J.P. Morgan advises clients to sell PH stocks citing 'myriad' economic challenges | ABS-CBN

ADVERTISEMENT

Welcome, Kapamilya! We use cookies to improve your browsing experience. Continuing to use this site means you agree to our use of cookies. Tell me more!

J.P. Morgan advises clients to sell PH stocks citing 'myriad' economic challenges

J.P. Morgan advises clients to sell PH stocks citing 'myriad' economic challenges

Jessica Fenol and Michelle Ong,

ABS-CBN News

Published May 11, 2022 12:09 PM PHT

MANILA - J.P. Morgan on Tuesday downgraded the Philippines to "underweight" citing "challenges that could push the stock market to underperform, in a report released following the May 9 polls.

MANILA - J.P. Morgan on Tuesday downgraded the Philippines to "underweight" citing "challenges that could push the stock market to underperform, in a report released following the May 9 polls.

"We downgrade the Philippines to underweight and the Philippine Real Estate sector to neutral," J.P. Morgan said in its Philippines Equity Strategy report made available to its clients.

"We downgrade the Philippines to underweight and the Philippine Real Estate sector to neutral," J.P. Morgan said in its Philippines Equity Strategy report made available to its clients.

Underweight means it expects Philippine stocks will not perform as well as peers in the short term.

Underweight means it expects Philippine stocks will not perform as well as peers in the short term.

"We recommend selling into a possible post-election hope rally in-line with the Philippines Equity Strategy team's view," J.P. Morgan said.

"We recommend selling into a possible post-election hope rally in-line with the Philippines Equity Strategy team's view," J.P. Morgan said.

ADVERTISEMENT

"Philippines equities face myriad challenges, including twin deficits, higher inflation, slower government spending in the quarters after the election (transition pain), high public debt, risk of a valuation derating and potential earning growth disappointment," it added.

"Philippines equities face myriad challenges, including twin deficits, higher inflation, slower government spending in the quarters after the election (transition pain), high public debt, risk of a valuation derating and potential earning growth disappointment," it added.

The report was released a day after the Philippine national elections where former Senator Ferdinand "Bongbong" Marcos Jr.; the namesake son of dictator Ferdinand Marcos, surged in the partial unofficial result.

The report was released a day after the Philippine national elections where former Senator Ferdinand "Bongbong" Marcos Jr.; the namesake son of dictator Ferdinand Marcos, surged in the partial unofficial result.

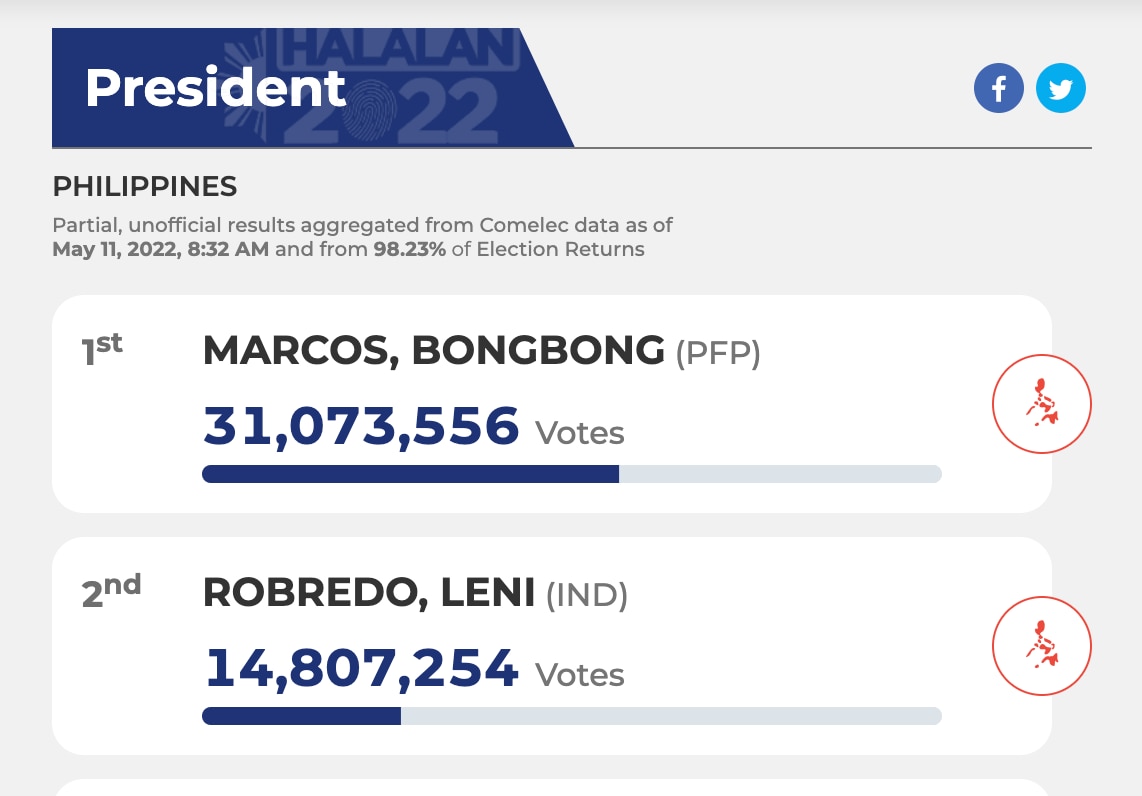

Marcos is poised to become the country's 17th president with 31,073,556 votes compared to Vice President Leni Robredo with 14,807,254 votes as of 8:37 a.m. of May 11 from a total of 98.23 percent of election returns transmitted.

Marcos is poised to become the country's 17th president with 31,073,556 votes compared to Vice President Leni Robredo with 14,807,254 votes as of 8:37 a.m. of May 11 from a total of 98.23 percent of election returns transmitted.

INVESTOR CONCERNS

In its Philippine Strategy Flash report, which was released before the May 9 polls, J.P. Morgan also listed investor concerns funder a Marcos presidency based on feedback in the last 3 months.

In its Philippine Strategy Flash report, which was released before the May 9 polls, J.P. Morgan also listed investor concerns funder a Marcos presidency based on feedback in the last 3 months.

Investor concerns include:

- potential for reassessing the administration's stance on major private sector business families based on past alignments or historical group positions on issues around the earlier Marcos regime

- policy questions "given the candidate's lack of an articulated substantive economic platform" and his seemingly limited access for traditional media such as the pre-election debates and interviews

- absence of meaningful track record as a government official

- perception based on the legacy of Marcos Sr's regime

- potential for reassessing the administration's stance on major private sector business families based on past alignments or historical group positions on issues around the earlier Marcos regime

- policy questions "given the candidate's lack of an articulated substantive economic platform" and his seemingly limited access for traditional media such as the pre-election debates and interviews

- absence of meaningful track record as a government official

- perception based on the legacy of Marcos Sr's regime

Philippine shares opened lower on Tuesday at the 6,632 level, down by 1.89 percent before climbing back and closing at the 6,720.93 level.

Philippine shares opened lower on Tuesday at the 6,632 level, down by 1.89 percent before climbing back and closing at the 6,720.93 level.

ADVERTISEMENT

Financial analyst and COL Financial's Head of Research April Lee Tan earlier said the stock exchange movements are likely driven by global issues such as the aggressive interest rate hike by the US Federal Reserve and the war in Ukraine.

Financial analyst and COL Financial's Head of Research April Lee Tan earlier said the stock exchange movements are likely driven by global issues such as the aggressive interest rate hike by the US Federal Reserve and the war in Ukraine.

Tan said it would be too early to say if the poll results have influenced the market.

Tan said it would be too early to say if the poll results have influenced the market.

J.P. Morgan clarified that the report does not have anything to do with the poll results.

J.P. Morgan clarified that the report does not have anything to do with the poll results.

"We think the Philippines faces a challenging macroeconomic outlook post-2022 regardless of the outcome of the May 2022 presidential elections," it said.

"We think the Philippines faces a challenging macroeconomic outlook post-2022 regardless of the outcome of the May 2022 presidential elections," it said.

WHAT A MARCOS ADMIN WOULD INHERIT

The financial services firm pointed out, that the next administration would be under pressure to mitigate ongoing economic challenges such as the lower gross domestic product growth due to the pandemic and higher debt.

The financial services firm pointed out, that the next administration would be under pressure to mitigate ongoing economic challenges such as the lower gross domestic product growth due to the pandemic and higher debt.

ADVERTISEMENT

National government debt hit a record P12.68 trillion in March, largely fueled by pandemic borrowings and the country's ambitious infrastructure program.

National government debt hit a record P12.68 trillion in March, largely fueled by pandemic borrowings and the country's ambitious infrastructure program.

The country's debt-to-GDP ratio ballooned to 60.5 percent in 2021 from below 40 percent before the pandemic.

The country's debt-to-GDP ratio ballooned to 60.5 percent in 2021 from below 40 percent before the pandemic.

Bangko Sentral ng Pilipinas Governor Benjamin Diokno earlier said the debt ratio remains manageable as long the government ensures robust economic growth moving forward.

Bangko Sentral ng Pilipinas Governor Benjamin Diokno earlier said the debt ratio remains manageable as long the government ensures robust economic growth moving forward.

The Philippine economy had been growing at an average of 6 percent before the pandemic.

But it contracted by 9.6 percent in 2020, its worst performance since the end of World War 2 due to the pandemic, before bouncing back to 5.6 percent in 2021 as quarantine restrictions were eased in the latter part of the year.

The Philippine economy had been growing at an average of 6 percent before the pandemic.

But it contracted by 9.6 percent in 2020, its worst performance since the end of World War 2 due to the pandemic, before bouncing back to 5.6 percent in 2021 as quarantine restrictions were eased in the latter part of the year.

J.P. Morgan said the recent growth trajectory could "wane" in 2023.

J.P. Morgan said the recent growth trajectory could "wane" in 2023.

ADVERTISEMENT

"We expect re-opening benefits for the GDP growth trajectory to wane next year and put strong pressure on the government to deliver on capital outlay spending acceleration," J.P. Morgan said.

"We expect re-opening benefits for the GDP growth trajectory to wane next year and put strong pressure on the government to deliver on capital outlay spending acceleration," J.P. Morgan said.

It said it would be crucial for the next administration to "explore and consider" tax reforms such as carbon tax or increase in sin taxes to rein in government debt.

It said it would be crucial for the next administration to "explore and consider" tax reforms such as carbon tax or increase in sin taxes to rein in government debt.

There are also upside risks to inflation due to the rising prices of oil and other global commodities as the conflict between Russia and Ukraine persists.

There are also upside risks to inflation due to the rising prices of oil and other global commodities as the conflict between Russia and Ukraine persists.

Inflation could settle above the 2 to 4 percent target this year at 4.3 percent and is likely to remain elevated for the rest of the year, according to the central bank's outlook.

Inflation could settle above the 2 to 4 percent target this year at 4.3 percent and is likely to remain elevated for the rest of the year, according to the central bank's outlook.

Although the BSP kept the interest rate at 2 percent since November 2020, it could start "normalizing" policies in June, Diokno said, to mitigate inflation.

Although the BSP kept the interest rate at 2 percent since November 2020, it could start "normalizing" policies in June, Diokno said, to mitigate inflation.

ADVERTISEMENT

Interest rate hikes, however, could also temper economic growth. Balancing growth and mitigating inflation is the challenge, the BSP said.

Interest rate hikes, however, could also temper economic growth. Balancing growth and mitigating inflation is the challenge, the BSP said.

RELATED VIDEO:

Read More:

Halalan 2022

economy

economic growth

investment rating

stock exchange

Ferdinand Marcos Jr

inflation

J.P. Morgan

Philippine Stock Exchange

ADVERTISEMENT

ADVERTISEMENT