Dissecting Data: How storms compromised food supply leading to 21-month high inflation | ABS-CBN

Welcome, Kapamilya! We use cookies to improve your browsing experience. Continuing to use this site means you agree to our use of cookies. Tell me more!

Dissecting Data: How storms compromised food supply leading to 21-month high inflation

Dissecting Data: How storms compromised food supply leading to 21-month high inflation

Warren de Guzman and Edson Guido,

ABS-CBN News

Published Dec 04, 2020 01:44 PM PHT

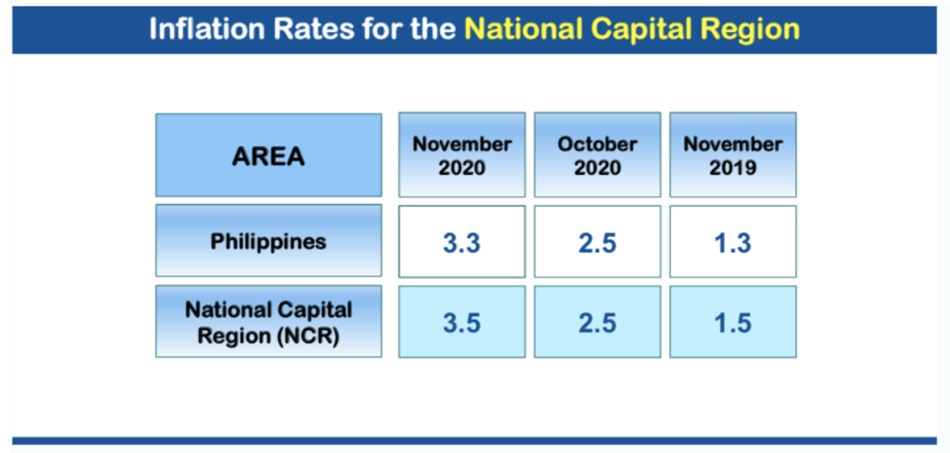

MANILA - Philippine inflation overshot expectations in November, hitting 3.3 percent for the month, above the Philippine Central Bank’s forecast range of 2.4 to 3.2 percent. Not only that, it was the highest inflation rate for the Philippines since February 2019, a 21-month high.

MANILA - Philippine inflation overshot expectations in November, hitting 3.3 percent for the month, above the Philippine Central Bank’s forecast range of 2.4 to 3.2 percent. Not only that, it was the highest inflation rate for the Philippines since February 2019, a 21-month high.

Philippine inflation has now risen for two straight months, and is inching toward the high end of the Philippine Central Bank’s inflation target range of between 2 and 4 percent. Prior to the November report, the Philippine Central Bank had warned a series of destructive typhoons that hit mostly the Luzon area between October and November might put upward pressure on agricultural commodity prices. They were right.

Philippine inflation has now risen for two straight months, and is inching toward the high end of the Philippine Central Bank’s inflation target range of between 2 and 4 percent. Prior to the November report, the Philippine Central Bank had warned a series of destructive typhoons that hit mostly the Luzon area between October and November might put upward pressure on agricultural commodity prices. They were right.

National Statistician, Undersecretary Dennis Mapa says “na-capture kaagad ang impact on prices of the storms. Ang nakita namin sa mga datos ay una, nagkaroon ng impact sa supply. Para naman dito sa karne, at dito sa baboy, nagkaroon kasi tayo ng ASF so that also affected the supply. Tracking prices in NCR talagang tumaas ang presyo ng itong mga commodities.”

National Statistician, Undersecretary Dennis Mapa says “na-capture kaagad ang impact on prices of the storms. Ang nakita namin sa mga datos ay una, nagkaroon ng impact sa supply. Para naman dito sa karne, at dito sa baboy, nagkaroon kasi tayo ng ASF so that also affected the supply. Tracking prices in NCR talagang tumaas ang presyo ng itong mga commodities.”

(November inflation quickly captured impact on prices of storms. What we saw are first, impact on supply. Pork was also affected by the African Swine Fever, which also affected supply. Tracking prices of commodities in the National Capital Region, it really rose)

(November inflation quickly captured impact on prices of storms. What we saw are first, impact on supply. Pork was also affected by the African Swine Fever, which also affected supply. Tracking prices of commodities in the National Capital Region, it really rose)

ADVERTISEMENT

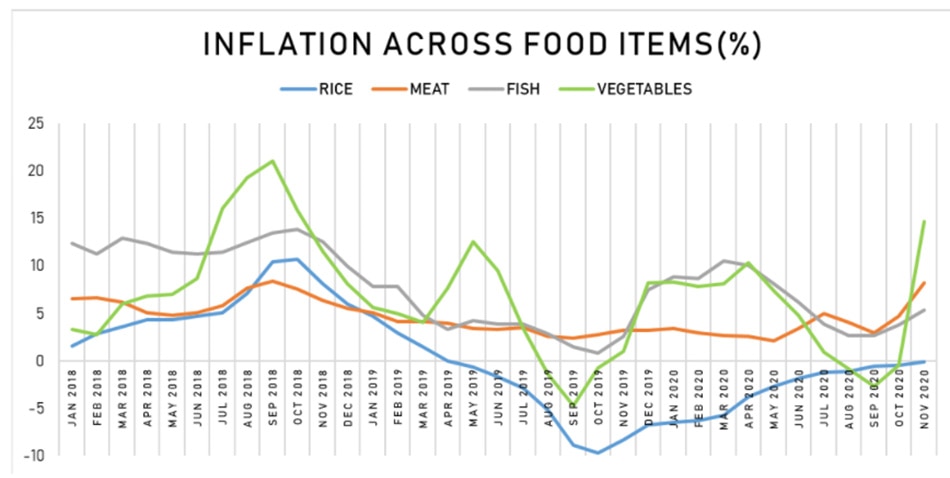

This chart shows how drastic of an impact the storms had on the key contributors to higher inflation in November.

This chart shows how drastic of an impact the storms had on the key contributors to higher inflation in November.

Vegetable inflation, shown in green, had the biggest acceleration, rocketing from negative inflation or deflation in October.

Vegetable inflation, shown in green, had the biggest acceleration, rocketing from negative inflation or deflation in October.

Meat inflation, which has been a consistent problem over the last few months due to the African Swine Fever, also rose. Fish inflation did the same. Rice inflation, which has been negative since May 2019 thanks to imports and the Rice Tariffication law, was on the verge of breaking into positive territory.

Meat inflation, which has been a consistent problem over the last few months due to the African Swine Fever, also rose. Fish inflation did the same. Rice inflation, which has been negative since May 2019 thanks to imports and the Rice Tariffication law, was on the verge of breaking into positive territory.

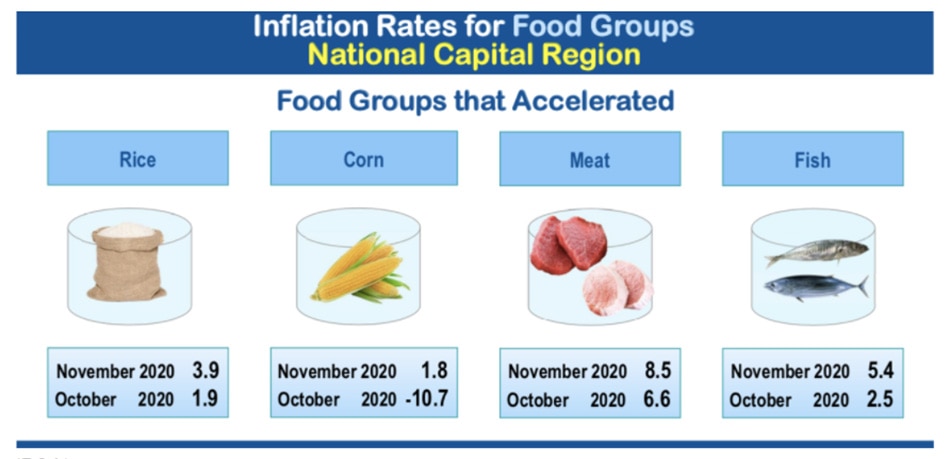

Rice inflation in the National Capital Region however is already positive, and it surged to 3.9 percent in November, higher than the national average for overall inflation.

Rice inflation in the National Capital Region however is already positive, and it surged to 3.9 percent in November, higher than the national average for overall inflation.

The higher inflation for rice and other food commodities pushed NCR inflation to 3.5 percent for the month, which was also higher than the national average.

The higher inflation for rice and other food commodities pushed NCR inflation to 3.5 percent for the month, which was also higher than the national average.

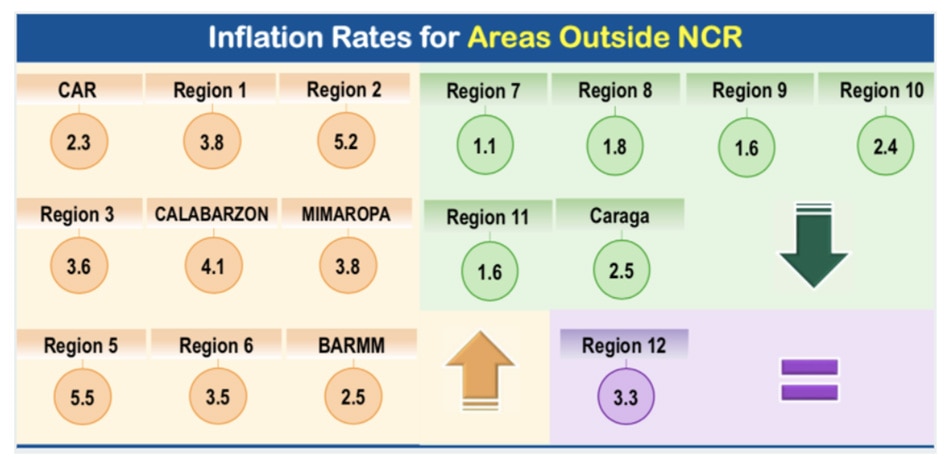

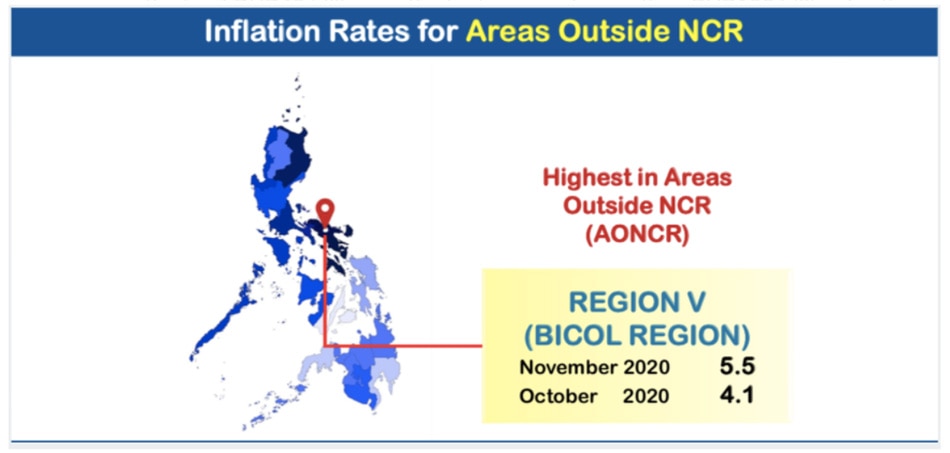

Inflation rates across all regions of Luzon increased in November from October, as these were the main areas which were hit by the devastating string of storms, including Typhoons Rolly and Ulysses.

Inflation rates across all regions of Luzon increased in November from October, as these were the main areas which were hit by the devastating string of storms, including Typhoons Rolly and Ulysses.

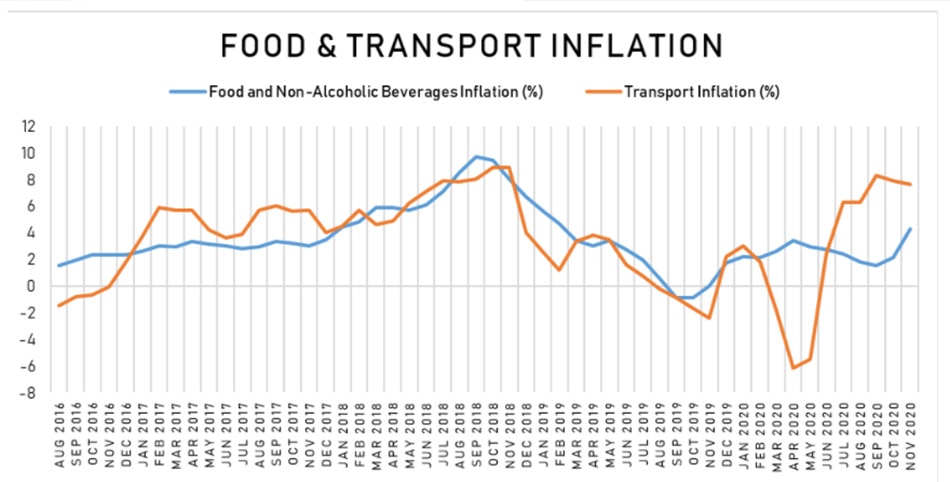

This chart shows us the trends in the two biggest contributors to inflation, food and transport. Transport inflation has been high due to COVID-19 related travel restrictions which prevent the sharing of rides on tricycles, and has limited access to many other modes of public transport. Food inflation meanwhile is trending higher, and the rise in both contributed to the November inflation rate spike.

This chart shows us the trends in the two biggest contributors to inflation, food and transport. Transport inflation has been high due to COVID-19 related travel restrictions which prevent the sharing of rides on tricycles, and has limited access to many other modes of public transport. Food inflation meanwhile is trending higher, and the rise in both contributed to the November inflation rate spike.

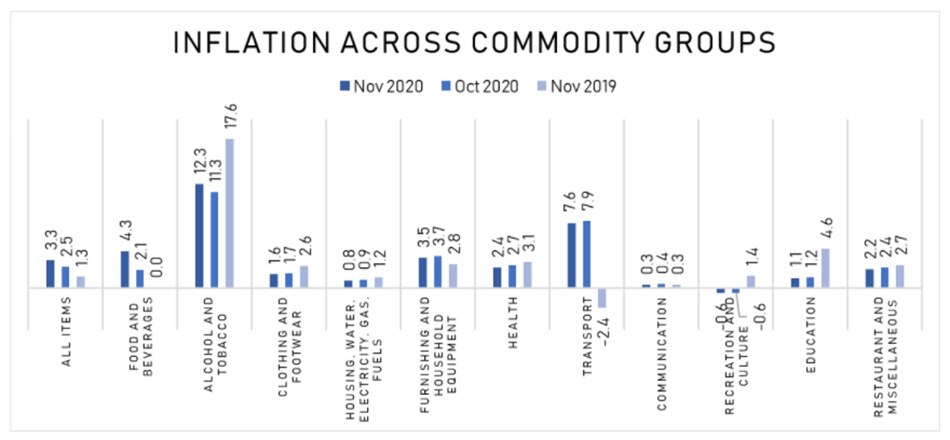

The Philippine Statistics Authority says it sees no evidence of rising inflation in other commodity groups, and this chart shows that to be true.

The Philippine Statistics Authority says it sees no evidence of rising inflation in other commodity groups, and this chart shows that to be true.

November 2020 inflation is shown in the darkest blue in this chart, and the only commodity categories where inflation is higher than October 2020 inflation (shown in light blue) are Food and Non-alcoholic Beverages, and Alcohol and Tobacco.

November 2020 inflation is shown in the darkest blue in this chart, and the only commodity categories where inflation is higher than October 2020 inflation (shown in light blue) are Food and Non-alcoholic Beverages, and Alcohol and Tobacco.

Philippine Central Bank Governor Benjamin Diokno says “the November 2020 inflation of 3.3 percent was slightly higher than BSP’s forecast range of 2.4 - 3.2 percent, driven mainly by higher food inflation, particularly for vegetables, fish, fruits and meat. Nonetheless, inflation is expected to settle within the government’s target range of 3.0% plus or minus 1.0 percent for 2020-2022 as the impact of supply disruptions due to recent typhoons is expected to be largely transitory.”

Philippine Central Bank Governor Benjamin Diokno says “the November 2020 inflation of 3.3 percent was slightly higher than BSP’s forecast range of 2.4 - 3.2 percent, driven mainly by higher food inflation, particularly for vegetables, fish, fruits and meat. Nonetheless, inflation is expected to settle within the government’s target range of 3.0% plus or minus 1.0 percent for 2020-2022 as the impact of supply disruptions due to recent typhoons is expected to be largely transitory.”

Usec Mapa says they will be keeping a close watch on prices to determine if the spike in inflation is indeed transitory. He says “dito sa aming pag track ng inflation following a storm. may mga buwan na mabilis lang. Sometimes after one month, or in the next month’s report mababa na kaagad. What we will do is track vegetables, meat and fish. Dadalasan kung madamage ang crops matagal, pero kung supply delivery lang ang issue, may supply na kaagad after the storm.”

Usec Mapa says they will be keeping a close watch on prices to determine if the spike in inflation is indeed transitory. He says “dito sa aming pag track ng inflation following a storm. may mga buwan na mabilis lang. Sometimes after one month, or in the next month’s report mababa na kaagad. What we will do is track vegetables, meat and fish. Dadalasan kung madamage ang crops matagal, pero kung supply delivery lang ang issue, may supply na kaagad after the storm.”

Diokno however says there are other factors affecting inflation. He says “downside risks to the global and domestic economy remain despite recent progress in the development of vaccines for COVID-19.

Diokno however says there are other factors affecting inflation. He says “downside risks to the global and domestic economy remain despite recent progress in the development of vaccines for COVID-19.

Moreover, logistical challenges in the distribution of the vaccine would have to be addressed before the recovery could resume. In the near term, uncertainty remains high following the resurgence of the virus in the US, Europe and parts of Asia. The reimposition of lockdowns could further dampen economic recovery."

Moreover, logistical challenges in the distribution of the vaccine would have to be addressed before the recovery could resume. In the near term, uncertainty remains high following the resurgence of the virus in the US, Europe and parts of Asia. The reimposition of lockdowns could further dampen economic recovery."

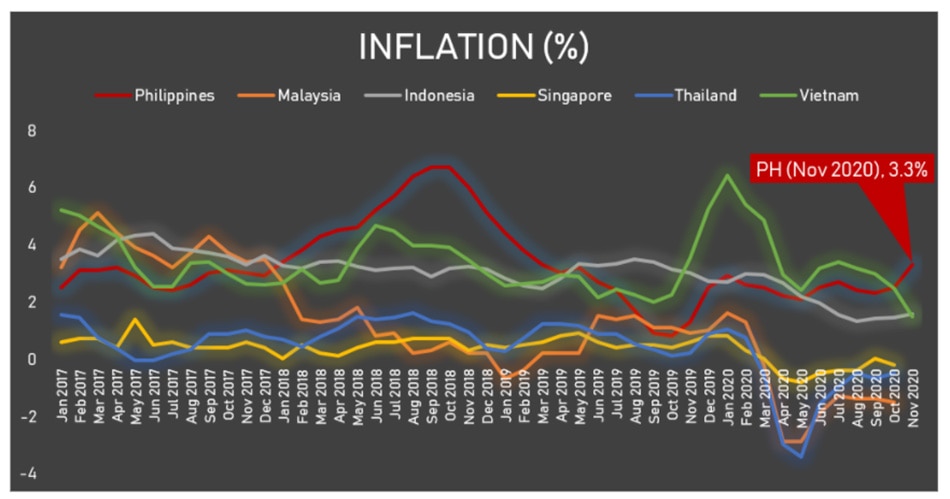

The November inflation rate has pushed the Philippines into the lead amongst major ASEAN economies. The Philippines, shown here in red, now has a higher inflation rate than Vietnam, Indonesia, Singapore, Thailand, and Malaysia.

The November inflation rate has pushed the Philippines into the lead amongst major ASEAN economies. The Philippines, shown here in red, now has a higher inflation rate than Vietnam, Indonesia, Singapore, Thailand, and Malaysia.

Moody’s chief economist for Asia Pacific Steve Cochrane says Philippine inflation has been largely steady, even amid the COVID-19 pandemic, which has been deflationary as it has sapped demand by limiting mobility.

Moody’s chief economist for Asia Pacific Steve Cochrane says Philippine inflation has been largely steady, even amid the COVID-19 pandemic, which has been deflationary as it has sapped demand by limiting mobility.

Cochrane says the steady inflation shows that demand in the Philippines is stable, and the government’s fiscal stimulus “may be going to the right pockets, the low income households” helping to support spending.

Cochrane says the steady inflation shows that demand in the Philippines is stable, and the government’s fiscal stimulus “may be going to the right pockets, the low income households” helping to support spending.

Cochrane however warns the Philippine economy is still in a “rough patch” being the only other economy aside from India to see as much as one fifth of total output wiped out in the first half of 2020.

Cochrane however warns the Philippine economy is still in a “rough patch” being the only other economy aside from India to see as much as one fifth of total output wiped out in the first half of 2020.

RCBC Treasury Group Chief Economist Michael Ricafort agrees the November inflation spike should be temporary or transitory. However, he says it may have an impact on monetary policy moving forward.

RCBC Treasury Group Chief Economist Michael Ricafort agrees the November inflation spike should be temporary or transitory. However, he says it may have an impact on monetary policy moving forward.

He says “this could somewhat temper/limit any further monetary easing measures for now, especially and particularly on local policy rates, currently at the record low of 2 percent (way below inflation producing negative net interest rates)”

He says “this could somewhat temper/limit any further monetary easing measures for now, especially and particularly on local policy rates, currently at the record low of 2 percent (way below inflation producing negative net interest rates)”

Ricafort however believes the Philippine government’s fiscal response will boost economic activity. He says “The CREATE Bill is next, groomed to be the country’s biggest stimulus measure, worth about P40 billion on the first year and more than P600 billion for the next years.”

Ricafort however believes the Philippine government’s fiscal response will boost economic activity. He says “The CREATE Bill is next, groomed to be the country’s biggest stimulus measure, worth about P40 billion on the first year and more than P600 billion for the next years.”

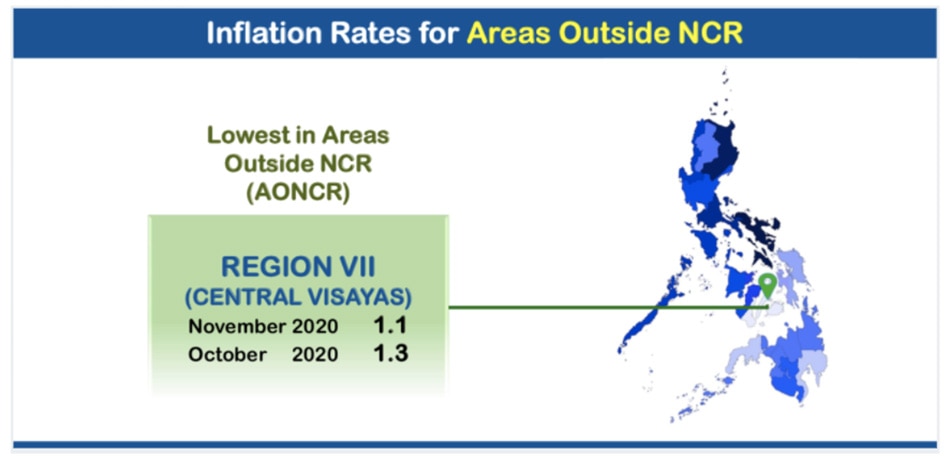

Central Visayas had the lowest inflation rate in November at 1.1 percent.

Central Visayas had the lowest inflation rate in November at 1.1 percent.

Bicol Region had the highest inflation rate in the country for November at 5.5 percent.

Bicol Region had the highest inflation rate in the country for November at 5.5 percent.

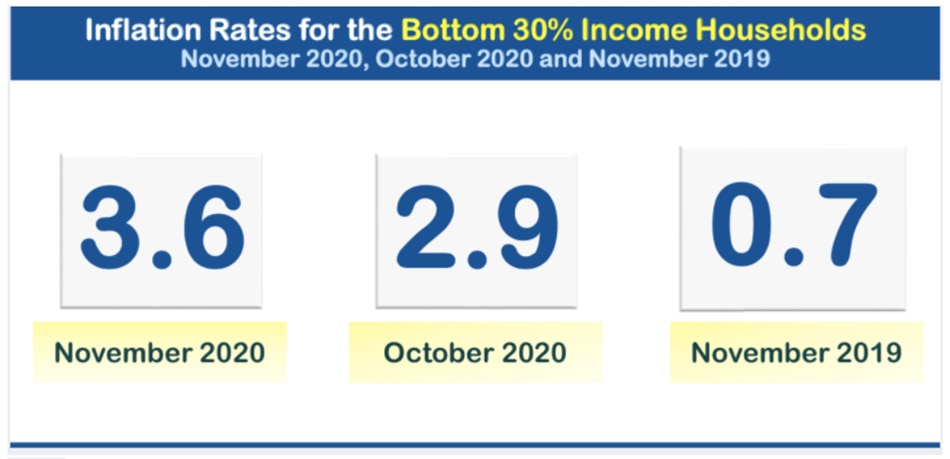

The inflation rate for the bottom 30 percent income households, the poorest of the poor, was at 3.6 percent.

The inflation rate for the bottom 30 percent income households, the poorest of the poor, was at 3.6 percent.

This basket has a heavier weight for food, housing, and transport, which make up a larger portion of the budget for the poor.

This basket has a heavier weight for food, housing, and transport, which make up a larger portion of the budget for the poor.

Read More:

Dissecting Data

November inflation

November 2020 inflation

consumer price index

CPI

prices

Philippines economy

impact of storms

ADVERTISEMENT

ADVERTISEMENT