Tax digital services? That's part of business, says DTI chief | ABS-CBN

ADVERTISEMENT

Welcome, Kapamilya! We use cookies to improve your browsing experience. Continuing to use this site means you agree to our use of cookies. Tell me more!

Tax digital services? That's part of business, says DTI chief

Tax digital services? That's part of business, says DTI chief

Arianne Merez,

ABS-CBN News

Published Jul 31, 2020 02:51 PM PHT

|

Updated Jul 31, 2020 02:52 PM PHT

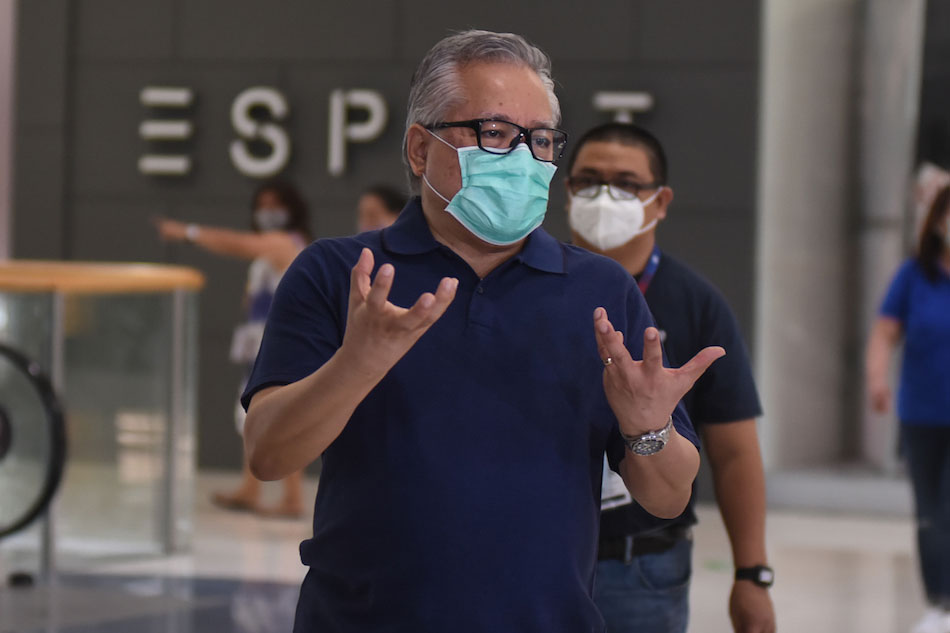

MANILA -- Paying taxes is part of doing business--even if its online, Trade Secretary Ramon Lopez said Friday after a legislative panel approved a bill that seeks to impose tariffs on digital transactions.

MANILA -- Paying taxes is part of doing business--even if its online, Trade Secretary Ramon Lopez said Friday after a legislative panel approved a bill that seeks to impose tariffs on digital transactions.

All businesses in the Philippines should be registered with the government and are subject to taxation, Lopez said as Congress seeks to charge online transactions of Filipinos.

All businesses in the Philippines should be registered with the government and are subject to taxation, Lopez said as Congress seeks to charge online transactions of Filipinos.

"Talaga hong dapat naman ay magbayad ng tax, dahil this is our responsibility sa ating lipunan at kailangan ay mayroon pong bahagi parati ang pagbubuwis sa atin pong mga ginagawa, basta ho negosyo," Lopez said in a virtual press briefing.

"Talaga hong dapat naman ay magbayad ng tax, dahil this is our responsibility sa ating lipunan at kailangan ay mayroon pong bahagi parati ang pagbubuwis sa atin pong mga ginagawa, basta ho negosyo," Lopez said in a virtual press briefing.

(We should really pay taxes because this is our responsibility to society and taxation is part of any business activity.)

(We should really pay taxes because this is our responsibility to society and taxation is part of any business activity.)

ADVERTISEMENT

"Kahit po ito online or kahit hindi online...Ito po ay kailangan ma-register at ito po ay subject to tax," he added.

"Kahit po ito online or kahit hindi online...Ito po ay kailangan ma-register at ito po ay subject to tax," he added.

(Even if it's online or not, it should be registered and is subject to tax.)

(Even if it's online or not, it should be registered and is subject to tax.)

A 12 percent value-added tax on digital services, including non-resident or foreign service providers, could generate P10.66 billion in revenues once enacted into law, economist Albay Rep. Joey Salceda said.

A 12 percent value-added tax on digital services, including non-resident or foreign service providers, could generate P10.66 billion in revenues once enacted into law, economist Albay Rep. Joey Salceda said.

Finance Secretary Carlos Dominguez III earlier said tax for digital services such as e-commerce and video streaming platforms is "critical" as consumption turns digital in the new normal following the devastating coronavirus pandemic.

Finance Secretary Carlos Dominguez III earlier said tax for digital services such as e-commerce and video streaming platforms is "critical" as consumption turns digital in the new normal following the devastating coronavirus pandemic.

ADVERTISEMENT

ADVERTISEMENT