How to grow your money with Pag-IBIG MP2 Savings | ABS-CBN

ADVERTISEMENT

Welcome, Kapamilya! We use cookies to improve your browsing experience. Continuing to use this site means you agree to our use of cookies. Tell me more!

How to grow your money with Pag-IBIG MP2 Savings

How to grow your money with Pag-IBIG MP2 Savings

When I left my corporate job five years ago, one of the first things I did was to check on my mandatory contributions. I visited SSS, Pag-IBIG and PhilHealth so I can continue my payments in my new unemployed/self-employed state.

When I left my corporate job five years ago, one of the first things I did was to check on my mandatory contributions. I visited SSS, Pag-IBIG and PhilHealth so I can continue my payments in my new unemployed/self-employed state.

Good thing I did because I found out that my employers (yes, plural) missed reporting contributions here and there over the last two decades. It took a while to sort that out but that’s another story.

Good thing I did because I found out that my employers (yes, plural) missed reporting contributions here and there over the last two decades. It took a while to sort that out but that’s another story.

While waiting for my turn in Pag-IBIG, I spotted a flyer about MP2 Savings, and back then they just announced paying a dividend rate of 8.11 percent!

While waiting for my turn in Pag-IBIG, I spotted a flyer about MP2 Savings, and back then they just announced paying a dividend rate of 8.11 percent!

I have not seen an interest rate that high – ever – as a bank depositor. During that time, I was used to 0.0125 annual interest (sadly, it’s even lower these days). So even though it meant I had to line up again in a different queue, I signed up for MP2 and made my first deposit.

I have not seen an interest rate that high – ever – as a bank depositor. During that time, I was used to 0.0125 annual interest (sadly, it’s even lower these days). So even though it meant I had to line up again in a different queue, I signed up for MP2 and made my first deposit.

ADVERTISEMENT

Over the last 5 years, thanks to the pandemic-induced economic slowdown, I have not been faithful in my contributions. To be honest, I stopped making any payments in year 2, and only remembered 5 years have passed when I saw a recent news report where Pag-IBIG announced a 7.03 percent dividend rate!

Over the last 5 years, thanks to the pandemic-induced economic slowdown, I have not been faithful in my contributions. To be honest, I stopped making any payments in year 2, and only remembered 5 years have passed when I saw a recent news report where Pag-IBIG announced a 7.03 percent dividend rate!

My MP2 account has reached maturity and when I looked at how much I saved and how much I gained, I was shocked to realize a net gain of over 35 percent in 5 years! Note that I only made 7 deposits in year 1, and 1 deposit in year 2, so this is clearly (the magic of) compound interest at work.

My MP2 account has reached maturity and when I looked at how much I saved and how much I gained, I was shocked to realize a net gain of over 35 percent in 5 years! Note that I only made 7 deposits in year 1, and 1 deposit in year 2, so this is clearly (the magic of) compound interest at work.

But before you decide if this is for you, check out the good (or great to me), the bad, and the in-between of Pag-IBIG MP2 Savings.

But before you decide if this is for you, check out the good (or great to me), the bad, and the in-between of Pag-IBIG MP2 Savings.

#1 How much can you save with MP2 Savings?

As a Pag-IBIG member, did you know you can add to your mandatory monthly contribution of P100? You can save as much as P5,000 (including the P100 employer counterpart), and this becomes part of your non-taxable income. However, with MP2 (which stands for Modified Pag-IBIG 2) Savings, you can save as much as you can

afford, but the minimum is set at P500 for every deposit.

As a Pag-IBIG member, did you know you can add to your mandatory monthly contribution of P100? You can save as much as P5,000 (including the P100 employer counterpart), and this becomes part of your non-taxable income. However, with MP2 (which stands for Modified Pag-IBIG 2) Savings, you can save as much as you can

afford, but the minimum is set at P500 for every deposit.

#2 Are dividend rates higher with MP2 Savings?

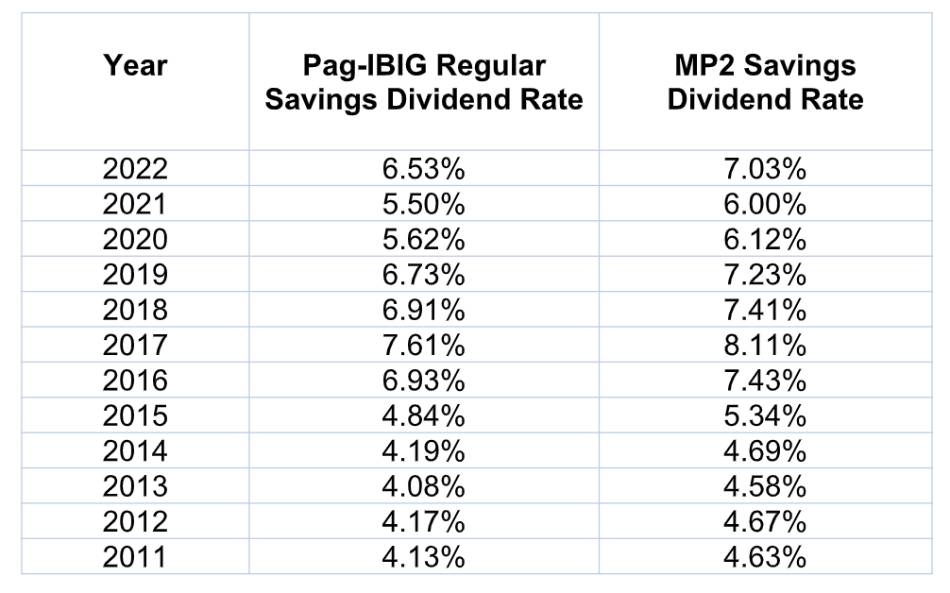

Yes, compared to Pag-IBIG Regular Savings. Check the table below for the dividend rates your regular savings earned against the payout for MP2 savings in the last 12 years. While Regular Savings pays less, those are still generous dividends, and hard to find in this market for small investors.

Yes, compared to Pag-IBIG Regular Savings. Check the table below for the dividend rates your regular savings earned against the payout for MP2 savings in the last 12 years. While Regular Savings pays less, those are still generous dividends, and hard to find in this market for small investors.

#3 What happens when you can’t make deposits with MP2 Savings?

Nothing, and that’s another good thing about this. The money you have saved will continue to earn interest, and the interest earned will also earn interest if you opt to leave all your dividends with Pag-IBIG for the next 5 years. There are no penalties if you stop, and you can stop anytime. You can also resume when you want to or can

afford to, or as the case with me, just leave your deposits to keep earning interest.

Nothing, and that’s another good thing about this. The money you have saved will continue to earn interest, and the interest earned will also earn interest if you opt to leave all your dividends with Pag-IBIG for the next 5 years. There are no penalties if you stop, and you can stop anytime. You can also resume when you want to or can

afford to, or as the case with me, just leave your deposits to keep earning interest.

#4 Is it really tax-free? Most investments are charged 20 percent withholding tax

Pag-IBIG said so from their website, but I am also happy to confirm this from my recent redemption. All my deposits were returned to me, plus all the dividends intact, tax-free.

Pag-IBIG said so from their website, but I am also happy to confirm this from my recent redemption. All my deposits were returned to me, plus all the dividends intact, tax-free.

This is another plus for me with MP2 Savings, as most commercial investments withhold as much as 20 percent tax on earnings. If you’re a new investor, or a small investor, that 20 percent can hurt. Instead, use the tax you saved to add to your MP2 Savings.

This is another plus for me with MP2 Savings, as most commercial investments withhold as much as 20 percent tax on earnings. If you’re a new investor, or a small investor, that 20 percent can hurt. Instead, use the tax you saved to add to your MP2 Savings.

#5 Is the holding period 5 years? What if you need the money?

Yes, MP2 Savings has a 5 year maturity, which is also how your money can earn more. While you cannot withdraw your savings, you have the option to receive the dividends annually, or on maturity. If you choose the latter, you will earn compounded interest on all your dividends.

Pag-IBIG does allow pre-termination before 5 years for various reasons including retirement, termination from employment due to health reasons, unemployment due to layoff or company closure and many more. Check the Pag-IBIG website for the full list.

Yes, MP2 Savings has a 5 year maturity, which is also how your money can earn more. While you cannot withdraw your savings, you have the option to receive the dividends annually, or on maturity. If you choose the latter, you will earn compounded interest on all your dividends.

Pag-IBIG does allow pre-termination before 5 years for various reasons including retirement, termination from employment due to health reasons, unemployment due to layoff or company closure and many more. Check the Pag-IBIG website for the full list.

#6 Can you lose your savings? Are the dividends guaranteed?

MP2 Savings are government-guaranteed, which makes it very low-risk in the investment world. This means you will most likely get your entire deposit back at the end of the 5 years. However, the annual dividends depend on Pag-IBIG Fund’s financial performance. While not guaranteed, you can look at the table of dividends for the last 12 years to see that the yield from MP2 Savings has a good track record. Even

during the pandemic when businesses were closing and markets were crashing, they reported a generous return.

MP2 Savings are government-guaranteed, which makes it very low-risk in the investment world. This means you will most likely get your entire deposit back at the end of the 5 years. However, the annual dividends depend on Pag-IBIG Fund’s financial performance. While not guaranteed, you can look at the table of dividends for the last 12 years to see that the yield from MP2 Savings has a good track record. Even

during the pandemic when businesses were closing and markets were crashing, they reported a generous return.

#7 Is it easy to open an MP2 Savings account?

Well, this is one of the “bad” for me, as you have to make a personal visit to a branch to open one. Even for me who was opening a second account after the first one has matured, I had to make my first deposit for the new account in a Pag-IBIG branch. The lines are always long, and so expect to spend at least 2 hours plus your travel time.

Well, this is one of the “bad” for me, as you have to make a personal visit to a branch to open one. Even for me who was opening a second account after the first one has matured, I had to make my first deposit for the new account in a Pag-IBIG branch. The lines are always long, and so expect to spend at least 2 hours plus your travel time.

You can cut back on the wait time by applying online to get an MP2 account number, print the form and bring it with you when you visit the branch.

You can cut back on the wait time by applying online to get an MP2 account number, print the form and bring it with you when you visit the branch.

#8 Is it easy to redeem the proceeds after 5 years?

Also a “bad” for me because one, Pag-IBIG will not inform you. You have to be the one to track the 5 years has lapsed. Two, I had to go to a branch and apply to claim my proceeds, and then wait about 20 working days to get a check that I can deposit to my bank. You also have to wait for a confirmation from Pag-IBIG before you return for your check. If you did not get one, you have to go back to the branch and ask why the delay (yes, you have to physically go and you cannot call any number to inquire).

Also a “bad” for me because one, Pag-IBIG will not inform you. You have to be the one to track the 5 years has lapsed. Two, I had to go to a branch and apply to claim my proceeds, and then wait about 20 working days to get a check that I can deposit to my bank. You also have to wait for a confirmation from Pag-IBIG before you return for your check. If you did not get one, you have to go back to the branch and ask why the delay (yes, you have to physically go and you cannot call any number to inquire).

I was told this would be a lot easier if I had a Pag-IBIG Loyalty Plus Card (because they will just deposit your proceeds there). But when I tried to get one, I was told to come at about 4 am as they only had 50 cards available each day at their Pasig City branch along Shaw Boulevard, and the demand continues to be high. There is no way I will

wake up at an indecent hour and visit Pag-IBIG for a queue number.

I was told this would be a lot easier if I had a Pag-IBIG Loyalty Plus Card (because they will just deposit your proceeds there). But when I tried to get one, I was told to come at about 4 am as they only had 50 cards available each day at their Pasig City branch along Shaw Boulevard, and the demand continues to be high. There is no way I will

wake up at an indecent hour and visit Pag-IBIG for a queue number.

* * *

* * *

Considering the good, the bad and the in-between, I would still choose MP2 Savings as an investment (I did say I lined up again and maybe my years at UP also known as University of Pila made me tolerant of queues). With as little as P500 deposit, you can earn dividends that not even corporate bonds from the country’s leading private firms

can match today, and they require 10x more initial investment. Pag-IBIG is slowly making a digital transformation, and maybe when my next maturity comes, I will no longer have to pop into a branch to make a claim, and God willing, open my third one.

Considering the good, the bad and the in-between, I would still choose MP2 Savings as an investment (I did say I lined up again and maybe my years at UP also known as University of Pila made me tolerant of queues). With as little as P500 deposit, you can earn dividends that not even corporate bonds from the country’s leading private firms

can match today, and they require 10x more initial investment. Pag-IBIG is slowly making a digital transformation, and maybe when my next maturity comes, I will no longer have to pop into a branch to make a claim, and God willing, open my third one.

RELATED VIDEO

RELATED VIDEO

Read More:

Pag-IBIG

pagibig

housing loan

savings program

MP2 Savings

personal finance

Aneth Ng Lim

Paying It Forward

featured blog

blogroll

ADVERTISEMENT

ADVERTISEMENT