UnionBank to offer Bitcoin trading on mobile app | ABS-CBN

Welcome, Kapamilya! We use cookies to improve your browsing experience. Continuing to use this site means you agree to our use of cookies. Tell me more!

UnionBank to offer Bitcoin trading on mobile app

UnionBank to offer Bitcoin trading on mobile app

ABS-CBN News

Published Sep 19, 2023 03:36 PM PHT

|

Updated Sep 20, 2023 01:18 PM PHT

MANILA -- Union Bank of the Philippines (UnionBank) has received a Certificate of Authority from the Bangko Sentral ng Pilipinas (BSP) to operate as a virtual asset service provider, the company said on Tuesday.

MANILA -- Union Bank of the Philippines (UnionBank) has received a Certificate of Authority from the Bangko Sentral ng Pilipinas (BSP) to operate as a virtual asset service provider, the company said on Tuesday.

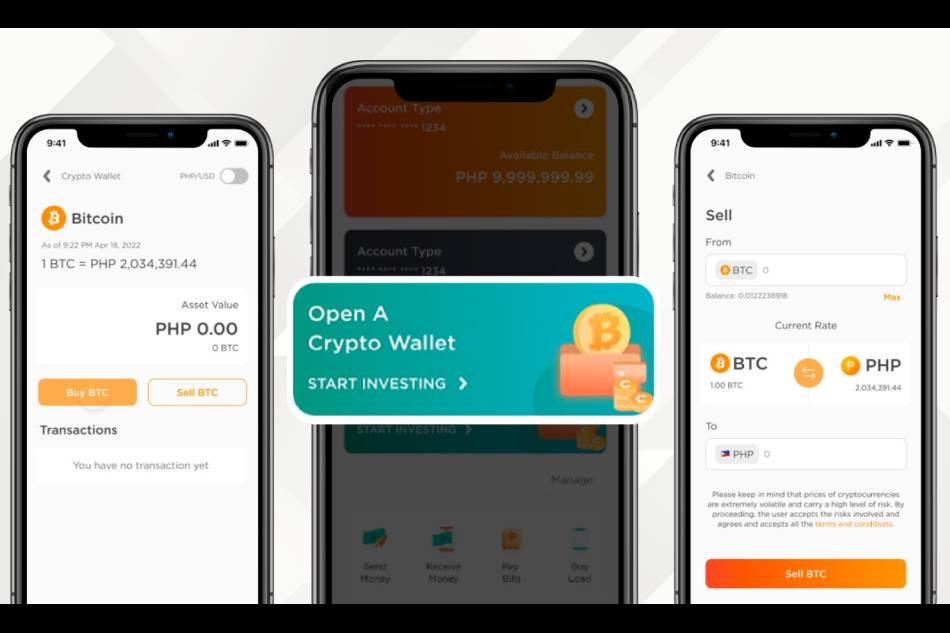

UnionBank said this makes it the first and only universal bank in the Philippines that allows users to trade cryptocurrencies on its mobile app.

UnionBank said this makes it the first and only universal bank in the Philippines that allows users to trade cryptocurrencies on its mobile app.

UnionBank said some users of its app will soon be allowed to directly buy and sell Bitcoin. The new feature will be gradually rolled out by the last quarter of 2023, it said.

UnionBank said some users of its app will soon be allowed to directly buy and sell Bitcoin. The new feature will be gradually rolled out by the last quarter of 2023, it said.

The bank said its customers now have a convenient and secure platform for trading cryptocurrencies through a well-established and trusted financial institution.

The bank said its customers now have a convenient and secure platform for trading cryptocurrencies through a well-established and trusted financial institution.

ADVERTISEMENT

"This will also allow them to manage both traditional banking and digital assets within a single mobile platform," the lender said in a statement.

"This will also allow them to manage both traditional banking and digital assets within a single mobile platform," the lender said in a statement.

UnionBank said the virtual asset exchange services were previously accessible only to randomly selected users of the app through a limited virtual asset license.

UnionBank said the virtual asset exchange services were previously accessible only to randomly selected users of the app through a limited virtual asset license.

"By obtaining this license, we are not only paving the way for even more groundbreaking opportunities, but also enhancing our digital capabilities and further transforming the way our customers interact with us,” said UnionBank President and CEO Edwin Bautista.

"By obtaining this license, we are not only paving the way for even more groundbreaking opportunities, but also enhancing our digital capabilities and further transforming the way our customers interact with us,” said UnionBank President and CEO Edwin Bautista.

UnionBank SVP and Head of Emerging Technology Group Cathy Casas said they pursued the virtual asset license to future-proof their business.

UnionBank SVP and Head of Emerging Technology Group Cathy Casas said they pursued the virtual asset license to future-proof their business.

In January 2018, UnionBank announced that it would offer the country’s first blockchain payment system for businesses called Visa B2B Connect.

In January 2018, UnionBank announced that it would offer the country’s first blockchain payment system for businesses called Visa B2B Connect.

Later that same year, the Aboitiz-led lender said it would tap blockchain to connect rural banks in the same way systems such as Bancnet and SWIFT link larger lenders.

Later that same year, the Aboitiz-led lender said it would tap blockchain to connect rural banks in the same way systems such as Bancnet and SWIFT link larger lenders.

In 2022, the bank said it raised P11 billion through the country’s first-ever offering of digital peso bonds powered by blockchain technology.

In 2022, the bank said it raised P11 billion through the country’s first-ever offering of digital peso bonds powered by blockchain technology.

Editor's note:

An earlier version of this article said that Bitcoin trading on UnionBank's mobile app will start in October. The company however has clarified that this feature will be rolled out in the fourth quarter of the year. We regret the error.

RELATED STORY:

ADVERTISEMENT

ADVERTISEMENT