BIR files cases vs buyers, firms linked to ghost receipts, P17.9-B tax liabilities | ABS-CBN

ADVERTISEMENT

Welcome, Kapamilya! We use cookies to improve your browsing experience. Continuing to use this site means you agree to our use of cookies. Tell me more!

BIR files cases vs buyers, firms linked to ghost receipts, P17.9-B tax liabilities

BIR files cases vs buyers, firms linked to ghost receipts, P17.9-B tax liabilities

ABS-CBN News

Published Jun 21, 2023 02:23 PM PHT

MANILA — The Bureau of Internal Revenue on Wednesday said it filed criminal cases against corporate officers, accounting firms, and accountants involved in fake or ghost receipts.

MANILA — The Bureau of Internal Revenue on Wednesday said it filed criminal cases against corporate officers, accounting firms, and accountants involved in fake or ghost receipts.

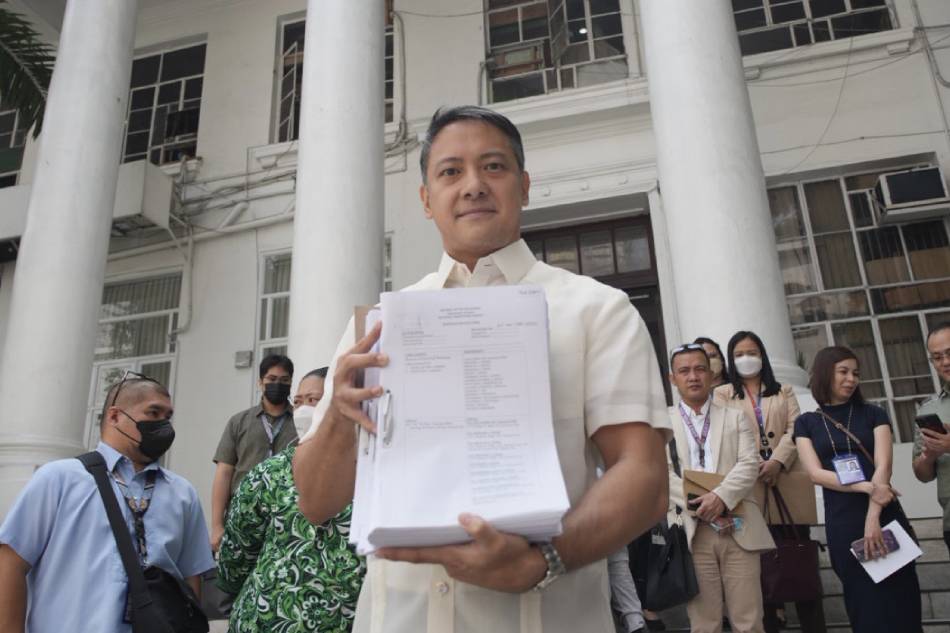

Commissioner Romeo Lumagui Jr led the filing of the cases against identified clients of a ghost receipt syndicate before the Department of Justice, the BIR said.

Commissioner Romeo Lumagui Jr led the filing of the cases against identified clients of a ghost receipt syndicate before the Department of Justice, the BIR said.

The BIR said this syndicate registers ghost companies to sell original receipts so their buyers could legally reduce their tax liabilities. The case targeted corporate officers, accounting firms, and certified public accountants (CPA) of companies that buy of fake receipts.

The BIR said this syndicate registers ghost companies to sell original receipts so their buyers could legally reduce their tax liabilities. The case targeted corporate officers, accounting firms, and certified public accountants (CPA) of companies that buy of fake receipts.

An estimated P17.9 billion in total tax liabilities were linked to these erring taxpayers for using ghost receipts issued by the syndicate, the agency said.

An estimated P17.9 billion in total tax liabilities were linked to these erring taxpayers for using ghost receipts issued by the syndicate, the agency said.

ADVERTISEMENT

"The BIR has filed criminal cases against Buyers of Fake/Ghost Receipts, their corporate officers, the accounting firms they engaged, and the CPAs that signed their documents," Lumagui said.

"The BIR has filed criminal cases against Buyers of Fake/Ghost Receipts, their corporate officers, the accounting firms they engaged, and the CPAs that signed their documents," Lumagui said.

"A total tax liability of P17.9 billion has been computed for this first set of cases. This is tax evasion of the highest order, and perhaps the most elaborate tax evasion scheme in the history of Philippine taxation. We will regularly file criminal cases against buyers of Fake/Ghost receipts", he said.

"A total tax liability of P17.9 billion has been computed for this first set of cases. This is tax evasion of the highest order, and perhaps the most elaborate tax evasion scheme in the history of Philippine taxation. We will regularly file criminal cases against buyers of Fake/Ghost receipts", he said.

Lumagui said the syndicate was discovered during a raid in December 2022.

Lumagui said the syndicate was discovered during a raid in December 2022.

Last March, the BIR filed criminal cases against sellers and their CPA, as well as administrative cases with the Professional Regulation Commission for the revocation of the license of the involved accountants.

Last March, the BIR filed criminal cases against sellers and their CPA, as well as administrative cases with the Professional Regulation Commission for the revocation of the license of the involved accountants.

The BIR earlier formed a task force to audit buyers of fake receipts.

The BIR earlier formed a task force to audit buyers of fake receipts.

"BIR is the sole authority that can audit the buyers of ghost receipts. Coordinate with the task force. Submit documents. Attend the meetings. This is merely the first set of criminal cases against the Buyers", Lumagui said.

"BIR is the sole authority that can audit the buyers of ghost receipts. Coordinate with the task force. Submit documents. Attend the meetings. This is merely the first set of criminal cases against the Buyers", Lumagui said.

Those involved in using fake receipts "will suffer the full force" of the BIR, it said.

Those involved in using fake receipts "will suffer the full force" of the BIR, it said.

ADVERTISEMENT

ADVERTISEMENT