Dissecting Data: The economic challenges Marcos Jr needs to hurdle | ABS-CBN

Welcome, Kapamilya! We use cookies to improve your browsing experience. Continuing to use this site means you agree to our use of cookies. Tell me more!

Dissecting Data: The economic challenges Marcos Jr needs to hurdle

Dissecting Data: The economic challenges Marcos Jr needs to hurdle

Edson Guido and Warren de Guzman,

ABS-CBN News

Published Sep 13, 2022 11:45 AM PHT

|

Updated Jun 21, 2023 04:09 PM PHT

President Ferdinand Marcos Jr declared during his first State of the Nation Address that the state of the nation is sound. While some indicators show that the economy is looking sound, there are also some causes for concern.

The ABS-CBN Data Analytics Team takes a deep dive into the numbers, two months into the new Marcos Administration.

1. Gross domestic product

Growth has been good. Gross domestic product, the go-to measure for economic activity around the world, looks good in the Philippines.

President Ferdinand Marcos Jr declared during his first State of the Nation Address that the state of the nation is sound. While some indicators show that the economy is looking sound, there are also some causes for concern.

The ABS-CBN Data Analytics Team takes a deep dive into the numbers, two months into the new Marcos Administration.

1. Gross domestic product

Growth has been good. Gross domestic product, the go-to measure for economic activity around the world, looks good in the Philippines.

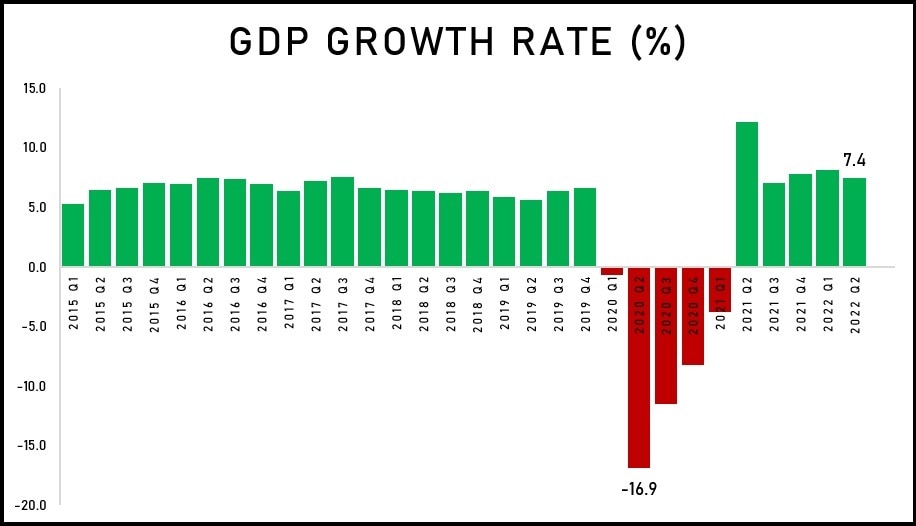

After five consecutive quarters of economic contraction due to the COVID-19 pandemic, the Philippine economy has grown by at least 7 percent for five consecutive quarters. With a 7.8 percent GDP growth in the first half of 2022, the country is still on pace to meet its growth target of 6.5 to 7.5 percent this year.

After five consecutive quarters of economic contraction due to the COVID-19 pandemic, the Philippine economy has grown by at least 7 percent for five consecutive quarters. With a 7.8 percent GDP growth in the first half of 2022, the country is still on pace to meet its growth target of 6.5 to 7.5 percent this year.

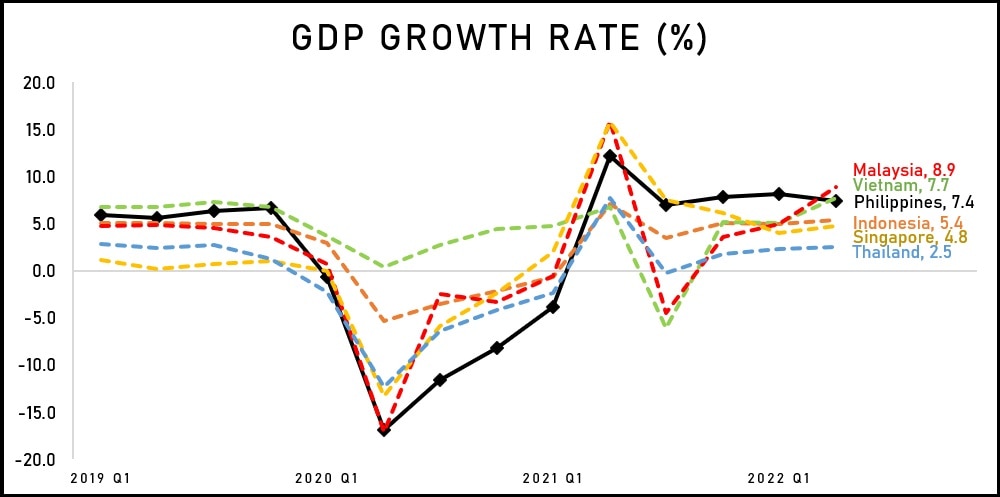

While the Philippine economy has yet to recover its pre-pandemic trajectory, it has at least grown larger than pre-pandemic levels in 2019. Even with base effects, that is still an impressive achievement. After all, the Philippines has rebounded from one of the deepest recessions among major ASEAN countries during the pandemic and is now one of the fastest growing so far in 2022.

While the Philippine economy has yet to recover its pre-pandemic trajectory, it has at least grown larger than pre-pandemic levels in 2019. Even with base effects, that is still an impressive achievement. After all, the Philippines has rebounded from one of the deepest recessions among major ASEAN countries during the pandemic and is now one of the fastest growing so far in 2022.

However, the 7.4 percent economic growth in the second quarter of the year was lower than expected. This was partly attributed to inflation.

2. Inflation

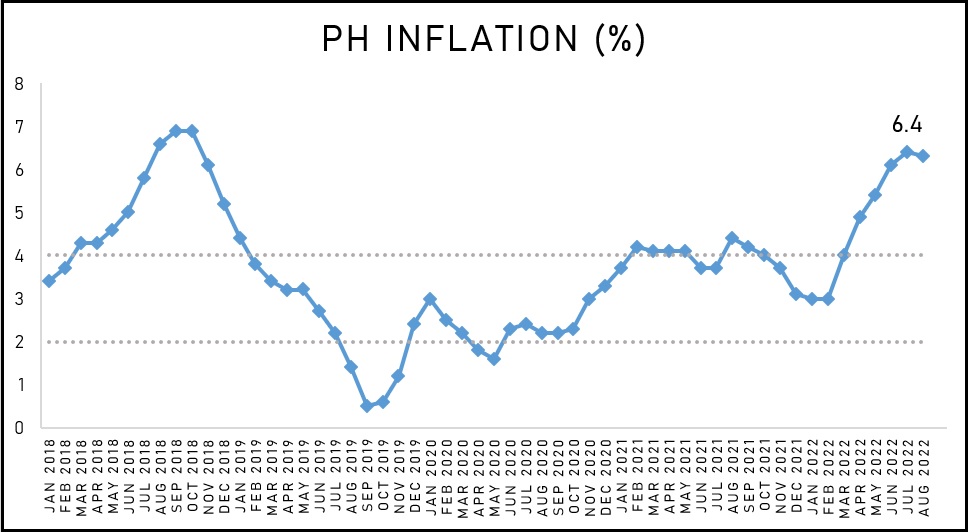

Inflation has been painful around the world this 2022. The Philippines has been no different. In July, Philippine inflation hit its highest level since 2018, when supply issues were bringing pain down on Filipino consumers.

However, the 7.4 percent economic growth in the second quarter of the year was lower than expected. This was partly attributed to inflation.

2. Inflation

Inflation has been painful around the world this 2022. The Philippines has been no different. In July, Philippine inflation hit its highest level since 2018, when supply issues were bringing pain down on Filipino consumers.

ADVERTISEMENT

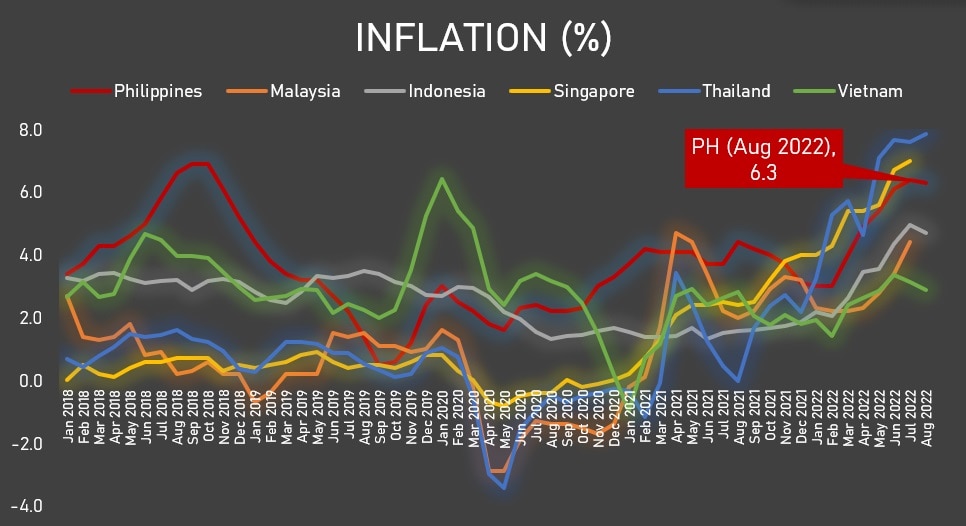

But relative to other nations in the region, Philippine inflation is actually lower than that of Thailand and Singapore.

But relative to other nations in the region, Philippine inflation is actually lower than that of Thailand and Singapore.

The inflation rate however could get worse due to the next data point.

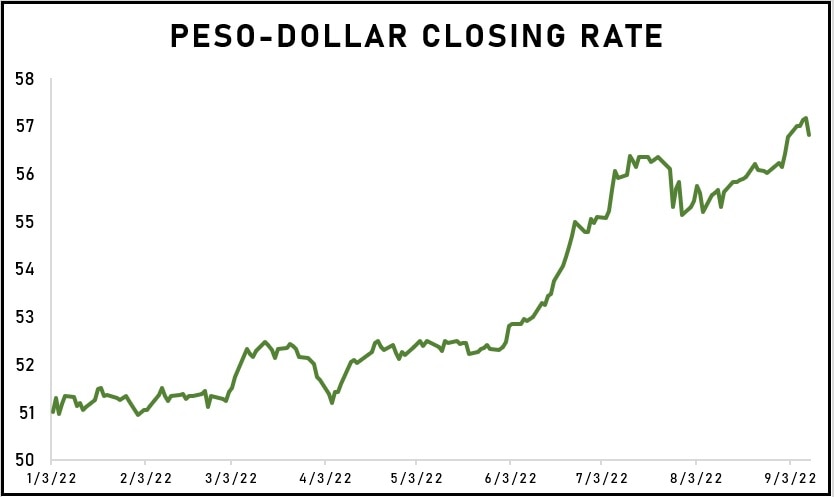

3. Peso-dollar exchange rate

From P51 to a dollar to start 2022, the Philippine peso breached P57 to a dollar in September, hitting an all-time low in foreign exchange markets. The US dollar has been appreciating against all currencies, not just the Philippine peso, but this is still painful. The Philippines is now draining its gross international reserves to pay for imports that were already costly before the peso’s slump.

The inflation rate however could get worse due to the next data point.

3. Peso-dollar exchange rate

From P51 to a dollar to start 2022, the Philippine peso breached P57 to a dollar in September, hitting an all-time low in foreign exchange markets. The US dollar has been appreciating against all currencies, not just the Philippine peso, but this is still painful. The Philippines is now draining its gross international reserves to pay for imports that were already costly before the peso’s slump.

The US dollar is expected to strengthen further as the US Federal Reserve signals more interest rate hikes as part of its own battle with domestic inflation. That will lead to more demand for the greenback, resulting in a weaker Philippine peso.

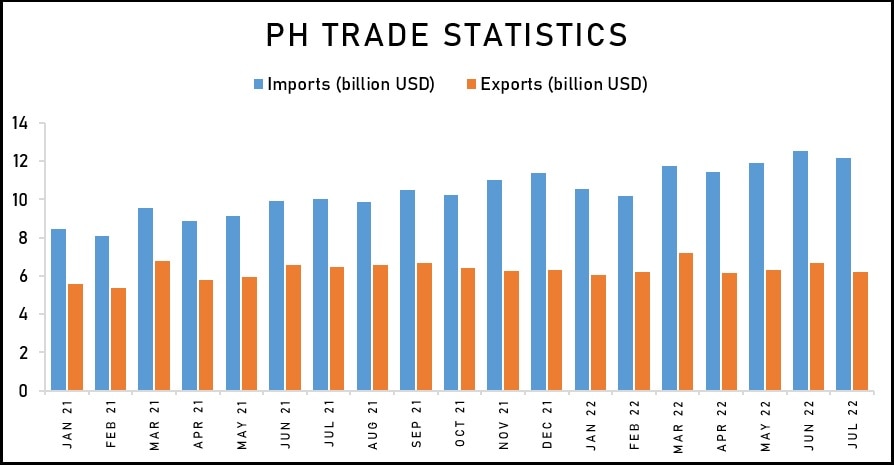

4. Trade

The weakening of the Philippine peso will only make the Philippine trade deficit grow faster. The trade deficit reached a record level of $5.93 billion in July as imports continued to grow at over 20 percent while exports contracted. Philippine exports simply can’t keep up due to the rising costs of inputs in key manufacturing sectors.

The US dollar is expected to strengthen further as the US Federal Reserve signals more interest rate hikes as part of its own battle with domestic inflation. That will lead to more demand for the greenback, resulting in a weaker Philippine peso.

4. Trade

The weakening of the Philippine peso will only make the Philippine trade deficit grow faster. The trade deficit reached a record level of $5.93 billion in July as imports continued to grow at over 20 percent while exports contracted. Philippine exports simply can’t keep up due to the rising costs of inputs in key manufacturing sectors.

This is a vicious cycle. More US dollars spent for imports will further weaken the Philippine peso, which in turn would lead to more pesos exchanged for US dollars to pay for imports, strengthening the greenback.

This is a vicious cycle. More US dollars spent for imports will further weaken the Philippine peso, which in turn would lead to more pesos exchanged for US dollars to pay for imports, strengthening the greenback.

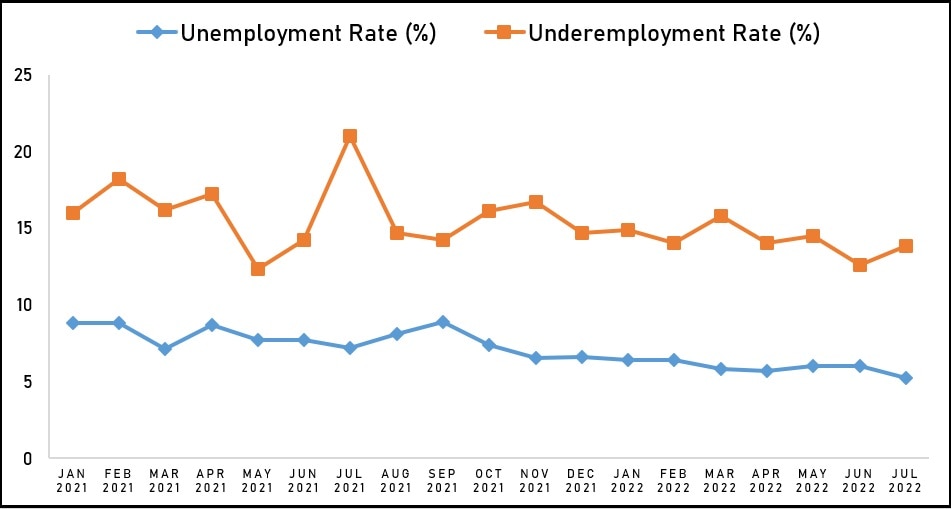

5. Jobs

Luckily, the reopening of the Philippine economy has led to the lowest unemployment rate since 2019. This means more Filipinos actually have incomes to help them cope with high inflation.

5. Jobs

Luckily, the reopening of the Philippine economy has led to the lowest unemployment rate since 2019. This means more Filipinos actually have incomes to help them cope with high inflation.

ADVERTISEMENT

However, underemployment is still on the rise because more employees feel their pay is inadequate.

However, underemployment is still on the rise because more employees feel their pay is inadequate.

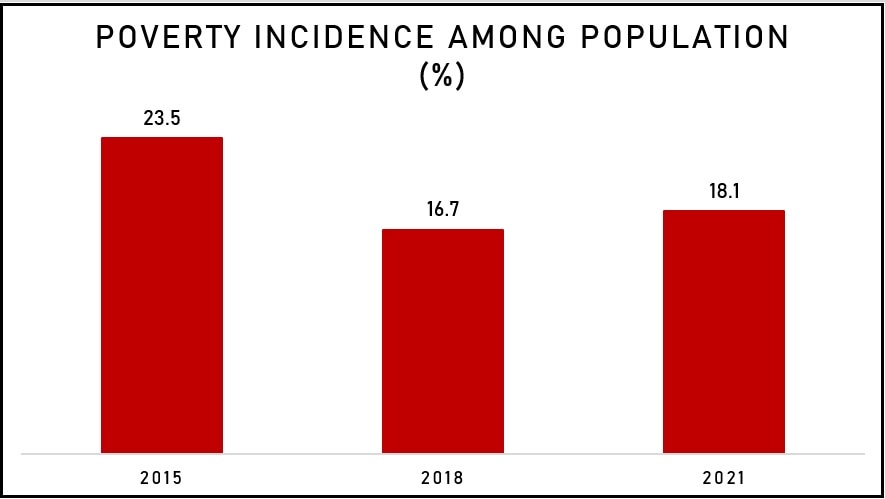

6. Poverty rate

Lowering unemployment is a fundamental step in the fight against poverty. The 2021 poverty incidence among population, or the proportion of poor Filipinos whose per capita income is insufficient to meet their basic food and non-food needs, was estimated at 18.1 percent, higher than the 16.7 percent in 2018.

6. Poverty rate

Lowering unemployment is a fundamental step in the fight against poverty. The 2021 poverty incidence among population, or the proportion of poor Filipinos whose per capita income is insufficient to meet their basic food and non-food needs, was estimated at 18.1 percent, higher than the 16.7 percent in 2018.

This translates to 19.99 million poor Filipinos. The reopened economy is generating new jobs for more Filipinos, giving them a chance to dig themselves out of the poverty hole.

This translates to 19.99 million poor Filipinos. The reopened economy is generating new jobs for more Filipinos, giving them a chance to dig themselves out of the poverty hole.

The Marcos Administration’s target is to reduce the poverty rate to 9 percent by the end of the president’s term in 2028. It will need to improve the quality of jobs to achieve this. That means both the unemployment rate and the underemployment rate need to go down together.

The Marcos Administration’s target is to reduce the poverty rate to 9 percent by the end of the president’s term in 2028. It will need to improve the quality of jobs to achieve this. That means both the unemployment rate and the underemployment rate need to go down together.

Part of the government’s program to make this happen includes strong support for the farm sector. The idea is to create more and better jobs in the countryside, while producing more food to bring down inflation. Reskilling and upskilling the workforce so they can find better paying jobs in sectors like IT and BPO are also part of the plan.

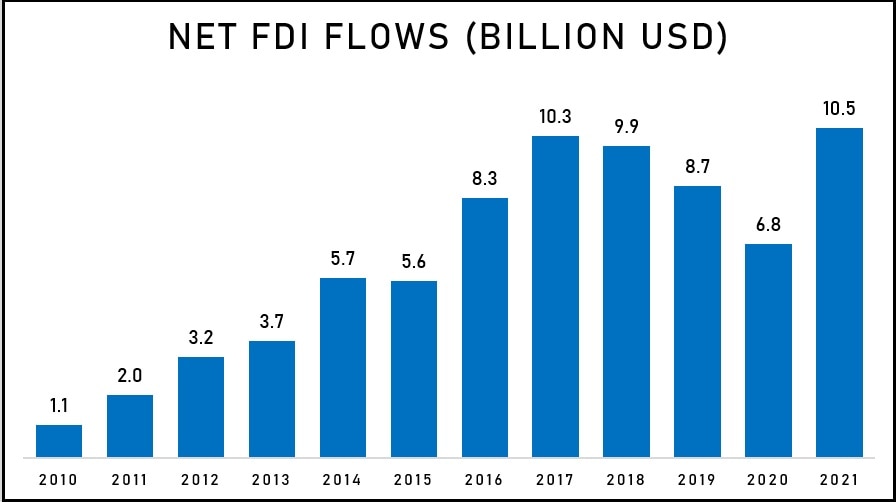

7. Foreign direct investments

To create jobs in farming, IT-BPO, and other industries, the Philippines is going to need a lot of investments. The good news is Net Foreign Direct Investment inflows reached a record high of $10.5 billion in 2021, surpassing the previous high of $10.3 billion in 2017.

Part of the government’s program to make this happen includes strong support for the farm sector. The idea is to create more and better jobs in the countryside, while producing more food to bring down inflation. Reskilling and upskilling the workforce so they can find better paying jobs in sectors like IT and BPO are also part of the plan.

7. Foreign direct investments

To create jobs in farming, IT-BPO, and other industries, the Philippines is going to need a lot of investments. The good news is Net Foreign Direct Investment inflows reached a record high of $10.5 billion in 2021, surpassing the previous high of $10.3 billion in 2017.

ADVERTISEMENT

In the first half of 2022, there was a 3.1 percent increase in net FDI inflows to $4.64 billion from $4.50 billion in the same period last year. Hopefully, more investments flow in following Marcos' visits to Indonesia and Singapore.

Recent reforms aimed at continuing this FDI winning streak include economic liberalization measures to allow more foreign investment in key sectors.

Other sweeteners include pledges to spend more on infrastructure improvements, both brick and mortar and digital. Finance Secretary Benjamin Diokno says they will welcome help from the private sector in these endeavors through Public-Private Partnerships.

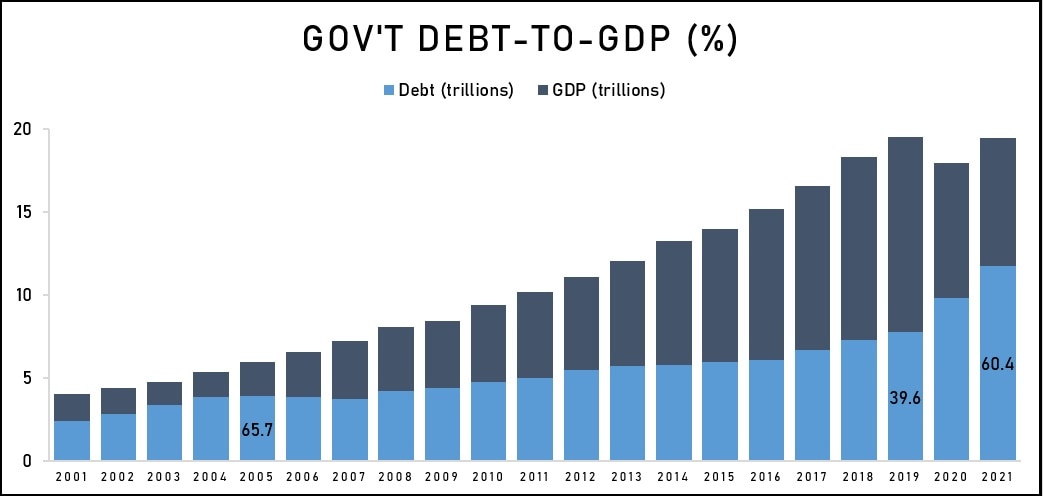

8. Ballooning debt

Private sector help will definitely be needed as the Philippines’ financing options are limited. Philippine debt grew to P11.73 trillion in 2021 from P9.80 trillion in 2020. This accounts for 60.5 percent of the country's GDP, the highest share to GDP since 2005. The globally accepted standard for a manageable debt-to-GDP ratio is 60 percent. The latest data show Philippine debt increased further to P12.89 trillion as of July 2022.

In the first half of 2022, there was a 3.1 percent increase in net FDI inflows to $4.64 billion from $4.50 billion in the same period last year. Hopefully, more investments flow in following Marcos' visits to Indonesia and Singapore.

Recent reforms aimed at continuing this FDI winning streak include economic liberalization measures to allow more foreign investment in key sectors.

Other sweeteners include pledges to spend more on infrastructure improvements, both brick and mortar and digital. Finance Secretary Benjamin Diokno says they will welcome help from the private sector in these endeavors through Public-Private Partnerships.

8. Ballooning debt

Private sector help will definitely be needed as the Philippines’ financing options are limited. Philippine debt grew to P11.73 trillion in 2021 from P9.80 trillion in 2020. This accounts for 60.5 percent of the country's GDP, the highest share to GDP since 2005. The globally accepted standard for a manageable debt-to-GDP ratio is 60 percent. The latest data show Philippine debt increased further to P12.89 trillion as of July 2022.

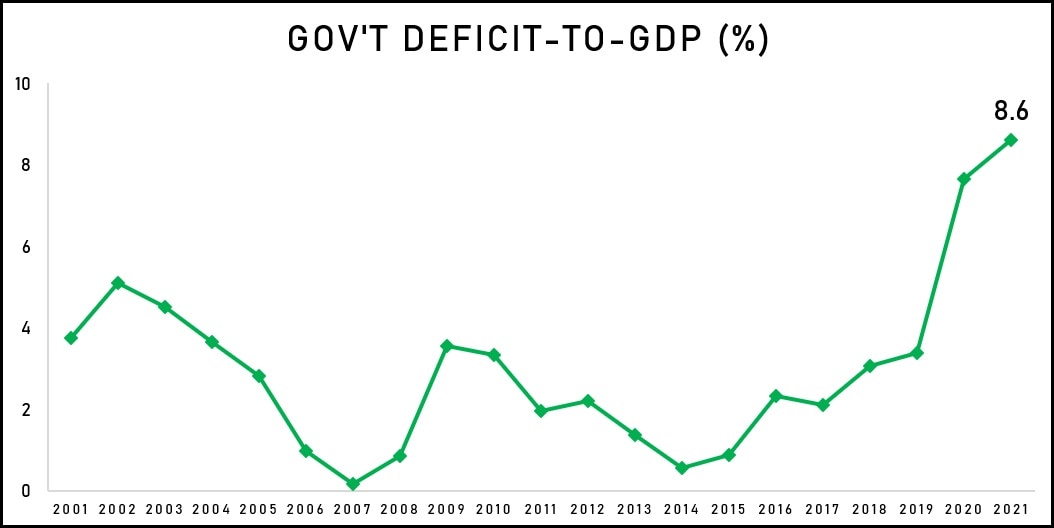

9. Record budget deficit

The Philippines is also dealing with a record budget deficit. From a budget deficit equivalent to 3.4 percent of GDP in 2019, this widened to 7.6 percent in 2020 and further to a record 8.6 percent in 2021 as the government continued to spend more while revenue collections suffered due to the pandemic. Note that the budget deficit was below 3 percent annually from 2011 to 2017.

9. Record budget deficit

The Philippines is also dealing with a record budget deficit. From a budget deficit equivalent to 3.4 percent of GDP in 2019, this widened to 7.6 percent in 2020 and further to a record 8.6 percent in 2021 as the government continued to spend more while revenue collections suffered due to the pandemic. Note that the budget deficit was below 3 percent annually from 2011 to 2017.

The Marcos Administration’s target is to trim the deficit-to-GDP ratio to the pre-pandemic level of 3 percent by 2028. It will need more economic activity to generate tax revenues for this to happen.

The Philippine economy has some momentum with Foreign Direct Investment pouring in, brightening prospects for even faster economic growth and better employment metrics. However, there are also problems bubbling up, with the weak Philippine peso and elevated inflation threatening Filipino families across the archipelago.

The Marcos Administration’s target is to trim the deficit-to-GDP ratio to the pre-pandemic level of 3 percent by 2028. It will need more economic activity to generate tax revenues for this to happen.

The Philippine economy has some momentum with Foreign Direct Investment pouring in, brightening prospects for even faster economic growth and better employment metrics. However, there are also problems bubbling up, with the weak Philippine peso and elevated inflation threatening Filipino families across the archipelago.

The Marcos administration can make things happen if it can deliver on its promise to boost both food security and employment through a stronger farm sector. But it will have to find a way to do so while dealing with surging input costs and carrying a record budget deficit along with significant amounts of debt.

Sources of raw data: Philippine Statistics Authority, Bangko Sentral ng Pilipinas, Bureau of the Treasury, Bankers Association of the Philippines

RELATED VIDEO

The Marcos administration can make things happen if it can deliver on its promise to boost both food security and employment through a stronger farm sector. But it will have to find a way to do so while dealing with surging input costs and carrying a record budget deficit along with significant amounts of debt.

Sources of raw data: Philippine Statistics Authority, Bangko Sentral ng Pilipinas, Bureau of the Treasury, Bankers Association of the Philippines

RELATED VIDEO

ADVERTISEMENT

ADVERTISEMENT