Pay taxes, Chinese workers in PH told | ABS-CBN

Welcome, Kapamilya! We use cookies to improve your browsing experience. Continuing to use this site means you agree to our use of cookies. Tell me more!

Pay taxes, Chinese workers in PH told

Pay taxes, Chinese workers in PH told

Dharel Placido,

ABS-CBN News

Published Jul 05, 2019 10:30 AM PHT

|

Updated Jul 05, 2019 10:33 AM PHT

MANILA – Senate President Pro-Tempore Ralph Recto on Friday said Chinese workers in the Philippines must pay income taxes, as the government aims to raise revenues to fund vital programs.

MANILA – Senate President Pro-Tempore Ralph Recto on Friday said Chinese workers in the Philippines must pay income taxes, as the government aims to raise revenues to fund vital programs.

Finance Secretary Carlos Dominguez estimated that the Bureau of Internal Revenue could collect at least P2 billion per month from at least 100,000 offshore gaming workers.

Finance Secretary Carlos Dominguez estimated that the Bureau of Internal Revenue could collect at least P2 billion per month from at least 100,000 offshore gaming workers.

Recto said government must first collect taxes properly before raising rates or levying new ones.

Recto said government must first collect taxes properly before raising rates or levying new ones.

“The BIR (Bureau of Internal Revenue) can’t be strict on Filipinos when it comes to paying taxes, by withholding these at source, while allowing foreign nationals a free pass,” Recto said in a statement.

“The BIR (Bureau of Internal Revenue) can’t be strict on Filipinos when it comes to paying taxes, by withholding these at source, while allowing foreign nationals a free pass,” Recto said in a statement.

ADVERTISEMENT

Recto added the government must not only tax Chinese workers in the online gaming business, but in other industries as well, such as construction.

Recto added the government must not only tax Chinese workers in the online gaming business, but in other industries as well, such as construction.

He said for this to happen, a “tax base” from data pooled from the Bureau of Immigration, Department of Labor and Employment, Securities and Exchange Commission, Philippine Amusement and Gaming Corp., and the various special economic zones must be assembled first.

He said for this to happen, a “tax base” from data pooled from the Bureau of Immigration, Department of Labor and Employment, Securities and Exchange Commission, Philippine Amusement and Gaming Corp., and the various special economic zones must be assembled first.

He noted that Filipino workers and professionals paid P370 billion in income tax in 2017, representing 20 percent of tax paid.

He noted that Filipino workers and professionals paid P370 billion in income tax in 2017, representing 20 percent of tax paid.

“For every 5 pesos tax paid, 1 peso comes from individual income earners,” he said.

“For every 5 pesos tax paid, 1 peso comes from individual income earners,” he said.

Besides income taxes, POGO workers are also supposed to pay SSS, Pag-IBIG and PhilHealth contributions.

Besides income taxes, POGO workers are also supposed to pay SSS, Pag-IBIG and PhilHealth contributions.

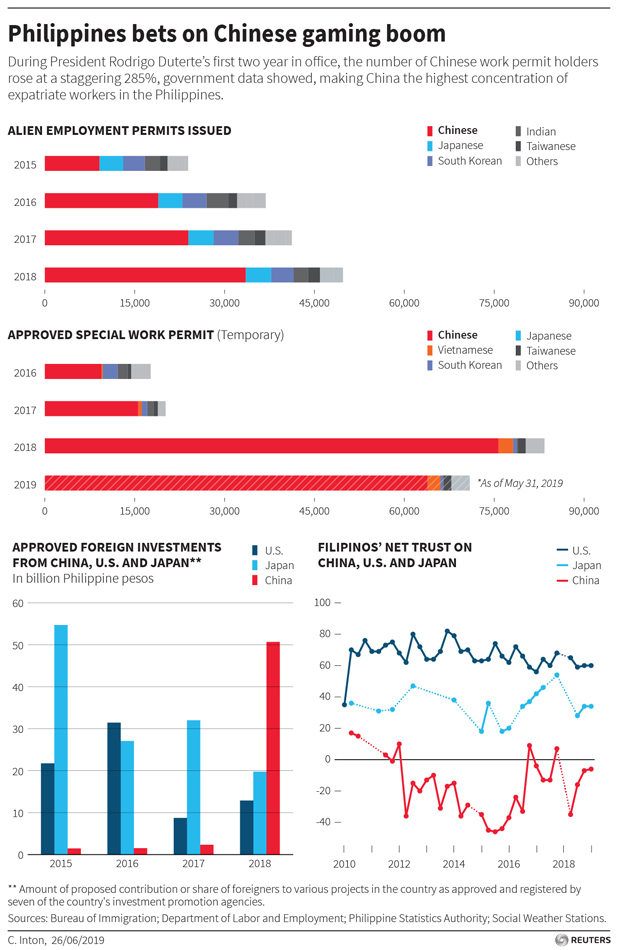

Most of the workers in the sector are foreigners from mainland China.

Most of the workers in the sector are foreigners from mainland China.

ADVERTISEMENT

ADVERTISEMENT