Inflation further eases to 5.4 percent in June | ABS-CBN

Welcome, Kapamilya! We use cookies to improve your browsing experience. Continuing to use this site means you agree to our use of cookies. Tell me more!

Inflation further eases to 5.4 percent in June

Inflation further eases to 5.4 percent in June

ABS-CBN News

Published Jul 05, 2023 09:10 AM PHT

|

Updated Jul 05, 2023 01:00 PM PHT

MANILA (UPDATE) - Inflation further eased in June, the state statistics bureau said on Wednesday.

MANILA (UPDATE) - Inflation further eased in June, the state statistics bureau said on Wednesday.

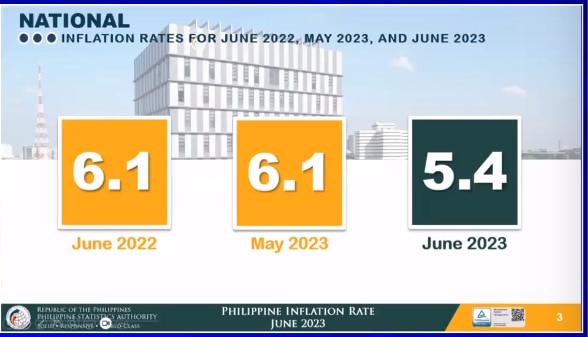

The consumer price index rose 5.4 percent last month, which was slower than the 6.1 percent inflation rate reported in May, the Philippine Statistics Authority said.

The consumer price index rose 5.4 percent last month, which was slower than the 6.1 percent inflation rate reported in May, the Philippine Statistics Authority said.

This was within the 5.3 to 6.1 percent forecast of the Bangko Sentral ng Pilipinas.

This was within the 5.3 to 6.1 percent forecast of the Bangko Sentral ng Pilipinas.

"This is the fifth consecutive month of deceleration in the headline inflation and the lowest in the past 13 months," the PSA said.

"This is the fifth consecutive month of deceleration in the headline inflation and the lowest in the past 13 months," the PSA said.

ADVERTISEMENT

It was also slower than the 6.1 percent inflation rate recorded in June last year.

It was also slower than the 6.1 percent inflation rate recorded in June last year.

However, it was still above the 2 to 4 percent target range of economic managers.

However, it was still above the 2 to 4 percent target range of economic managers.

Last month, economic managers revised their inflation forecast for 2023 to between 5 and 6 percent, which was lower than the 5 to 7 percent assumption they gave in April.

Last month, economic managers revised their inflation forecast for 2023 to between 5 and 6 percent, which was lower than the 5 to 7 percent assumption they gave in April.

According to the PSA, the average inflation rate for the first six months stood at 7.2 percent.

According to the PSA, the average inflation rate for the first six months stood at 7.2 percent.

Inflation has been easing since hitting a 14-year high of 8.7 percent in January.

Inflation has been easing since hitting a 14-year high of 8.7 percent in January.

The PSA said this was primarily due to the slower annual increase in the prices of food and non-alcoholic beverages at 6.7 percent in June from 7.4 percent in May.

The PSA said this was primarily due to the slower annual increase in the prices of food and non-alcoholic beverages at 6.7 percent in June from 7.4 percent in May.

Transport costs also fell faster at -3.1 percent during the month from -0.5 percent in May 2023.

Transport costs also fell faster at -3.1 percent during the month from -0.5 percent in May 2023.

"Housing, water, electricity, gas and other fuels was the third main source of deceleration of the headline inflation in June 2023 with 5.6 percent annual growth rate from 6.5 percent in May 2023," the agency added.

"Housing, water, electricity, gas and other fuels was the third main source of deceleration of the headline inflation in June 2023 with 5.6 percent annual growth rate from 6.5 percent in May 2023," the agency added.

Core inflation, which excludes food and energy costs that tend to rise or fall sharply, also slowed to 7.4 percent in June 2023 from 7.7 percent in May 2023.

Core inflation, which excludes food and energy costs that tend to rise or fall sharply, also slowed to 7.4 percent in June 2023 from 7.7 percent in May 2023.

Easing inflation has allowed the BSP to pause rate hikes during its last policy-setting meeting.

Easing inflation has allowed the BSP to pause rate hikes during its last policy-setting meeting.

President Ferdinand Marcos Jr. said the government will continue to work to bring down inflation in the Philippines.

President Ferdinand Marcos Jr. said the government will continue to work to bring down inflation in the Philippines.

He noted that the easing of inflation is also partly due to government's effort to make agricultural production more efficient and help farmers use new technology in their work.

He noted that the easing of inflation is also partly due to government's effort to make agricultural production more efficient and help farmers use new technology in their work.

"I really believe that it's a large part of why the inflation rate has begun to come down," Marcos said.

"I really believe that it's a large part of why the inflation rate has begun to come down," Marcos said.

"That's why doing this, improving the technologies, helping our farmers at both ends of that value chain, there is an advantage because the farmers will make more money because they are spending less, because they are more efficient. At the same time, that price level will translate all the way to the consumer na at least stable and we can plan and we know exactly," he added.

"That's why doing this, improving the technologies, helping our farmers at both ends of that value chain, there is an advantage because the farmers will make more money because they are spending less, because they are more efficient. At the same time, that price level will translate all the way to the consumer na at least stable and we can plan and we know exactly," he added.

"We will try of course to continue to bring it down but that requires our success in increasing our production, making it more efficient and again the value chain that I'm always talking about ad infinitum but it's really the answer."

"We will try of course to continue to bring it down but that requires our success in increasing our production, making it more efficient and again the value chain that I'm always talking about ad infinitum but it's really the answer."

National Economic and Development Authority (NEDA) Secretary Arsenio Balisacan said the government is making progress in managing the rising prices of goods in the country.

National Economic and Development Authority (NEDA) Secretary Arsenio Balisacan said the government is making progress in managing the rising prices of goods in the country.

"We can expect that it will decline to within 2-4 percent by the end of the year."

"We can expect that it will decline to within 2-4 percent by the end of the year."

Balisacan also said that the Inter-Agency Committee on Inflation and Market Outlook will continue to take steps to address the root causes of inflation.

Balisacan also said that the Inter-Agency Committee on Inflation and Market Outlook will continue to take steps to address the root causes of inflation.

"This is particularly important considering the impending El Nino, which poses risks to food supply and prices," he said.

"This is particularly important considering the impending El Nino, which poses risks to food supply and prices," he said.

National Statistician Clare Dennis Mapa said that the impact of wage hikes on the Philippine economy remains to be seen after an economist warned that these may drive up inflation.

National Statistician Clare Dennis Mapa said that the impact of wage hikes on the Philippine economy remains to be seen after an economist warned that these may drive up inflation.

"It could be inflationary, pero depende kasi yun sa amount. So iba-iba yung wage increases natin, well of course ang NCR nag-announce na sila ng P40, we would be tracking naman ang impact niya."

"It could be inflationary, pero depende kasi yun sa amount. So iba-iba yung wage increases natin, well of course ang NCR nag-announce na sila ng P40, we would be tracking naman ang impact niya."

(It could be inflationary, but it depends on the amount. Wage hikes differ from region to region--NCR has announced that theirs is P40. So we will monitor these.)

(It could be inflationary, but it depends on the amount. Wage hikes differ from region to region--NCR has announced that theirs is P40. So we will monitor these.)

For its part, the Bangko Sentral ng Pilipinas said that transport fare hikes, minimum wage adjustments, supply constraints on some food items, and possible knock-on effects of higher toll rates on agricultural products may also push up commodity prices throughout the country.

For its part, the Bangko Sentral ng Pilipinas said that transport fare hikes, minimum wage adjustments, supply constraints on some food items, and possible knock-on effects of higher toll rates on agricultural products may also push up commodity prices throughout the country.

The BSP added that it remains ready to adjust the monetary policy stance to prevent the further broadening of price pressures.

The BSP added that it remains ready to adjust the monetary policy stance to prevent the further broadening of price pressures.

HSBC Global Research ASEAN Economist Aris Dacanay said the bank shares the BSP's sentiments that inflation will continue to ease.

HSBC Global Research ASEAN Economist Aris Dacanay said the bank shares the BSP's sentiments that inflation will continue to ease.

"We expect it to actually fall to within the BSP’s target band by the 4th quarter 2023, mainly because of base effects. So our full year inflation forecast is for inflation to average around 5.5 percent for 2023 and 3.6 percent for 2024 and that’s mainly driven by base effects," he said.

"We expect it to actually fall to within the BSP’s target band by the 4th quarter 2023, mainly because of base effects. So our full year inflation forecast is for inflation to average around 5.5 percent for 2023 and 3.6 percent for 2024 and that’s mainly driven by base effects," he said.

Dacanay also said he expects BSP to keep rates steady with the current inflation figures.

Dacanay also said he expects BSP to keep rates steady with the current inflation figures.

"What’s making it harder for the BSP to cut rates is actually the yield differential between the Fed. But on the inflation aspect, I do think it’s enough to keep things steady right now for the BSP, to give BSP some time to assess the economic impacts of its previous rate hikes.

"What’s making it harder for the BSP to cut rates is actually the yield differential between the Fed. But on the inflation aspect, I do think it’s enough to keep things steady right now for the BSP, to give BSP some time to assess the economic impacts of its previous rate hikes.

"If El Nino does materialize to be a bigger risk than expected, then that will add to the challenges that the BSP will face on its timing of when it begins its easing cycle," he added.

"If El Nino does materialize to be a bigger risk than expected, then that will add to the challenges that the BSP will face on its timing of when it begins its easing cycle," he added.

Read More:

inflation

consumer price index

consumer prices

PSA

Philippine Statistics Authority

BSP

Bangko Sentral ng Pilipinas

ADVERTISEMENT

ADVERTISEMENT