PH 'exceeds' P2.2-T estimated tax revenue this year, says Finance chief | ABS-CBN

Welcome, Kapamilya! We use cookies to improve your browsing experience. Continuing to use this site means you agree to our use of cookies. Tell me more!

PH 'exceeds' P2.2-T estimated tax revenue this year, says Finance chief

PH 'exceeds' P2.2-T estimated tax revenue this year, says Finance chief

Katrina Domingo,

ABS-CBN News

Published Sep 23, 2020 02:03 PM PHT

MANILA - Finance Secretary Carlos Dominguez on Wednesday said the Philippines has already exceeded this year's estimated P2.2 trillion tax revenue as early as August.

MANILA - Finance Secretary Carlos Dominguez on Wednesday said the Philippines has already exceeded this year's estimated P2.2 trillion tax revenue as early as August.

"We are above that estimate as of end August 31st. We are above it by 8 percent," Dominguez told senators during the Department of Finance's (DOF) budget hearing in the Senate.

"We are above that estimate as of end August 31st. We are above it by 8 percent," Dominguez told senators during the Department of Finance's (DOF) budget hearing in the Senate.

The Philippines revised its projected tax revenue to P2.2 trillion, about P1.2 trillion lower than the original P3.42-trillion target before the COVID-19 pandemic forced businesses to shut earlier this year.

The Philippines revised its projected tax revenue to P2.2 trillion, about P1.2 trillion lower than the original P3.42-trillion target before the COVID-19 pandemic forced businesses to shut earlier this year.

"We are 24.29 percent below that original target," Dominguez said.

"We are 24.29 percent below that original target," Dominguez said.

ADVERTISEMENT

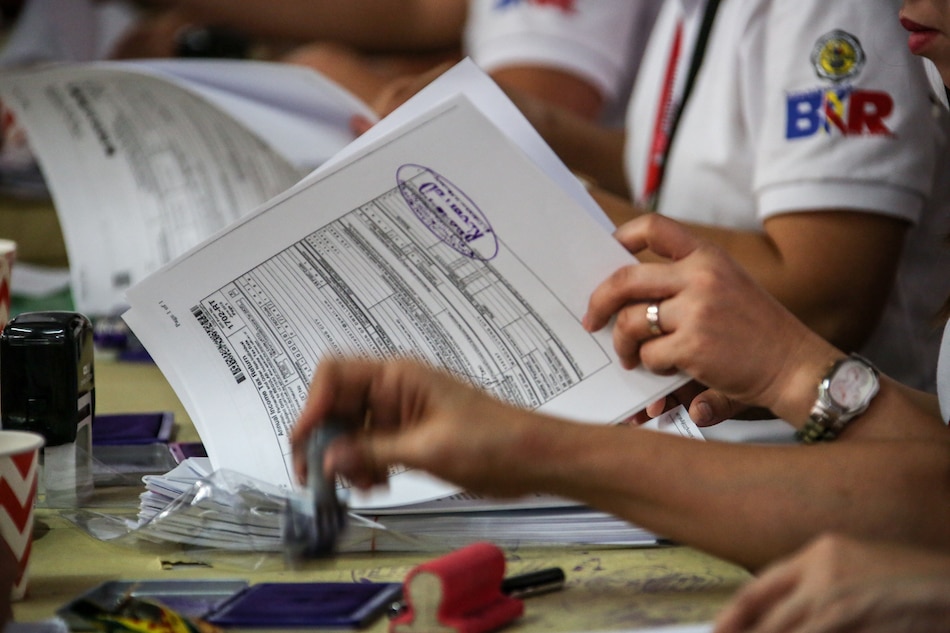

The Finance chief earlier said that the Bureau of Internal Revenue and the Bureau of Customs have improved collection schemes, even achieving "pretty close to 95 percent" in collections in 2019.

The Finance chief earlier said that the Bureau of Internal Revenue and the Bureau of Customs have improved collection schemes, even achieving "pretty close to 95 percent" in collections in 2019.

"Anybody who hits 95 percent of the target is not so bad... It could have been better but they have a passing grade," he said.

"Anybody who hits 95 percent of the target is not so bad... It could have been better but they have a passing grade," he said.

The 5 percent that tax collectors failed to get last year amounts to P126.41 billion, Sen. Grace Poe said in a hearing last week.

The 5 percent that tax collectors failed to get last year amounts to P126.41 billion, Sen. Grace Poe said in a hearing last week.

This year, the government is expected to lose some P40 billion in taxes should Congress approve the passage of the Corporate Recovery and Tax Incentives for Enterprises Act (CREATE) bill, which would reduce corporate income taxes to 25 percent.

This year, the government is expected to lose some P40 billion in taxes should Congress approve the passage of the Corporate Recovery and Tax Incentives for Enterprises Act (CREATE) bill, which would reduce corporate income taxes to 25 percent.

If CREATE is passed into law, the government will forego a total of P650 billion in taxes in the next 5 years, he said.

If CREATE is passed into law, the government will forego a total of P650 billion in taxes in the next 5 years, he said.

"This is trusting the private sector to do the right decision with that money, like retaining their employees," the Finance chief said.

"This is trusting the private sector to do the right decision with that money, like retaining their employees," the Finance chief said.

"By doing that we hope and believe that the economy will be stimulated and additional investments will generate more taxes in the long run, and make us more attractive for investments," he said.

"By doing that we hope and believe that the economy will be stimulated and additional investments will generate more taxes in the long run, and make us more attractive for investments," he said.

Economic managers have been pushing for the passage of the CREATE bill to make the Philippines a more attractive investment destination in Southeast Asia.

Economic managers have been pushing for the passage of the CREATE bill to make the Philippines a more attractive investment destination in Southeast Asia.

The country's current 30 percent corporate income tax is one of the highest in Southeast Asia, as the regional average is only at 22.5 percent, Dominguez said.

The country's current 30 percent corporate income tax is one of the highest in Southeast Asia, as the regional average is only at 22.5 percent, Dominguez said.

"We want to approach that [regional average] and reach a 20 percent tax rate overtime," he said.

"We want to approach that [regional average] and reach a 20 percent tax rate overtime," he said.

Despite the projected loses, the DOF expects to collect some P2.71 trillion in taxes in 2021 when the economy further reopens after being stifled by the global pandemic, he said.

Despite the projected loses, the DOF expects to collect some P2.71 trillion in taxes in 2021 when the economy further reopens after being stifled by the global pandemic, he said.

Read More:

Carlos Dominguez

Department of Finance

DOF

tax collection

tax revenue

BIR

BOC

CREATE bill

corporate income tax

ADVERTISEMENT

ADVERTISEMENT