Recto wants long-time ecozone investors exempted from new tax rates under CREATE | ABS-CBN

Welcome, Kapamilya! We use cookies to improve your browsing experience. Continuing to use this site means you agree to our use of cookies. Tell me more!

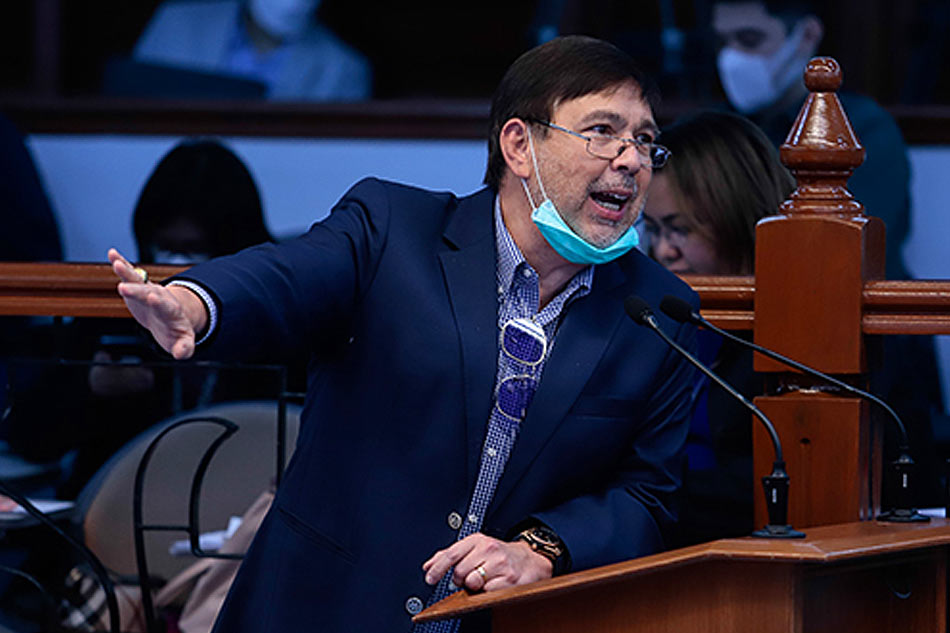

Recto wants long-time ecozone investors exempted from new tax rates under CREATE

Recto wants long-time ecozone investors exempted from new tax rates under CREATE

Katrina Domingo,

ABS-CBN News

Published Sep 23, 2020 11:03 PM PHT

MANILA - Senate President Pro Tempore Ralph Recto on Wednesday said higher corporate income taxes imposed on investors in special economic zones under a proposed tax bill should only apply to businesses coming into the country, because it could discourage existing companies from expanding in the Philippines.

MANILA - Senate President Pro Tempore Ralph Recto on Wednesday said higher corporate income taxes imposed on investors in special economic zones under a proposed tax bill should only apply to businesses coming into the country, because it could discourage existing companies from expanding in the Philippines.

Recto pushed for the inclusion of a "grandfather rule" -- which allows existing investors in the country to enjoy status quo, while a new rule is applied to future investors -- in the Corporate Recovery and Tax Incentives for Enterprises (CREATE) bill.

Recto pushed for the inclusion of a "grandfather rule" -- which allows existing investors in the country to enjoy status quo, while a new rule is applied to future investors -- in the Corporate Recovery and Tax Incentives for Enterprises (CREATE) bill.

Under the proposed measure, corporate income taxes in the country will be reduced to 25 percent, but "profitable" companies enjoying incentives in ecozones will see their taxes double to 10 percent in a few years.

Under the proposed measure, corporate income taxes in the country will be reduced to 25 percent, but "profitable" companies enjoying incentives in ecozones will see their taxes double to 10 percent in a few years.

"We will have a new tax regime, but for all those enjoying these tax regime, let's not be an Indian giver," Recto said as the Senate debated on the bill in plenary.

"We will have a new tax regime, but for all those enjoying these tax regime, let's not be an Indian giver," Recto said as the Senate debated on the bill in plenary.

ADVERTISEMENT

"It's an issue of fairness too... We're changing the rules in the middle of the game.

"It's an issue of fairness too... We're changing the rules in the middle of the game.

"Those [companies] who are already here with us when we are down... They brought in so much investments, they brought in billions of dollars... Tapos nung gumaganda ang panahon, we are saying 'Uy, you're earning too much'."

"Those [companies] who are already here with us when we are down... They brought in so much investments, they brought in billions of dollars... Tapos nung gumaganda ang panahon, we are saying 'Uy, you're earning too much'."

While the tax hike in companies enjoying special incentives for years is meant to offset some P675 billion in foregone taxes due to the rationalization, Recto warned that a lot of businesses in ecozones are business process outsourcing (BPO) companies and export-related firms that generate thousands of jobs across the country.

While the tax hike in companies enjoying special incentives for years is meant to offset some P675 billion in foregone taxes due to the rationalization, Recto warned that a lot of businesses in ecozones are business process outsourcing (BPO) companies and export-related firms that generate thousands of jobs across the country.

"They are our best diplomats to tell their home office, their home country na, 'Uy, alis tayo sa China punta tayo sa Philippines because we have superior incentives there'," he said.

"They are our best diplomats to tell their home office, their home country na, 'Uy, alis tayo sa China punta tayo sa Philippines because we have superior incentives there'," he said.

"But they will be saying now na, 'Huwag na tayo mag invest sa Philippines kasi 5 percent tax natin dati gagawin pa nilang 10 percent ngayon e pandemic pa ngayon'."

"But they will be saying now na, 'Huwag na tayo mag invest sa Philippines kasi 5 percent tax natin dati gagawin pa nilang 10 percent ngayon e pandemic pa ngayon'."

Senate Committee on Ways and Means chair Pia Cayetano told Recto that there is no country in the world that grants perpetual incentives for investors.

Senate Committee on Ways and Means chair Pia Cayetano told Recto that there is no country in the world that grants perpetual incentives for investors.

"The Department of Finance has presented the feedback they have gotten with the industries and they (investors) are okay with the new incentive package under CREATE," she said.

"The Department of Finance has presented the feedback they have gotten with the industries and they (investors) are okay with the new incentive package under CREATE," she said.

Cayetano noted the the bill was crafted to make the Philippines a more attractive destination in Southeast Asia as its current 30 percent corporate tax rate is higher that the regional average of 22 percent.

Cayetano noted the the bill was crafted to make the Philippines a more attractive destination in Southeast Asia as its current 30 percent corporate tax rate is higher that the regional average of 22 percent.

"There would be some [companies] that would have more favorable rates but there would be others with higher rates," Cayetano said, nothing that 44 percent of investors in the country will enjoy lower taxes with the passage of the measure.

"There would be some [companies] that would have more favorable rates but there would be others with higher rates," Cayetano said, nothing that 44 percent of investors in the country will enjoy lower taxes with the passage of the measure.

"Over and above, most would continue top be profitable," she said.

"Over and above, most would continue top be profitable," she said.

Recto agreed that the Philippines needs to reduce its corporate income tax rate, but warned that it may result in job losses should it be made at the expense of long-time investors in the country.

Recto agreed that the Philippines needs to reduce its corporate income tax rate, but warned that it may result in job losses should it be made at the expense of long-time investors in the country.

"There is a trade war... a lot of companies want to leave China... If we make a mistake and pass a bad law on rationalizing fiscal incentives, we will miss the boat," Recto said.

"There is a trade war... a lot of companies want to leave China... If we make a mistake and pass a bad law on rationalizing fiscal incentives, we will miss the boat," Recto said.

"The worst case is we will lose jobs in the process," he said.

"The worst case is we will lose jobs in the process," he said.

The Senate is expected to continue deliberations about the CREATE bill next week.

The Senate is expected to continue deliberations about the CREATE bill next week.

ADVERTISEMENT

ADVERTISEMENT