BSP says 1 in 5 payments now digital; InstaPay overtakes ATM withdrawals in 2020 | ABS-CBN

Welcome, Kapamilya! We use cookies to improve your browsing experience. Continuing to use this site means you agree to our use of cookies. Tell me more!

BSP says 1 in 5 payments now digital; InstaPay overtakes ATM withdrawals in 2020

BSP says 1 in 5 payments now digital; InstaPay overtakes ATM withdrawals in 2020

Jessica Fenol,

ABS-CBN News

Published Oct 18, 2021 06:49 PM PHT

MANILA - One in 5 payments in the Philippines is now done digitally as the country moves towards its digitalization goals, Bangko Sentral ng Pilipinas Gov. Benjamin Diokno said Monday.

MANILA - One in 5 payments in the Philippines is now done digitally as the country moves towards its digitalization goals, Bangko Sentral ng Pilipinas Gov. Benjamin Diokno said Monday.

Under its digitalization roadmap, the BSP aims to digitalize at least 50 percent of payments and onboard 70 percent of the population to the financial system by 2023.

Under its digitalization roadmap, the BSP aims to digitalize at least 50 percent of payments and onboard 70 percent of the population to the financial system by 2023.

The volume of digital payments has "grown substantially" to 20.1 percent of total average monthly payments from 14 percent in 2019 overshooting estimates of 20 percent, Diokno said in a report released by the BSP Monday.

The volume of digital payments has "grown substantially" to 20.1 percent of total average monthly payments from 14 percent in 2019 overshooting estimates of 20 percent, Diokno said in a report released by the BSP Monday.

The growth is fueled by high-frequency, low-value retail transactions and person-to-person payments, according to the "Status of Digital Payments in the Philippines 2021 Edition" report.

The growth is fueled by high-frequency, low-value retail transactions and person-to-person payments, according to the "Status of Digital Payments in the Philippines 2021 Edition" report.

ADVERTISEMENT

"We achieved a few milestones in our digital transformation journey. We hit our “20 percent by 2020” target, with one in five payments now digital. The BSP supports the development of innovative financial services to realize our inclusive growth agenda," the central bank chief said.

"We achieved a few milestones in our digital transformation journey. We hit our “20 percent by 2020” target, with one in five payments now digital. The BSP supports the development of innovative financial services to realize our inclusive growth agenda," the central bank chief said.

We achieved a few milestones in our digital transformation journey. We hit our “20% by 2020” target, with one in five payments now digital.

The BSP supports the development of innovative financial services to realize our inclusive growth agenda.

— Benjamin Diokno (@GovBenDiokno) October 18, 2021

We achieved a few milestones in our digital transformation journey. We hit our “20% by 2020” target, with one in five payments now digital.

— Benjamin Diokno (@GovBenDiokno) October 18, 2021

The BSP supports the development of innovative financial services to realize our inclusive growth agenda.

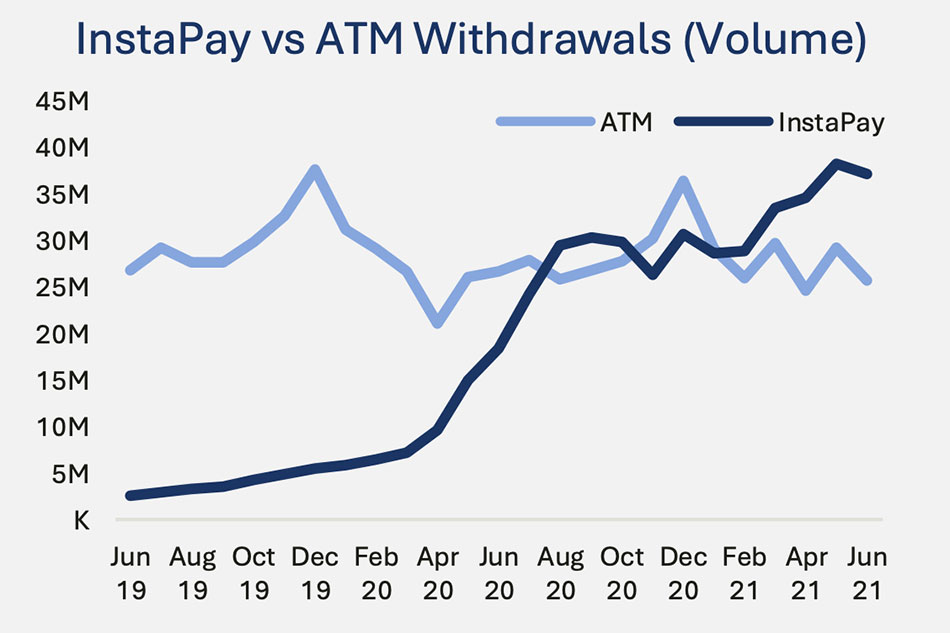

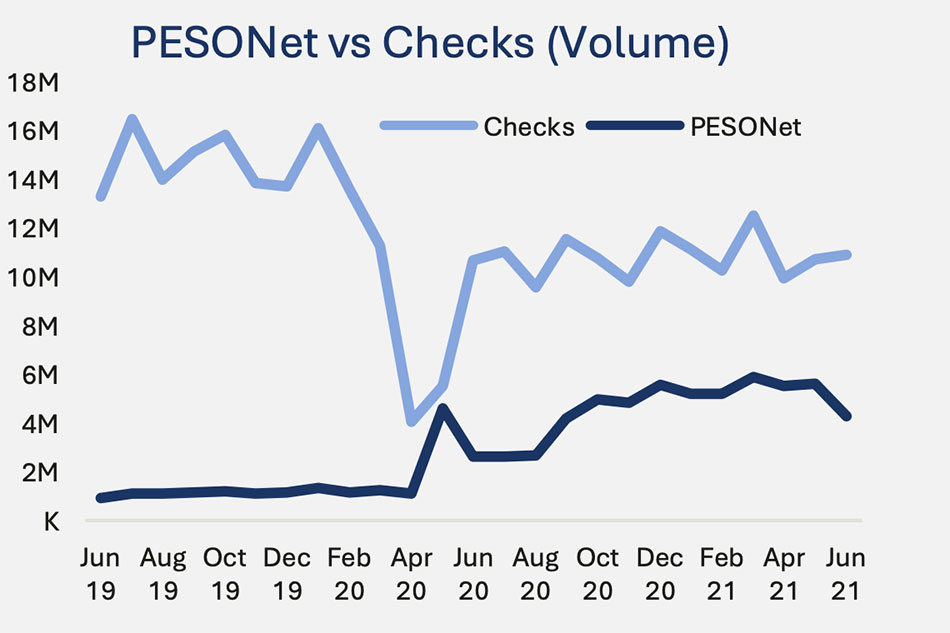

The combined PESONet and InstaPay transfers in volume grew by 484.7 percent in 2020 as well as 165.4 percent in terms of value, the central bank said.

The combined PESONet and InstaPay transfers in volume grew by 484.7 percent in 2020 as well as 165.4 percent in terms of value, the central bank said.

InstaPay transfers have also "overtaken" ATM withdrawals, while PESONet is "on track" in minimizing the gaps and may exceed check volume over time, it said.

InstaPay transfers have also "overtaken" ATM withdrawals, while PESONet is "on track" in minimizing the gaps and may exceed check volume over time, it said.

With this development, the BSP is "optimistic" in achieving this goal by 2023, he said.

With this development, the BSP is "optimistic" in achieving this goal by 2023, he said.

Digital payments have emerged as "vital and inevitable solutions" to enable Filipinos to complete transactions without physical contact, therefore, reducing health risks, the BSP study report said.

Digital payments have emerged as "vital and inevitable solutions" to enable Filipinos to complete transactions without physical contact, therefore, reducing health risks, the BSP study report said.

COVID-19 has emerged as a "catalyst" for the growth of digital payments, it added.

COVID-19 has emerged as a "catalyst" for the growth of digital payments, it added.

Diokno said the BSP laid out regulatory reforms meant to support a cash-lite economy.

Diokno said the BSP laid out regulatory reforms meant to support a cash-lite economy.

The BSP earlier approved a framework recognizing digital banks and had given out 6 digital banking licenses.

The BSP earlier approved a framework recognizing digital banks and had given out 6 digital banking licenses.

Digital banks are financial technology companies with no physical branches and are designed to make onboarding into the financial system easier and more accessible especially for the unbanked.

Digital banks are financial technology companies with no physical branches and are designed to make onboarding into the financial system easier and more accessible especially for the unbanked.

RELATED VIDEO:

ADVERTISEMENT

ADVERTISEMENT