Inflation quickens to 5.3 pct in August as rice, fuel costs rise | ABS-CBN

Welcome, Kapamilya! We use cookies to improve your browsing experience. Continuing to use this site means you agree to our use of cookies. Tell me more!

Inflation quickens to 5.3 pct in August as rice, fuel costs rise

Inflation quickens to 5.3 pct in August as rice, fuel costs rise

ABS-CBN News

Published Sep 05, 2023 09:07 AM PHT

|

Updated Sep 05, 2023 01:19 PM PHT

MANILA (UPDATE) - After slowing down for six months, inflation again quickened in August following increases in fuel and food prices, particularly rice, the state statistics bureau said on Tuesday.

MANILA (UPDATE) - After slowing down for six months, inflation again quickened in August following increases in fuel and food prices, particularly rice, the state statistics bureau said on Tuesday.

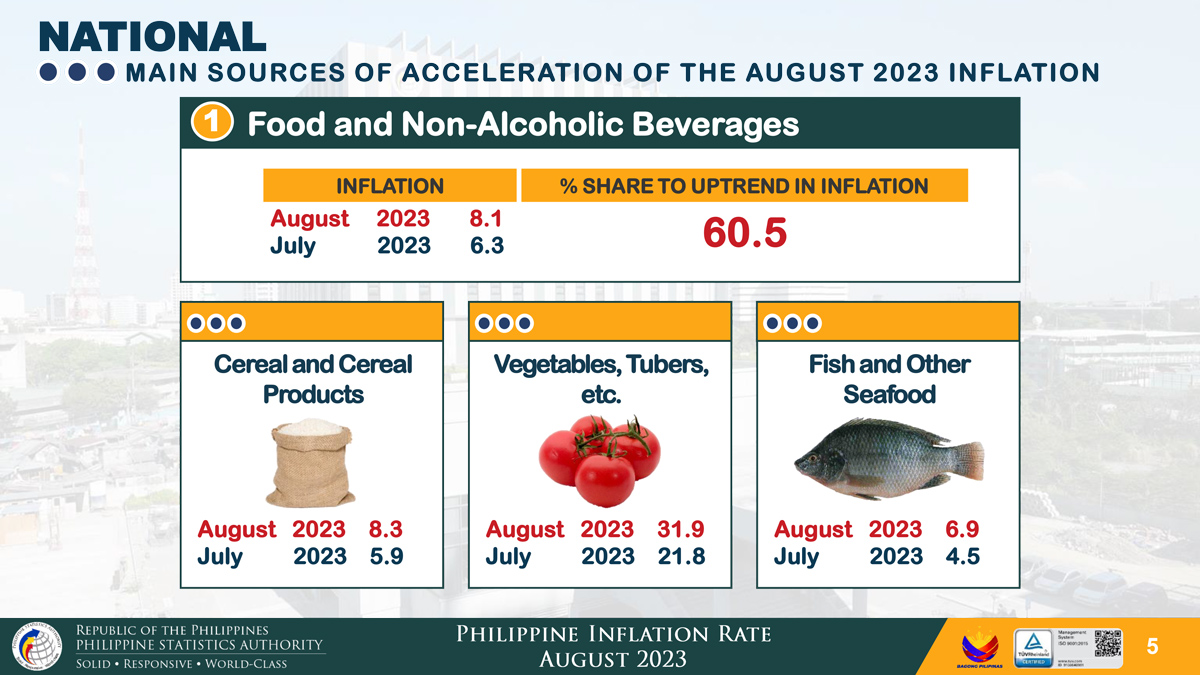

Inflation hit 5.3 percent in August, which was higher than the 4.7 percent seen in July, the Philippine Statistics Authority said.

Inflation hit 5.3 percent in August, which was higher than the 4.7 percent seen in July, the Philippine Statistics Authority said.

National Statistician and PSA Undersecretary Dennis Mapa noted the higher prices of rice, which weigh heavily in the consumer price index.

National Statistician and PSA Undersecretary Dennis Mapa noted the higher prices of rice, which weigh heavily in the consumer price index.

“The acceleration of food inflation in August 2023 was mainly brought about by the higher year-on-year growth rate observed in rice at 8.7 percent from 4.2 percent in July 2023,” the PSA said.

Food inflation at the national level rose to 8.2 percent in August 2023 from 6.3 percent in July 2023, it said. This was even higher than the 6.5 percent food inflation seen in August last year.

“The acceleration of food inflation in August 2023 was mainly brought about by the higher year-on-year growth rate observed in rice at 8.7 percent from 4.2 percent in July 2023,” the PSA said.

Food inflation at the national level rose to 8.2 percent in August 2023 from 6.3 percent in July 2023, it said. This was even higher than the 6.5 percent food inflation seen in August last year.

ADVERTISEMENT

Worries over rising food costs recently prompted the government to put a cap on rice prices, which some retailers criticized.

Worries over rising food costs recently prompted the government to put a cap on rice prices, which some retailers criticized.

The National Economic and Development Authority (NEDA) said the expected reduction in rice production due to El Niño and the export ban recently imposed by major rice exporters such as India and Myanmar led to higher prices of the grain globally.

The National Economic and Development Authority (NEDA) said the expected reduction in rice production due to El Niño and the export ban recently imposed by major rice exporters such as India and Myanmar led to higher prices of the grain globally.

The agency also said that alleged hoarding incidents, an artificial shortage, and speculative business decisions of market players could have driven rice prices upward.

The agency also said that alleged hoarding incidents, an artificial shortage, and speculative business decisions of market players could have driven rice prices upward.

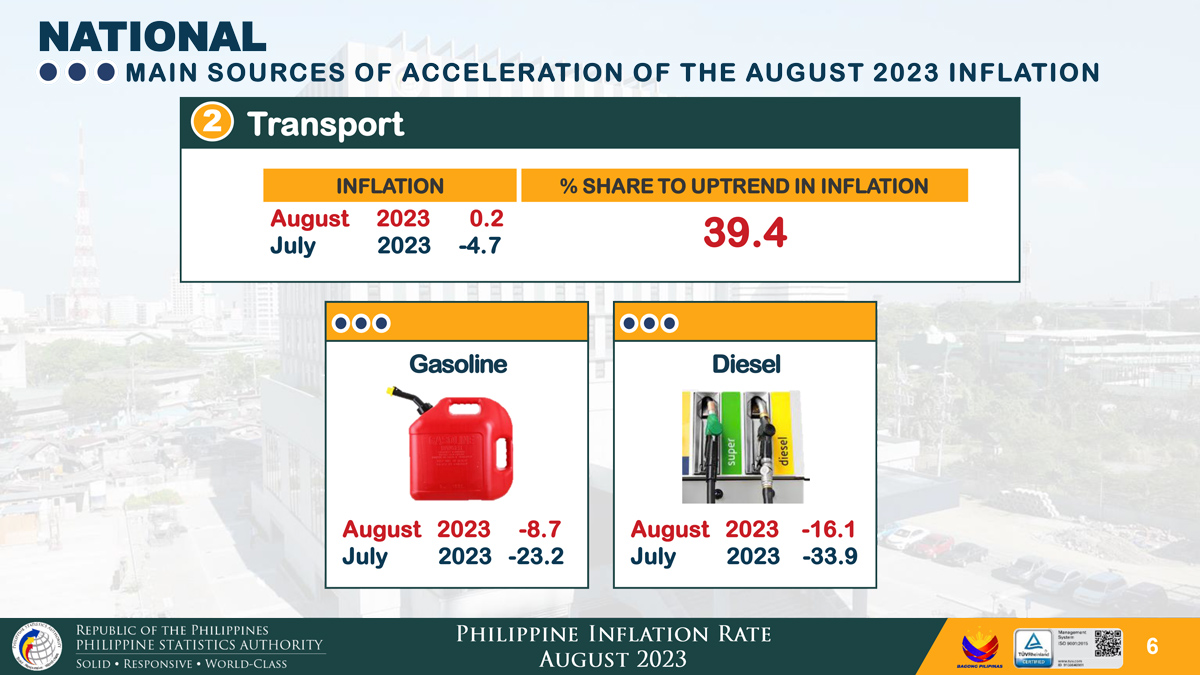

Transport costs also climbed 0.2 percent during the month, from an annual decline of -4.7 percent in July, the PSA said.

Transport costs also climbed 0.2 percent during the month, from an annual decline of -4.7 percent in July, the PSA said.

Over the past 9 weeks, fuel prices increased by the following amounts:

Over the past 9 weeks, fuel prices increased by the following amounts:

ADVERTISEMENT

- Gasoline: P9.65/L increase

- Kerosene: P13.74/L increase

- Diesel: P14.40/L increase

- Gasoline: P9.65/L increase

- Kerosene: P13.74/L increase

- Diesel: P14.40/L increase

Meanwhile, core inflation, which strips out volatile food and energy items, slowed further to 6.1 percent in August 2023 from 6.7 percent in July 2023, the PSA said.

Meanwhile, core inflation, which strips out volatile food and energy items, slowed further to 6.1 percent in August 2023 from 6.7 percent in July 2023, the PSA said.

“This brings the average core inflation from January to August 2023 to 7.4 percent. In August 2022, core inflation was observed at 4.6 percent.”

“This brings the average core inflation from January to August 2023 to 7.4 percent. In August 2022, core inflation was observed at 4.6 percent.”

August’s headline inflation rate was within the 4.8 to 5.6 percent forecast of the Bangko Sentral ng Pilipinas (BSP), which earlier also took note of the higher prices of rice and other agricultural commodities due to weather disturbances, the sharp rise in fuel prices as well as increased transport costs.

August’s headline inflation rate was within the 4.8 to 5.6 percent forecast of the Bangko Sentral ng Pilipinas (BSP), which earlier also took note of the higher prices of rice and other agricultural commodities due to weather disturbances, the sharp rise in fuel prices as well as increased transport costs.

The inflation rate in August brought the average for the year to 6.6 percent. In June, economic managers revised their inflation forecast for 2023 to between 5 and 6 percent, which was lower than the 5 to 7 percent assumption they gave in April.

The inflation rate in August brought the average for the year to 6.6 percent. In June, economic managers revised their inflation forecast for 2023 to between 5 and 6 percent, which was lower than the 5 to 7 percent assumption they gave in April.

The BSP said transport fare hikes and higher-than-expected minimum wage adjustments could keep inflation high in the coming months.

The BSP said transport fare hikes and higher-than-expected minimum wage adjustments could keep inflation high in the coming months.

ADVERTISEMENT

It said persistent supply constraints for key food items, the El Niño, and possible knock-on effects of higher toll rates on prices of key agricultural items might keep commodity prices up.

It said persistent supply constraints for key food items, the El Niño, and possible knock-on effects of higher toll rates on prices of key agricultural items might keep commodity prices up.

"Nonetheless, inflation is still projected to decelerate back to within the inflation target by (the fourth quarter of) 2023," it said.

"Nonetheless, inflation is still projected to decelerate back to within the inflation target by (the fourth quarter of) 2023," it said.

Security Bank economist Dan Roces shares this view.

Security Bank economist Dan Roces shares this view.

"So given that the August numbers actually beat estimates, so I think on average that will move the estimates that everyone has but inflation nonetheless will still probably hit the target," he said.

"So given that the August numbers actually beat estimates, so I think on average that will move the estimates that everyone has but inflation nonetheless will still probably hit the target," he said.

"But it can get pushed back. Instead of expecting it in October, we might probably see it in November, December," he noted.

"But it can get pushed back. Instead of expecting it in October, we might probably see it in November, December," he noted.

ADVERTISEMENT

NEDA Secretary Arsenio Balisacan said government remains focused on its goal of bringing down Philippine inflation to its target of 2 to 4 percent.

NEDA Secretary Arsenio Balisacan said government remains focused on its goal of bringing down Philippine inflation to its target of 2 to 4 percent.

To this end, he said government must strengthen its measures to ensure Philippine food security by providing assistance to rice and vegetable farmers to boost production.

To this end, he said government must strengthen its measures to ensure Philippine food security by providing assistance to rice and vegetable farmers to boost production.

He also called on the Department of Agriculture and the National Food Authority to increase support for farmers in the drying and milling palay in the upcoming harvest season.

He also called on the Department of Agriculture and the National Food Authority to increase support for farmers in the drying and milling palay in the upcoming harvest season.

The country's economic development chief also noted that government must roll out its Food Stamp Program faster to help consumers, especially the poor.

The country's economic development chief also noted that government must roll out its Food Stamp Program faster to help consumers, especially the poor.

The economist also called for a review of the existing rice tariffs.

The economist also called for a review of the existing rice tariffs.

ADVERTISEMENT

“To partially counterbalance the rise in global prices and alleviate the impact on consumers and households, we may implement a temporary and calibrated reduction in tariffs,” he explained.

“To partially counterbalance the rise in global prices and alleviate the impact on consumers and households, we may implement a temporary and calibrated reduction in tariffs,” he explained.

Finance Secretary Benjamin DIokno also called on government to ensure sufficient rice supply at reduced prices, avoid non-competitive behavior in the rice industry, and pursue targeted programs to protect vulnerable sectors.

Finance Secretary Benjamin DIokno also called on government to ensure sufficient rice supply at reduced prices, avoid non-competitive behavior in the rice industry, and pursue targeted programs to protect vulnerable sectors.

The BSP, meanwhile, said it was ready to adjust monetary policy to ease price pressures.

The BSP, meanwhile, said it was ready to adjust monetary policy to ease price pressures.

The central bank kept its benchmark rate steady at 6.25 percent in its last policy-setting meeting as inflation showed signs of cooling, while the economy showed signs of losing steam.

The central bank kept its benchmark rate steady at 6.25 percent in its last policy-setting meeting as inflation showed signs of cooling, while the economy showed signs of losing steam.

The central bank also raised its inflation forecast for this year to 5.6 percent from an earlier forecast of 5.5 percent. The forecast for 2024 was also raised to 3.3 percent from 2.8 percent.

The central bank also raised its inflation forecast for this year to 5.6 percent from an earlier forecast of 5.5 percent. The forecast for 2024 was also raised to 3.3 percent from 2.8 percent.

Read More:

inflation

consumer price index

food prices

fuel prices

PSA

Philippine Statistics Authority

BSP

Bangko Sentral ng Pilipinas

benchmark rate

interest rates

ADVERTISEMENT

ADVERTISEMENT