PayMaya becomes 'Maya' ahead of launch of digital bank | ABS-CBN

ADVERTISEMENT

Welcome, Kapamilya! We use cookies to improve your browsing experience. Continuing to use this site means you agree to our use of cookies. Tell me more!

PayMaya becomes 'Maya' ahead of launch of digital bank

PayMaya becomes 'Maya' ahead of launch of digital bank

Jessica Fenol,

ABS-CBN News

Published Apr 29, 2022 12:57 PM PHT

MANILA - PayMaya rebranded its app to Maya and said users will get to experience new services as the fintech firm gets ready for the official launch of its digital bank, Maya Bank, later on Thursday.

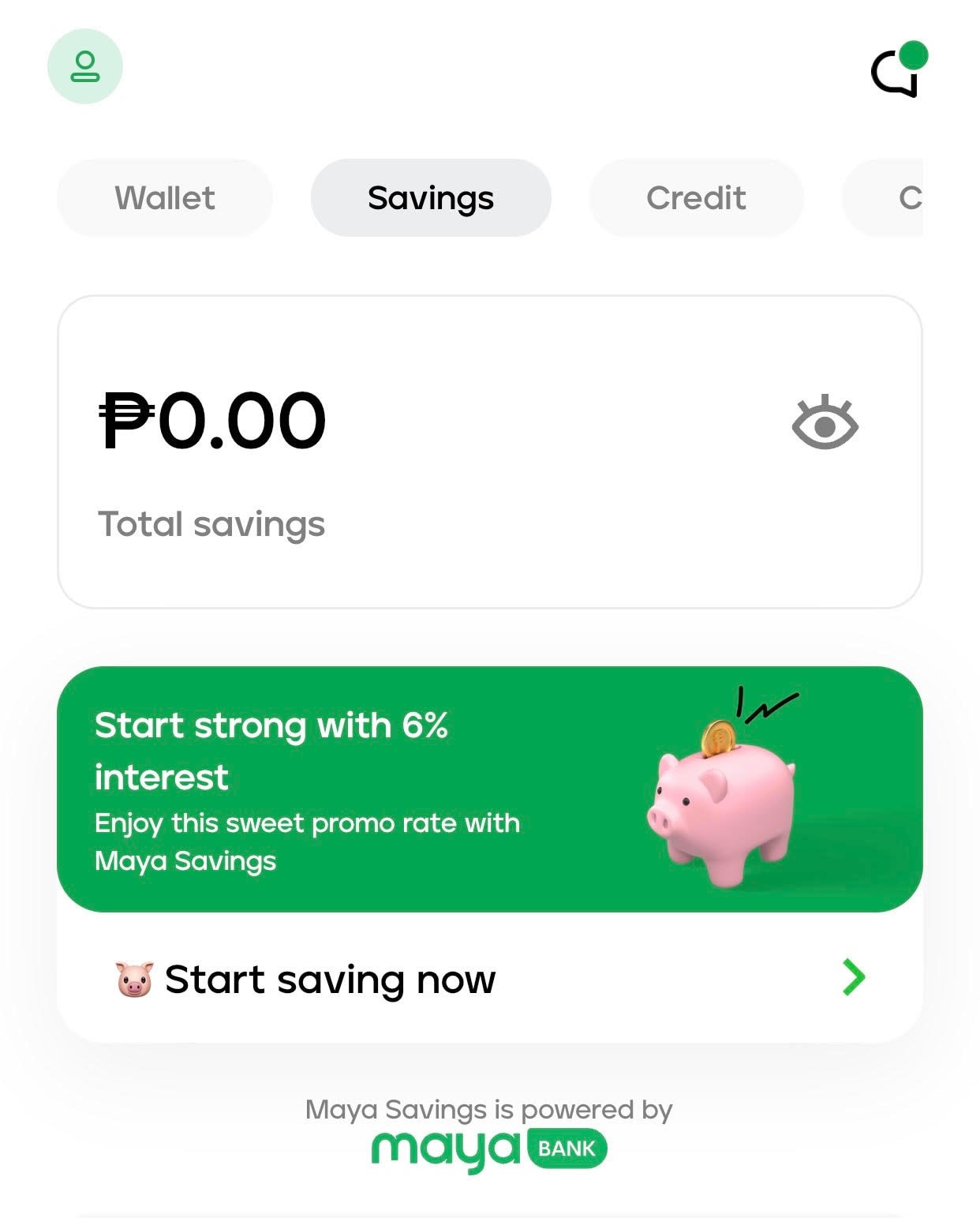

Deposits in Maya Bank will have a 6 percent per annum interest rate, according to the app.

MANILA - PayMaya rebranded its app to Maya and said users will get to experience new services as the fintech firm gets ready for the official launch of its digital bank, Maya Bank, later on Thursday.

Deposits in Maya Bank will have a 6 percent per annum interest rate, according to the app.

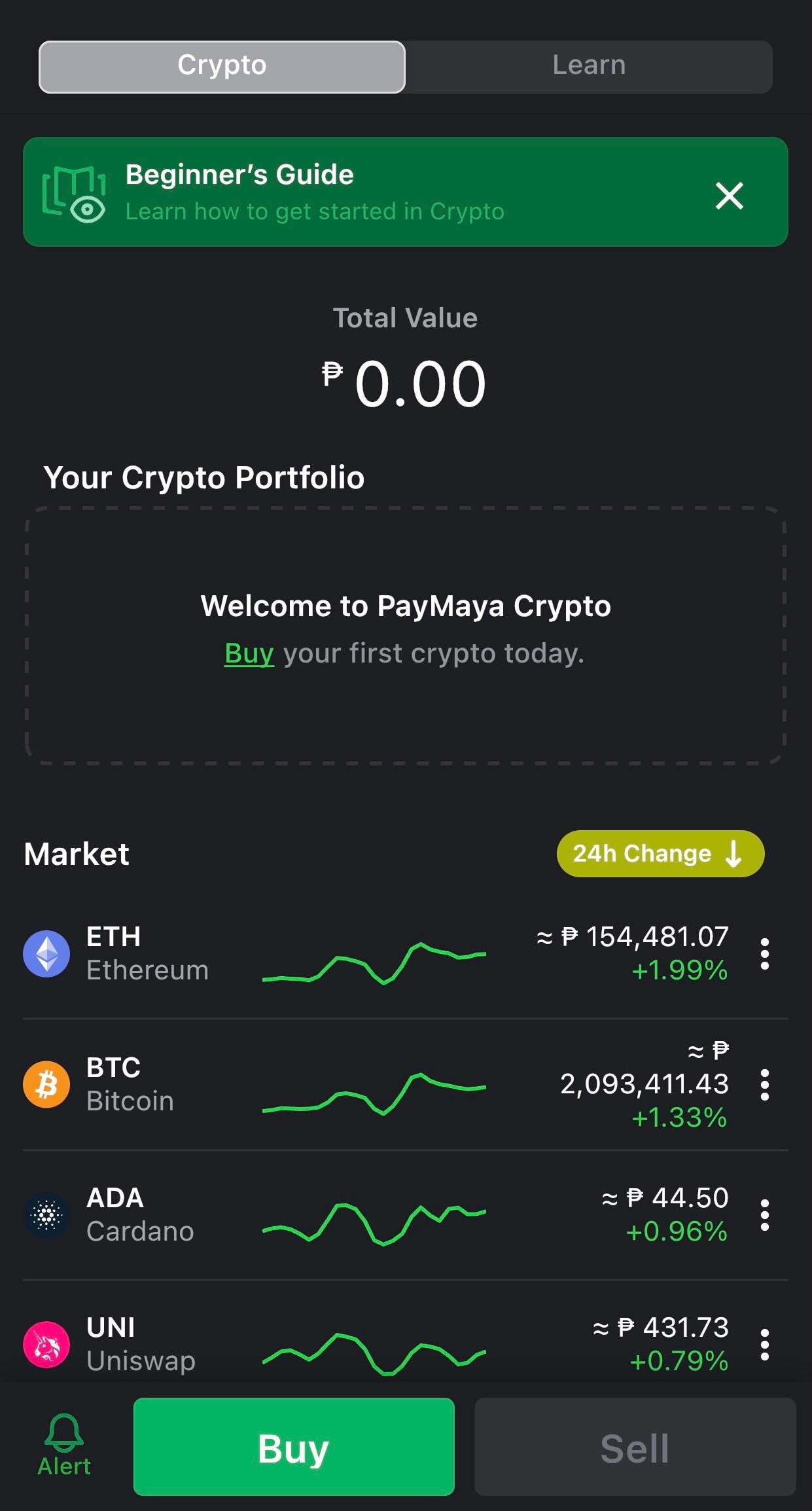

Users will be able to access new features such as crypto under its "Money Makers" tab where they can buy and sell cryptocurrencies such as Bitcoin, Ethereum, Cardano and Uniswap, among others.

Users will be able to access new features such as crypto under its "Money Makers" tab where they can buy and sell cryptocurrencies such as Bitcoin, Ethereum, Cardano and Uniswap, among others.

On the same menu, users can also access its savings and credit features, which are both still in beta mode.

On the same menu, users can also access its savings and credit features, which are both still in beta mode.

Maya Bank, along with 5 other firms, secured a digital banking license from the Bangko Sentral ng Pilipinas in 2021.

Maya Bank, along with 5 other firms, secured a digital banking license from the Bangko Sentral ng Pilipinas in 2021.

ADVERTISEMENT

Singapore-based Tonik bank also earlier introduced its digital bank with up to 6 percent interest rate for time deposits. Some digital banks offer lower interest rates at 2 to 4.5 percent.

The app still has a suite of financial tools including send money, bills payments and loading capability.

The app still has a suite of financial tools including send money, bills payments and loading capability.

PayMaya president Shailesh Baidwan earlier said they would soon test the "crypto-ready" Maya Bank.

PayMaya president Shailesh Baidwan earlier said they would soon test the "crypto-ready" Maya Bank.

Meanwhile, PLDT Inc chairman Manny Pangilinan earlier said the new Maya Bank would be a "game-changer."

Meanwhile, PLDT Inc chairman Manny Pangilinan earlier said the new Maya Bank would be a "game-changer."

In April, Voyager Innovations said it has raised $210 million (P10.9 billion) in new funds, which will be used to expand PayMaya and to launch the new digital bank Maya Bank.

In April, Voyager Innovations said it has raised $210 million (P10.9 billion) in new funds, which will be used to expand PayMaya and to launch the new digital bank Maya Bank.

New investor SIG Venture Capital led the most recent funding with Singapore-based global investor EDBI and investment holding company First Pacific Company Ltd, it said.

New investor SIG Venture Capital led the most recent funding with Singapore-based global investor EDBI and investment holding company First Pacific Company Ltd, it said.

Existing shareholders include PLDT Inc, KKR, Tencent, the International Finance Corp, and the two funds managed by the IFC Asset Management Company, namely the IFC Emerging Asia Fund and IFC Financial Institutions Growth Fund.

Existing shareholders include PLDT Inc, KKR, Tencent, the International Finance Corp, and the two funds managed by the IFC Asset Management Company, namely the IFC Emerging Asia Fund and IFC Financial Institutions Growth Fund.

PayMaya said it has a total of 44 million registered customers as of the end of 2021.

PayMaya said it has a total of 44 million registered customers as of the end of 2021.

RELATED VIDEO:

ADVERTISEMENT

ADVERTISEMENT