GCash, PayMaya to charge fees for fund transfers starting Oct. 1 | ABS-CBN

Welcome, Kapamilya! We use cookies to improve your browsing experience. Continuing to use this site means you agree to our use of cookies. Tell me more!

GCash, PayMaya to charge fees for fund transfers starting Oct. 1

GCash, PayMaya to charge fees for fund transfers starting Oct. 1

ABS-CBN News

Published Sep 25, 2020 04:57 PM PHT

|

Updated Sep 26, 2020 10:14 PM PHT

MANILA (UPDATE)--Selected commercial banks will begin charging a transaction fee for fund transfers into GCash and PayMaya using the InstaPay network.

MANILA (UPDATE)--Selected commercial banks will begin charging a transaction fee for fund transfers into GCash and PayMaya using the InstaPay network.

In a statement, GCash said the policy would take effect on Oct. 1.

In a statement, GCash said the policy would take effect on Oct. 1.

“Effective October 1, 2020, selected commercial banks and Electronic Money Institutions (EMIs) using the InstaPay network will start charging a transaction fee when doing a fund transfer (cash in transaction) into GCash,” the statement said.

“Effective October 1, 2020, selected commercial banks and Electronic Money Institutions (EMIs) using the InstaPay network will start charging a transaction fee when doing a fund transfer (cash in transaction) into GCash,” the statement said.

Fees will vary depending on the bank or EMI but could be up to P50 each, the mobile wallet provider said.

Fees will vary depending on the bank or EMI but could be up to P50 each, the mobile wallet provider said.

ADVERTISEMENT

GCash will charge a P15 fee per fund transfer (cash out transaction) to a bank or EMI using the InstaPay network. This will also take effect on Oct. 1.

GCash will charge a P15 fee per fund transfer (cash out transaction) to a bank or EMI using the InstaPay network. This will also take effect on Oct. 1.

All GCash-to-GCash Send Money transactions, bills payments or loading will remain free of charge, it said.

All GCash-to-GCash Send Money transactions, bills payments or loading will remain free of charge, it said.

To avoid paying a transaction fee, GCash users are advised to link their BPI or UnionBank accounts to their GCash App. These fund transfers will remain free of charge.

To avoid paying a transaction fee, GCash users are advised to link their BPI or UnionBank accounts to their GCash App. These fund transfers will remain free of charge.

TRANSACTION CHARGES AND FEES Send Money

PayMaya to Smart Money (v.v) 1.5%

(Sender Pays) Bank transfer via PayMaya app Php 10.00*

*Effective October 1, 2020 Send to bank account via ATM (IBFT via ATM) Php 15.00* Effective August 1,2020

| TRANSACTION | CHARGES AND FEES |

| Send Money PayMaya to Smart Money (v.v) | 1.5% (Sender Pays) |

| Bank transfer via PayMaya app | Php 10.00* *Effective October 1, 2020 |

| Send to bank account via ATM (IBFT via ATM) | Php 15.00* Effective August 1,2020 |

Digital financial service firm PayMaya also announced that users would be charged P10 for bank transfer via the PayMaya app effective Oct. 1.

Digital financial service firm PayMaya also announced that users would be charged P10 for bank transfer via the PayMaya app effective Oct. 1.

Sending money to a bank account via ATM will also cost users P15, it posted on its website.

Sending money to a bank account via ATM will also cost users P15, it posted on its website.

The company noted that PayMaya to PayMaya transactions remain free of charge while sending money to Smart Money would incur a 1.5 percent fee.

The company noted that PayMaya to PayMaya transactions remain free of charge while sending money to Smart Money would incur a 1.5 percent fee.

Bankers Association of the Philippines head and president of BPI Cezar Consing earlier said many banks would resume charging for online transactions using InstaPay, among others by October.

Bankers Association of the Philippines head and president of BPI Cezar Consing earlier said many banks would resume charging for online transactions using InstaPay, among others by October.

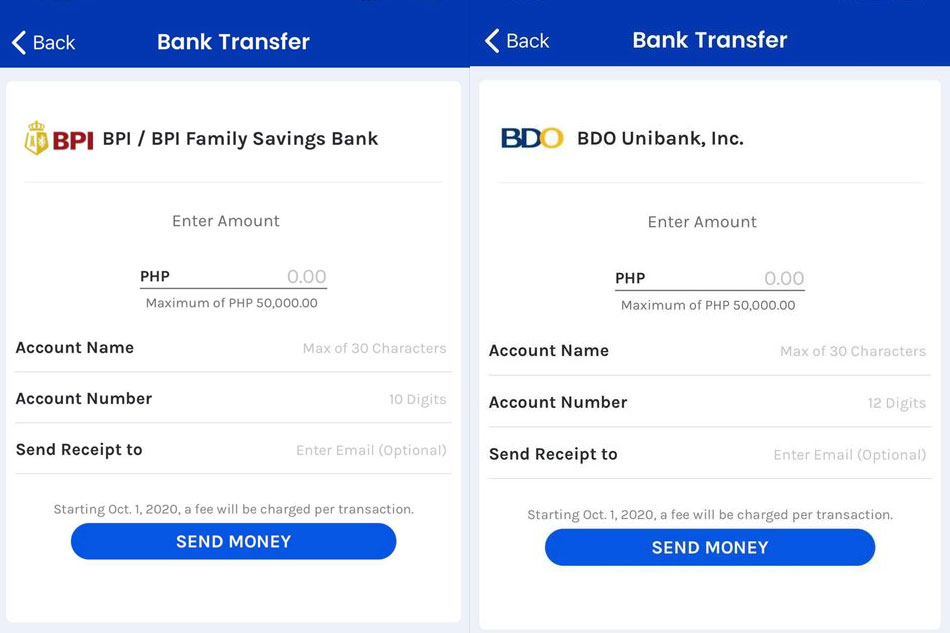

InstaPay lets banking clients transfer up to P50,000 per transaction, which is credited instantly to the recipient’s account in any local bank.

InstaPay lets banking clients transfer up to P50,000 per transaction, which is credited instantly to the recipient’s account in any local bank.

The Bangko Sentral ng Pilipinas earlier urged banks to waive online transaction fees to encourage Filipinos to use online banking during the COVID-19 pandemic.

The Bangko Sentral ng Pilipinas earlier urged banks to waive online transaction fees to encourage Filipinos to use online banking during the COVID-19 pandemic.

Several banks would waive fees for InstaPay and PesoNet until the end of the year, the BSP said in an update in August.

Several banks would waive fees for InstaPay and PesoNet until the end of the year, the BSP said in an update in August.

Read More:

ANC

ANC Top

GCash

GCash fees

money transfer

online money transfer

bank transfer

InstaPay

online banking

ADVERTISEMENT

ADVERTISEMENT