GCash eyes launching 'Buy Now, Pay Later' service this year | ABS-CBN

ADVERTISEMENT

Welcome, Kapamilya! We use cookies to improve your browsing experience. Continuing to use this site means you agree to our use of cookies. Tell me more!

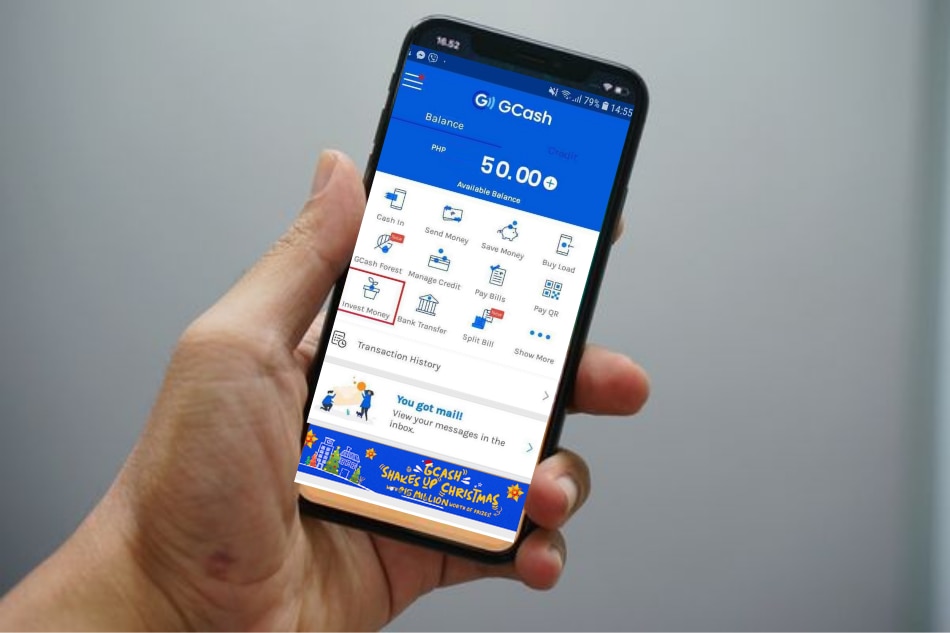

GCash eyes launching 'Buy Now, Pay Later' service this year

GCash eyes launching 'Buy Now, Pay Later' service this year

ABS-CBN News

Published Sep 22, 2021 08:51 PM PHT

MANILA - GCash on Wednesday said it is eyeing to launch a Buy Now, Pay Later (BNPL) service this year.

MANILA - GCash on Wednesday said it is eyeing to launch a Buy Now, Pay Later (BNPL) service this year.

BNPL is a short-term financing service that lets consumers buy items and pay for them at a future date, often interest-free. The payment scheme has become increasingly popular for online purchases in other countries.

BNPL is a short-term financing service that lets consumers buy items and pay for them at a future date, often interest-free. The payment scheme has become increasingly popular for online purchases in other countries.

GCash said the move to BNPL is part of its expanding array of financial services.

GCash said the move to BNPL is part of its expanding array of financial services.

ADVERTISEMENT

The company said its in-house lending service GCredit, already disburses P1 billion worth of loans a month on average, with P15 billion worth disbursed as of June this year.

The company said its in-house lending service GCredit, already disburses P1 billion worth of loans a month on average, with P15 billion worth disbursed as of June this year.

The Ayala-led fintech said it is also piloting GLoan, a new service that allows qualified users to borrow as much as P25,000, with repayment spread over 12 months.

The Ayala-led fintech said it is also piloting GLoan, a new service that allows qualified users to borrow as much as P25,000, with repayment spread over 12 months.

“The service is doing well and has shown the fastest growing revenue for its category,” GCash said.

“The service is doing well and has shown the fastest growing revenue for its category,” GCash said.

“As a driver of financial inclusion, our objective is clear, and that is to ease the friction being experienced by unbanked and underserved Filipinos,” said Martha Sazon, President and CEO of GCash.

“As a driver of financial inclusion, our objective is clear, and that is to ease the friction being experienced by unbanked and underserved Filipinos,” said Martha Sazon, President and CEO of GCash.

The explosive growth of GCash, which reportedly had 46 million users as of July, is credited for driving the recent surge in the stock price of parent firm Globe Telecom.

The explosive growth of GCash, which reportedly had 46 million users as of July, is credited for driving the recent surge in the stock price of parent firm Globe Telecom.

RELATED VIDEO

Read More:

GCash

Buy Now Pay Later

BNPL

fintech

moile wallet

e-wallet

online payment

cashless payment

Globe Telecom

GCredit

ADVERTISEMENT

ADVERTISEMENT