5 and -9.5 percent, from an earlier forecast of -5.5 percent. That would be the worst performance ever, based on records going back to the 1940’s.

The Philippine government’s Development Budget Coordination Committee however has lowered its GDP growth forecast for 2020 to between -8.5 and -9.5 percent, from an earlier forecast of -5.5 percent. That would be the worst performance ever, based on records going back to the 1940’s.

The Philippines had the worst contraction amongst major ASEAN regions in the third quarter at 11.5 percent. It had the second worst contraction in the second quarter at 16.9 percent, behind only Malaysia’s 17.1 percent record fall. Those second and third quarters were the worst quarters of economic growth in Philippine history. 2020 knocked the Philippines from its position just one year ago, when it was challenging Vietnam for the best economic performance amongst major ASEAN economies. The revitalized tiger economy is once again the region’s sick man.

The Philippines had the worst contraction amongst major ASEAN regions in the third quarter at 11.5 percent. It had the second worst contraction in the second quarter at 16.9 percent, behind only Malaysia’s 17.1 percent record fall. Those second and third quarters were the worst quarters of economic growth in Philippine history. 2020 knocked the Philippines from its position just one year ago, when it was challenging Vietnam for the best economic performance amongst major ASEAN economies. The revitalized tiger economy is once again the region’s sick man.

ADVERTISEMENT

Why are the other economies doing better?

Why are the other economies doing better?

SMALL ALLOCATION FOR COVID RESPONSE

Former Socioeconomic Planning Secretary Ernesto Pernia said one reason the Philippines is lagging behind the rest of the region is its relatively small COVID-19 response. Based on data he gathered from the Asian Development Bank, the Philippines is only spending $21.65 billion for its COVID-19 response. That is about 5.88 percent of the country’s GDP and $202.95 per person. All these figures are the lowest amongst major ASEAN economies.

Former Socioeconomic Planning Secretary Ernesto Pernia said one reason the Philippines is lagging behind the rest of the region is its relatively small COVID-19 response. Based on data he gathered from the Asian Development Bank, the Philippines is only spending $21.65 billion for its COVID-19 response. That is about 5.88 percent of the country’s GDP and $202.95 per person. All these figures are the lowest amongst major ASEAN economies.

Indonesia and Vietnam are the next closest in terms of spending as a percentage of GDP. Indonesia’s response is at 10.94 percent of GDP while Vietnam is at 10.12 percent. In terms of actual budget, Vietnam is spending $26.50 billion and Indonesia is spending $115.78 billion. The biggest spenders relative to their economy are Singapore and Malaysia, at 25.35 percent and 22.73 percent of GDP, respectively. They are also the biggest spenders in terms of dollars per capita. All figures quoted are as of November 2020.

Indonesia and Vietnam are the next closest in terms of spending as a percentage of GDP. Indonesia’s response is at 10.94 percent of GDP while Vietnam is at 10.12 percent. In terms of actual budget, Vietnam is spending $26.50 billion and Indonesia is spending $115.78 billion. The biggest spenders relative to their economy are Singapore and Malaysia, at 25.35 percent and 22.73 percent of GDP, respectively. They are also the biggest spenders in terms of dollars per capita. All figures quoted are as of November 2020.

Pernia isn’t alone in advocating for more government spending. Filipino tycoons Enrique Razon, Jaime Augusto Zobel de Ayala, and Tessie Sy-Coson have all come forward to appeal for more spending. Razon has called for spending of up to 25 percent of GDP, considering that the Philippines is a consumption-driven country.

Pernia isn’t alone in advocating for more government spending. Filipino tycoons Enrique Razon, Jaime Augusto Zobel de Ayala, and Tessie Sy-Coson have all come forward to appeal for more spending. Razon has called for spending of up to 25 percent of GDP, considering that the Philippines is a consumption-driven country.

But the Philippine government’s economic team is sticking to its guns, namely “prudent fiscal spending” and infrastructure investment. Finance Secretary Carlos Dominguez says government spending can’t solve the public’s lack of confidence in terms of safety when it comes to COVID. He says: “The economy is just waiting for this fear factor to be removed, for people to have confidence they won’t get sick. Once you remove that, this economy, believe me, is going to boom.”

But the Philippine government’s economic team is sticking to its guns, namely “prudent fiscal spending” and infrastructure investment. Finance Secretary Carlos Dominguez says government spending can’t solve the public’s lack of confidence in terms of safety when it comes to COVID. He says: “The economy is just waiting for this fear factor to be removed, for people to have confidence they won’t get sick. Once you remove that, this economy, believe me, is going to boom.”

He adds, the Build Build Build infrastructure push and fiscal reforms, including the reduction of corporate income taxes and the introduction of more targeted fiscal incentives, will provide more than enough stimulus to revive the economy post pandemic. For Dominguez, a disciplined reopening of the economy, alongside a strengthened health sector and a multi-year vaccination program, will solve the confidence problem.

He adds, the Build Build Build infrastructure push and fiscal reforms, including the reduction of corporate income taxes and the introduction of more targeted fiscal incentives, will provide more than enough stimulus to revive the economy post pandemic. For Dominguez, a disciplined reopening of the economy, alongside a strengthened health sector and a multi-year vaccination program, will solve the confidence problem.

Dominguez also warns that no matter how much the government spends, if it is done wrong it will not lead to higher GDP growth. He says: “For instance, there is one ASEAN country that spent in excess of 20 percent of GDP as stimulus, yet their GDP dropped 19 percent. A European company did the same and their GDP dropped 23 percent. There is no direct relationship between stimulus and GDP growth.”

If we return to the previous chart, we see countries that spent a lot of money on their pandemic response did not perform that well. At least not immediately.

Dominguez also warns that no matter how much the government spends, if it is done wrong it will not lead to higher GDP growth. He says: “For instance, there is one ASEAN country that spent in excess of 20 percent of GDP as stimulus, yet their GDP dropped 19 percent. A European company did the same and their GDP dropped 23 percent. There is no direct relationship between stimulus and GDP growth.”

If we return to the previous chart, we see countries that spent a lot of money on their pandemic response did not perform that well. At least not immediately.

Big spender Malaysia had one of the worst performances in the region in the second quarter with a contraction of 17.1 percent. However its economy rebounded in the third quarter, slashing its contraction to just 2.7 percent. That’s the second best amongst the economies in the chart for that quarter.

Big spender Malaysia had one of the worst performances in the region in the second quarter with a contraction of 17.1 percent. However its economy rebounded in the third quarter, slashing its contraction to just 2.7 percent. That’s the second best amongst the economies in the chart for that quarter.

Indonesia and Singapore are spending the most out of all the countries measured, but their economies are doing worse than small spender Vietnam. In fact, Vietnam only spent $5 billion more than the Philippines, yet it has the best performing economy so far with a growth of 2.6 percent in the third quarter. It is the only major ASEAN economy that has registered growth this year.

Indonesia and Singapore are spending the most out of all the countries measured, but their economies are doing worse than small spender Vietnam. In fact, Vietnam only spent $5 billion more than the Philippines, yet it has the best performing economy so far with a growth of 2.6 percent in the third quarter. It is the only major ASEAN economy that has registered growth this year.

So while Dominguez is right to say that the size of the pandemic response spending does not matter, the Philippines remains the worst performing economy out of the lot. Something else is dragging the Philippines down.

So while Dominguez is right to say that the size of the pandemic response spending does not matter, the Philippines remains the worst performing economy out of the lot. Something else is dragging the Philippines down.

One obvious factor would be the actual prevalence and management of COVID-19 cases. Less COVID-19 meant less economic disruptions, and more time to actually generate economic activity without mobility restrictions. More COVID-19 means the opposite.

One obvious factor would be the actual prevalence and management of COVID-19 cases. Less COVID-19 meant less economic disruptions, and more time to actually generate economic activity without mobility restrictions. More COVID-19 means the opposite.

As of December 23, Vietnam had the least number of confirmed cases amongst the major ASEAN economies. That is a big push factor for Vietnamese GDP. Indonesia on the other hand had the most confirmed cases, active cases, and deaths. However, Indonesia’s GDP growth was still third best amongst major ASEAN economies in the third quarter. Meanwhile, the Philippines ranked second in terms of confirmed and active cases and COVID-19 related deaths.

As of December 23, Vietnam had the least number of confirmed cases amongst the major ASEAN economies. That is a big push factor for Vietnamese GDP. Indonesia on the other hand had the most confirmed cases, active cases, and deaths. However, Indonesia’s GDP growth was still third best amongst major ASEAN economies in the third quarter. Meanwhile, the Philippines ranked second in terms of confirmed and active cases and COVID-19 related deaths.

COVID-19 prevalence and management is another factor that pulled the Philippine economy down. But again, it isn’t the only force in action.

COVID-19 prevalence and management is another factor that pulled the Philippine economy down. But again, it isn’t the only force in action.

SMALL BUDGET, DELAYED RELEASE

The Citizen’s Budget Tracker, a private sector initiative led by former government employees, accountants, data scientists, and other professionals, paints a clearer picture on the government spending of the Philippines.

The Citizen’s Budget Tracker, a private sector initiative led by former government employees, accountants, data scientists, and other professionals, paints a clearer picture on the government spending of the Philippines.

Already armed with a relatively smaller budget compared to regional peers, the Citizen’s Budget Tracker scoured data from the Office of the President itself to determine if government funds were released and spent in a timely manner. They were not.

Already armed with a relatively smaller budget compared to regional peers, the Citizen’s Budget Tracker scoured data from the Office of the President itself to determine if government funds were released and spent in a timely manner. They were not.

The data show there was a 4-month delay from the expiration of Bayanihan 1, the first COVID-19 response allocation, to the budget release of Bayanihan 2, the second allocation. That left government agencies scrambling to cram their pandemic allocations in the last two months of 2020 ahead of the Dec. 19 deadline. Lawmakers are now scrambling to extend the validity of the allocated funds under Bayanihan 2, to allow for more time to spend the funds.

The data show there was a 4-month delay from the expiration of Bayanihan 1, the first COVID-19 response allocation, to the budget release of Bayanihan 2, the second allocation. That left government agencies scrambling to cram their pandemic allocations in the last two months of 2020 ahead of the Dec. 19 deadline. Lawmakers are now scrambling to extend the validity of the allocated funds under Bayanihan 2, to allow for more time to spend the funds.

The size of the government’s COVID-19 response package was already criticized as small to begin with. The delays in the actual spending is another missed opportunity that is already haunting the economy.

The size of the government’s COVID-19 response package was already criticized as small to begin with. The delays in the actual spending is another missed opportunity that is already haunting the economy.

LOST JOBS HERE AND ABROAD

The economy always becomes more personal and relatable when it is discussed in terms of jobs. 2020 delivered an average unemployment rate of over 10 percent. That was the worst on record. That also undid all of the gains realized in the previous years, which had brought the unemployment rate to an average of 5.1 percent in 2019. That rate was the lowest since 2005, when the government last adjusted the definition of employment. Labor force participation rate in April was also the lowest in the history of the Philippine labor market.

The economy always becomes more personal and relatable when it is discussed in terms of jobs. 2020 delivered an average unemployment rate of over 10 percent. That was the worst on record. That also undid all of the gains realized in the previous years, which had brought the unemployment rate to an average of 5.1 percent in 2019. That rate was the lowest since 2005, when the government last adjusted the definition of employment. Labor force participation rate in April was also the lowest in the history of the Philippine labor market.

The October Labor Force Survey report of the Philippine Statistics Authority showed an increase of 1.8 million unemployed Filipinos from the same month in 2019 for a total of 3.8 million. This was an improvement from the 7.2 million unemployed Filipinos hit in April.

The October Labor Force Survey report of the Philippine Statistics Authority showed an increase of 1.8 million unemployed Filipinos from the same month in 2019 for a total of 3.8 million. This was an improvement from the 7.2 million unemployed Filipinos hit in April.

But does this present a complete picture of the job market this year? The Philippine government has not always been able to reconcile data gathered by the Department of Labor and Employment, the Philippine Statistics Authority, and the Department of Foreign Affairs.

But does this present a complete picture of the job market this year? The Philippine government has not always been able to reconcile data gathered by the Department of Labor and Employment, the Philippine Statistics Authority, and the Department of Foreign Affairs.

Labor Secretary Silvestre Bello himself contested the April unemployment figures in June, saying it was overstated, even bloated. He claimed only 2,068 companies have reported closures, leaving just 69,000 Filipinos unemployed. That is far less than the 7.3 million figure from the PSA Labor report.

Labor Secretary Silvestre Bello himself contested the April unemployment figures in June, saying it was overstated, even bloated. He claimed only 2,068 companies have reported closures, leaving just 69,000 Filipinos unemployed. That is far less than the 7.3 million figure from the PSA Labor report.

The Department of Foreign Affairs meanwhile said 300,000 overseas Filipino workers joined the ranks of the unemployed in the Philippines this year due to the COVID-19 pandemic. That announcement was made December 14.

The Department of Foreign Affairs meanwhile said 300,000 overseas Filipino workers joined the ranks of the unemployed in the Philippines this year due to the COVID-19 pandemic. That announcement was made December 14.

The Department of Labor and Employment said in August that the number of OFWs displaced and repatriated because of the pandemic was already over 600,000.

The Department of Labor and Employment said in August that the number of OFWs displaced and repatriated because of the pandemic was already over 600,000.

Add to this picture the informal sector, which is largely undocumented, and mostly without the usual safety nets offered to registered businesses such as insurance, paid leaves, and other labor privileges. It is unclear just exactly how many are struggling.

Add to this picture the informal sector, which is largely undocumented, and mostly without the usual safety nets offered to registered businesses such as insurance, paid leaves, and other labor privileges. It is unclear just exactly how many are struggling.

The Philippine government’s inability to properly ascertain the state of its citizens is a problem that runs deep. It stems from the lack of an efficient and reliable identification system, an alarmingly high level of financial illiteracy and unbanked individuals, and corruption.

The Philippine government’s inability to properly ascertain the state of its citizens is a problem that runs deep. It stems from the lack of an efficient and reliable identification system, an alarmingly high level of financial illiteracy and unbanked individuals, and corruption.

The ID system is being addressed by the PSA through PhilSys or the National ID System. Over 9 million heads of poor households have already been registered in the first step of the process.

The ID system is being addressed by the PSA through PhilSys or the National ID System. Over 9 million heads of poor households have already been registered in the first step of the process.

The Philsys launch however has come a bit late. The lack of such a system when the pandemic hit has proved to be a serious deficiency. It even led to difficulties in disbursing government aid through the Department of Social Welfare and Development. Some poor households got nothing, while other beneficiaries received double or even triple disbursements. Some of the funds were reportedly siphoned off.

The Philsys launch however has come a bit late. The lack of such a system when the pandemic hit has proved to be a serious deficiency. It even led to difficulties in disbursing government aid through the Department of Social Welfare and Development. Some poor households got nothing, while other beneficiaries received double or even triple disbursements. Some of the funds were reportedly siphoned off.

HIGHER FOOD PRICES, LIMITED PUBLIC TRANSPORT

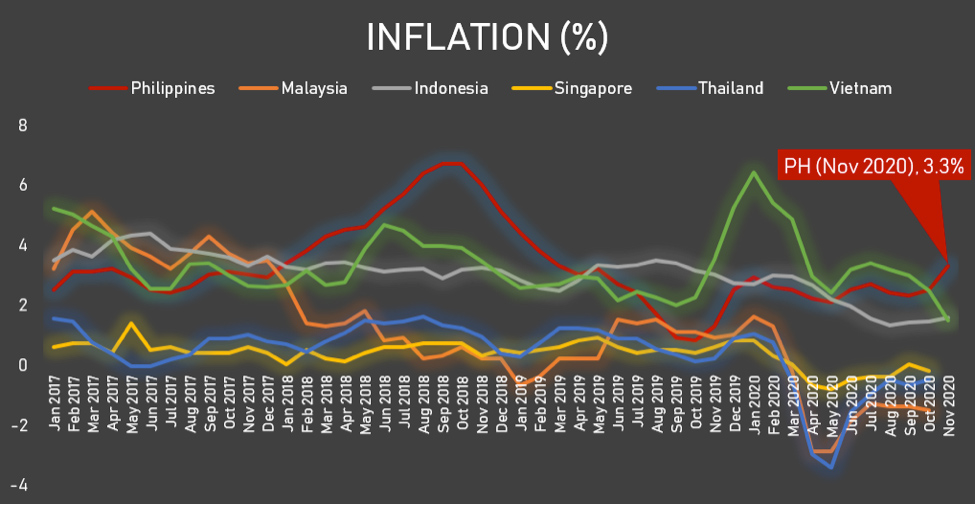

Making matters worse was inflation. As of November, the Philippines has the highest inflation rate amongst major ASEAN economies. The inflation rate is still low at 3.3 percent, which is also within the Bangko Sentral’s inflation target for the mid term of between 2 and 4 percent. But it still hurts.

Making matters worse was inflation. As of November, the Philippines has the highest inflation rate amongst major ASEAN economies. The inflation rate is still low at 3.3 percent, which is also within the Bangko Sentral’s inflation target for the mid term of between 2 and 4 percent. But it still hurts.

Food inflation has been particularly high, due to supply problems created by a recent spate of destructive typhoons. This is nothing new as the Philippines is subject to such natural calamities on an annual basis. 2020 however was the first time such storms hit during a global pandemic. Vegetable prices have been particularly volatile, and rice prices have spiked, especially in the National Capital Region.

Food inflation has been particularly high, due to supply problems created by a recent spate of destructive typhoons. This is nothing new as the Philippines is subject to such natural calamities on an annual basis. 2020 however was the first time such storms hit during a global pandemic. Vegetable prices have been particularly volatile, and rice prices have spiked, especially in the National Capital Region.

Transport inflation, specifically for public transport, has hit astronomical heights. Mobility restrictions have put a premium on space on board public utility vehicles such as buses and jeepneys. Tricycles are no longer allowed to fill their side cars to capacity. The result, commutes have doubled, even tripled in cost for groups.

Transport inflation, specifically for public transport, has hit astronomical heights. Mobility restrictions have put a premium on space on board public utility vehicles such as buses and jeepneys. Tricycles are no longer allowed to fill their side cars to capacity. The result, commutes have doubled, even tripled in cost for groups.

Many individuals are forced to wait for hours on the road for a ride. Others have been forced into the more expensive options such as taxis and transport network vehicle services such as Grab.

Many individuals are forced to wait for hours on the road for a ride. Others have been forced into the more expensive options such as taxis and transport network vehicle services such as Grab.

Inflation in the Philippines is at a 21-month high as of November 2020.

Inflation in the Philippines is at a 21-month high as of November 2020.

Record-high unemployment, record-low growth, and rising inflation. If the Philippines isn’t careful, its first official economic recession in three decades could turn into a nasty case of stagflation, or recession with high inflation.

Record-high unemployment, record-low growth, and rising inflation. If the Philippines isn’t careful, its first official economic recession in three decades could turn into a nasty case of stagflation, or recession with high inflation.

Remember, inflation was at a near decade high just two years ago. Should inflation return to those levels, it could limit consumption. That in turn would extend the current period of low growth. Any effort to reduce inflation, such as a reduction in money supply by the Central Bank via higher interest rates, would also curb spending. Less borrowing and spending by companies and households would also extend the period of low growth. It is a lose-lose situation.

Remember, inflation was at a near decade high just two years ago. Should inflation return to those levels, it could limit consumption. That in turn would extend the current period of low growth. Any effort to reduce inflation, such as a reduction in money supply by the Central Bank via higher interest rates, would also curb spending. Less borrowing and spending by companies and households would also extend the period of low growth. It is a lose-lose situation.

ANNUS HORRIBILIS

This has been one hell of a year. It was supposed to be a year of recovery from a botched 2019 national budget. It was supposed to be a year of infrastructure, the midpoint of the Duterte administration’s vaunted P8 trillion Build Build Build infrastructure initiative. It was supposed to be a year of continued gains in poverty eradication, unemployment reduction, and increasing per capita income.

This has been one hell of a year. It was supposed to be a year of recovery from a botched 2019 national budget. It was supposed to be a year of infrastructure, the midpoint of the Duterte administration’s vaunted P8 trillion Build Build Build infrastructure initiative. It was supposed to be a year of continued gains in poverty eradication, unemployment reduction, and increasing per capita income.

There were signs of hope mid-year, when the economic team was oozing with confidence over higher credit rating scores and healthy balance sheets.

There were signs of hope mid-year, when the economic team was oozing with confidence over higher credit rating scores and healthy balance sheets.

Their confidence however has grown less reassuring as the pandemic induced recession drags on.

Their confidence however has grown less reassuring as the pandemic induced recession drags on.

Promising infrastructure projects have bogged down and stalled.

Promising infrastructure projects have bogged down and stalled.

COVID-19 remains a very real threat.

COVID-19 remains a very real threat.

A new strain of COVID-19 is knocking on the door.

A new strain of COVID-19 is knocking on the door.

The Philippine government is struggling to procure vaccines.

The Philippine government is struggling to procure vaccines.

With just a few days left, only a miracle would keep 2020 from ending as a terrible year. No goals were met, no targets were hit, no schedules were kept.

With just a few days left, only a miracle would keep 2020 from ending as a terrible year. No goals were met, no targets were hit, no schedules were kept.

Instead, 2020 delivered record-lows in economic growth and employment, pushing the Philippines from the front of the ASEAN economic class all the way back to the rear. Inflation is also rising, lifting the Philippines to the top of the region in terms of rising costs, threatening stagflation.

Instead, 2020 delivered record-lows in economic growth and employment, pushing the Philippines from the front of the ASEAN economic class all the way back to the rear. Inflation is also rising, lifting the Philippines to the top of the region in terms of rising costs, threatening stagflation.

Hundreds of thousands, even millions of Filipinos are without work or access to financial or digital services. Government and private sector leaders can’t agree on where, how, and how much should be spent to end the economic crisis.

Hundreds of thousands, even millions of Filipinos are without work or access to financial or digital services. Government and private sector leaders can’t agree on where, how, and how much should be spent to end the economic crisis.

The pandemic was the biggest cause of it all, but it wasn’t the only factor. It exacerbated all the other risks the Philippines faces on a yearly basis, such as typhoons, earthquakes and volcanic eruptions. It further exposed institutional weaknesses in government welfare, healthcare, budgeting, LGU capacity, and general services.

The pandemic was the biggest cause of it all, but it wasn’t the only factor. It exacerbated all the other risks the Philippines faces on a yearly basis, such as typhoons, earthquakes and volcanic eruptions. It further exposed institutional weaknesses in government welfare, healthcare, budgeting, LGU capacity, and general services.

The age-old problem of corruption also reared its ugly head to take advantage of all the problems that come with rapidly distributing cash handouts without a reliable identification system. Worst of all, it exposed the Philippines’ inability to work as a country toward a common goal.

The age-old problem of corruption also reared its ugly head to take advantage of all the problems that come with rapidly distributing cash handouts without a reliable identification system. Worst of all, it exposed the Philippines’ inability to work as a country toward a common goal.

The year 2020 didn’t just subject the Philippines to the worst pandemic in a century. It infected the Philippines with COVID-19. All the glamour from recent financial and economic achievements have been eroded by the sobering side effects of the virus. The credit rating upgrades and the promise of an age of infrastructure have lost their smell and taste. Public and private leaders are operating in isolation, unable to see and feel what the Philippines needs to survive. Vital cogs of economic growth, overseas Filipinos, manufacturers, consumer goods and services are running out of air. The result, an economy gasping for oxygen, and dead last in the regional rankings.

The year 2020 didn’t just subject the Philippines to the worst pandemic in a century. It infected the Philippines with COVID-19. All the glamour from recent financial and economic achievements have been eroded by the sobering side effects of the virus. The credit rating upgrades and the promise of an age of infrastructure have lost their smell and taste. Public and private leaders are operating in isolation, unable to see and feel what the Philippines needs to survive. Vital cogs of economic growth, overseas Filipinos, manufacturers, consumer goods and services are running out of air. The result, an economy gasping for oxygen, and dead last in the regional rankings.

The year 2020 can’t end soon enough.

The year 2020 can’t end soon enough.

When it does end, it will turn over all of its problems to 2021.

When it does end, it will turn over all of its problems to 2021.

ADVERTISEMENT

ADVERTISEMENT