'Neither good or bad': What is the Maharlika sovereign wealth fund? | ABS-CBN

ADVERTISEMENT

Welcome, Kapamilya! We use cookies to improve your browsing experience. Continuing to use this site means you agree to our use of cookies. Tell me more!

'Neither good or bad': What is the Maharlika sovereign wealth fund?

'Neither good or bad': What is the Maharlika sovereign wealth fund?

Jessica Fenol,

ABS-CBN News

Published Dec 08, 2022 05:15 PM PHT

MANILA - Allies of President Ferdinand Bongbong Marcos Jr are pushing for the creation of a sovereign wealth fund (SWF) called Maharlika, which has drawn mixed reactions from the public.

MANILA - Allies of President Ferdinand Bongbong Marcos Jr are pushing for the creation of a sovereign wealth fund (SWF) called Maharlika, which has drawn mixed reactions from the public.

House Speaker Martin Romualdez led several lawmakers in filing House Bill 6398 which seeks to create the Maharlika Investment Fund (MIF).

House Speaker Martin Romualdez led several lawmakers in filing House Bill 6398 which seeks to create the Maharlika Investment Fund (MIF).

WHAT IS A SOVEREIGN WEALTH FUND?

Sovereign wealth funds are state-owned investment companies meant to generate profits for their beneficiaries, ING Bank Manila's Senior Economist Nicholas Mapa told ABS-CBN News

Sovereign wealth funds are state-owned investment companies meant to generate profits for their beneficiaries, ING Bank Manila's Senior Economist Nicholas Mapa told ABS-CBN News

"Oftentimes, they are supported by government revenues and or surpluses and in some cases future revenue streams... An SWF is neither good nor bad. It can be used as a tool to achieve a goal if used properly," he said.

"Oftentimes, they are supported by government revenues and or surpluses and in some cases future revenue streams... An SWF is neither good nor bad. It can be used as a tool to achieve a goal if used properly," he said.

ADVERTISEMENT

As of June 2022, Statista said the top 5 sovereign wealth funds in the world are operated by 4 countries.

As of June 2022, Statista said the top 5 sovereign wealth funds in the world are operated by 4 countries.

Norway handles the world’s largest sovereign fund worth $1.3 trillion. Completing the world's top 5 are 2 funds from China followed by the United Arab Emirates and Singapore.

Norway handles the world’s largest sovereign fund worth $1.3 trillion. Completing the world's top 5 are 2 funds from China followed by the United Arab Emirates and Singapore.

MAHARLIKA?

According to House Bill 6398, the Maharlika fund will help “stabilize national budgets, create savings for their citizens, or promote economic development.”

According to House Bill 6398, the Maharlika fund will help “stabilize national budgets, create savings for their citizens, or promote economic development.”

Romualdez, who is the cousin of President Ferdinand Bongbong Marcos Jr, said the fund is in line with the government’s economic agenda to reduce the poverty rate to a single digit and drive robust economic growth of 6.5 to 8 percent annually from 2023 to 2028.

Romualdez, who is the cousin of President Ferdinand Bongbong Marcos Jr, said the fund is in line with the government’s economic agenda to reduce the poverty rate to a single digit and drive robust economic growth of 6.5 to 8 percent annually from 2023 to 2028.

The bill, however, has been criticized for mandating contributions from the Government Service Insurance System, the Social Security System as well as the national government through the annual budget.

The bill, however, has been criticized for mandating contributions from the Government Service Insurance System, the Social Security System as well as the national government through the annual budget.

ADVERTISEMENT

Some critics said using money from pension funds to back the MIF is "unconstitutional" saying pension fund contributions must only benefit fund members.

Some critics said using money from pension funds to back the MIF is "unconstitutional" saying pension fund contributions must only benefit fund members.

GSIS, SSS DROPPED

Following these criticisms, proponents of the bill said the measure would no longer source contributions from GSIS, SSS, or the national government.

Following these criticisms, proponents of the bill said the measure would no longer source contributions from GSIS, SSS, or the national government.

The fund would instead utilize the profits of the Bangko Sentral ng Pilipinas, the Landbank of the Philippines, and the Development Bank of the Philippines.

The fund would instead utilize the profits of the Bangko Sentral ng Pilipinas, the Landbank of the Philippines, and the Development Bank of the Philippines.

House leaders revised the proposal after meeting with the country's economic managers to reassess the bill.

House leaders revised the proposal after meeting with the country's economic managers to reassess the bill.

WORRIES OVER ABUSE, TIMING

The Maharlika fund could be good for a country depending on the safeguards put in place, according to Investment & Capital Corp of the Philippines’ managing director Manny Ocampo.

The Maharlika fund could be good for a country depending on the safeguards put in place, according to Investment & Capital Corp of the Philippines’ managing director Manny Ocampo.

ADVERTISEMENT

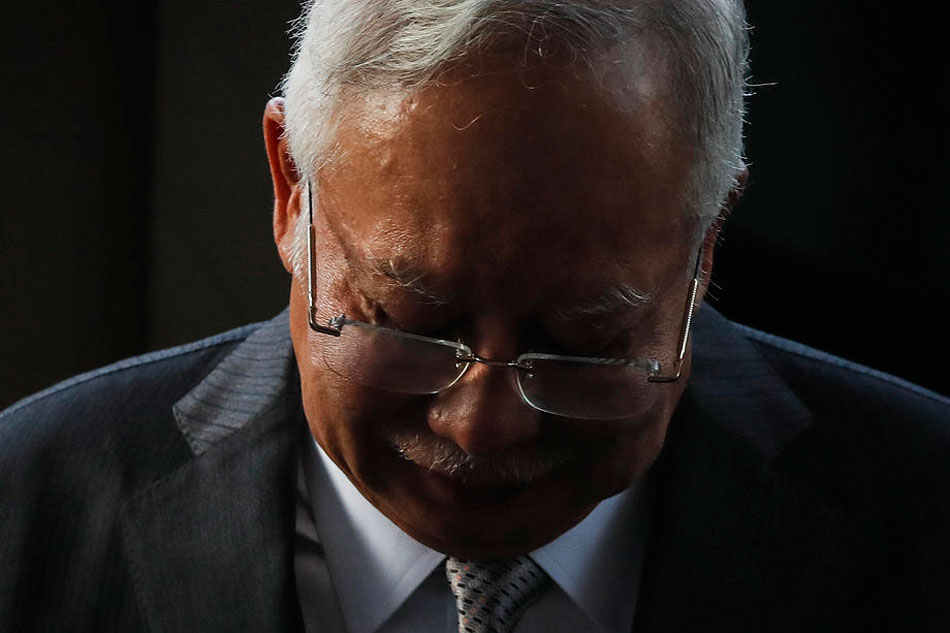

Safeguards are needed because a massive fund such as Maharlika is prone to corruption, as shown by the case of Malaysia’s 1MDB.

Safeguards are needed because a massive fund such as Maharlika is prone to corruption, as shown by the case of Malaysia’s 1MDB.

Former Prime Minister Najib Razak was convicted for abusing 1MDB.

Former Prime Minister Najib Razak was convicted for abusing 1MDB.

Mapa and other financial experts agree that for the fund to succeed, it must be corruption-free.

Mapa and other financial experts agree that for the fund to succeed, it must be corruption-free.

"Once again, an SWF is neither good nor bad as it is only a vehicle that can be used to attain an end. There are some issues with regard to capital that hopefully can be addressed," Mapa said.

"Once again, an SWF is neither good nor bad as it is only a vehicle that can be used to attain an end. There are some issues with regard to capital that hopefully can be addressed," Mapa said.

"However, any SWF will need to avoid and sidestep corruption and crony investments, which have plagued other SWFs in the region. This will be the most contentious issue: governance to ensure the proposed fund is corruption free," he added.

"However, any SWF will need to avoid and sidestep corruption and crony investments, which have plagued other SWFs in the region. This will be the most contentious issue: governance to ensure the proposed fund is corruption free," he added.

ADVERTISEMENT

Independent think tank Action for Economic Reforms, which counts leading economists from UP meanwhile said that everything Maharlika wants to achieve can already be done by the very institutions being compelled to contribute funds to it. These goals include lending to infrastructure projects or investing in riskier but more rewarding financial assets.

AER founder Filomeno Sta. Ana also noted that Maharlika does not work like other sovereign wealth funds because it is asking for money from institutions that need more income instead of mobilizing surplus cash that would have otherwise been left unproductive

Independent think tank Action for Economic Reforms, which counts leading economists from UP meanwhile said that everything Maharlika wants to achieve can already be done by the very institutions being compelled to contribute funds to it. These goals include lending to infrastructure projects or investing in riskier but more rewarding financial assets.

AER founder Filomeno Sta. Ana also noted that Maharlika does not work like other sovereign wealth funds because it is asking for money from institutions that need more income instead of mobilizing surplus cash that would have otherwise been left unproductive

Former Senator Bam Aquino, who proposed a similar measure in 2016, meanwhile questioned the timing of the sovereign wealth fund.

Former Senator Bam Aquino, who proposed a similar measure in 2016, meanwhile questioned the timing of the sovereign wealth fund.

In a statement, Aquino said the economy was rapidly growing in 2016 at an average of 6 percent, and debt levels were low. He said this was no longer the case, after the pandemic disrupted the economy, and with the national debt hitting record highs.

In a statement, Aquino said the economy was rapidly growing in 2016 at an average of 6 percent, and debt levels were low. He said this was no longer the case, after the pandemic disrupted the economy, and with the national debt hitting record highs.

Even the President's own sister, Senator Imee Marcos earlier called the bill a "risky" investment at this time.

Even the President's own sister, Senator Imee Marcos earlier called the bill a "risky" investment at this time.

RELATED VIDEO:

Read More:

Sovereign wealth funds

Maharlika investment fund

SWF

MIF

investing

inflation

corruption

economy

debt level

government fund

ADVERTISEMENT

ADVERTISEMENT