Dissecting Data: Foreign direct investments fall by a quarter | ABS-CBN

Welcome, Kapamilya! We use cookies to improve your browsing experience. Continuing to use this site means you agree to our use of cookies. Tell me more!

Dissecting Data: Foreign direct investments fall by a quarter

Dissecting Data: Foreign direct investments fall by a quarter

Warren de Guzman and Edson Guido,

ABS-CBN News

Published Mar 11, 2021 02:44 PM PHT

What led to the plunge?

What led to the plunge?

MANILA - The Philippines has always been a laggard in ASEAN when it comes to FDI or foreign direct investments. FDI inflows were on the rise, peaking at a record high of over $10 billion in 2017, raising hopes for the country finally becoming a preferred destination for offshore investors. But after 2017, it has been all downhill.

MANILA - The Philippines has always been a laggard in ASEAN when it comes to FDI or foreign direct investments. FDI inflows were on the rise, peaking at a record high of over $10 billion in 2017, raising hopes for the country finally becoming a preferred destination for offshore investors. But after 2017, it has been all downhill.

FDI inflows climbed to over $10 billion in 2017, before sliding the next year. In 2020, FDI inflows cratered, contracting nearly 25 percent year-on-year to $6.54 billion.

FDI inflows climbed to over $10 billion in 2017, before sliding the next year. In 2020, FDI inflows cratered, contracting nearly 25 percent year-on-year to $6.54 billion.

“The disruptive impact of the pandemic on global supply chains and the weak business outlook adversely affected investor decisions in 2020,” the Bangko Sentral ng Pilipinas said.

“The disruptive impact of the pandemic on global supply chains and the weak business outlook adversely affected investor decisions in 2020,” the Bangko Sentral ng Pilipinas said.

But three straight years of decline in FDI inflows indicate there are other reasons why money isn’t flowing into a Philippine economy that averaged over 6 percent GDP growth in the years prior to the pandemic.

But three straight years of decline in FDI inflows indicate there are other reasons why money isn’t flowing into a Philippine economy that averaged over 6 percent GDP growth in the years prior to the pandemic.

ADVERTISEMENT

FDI inflows broken down into months show the start of the COVID-19 lockdown in the Philippines, March to April 2020, were the worst months for investment last year.

FDI inflows broken down into months show the start of the COVID-19 lockdown in the Philippines, March to April 2020, were the worst months for investment last year.

Inflows however showed signs of improvement by May, but overall, FDI inflows declined in 8 of the 12 months of 2020, including the last four months. By the fourth quarter, investors were already aware the COVID lockdowns had caused the worst and second worst quarterly economic contractions in the Philippines post World War 2, as well as the first official economic recession in decades.

Inflows however showed signs of improvement by May, but overall, FDI inflows declined in 8 of the 12 months of 2020, including the last four months. By the fourth quarter, investors were already aware the COVID lockdowns had caused the worst and second worst quarterly economic contractions in the Philippines post World War 2, as well as the first official economic recession in decades.

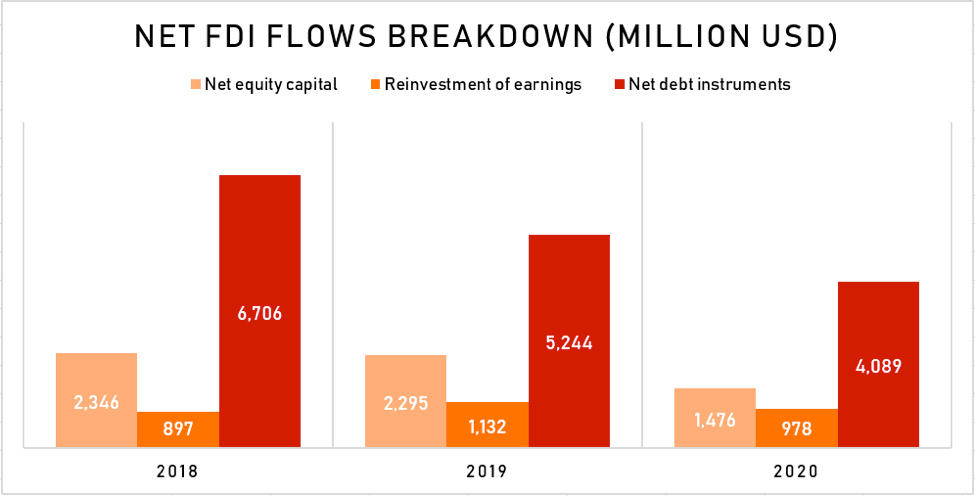

New investments, reinvestments of earnings, and money placed in Philippine debt instruments were all down year-on-year. New investments in particular fell by nearly 36 percent from 2019 levels, a clear sign of shaky confidence in the Philippine economy.

New investments, reinvestments of earnings, and money placed in Philippine debt instruments were all down year-on-year. New investments in particular fell by nearly 36 percent from 2019 levels, a clear sign of shaky confidence in the Philippine economy.

Multinationals already present in the Philippines reinvested 13.6 percent less earnings year-on-year. But they were confident enough to reinvest more on their Philippine operations compared to 2018. Foreign participation in the Philippine debt market was 22 percent lower even as the Philippine government and Filipino corporations sold a substantial amount of debt to take advantage of record low interest rates.

Multinationals already present in the Philippines reinvested 13.6 percent less earnings year-on-year. But they were confident enough to reinvest more on their Philippine operations compared to 2018. Foreign participation in the Philippine debt market was 22 percent lower even as the Philippine government and Filipino corporations sold a substantial amount of debt to take advantage of record low interest rates.

Looking at FDI inflows by origin, the chart above shows that the Japanese are confident in the Philippines. Through the Asian Development Bank and the Japan International Cooperation Agency, the Japanese have been leading the way in pouring money into the Philippines.

Looking at FDI inflows by origin, the chart above shows that the Japanese are confident in the Philippines. Through the Asian Development Bank and the Japan International Cooperation Agency, the Japanese have been leading the way in pouring money into the Philippines.

ADVERTISEMENT

They are historically strong contributors to the Philippines through official development assistance, grants and loans. In 2020, Japan was the biggest source of new investments from overseas. It was the only country that increased investment in the Philippines among the top sources of FDI. The European Union was a far second, followed by the United States. China, which was expected to contribute more inflows on account of President Rodrigo Duterte’s charm offensive on Beijing, was sixth on the list behind Taiwan.

They are historically strong contributors to the Philippines through official development assistance, grants and loans. In 2020, Japan was the biggest source of new investments from overseas. It was the only country that increased investment in the Philippines among the top sources of FDI. The European Union was a far second, followed by the United States. China, which was expected to contribute more inflows on account of President Rodrigo Duterte’s charm offensive on Beijing, was sixth on the list behind Taiwan.

Even foreign investments approved by investment promotion agencies or IPAs contracted in 2020, falling a whopping 71 percent to P112.1B. That is its lowest level since 2017, the first full-year of the Duterte administration. These numbers represent possible investments that may or may not come to fruition. Some of these could take years to be consummated by the involved parties. Some may fizzle out due to one reason or another. The fact that these ‘promises’ also fell is another sign of weak investor confidence in the Philippines.

Even foreign investments approved by investment promotion agencies or IPAs contracted in 2020, falling a whopping 71 percent to P112.1B. That is its lowest level since 2017, the first full-year of the Duterte administration. These numbers represent possible investments that may or may not come to fruition. Some of these could take years to be consummated by the involved parties. Some may fizzle out due to one reason or another. The fact that these ‘promises’ also fell is another sign of weak investor confidence in the Philippines.

However, there are reasons for investors to be optimistic about a Philippine economic recovery. Economists have forecast a strong rebound in GDP growth this year helped by low base effects. This means that because 2020 was such a bad year, it wouldn’t take much for growth to rebound in 2021.

However, there are reasons for investors to be optimistic about a Philippine economic recovery. Economists have forecast a strong rebound in GDP growth this year helped by low base effects. This means that because 2020 was such a bad year, it wouldn’t take much for growth to rebound in 2021.

S&P Global Ratings says Philippine GDP should grow 9.6 percent this 2021, much higher compared to the Philippine government’s own forecast of between 6.5 and 7.5 percent.

S&P Global Ratings says Philippine GDP should grow 9.6 percent this 2021, much higher compared to the Philippine government’s own forecast of between 6.5 and 7.5 percent.

There is also the CREATE bill passed by congress.

There is also the CREATE bill passed by congress.

ADVERTISEMENT

The Philippine business sector is very excited about the measure, which will cut corporate income taxes for all businesses and introduce a new menu of fiscal incentives to attract foreign capital.

The Philippine business sector is very excited about the measure, which will cut corporate income taxes for all businesses and introduce a new menu of fiscal incentives to attract foreign capital.

CREATE went through several iterations over the last few years, and some blame the dips in FDI prior to the pandemic to the uncertainty created by the tax reform measure. However the final implementation of CREATE is expected to make up for all of that.

CREATE went through several iterations over the last few years, and some blame the dips in FDI prior to the pandemic to the uncertainty created by the tax reform measure. However the final implementation of CREATE is expected to make up for all of that.

The outlook however is clouded by risks to mobility and consumer activity. The COVID-19 lockdown in the Philippines is already the longest in the world. It is coming up on its first anniversary next week, and a surge in new COVID-19 cases has already forced some local government units to once again tighten quarantine restrictions. Even before this latest surge S&P Global Ratings said Philippine mobility was already “limping back slower than peers.”

The outlook however is clouded by risks to mobility and consumer activity. The COVID-19 lockdown in the Philippines is already the longest in the world. It is coming up on its first anniversary next week, and a surge in new COVID-19 cases has already forced some local government units to once again tighten quarantine restrictions. Even before this latest surge S&P Global Ratings said Philippine mobility was already “limping back slower than peers.”

The drop in FDI inflows is also not unique to the Philippines. The Asian Development Bank noted FDI inflows for greenfield or new projects have fallen sharply in Asia, particularly in coal, oil, gas, hotels, and tourism.

The drop in FDI inflows is also not unique to the Philippines. The Asian Development Bank noted FDI inflows for greenfield or new projects have fallen sharply in Asia, particularly in coal, oil, gas, hotels, and tourism.

ADB said mergers and acquisitions fell in the first quarter of 2020, but recovered in the two quarters since, as investors took advantage of depressed share prices and valuations. They favored food and beverages and communications. The global outlook for FDI is also clouded by the shadow of the COVID-19 pandemic, particularly the new variants coming to the fore.

ADB said mergers and acquisitions fell in the first quarter of 2020, but recovered in the two quarters since, as investors took advantage of depressed share prices and valuations. They favored food and beverages and communications. The global outlook for FDI is also clouded by the shadow of the COVID-19 pandemic, particularly the new variants coming to the fore.

ADVERTISEMENT

The ADB, alongside many other multilateral agencies and business groups, said the Philippines would likely do much better with FDI inflows if it could only clear up complex legal restrictions on foreign ownership and investment. There are pending proposals in Congress that would lift some of these restrictions, but the fight to open up the Philippine economy has been going on for decades without resolution.

The ADB, alongside many other multilateral agencies and business groups, said the Philippines would likely do much better with FDI inflows if it could only clear up complex legal restrictions on foreign ownership and investment. There are pending proposals in Congress that would lift some of these restrictions, but the fight to open up the Philippine economy has been going on for decades without resolution.

In spite of this, there are instances of continued foreign investment in the Philippines, such as China Telecom’s partnership with Dennis Uy’s DITO Telecommunity. They launched commercially in the Visayas and Mindanao this March.

In spite of this, there are instances of continued foreign investment in the Philippines, such as China Telecom’s partnership with Dennis Uy’s DITO Telecommunity. They launched commercially in the Visayas and Mindanao this March.

But there are also instances of withdrawn investment, such China’s Redco Transit Development’s decision to terminate talks for a stake in the Makati City Subway.

But there are also instances of withdrawn investment, such China’s Redco Transit Development’s decision to terminate talks for a stake in the Makati City Subway.

The Philippine Competition Commission announced the scuttling of the deal, saying they were informed that the parties “decided not to pursue the transaction and to terminate their Share Purchase Agreement due to circumstances arising from the COVID-19 pandemic.”

The Philippine Competition Commission announced the scuttling of the deal, saying they were informed that the parties “decided not to pursue the transaction and to terminate their Share Purchase Agreement due to circumstances arising from the COVID-19 pandemic.”

There will be plenty of opportunities for investors to put money in the Philippines for both foreign and local parties. Philippine capital markets for instance are expected to be quite active this year. Monde Nissin has filed for what could end up being the largest initial public offering in the Philippines ever. It could go for P72 billion.

There will be plenty of opportunities for investors to put money in the Philippines for both foreign and local parties. Philippine capital markets for instance are expected to be quite active this year. Monde Nissin has filed for what could end up being the largest initial public offering in the Philippines ever. It could go for P72 billion.

ADVERTISEMENT

The Philippine Stock Exchange and the Securities and Exchange Commission have also said 4 to 5 real estate investment trusts will also be going public, including one set for listing this March, Double Dragon Properties’ nearly P15 billion offering.

The Philippine Stock Exchange and the Securities and Exchange Commission have also said 4 to 5 real estate investment trusts will also be going public, including one set for listing this March, Double Dragon Properties’ nearly P15 billion offering.

For now, the trend for FDI inflows to the Philippines is unfortunately down.

For now, the trend for FDI inflows to the Philippines is unfortunately down.

Read More:

FDI

foreign direct investments

BSP

central bank

Bangko Sentral

economy

economic growth

economic analysis

recession

economic contraction

ADVERTISEMENT

ADVERTISEMENT