Will the government ramp up spending to pull the economy out of its slump?

ADVERTISEMENT

Welcome, Kapamilya! We use cookies to improve your browsing experience. Continuing to use this site means you agree to our use of cookies. Tell me more!

Will the government ramp up spending to pull the economy out of its slump?

Warren de Guzman and Edson Guido,

ABS-CBN News

Published Nov 17, 2020 07:37 PM PHT

MANILA - The Philippine economic team, led by Finance Secretary Carlos Dominguez, has been preaching fiscal prudence all year amid calls for more spending to fight COVID-19.

MANILA - The Philippine economic team, led by Finance Secretary Carlos Dominguez, has been preaching fiscal prudence all year amid calls for more spending to fight COVID-19.

Dominguez stressed that the government's revenue generation would be adversely affected by the pandemic, and nobody knows how long the virus will affect the economy. Sure enough, that uncertainty remains to this day.

Dominguez stressed that the government's revenue generation would be adversely affected by the pandemic, and nobody knows how long the virus will affect the economy. Sure enough, that uncertainty remains to this day.

Congratulations to the economic team. Thanks to their prudence, they have the resources to address the string of massively damaging storms that just hit the Philippines.

Congratulations to the economic team. Thanks to their prudence, they have the resources to address the string of massively damaging storms that just hit the Philippines.

The question now is, will they ramp up spending?

The question now is, will they ramp up spending?

ADVERTISEMENT

To answer this, let us take a look at some data on government spending for COVID-19.

To answer this, let us take a look at some data on government spending for COVID-19.

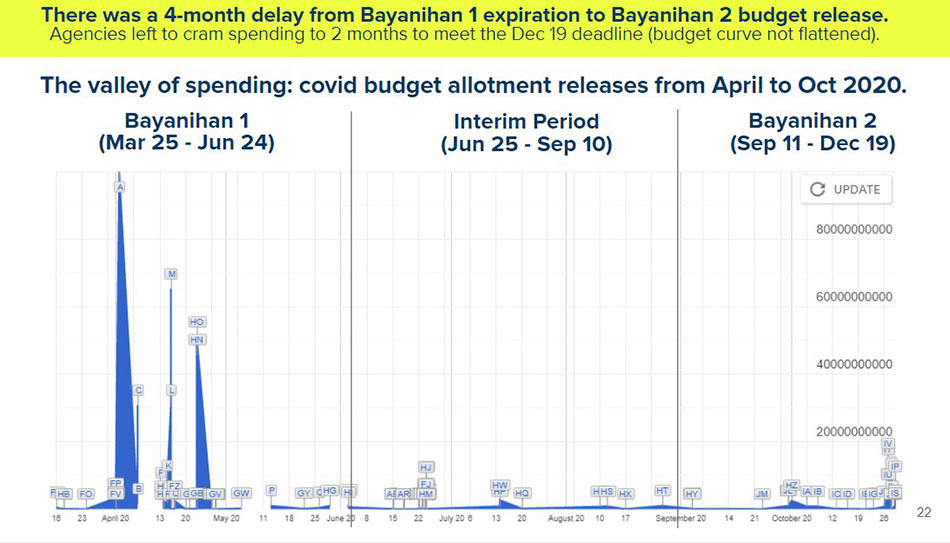

This chart prepared by the civil society initiative, the Citizen’s Budget Tracker, shows us information on spending for the COVID-19 response. Their latest report was released on November 11. Their findings show there was a clear response to COVID-19 in the first half of 2020 under the Bayanihan 1 law, with a huge spike in expenditures to help fight the disease, fund healthcare institutions, and provide financial relief to sectors forced to stop work by COVID-19 lockdowns.

This chart prepared by the civil society initiative, the Citizen’s Budget Tracker, shows us information on spending for the COVID-19 response. Their latest report was released on November 11. Their findings show there was a clear response to COVID-19 in the first half of 2020 under the Bayanihan 1 law, with a huge spike in expenditures to help fight the disease, fund healthcare institutions, and provide financial relief to sectors forced to stop work by COVID-19 lockdowns.

Since then, the spike in spending has disappeared and has turned into what the Citizen’s Budget Tracker calls a “valley of spending.” The report notes there was a 4-month delay in the release of Bayanihan-2 funds, dating back to the expiration of Bayanihan 1, and now government agencies are trying to cram their expenditures into the last 2 months of 2020.

Since then, the spike in spending has disappeared and has turned into what the Citizen’s Budget Tracker calls a “valley of spending.” The report notes there was a 4-month delay in the release of Bayanihan-2 funds, dating back to the expiration of Bayanihan 1, and now government agencies are trying to cram their expenditures into the last 2 months of 2020.

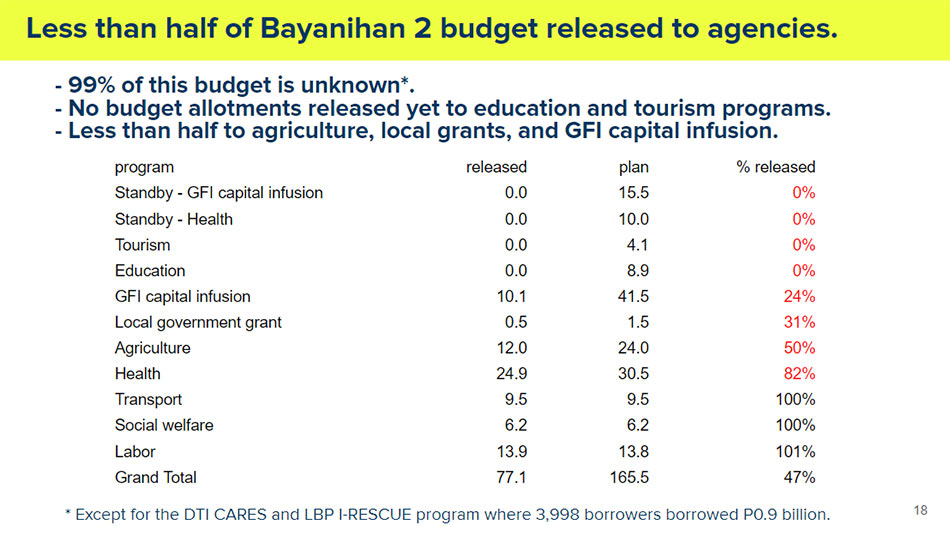

This chart shows one key reason why spending has been delayed. Of the P165B Bayanihan 2 budget, already criticized as insufficient by the Citizen’s Budget Tracker and other sectors, less than 50 percent has been released to government agencies.

This chart shows one key reason why spending has been delayed. Of the P165B Bayanihan 2 budget, already criticized as insufficient by the Citizen’s Budget Tracker and other sectors, less than 50 percent has been released to government agencies.

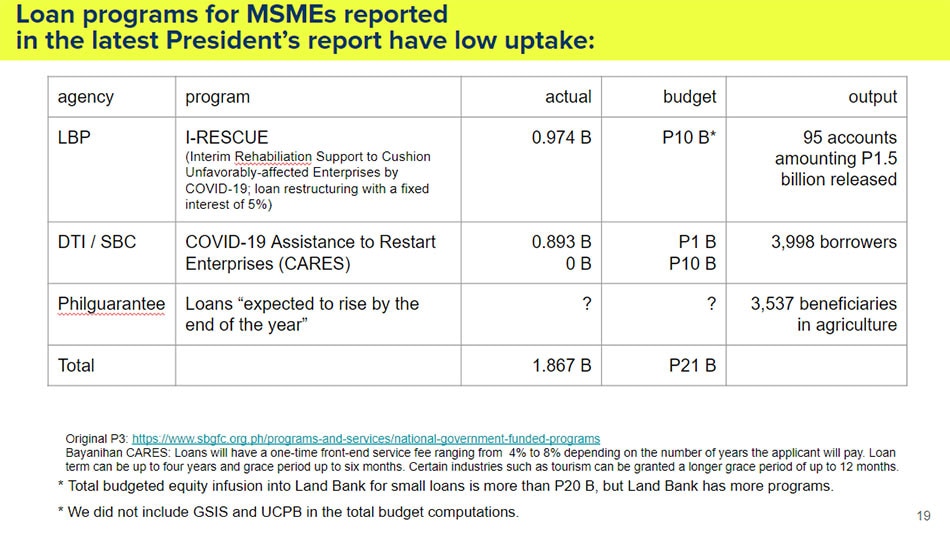

Furthermore, the government’s goal of targeting public funds through low interest loans, for maximum effect and impact, appears to be slow. The Citizen’s Budget Tracker says these loans have a low uptake. Out of a budget of P21 billion, under P2 billion has actually been disbursed to borrowers.

Furthermore, the government’s goal of targeting public funds through low interest loans, for maximum effect and impact, appears to be slow. The Citizen’s Budget Tracker says these loans have a low uptake. Out of a budget of P21 billion, under P2 billion has actually been disbursed to borrowers.

ADVERTISEMENT

The COVID-19 Assistance to Restart Enterprises for MSMEs, which employ about 60 percent of the Philippines’ total workforce, has only helped 3,998 borrowers out of a million small businesses registered.

The COVID-19 Assistance to Restart Enterprises for MSMEs, which employ about 60 percent of the Philippines’ total workforce, has only helped 3,998 borrowers out of a million small businesses registered.

This information mirrors the findings of the latest Senior Bank Loan Officer’s Survey of the Philippine Central Bank conducted in the third quarter, which showed banks are not lending due to heightened risk of default or non-payment.

This information mirrors the findings of the latest Senior Bank Loan Officer’s Survey of the Philippine Central Bank conducted in the third quarter, which showed banks are not lending due to heightened risk of default or non-payment.

The survey also showed households and businesses are less inclined to borrow, due to the heightened risk of loss of income. Both consumers and entrepreneurs are afraid they won’t have the money to pay for added interest expenses, even with the offered low lending rates.

The survey also showed households and businesses are less inclined to borrow, due to the heightened risk of loss of income. Both consumers and entrepreneurs are afraid they won’t have the money to pay for added interest expenses, even with the offered low lending rates.

All the data show that while using loans to target businesses that provide employment and generate business opportunities through new supply chains and markets may be smart, it isn’t effective or efficient right now.

All the data show that while using loans to target businesses that provide employment and generate business opportunities through new supply chains and markets may be smart, it isn’t effective or efficient right now.

The problems don’t end with Bayanihan 2. The Budget Tracker’s findings show Bayanihan 1 hasn’t been fully utilized either.

The problems don’t end with Bayanihan 2. The Budget Tracker’s findings show Bayanihan 1 hasn’t been fully utilized either.

ADVERTISEMENT

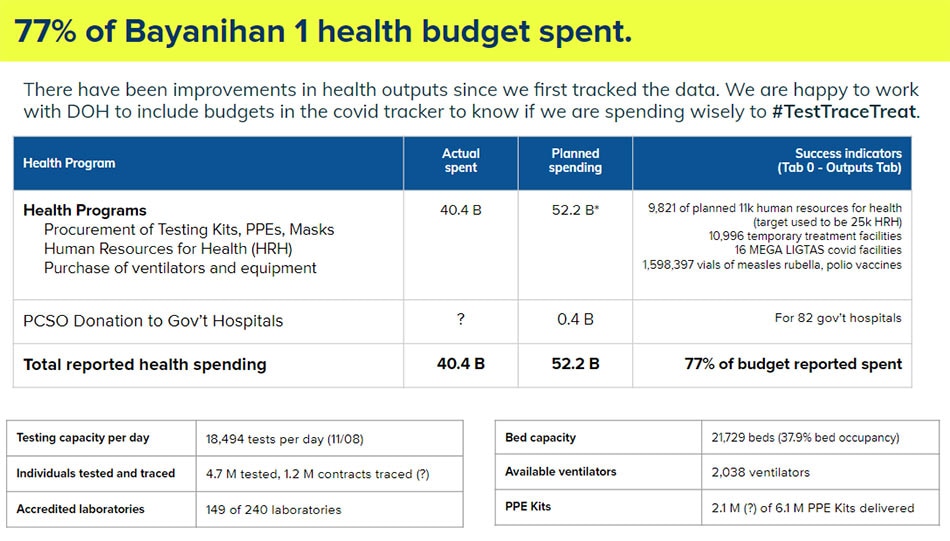

Only 77 percent of the Bayanihan 1 health budget valued at P52.2B has been spent. PCSO donations to government hospitals, budgeted at P400M, have not been accounted for or liquidated.

Only 77 percent of the Bayanihan 1 health budget valued at P52.2B has been spent. PCSO donations to government hospitals, budgeted at P400M, have not been accounted for or liquidated.

Meanwhile, there is a P12 billion difference between the budget and actual expenditures for health programs to acquire testing kits, personal protection equipment and ventilators and other equipment.

Meanwhile, there is a P12 billion difference between the budget and actual expenditures for health programs to acquire testing kits, personal protection equipment and ventilators and other equipment.

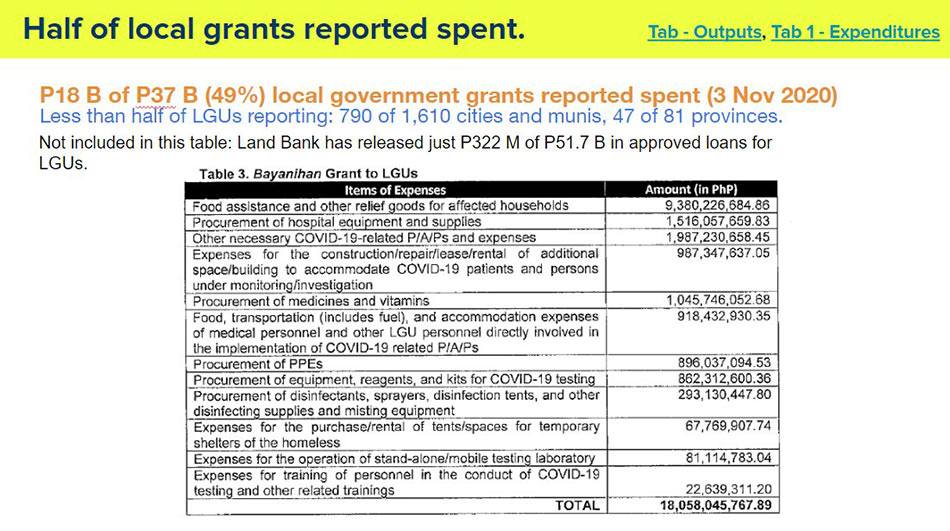

Data on the disbursement and liquidation of grants for local government units under Bayanihan 1 appear to be in a worse state. Less than half of the P37 billion allocated has been spent, because less than half of the LGUs with grants have reported.

Data on the disbursement and liquidation of grants for local government units under Bayanihan 1 appear to be in a worse state. Less than half of the P37 billion allocated has been spent, because less than half of the LGUs with grants have reported.

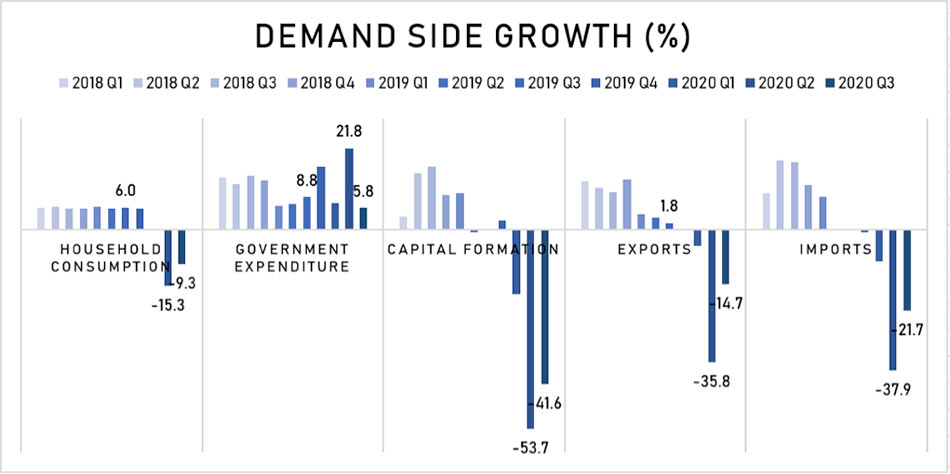

This chart, prepared by the ABS-CBN Data Analytics Team, shows overall government spending is in fact growing, helping to offset the contractions in household and private sector spending, as well as spending for imports and exports.

This chart, prepared by the ABS-CBN Data Analytics Team, shows overall government spending is in fact growing, helping to offset the contractions in household and private sector spending, as well as spending for imports and exports.

However the growth rate of government spending actually decreased in the third quarter to 5.8 percent, from 21.8 percent in the second quarter. This is odd, considering the government is trying to jump-start an economic recovery so more Filipinos can bounce back from the COVID-19 pandemic.

However the growth rate of government spending actually decreased in the third quarter to 5.8 percent, from 21.8 percent in the second quarter. This is odd, considering the government is trying to jump-start an economic recovery so more Filipinos can bounce back from the COVID-19 pandemic.

ADVERTISEMENT

The slowdown in government spending contributed to a deeper than expected third quarter contraction of 11.5 percent. National Statistician Dennis Mapa says that has made the full year goal of a contraction of 5.5 percent unfeasible.

The slowdown in government spending contributed to a deeper than expected third quarter contraction of 11.5 percent. National Statistician Dennis Mapa says that has made the full year goal of a contraction of 5.5 percent unfeasible.

While the economic team insists prudent spending is the most appropriate action, it says it is spending an appropriate amount of money. Acting Socioeconomic Planning Secretary Karl Chua directly addressed criticism of the spending plan recently, when the PSA and NEDA released the third quarter GDP report for the Philippines.

While the economic team insists prudent spending is the most appropriate action, it says it is spending an appropriate amount of money. Acting Socioeconomic Planning Secretary Karl Chua directly addressed criticism of the spending plan recently, when the PSA and NEDA released the third quarter GDP report for the Philippines.

“The total is by the trillions, so that is a first, so we are not shy in providing both fiscal and monetary support. We are also doing other support such as the passage of CREATE which will lower the income tax immediately for 99 percent of SMEs that employ 60 percent of workers. We are pursuing FIST and GUIDE bills that will help more of the banks help distressed firms facing liquidity and solvency issues. We are also changing our policy to risk management to open up the economy further. We should look at it as a package,” Chua said.

“The total is by the trillions, so that is a first, so we are not shy in providing both fiscal and monetary support. We are also doing other support such as the passage of CREATE which will lower the income tax immediately for 99 percent of SMEs that employ 60 percent of workers. We are pursuing FIST and GUIDE bills that will help more of the banks help distressed firms facing liquidity and solvency issues. We are also changing our policy to risk management to open up the economy further. We should look at it as a package,” Chua said.

Despite these pronouncements, government spending has come under even more scrutiny and criticism this week.

Despite these pronouncements, government spending has come under even more scrutiny and criticism this week.

Representative Stella Quimbo, an economist and former commissioner of the Philippine Competition Commission, delivered a sharp rebuke of government spending outlays in a privilege speech on Monday, November 16th.

Representative Stella Quimbo, an economist and former commissioner of the Philippine Competition Commission, delivered a sharp rebuke of government spending outlays in a privilege speech on Monday, November 16th.

ADVERTISEMENT

Quimbo said much more spending is needed now that the economy is seen contracting by 8 to 10 percent this year.

Quimbo said much more spending is needed now that the economy is seen contracting by 8 to 10 percent this year.

“The 2021 General Appropriations Bill (GAB) which authorizes a total spending of 4.506 trillion pesos, is based on the assumption that the economy will contract at only 5.5 percent. The 2021 national budget – being a COVID budget, includes COVID related spending that is presumed to sufficiently address an expected 5.5 percent contraction of the economy. And since the contraction is likely to be deeper than expected, the proposed COVID response in its current shape in the 2021 GAB, is simply insufficient.”

“The 2021 General Appropriations Bill (GAB) which authorizes a total spending of 4.506 trillion pesos, is based on the assumption that the economy will contract at only 5.5 percent. The 2021 national budget – being a COVID budget, includes COVID related spending that is presumed to sufficiently address an expected 5.5 percent contraction of the economy. And since the contraction is likely to be deeper than expected, the proposed COVID response in its current shape in the 2021 GAB, is simply insufficient.”

“The total amount of COVID response in the 2021 GAB, according to the DBM, Mr. Speaker, is 838.4 billion pesos. But what can be misleading, Mr. Speaker, is that a huge chunk of this amount, P590 billion, is for infrastructure as part of Build, Build, Build, which we’ve been planning even before the pandemic. So I have reservations tagging this amount as a COVID response,” Quimbo added.

“The total amount of COVID response in the 2021 GAB, according to the DBM, Mr. Speaker, is 838.4 billion pesos. But what can be misleading, Mr. Speaker, is that a huge chunk of this amount, P590 billion, is for infrastructure as part of Build, Build, Build, which we’ve been planning even before the pandemic. So I have reservations tagging this amount as a COVID response,” Quimbo added.

“Para sa akin po, dapat tatanggalin ito sa listahan, at P248 billion na lang ang tunay na COVID response na kasama sa 2021 budget. Kahit idagdag pa natin dito, Mr. Speaker, ang P165 billion spending sa ilalim ng Bayanihan to Recover as One Act o Bayanihan 2, napakaliit pa rin ng P413 billion para sa COVID response. This is equivalent to only 2.12 percent of GDP. Buti pa ang ibang bansa sa ASEAN, di hamak na mas malaki ang nakalaan para sa COVID response: 18.7 percent sa Malaysia, 18.2 percent sa Singapore, 13.2 percent sa Thailand. Sa laki ng nawala at patuloy na mawawala sa ekonomiya, kulang na kulang po ang halagang ito para makabangon ang ekonomiya.”

“Para sa akin po, dapat tatanggalin ito sa listahan, at P248 billion na lang ang tunay na COVID response na kasama sa 2021 budget. Kahit idagdag pa natin dito, Mr. Speaker, ang P165 billion spending sa ilalim ng Bayanihan to Recover as One Act o Bayanihan 2, napakaliit pa rin ng P413 billion para sa COVID response. This is equivalent to only 2.12 percent of GDP. Buti pa ang ibang bansa sa ASEAN, di hamak na mas malaki ang nakalaan para sa COVID response: 18.7 percent sa Malaysia, 18.2 percent sa Singapore, 13.2 percent sa Thailand. Sa laki ng nawala at patuloy na mawawala sa ekonomiya, kulang na kulang po ang halagang ito para makabangon ang ekonomiya.”

(For me, we should remove the Build Build Build items from the list and admit that only P248 billion was allocated for the COVID response in the 2021 budget. Even if we include the P165 billion budget under Bayanihan 2, the total comes to a paltry P413 billion. Other ASEAN countries have a much larger COVID response: 18.7 percent of GDP for Malaysia, 18.2 percent for Singapore, 13.2 percent in Thailand. Based on the impact on our economy, our response is too small to help spark a recovery)

(For me, we should remove the Build Build Build items from the list and admit that only P248 billion was allocated for the COVID response in the 2021 budget. Even if we include the P165 billion budget under Bayanihan 2, the total comes to a paltry P413 billion. Other ASEAN countries have a much larger COVID response: 18.7 percent of GDP for Malaysia, 18.2 percent for Singapore, 13.2 percent in Thailand. Based on the impact on our economy, our response is too small to help spark a recovery)

ADVERTISEMENT

Quimbo also computed the projected impact of the recent storms.

Quimbo also computed the projected impact of the recent storms.

“Moving from 5.5 percent contraction of GDP to a 10 percent contraction means losing an additional P900 billion. So from an expected P2.4 trillion loss, we now stand to lose P3.3 trillion. Pag isama pa natin dito ang economic damage na taglay ng bagyong Rolly, Quinta, Siony at Ulysses, aabot ito sa P3.4 trillion. (If we include here the economic damage from Typhoons Rolly, Quinta, Siony and Ulysses, it will go up to P3.4T.)"

“Moving from 5.5 percent contraction of GDP to a 10 percent contraction means losing an additional P900 billion. So from an expected P2.4 trillion loss, we now stand to lose P3.3 trillion. Pag isama pa natin dito ang economic damage na taglay ng bagyong Rolly, Quinta, Siony at Ulysses, aabot ito sa P3.4 trillion. (If we include here the economic damage from Typhoons Rolly, Quinta, Siony and Ulysses, it will go up to P3.4T.)"

In the Senate, Senator Ralph Recto also called for more spending.

In the Senate, Senator Ralph Recto also called for more spending.

“We have to flood areas with help. Not trickle down aid that is good enough for bags of groceries. But appropriated funds for targeted expenditures as a way of helping the victims and the economy,” Recto said.

“We have to flood areas with help. Not trickle down aid that is good enough for bags of groceries. But appropriated funds for targeted expenditures as a way of helping the victims and the economy,” Recto said.

Recto noted that in the 2020 spending program worth P4.3 trillion, only P3.022 trillion has been released as of September, and “most of the releases are for overhead, like salaries. Konti lang ang for economic pump-priming. (Only a little portion of the funds are for economic pump priming."

Recto noted that in the 2020 spending program worth P4.3 trillion, only P3.022 trillion has been released as of September, and “most of the releases are for overhead, like salaries. Konti lang ang for economic pump-priming. (Only a little portion of the funds are for economic pump priming."

ADVERTISEMENT

Recto went as far as blaming the third quarter contraction on government underspending saying “this below-program underspending could be one of the reasons why our economy contracted 11.5 percent in the third quarter. Budget should be a stimulus. In areas where the virus has caused an economic free-fall, government spending on social aid and capital outlays are expected to be the saviors.”

Recto went as far as blaming the third quarter contraction on government underspending saying “this below-program underspending could be one of the reasons why our economy contracted 11.5 percent in the third quarter. Budget should be a stimulus. In areas where the virus has caused an economic free-fall, government spending on social aid and capital outlays are expected to be the saviors.”

Recto called for “a last quarter storm” in spending, focused on typhoon-hit areas.

Recto called for “a last quarter storm” in spending, focused on typhoon-hit areas.

“The definition of good spending is not just releasing funds to the agencies, but the agencies releasing them to the people, or finally disbursing them for what they have been intended for,” he said.

“The definition of good spending is not just releasing funds to the agencies, but the agencies releasing them to the people, or finally disbursing them for what they have been intended for,” he said.

Business groups are also urging for the public sector, as well as private citizens and organizations to cooperate for disaster response.

Business groups are also urging for the public sector, as well as private citizens and organizations to cooperate for disaster response.

What is the state of the government’s finances?

What is the state of the government’s finances?

ADVERTISEMENT

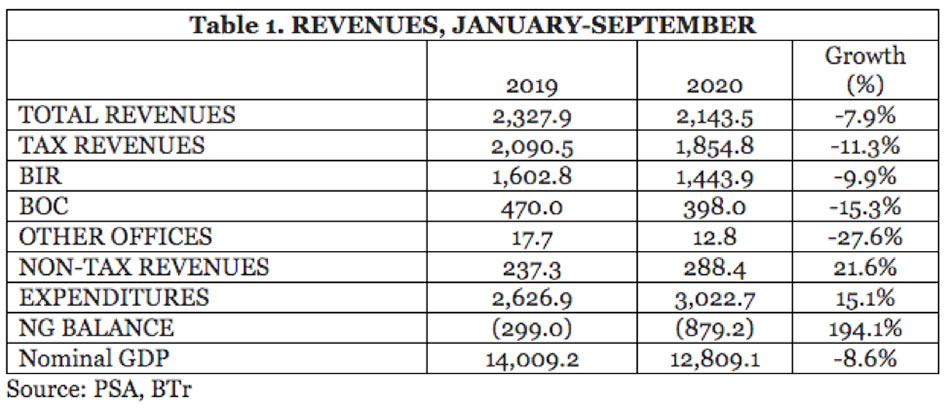

The Finance Department said over the weekend that its revenue collections fell by 7.9 percent year on year in the first three quarters of 2020.

The Finance Department said over the weekend that its revenue collections fell by 7.9 percent year on year in the first three quarters of 2020.

Collections by the Bureau of Internal Revenue fell 9.9 percent, while the Bureau of Customs saw its collections fall by 15.3 percent. Revenues from motor vehicle taxes and other charges meanwhile fell 27.6 percent for the period.

Collections by the Bureau of Internal Revenue fell 9.9 percent, while the Bureau of Customs saw its collections fall by 15.3 percent. Revenues from motor vehicle taxes and other charges meanwhile fell 27.6 percent for the period.

Government-owned and controlled corporations however stepped up their remittances, boosting non-tax revenues by 21.6 percent. The Bureau of Treasury also made P201.6 billion in income, nearly twice the P118.6 billion earned in the same period in 2019.

Government-owned and controlled corporations however stepped up their remittances, boosting non-tax revenues by 21.6 percent. The Bureau of Treasury also made P201.6 billion in income, nearly twice the P118.6 billion earned in the same period in 2019.

Part of the performance was also attributed to the Bayanihan to Heal as One Act, which allowed President Rodrigo Duterte to realign unutilized funds toward COVID-19 response expenditures.

Part of the performance was also attributed to the Bayanihan to Heal as One Act, which allowed President Rodrigo Duterte to realign unutilized funds toward COVID-19 response expenditures.

Spending rose by 15.1 percent for the period, to support measures against COVID. This led to a national government budget deficit of P879.2 billion, 6.9 percent of GDP. The Department of Finance said this is still a good number because they were expecting a deficit of P1.298 trillion or 10.1 percent of GDP for the period ending September.

Spending rose by 15.1 percent for the period, to support measures against COVID. This led to a national government budget deficit of P879.2 billion, 6.9 percent of GDP. The Department of Finance said this is still a good number because they were expecting a deficit of P1.298 trillion or 10.1 percent of GDP for the period ending September.

ADVERTISEMENT

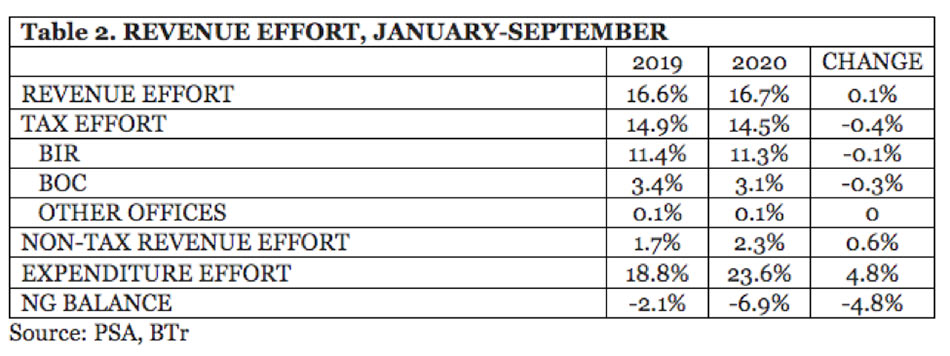

Economic managers said the government’s overall revenue effort, which measures its ability to generate and collect revenues versus available revenue sources and opportunities, improved by 0.1 percentage points. Tax effort however fell due to the lower collections of both the BIR and BOC.

Economic managers said the government’s overall revenue effort, which measures its ability to generate and collect revenues versus available revenue sources and opportunities, improved by 0.1 percentage points. Tax effort however fell due to the lower collections of both the BIR and BOC.

Between now and the end of 2020, the government can still strive to fully utilize all allocated funding under the Bayanihan 1 and 2 laws for its continuing response to COVID 19.

Between now and the end of 2020, the government can still strive to fully utilize all allocated funding under the Bayanihan 1 and 2 laws for its continuing response to COVID 19.

It can ask for additional funding from Congress for its response and economic pump-priming for typhoon-hit areas, and many lawmakers appear willing to work with the executive on this.

It can ask for additional funding from Congress for its response and economic pump-priming for typhoon-hit areas, and many lawmakers appear willing to work with the executive on this.

A Bayanihan ‘3’ proposal is reportedly in the works. A P10 billion augmentation fund for disaster response has also been reported, alongside an official order from President Rodrigo Duterte for some P1.5 billion in additional funds for LGUs badly hit by storms and floods.

A Bayanihan ‘3’ proposal is reportedly in the works. A P10 billion augmentation fund for disaster response has also been reported, alongside an official order from President Rodrigo Duterte for some P1.5 billion in additional funds for LGUs badly hit by storms and floods.

Representative Quimbo meanwhile is pushing for additions to be made to next year’s allocation, to address the losses to the economy. That money can be available in less than two months provided lawmakers approve the 2021 budget swiftly, and it is signed into law before the end of December.

Representative Quimbo meanwhile is pushing for additions to be made to next year’s allocation, to address the losses to the economy. That money can be available in less than two months provided lawmakers approve the 2021 budget swiftly, and it is signed into law before the end of December.

ADVERTISEMENT

Saving up for an emergency fund is always a smart decision. When an emergency happens, there should be no hesitation to spend.

Saving up for an emergency fund is always a smart decision. When an emergency happens, there should be no hesitation to spend.

ADVERTISEMENT

ADVERTISEMENT