ABS-CBN pays proper taxes, has no tax liability: CFO | ABS-CBN

Welcome, Kapamilya! We use cookies to improve your browsing experience. Continuing to use this site means you agree to our use of cookies. Tell me more!

ABS-CBN pays proper taxes, has no tax liability: CFO

ABS-CBN pays proper taxes, has no tax liability: CFO

Art Fuentes,

ABS-CBN News

Published Jul 01, 2020 01:24 AM PHT

MANILA - ABS-CBN has been paying the proper taxes and has no tax liability with the Bureau of Internal Revenue (BIR), a company official testified during Tuesday’s congressional hearing on the network’s broadcast franchise application.

MANILA - ABS-CBN has been paying the proper taxes and has no tax liability with the Bureau of Internal Revenue (BIR), a company official testified during Tuesday’s congressional hearing on the network’s broadcast franchise application.

Ricardo Tan, Group Chief Financial Officer of ABS-CBN, belied allegations that the company paid zero taxes in 2018, violated its franchise by availing of tax incentives, and that its charitable arm is being used as a tax shield.

Ricardo Tan, Group Chief Financial Officer of ABS-CBN, belied allegations that the company paid zero taxes in 2018, violated its franchise by availing of tax incentives, and that its charitable arm is being used as a tax shield.

Tan also said that a compromise agreement between ABS-CBN and the BIR was legal, and that it was the company that filed a petition with the Court of Tax Appeals which led to the compromise deal.

Tan also said that a compromise agreement between ABS-CBN and the BIR was legal, and that it was the company that filed a petition with the Court of Tax Appeals which led to the compromise deal.

‘NEGATIVE TAX RATE’ IN 2018

Allegations recently surfaced that ABS-CBN Corp had a negative 5 percent effective tax rate or negative P85 million in taxes in 2018, Tan said. This meant that the company paid zero taxes that year.

Allegations recently surfaced that ABS-CBN Corp had a negative 5 percent effective tax rate or negative P85 million in taxes in 2018, Tan said. This meant that the company paid zero taxes that year.

ADVERTISEMENT

“This is not true,” Tan said.

“This is not true,” Tan said.

He explained that in 2018, ABS-CBN as a group paid P5.2 billion in various taxes, P465 million of which was income tax.

He explained that in 2018, ABS-CBN as a group paid P5.2 billion in various taxes, P465 million of which was income tax.

“The BIR even issued a tax clearance to ABS-CBN for 2018,” he added.

“The BIR even issued a tax clearance to ABS-CBN for 2018,” he added.

The negative 5 percent or P85 million which appeared in the company’s financial statements was incorrectly interpreted as the income taxes that were due for 2018. The actual income tax paid by ABS-CBN, excluding its subsidiaries, was P164 million as shown in the company’s 2018 income tax return.

The negative 5 percent or P85 million which appeared in the company’s financial statements was incorrectly interpreted as the income taxes that were due for 2018. The actual income tax paid by ABS-CBN, excluding its subsidiaries, was P164 million as shown in the company’s 2018 income tax return.

He said the negative tax rate was due to an accounting recognition of deferred tax benefit, which was only for accounting purposes and does not affect or reduce the income tax.

He said the negative tax rate was due to an accounting recognition of deferred tax benefit, which was only for accounting purposes and does not affect or reduce the income tax.

BIG DIPPER TAX AVOIDANCE

Tan also belied allegations that ABS-CBN violated its franchise by registering its subsidiary Big Dipper with the Philippine Economic Zone Authority (PEZA) to avoid paying taxes.

Tan also belied allegations that ABS-CBN violated its franchise by registering its subsidiary Big Dipper with the Philippine Economic Zone Authority (PEZA) to avoid paying taxes.

He said that Big Dipper, which processes ABS-CBN content for distribution to other countries and content platforms, availed of tax incentives offered by the government in accordance with its Investment Priorities Plan in 2009.

He said that Big Dipper has invested over P700 million in equipment, which would exceed P1 billion by the end of 2020. The ABS-CBN subsidiary has also generated over $237 million in foreign exchange inflows, created jobs, and helped bring Filipino content to a global audience, Tan added.

He said that Big Dipper, which processes ABS-CBN content for distribution to other countries and content platforms, availed of tax incentives offered by the government in accordance with its Investment Priorities Plan in 2009.

He said that Big Dipper has invested over P700 million in equipment, which would exceed P1 billion by the end of 2020. The ABS-CBN subsidiary has also generated over $237 million in foreign exchange inflows, created jobs, and helped bring Filipino content to a global audience, Tan added.

“The opportunity to avail of tax incentives is open to all companies willing to shoulder the investment and financial risk and comply with the government requirements, and not just to Big Dipper.”

“The opportunity to avail of tax incentives is open to all companies willing to shoulder the investment and financial risk and comply with the government requirements, and not just to Big Dipper.”

COMPROMISE AGREEMENT

Tan also belied allegations that ABS-CBN did not pay proper taxes in 2019 by entering into compromise agreements with the BIR. He also dismissed accusations that the company had to be compelled by the BIR to pay proper taxes after the bureau filed cases against it with the Court of Tax Appeals.

Tan also belied allegations that ABS-CBN did not pay proper taxes in 2019 by entering into compromise agreements with the BIR. He also dismissed accusations that the company had to be compelled by the BIR to pay proper taxes after the bureau filed cases against it with the Court of Tax Appeals.

“It is incorrect to state that the BIR lodged cases against ABS-CBN with the Court of Tax Appeals. It was ABS-CBN which filed a petition with the Court of Tax Appeals as is the right of every taxpayer and not just ABS-CBN,” Tan said.

“It is incorrect to state that the BIR lodged cases against ABS-CBN with the Court of Tax Appeals. It was ABS-CBN which filed a petition with the Court of Tax Appeals as is the right of every taxpayer and not just ABS-CBN,” Tan said.

He said ABS-CBN complied with BIR processes for the compromise agreements and paid the agreed taxes.

He said ABS-CBN complied with BIR processes for the compromise agreements and paid the agreed taxes.

“The fact that these taxes were approved by the court validates the legality of these agreements. It should be pointed out that there were no issues of fraud in the disputed assessments. Had there been such issues, these compromise agreements would not have qualified would not have been accepted and would not have been approved by the BIR under the conditions provided for by law,” Tan said.

“The fact that these taxes were approved by the court validates the legality of these agreements. It should be pointed out that there were no issues of fraud in the disputed assessments. Had there been such issues, these compromise agreements would not have qualified would not have been accepted and would not have been approved by the BIR under the conditions provided for by law,” Tan said.

LINGKOD KAPAMILYA TAX SHIELD?

It is not true either that ABS-CBN has been using its charitable foundation Lingkod Kapamilya as a tax shield, and that the foundation has failed to file donor's tax returns and pay donor's tax, Tan said.

It is not true either that ABS-CBN has been using its charitable foundation Lingkod Kapamilya as a tax shield, and that the foundation has failed to file donor's tax returns and pay donor's tax, Tan said.

Lingkod Kapamilya is a non-stock, non-profit foundation whose tax exemption has been confirmed by the BIR, and is accredited by the Philippine Council for NGO Certification, Tan said.

Lingkod Kapamilya is a non-stock, non-profit foundation whose tax exemption has been confirmed by the BIR, and is accredited by the Philippine Council for NGO Certification, Tan said.

He added that the donations received by the Foundation are not subject to donor's tax.

He added that the donations received by the Foundation are not subject to donor's tax.

“Contrary to the allegation, it has not and has never been a tax shield.”

“Contrary to the allegation, it has not and has never been a tax shield.”

Last month, Congressman Rodante Marcoleta raised ABS-CBN’s alleged tax avoidance, claiming the network did not pay taxes in 2018, and the right amount the following year.

Last month, Congressman Rodante Marcoleta raised ABS-CBN’s alleged tax avoidance, claiming the network did not pay taxes in 2018, and the right amount the following year.

But Tan said this was not true.

But Tan said this was not true.

“To date, there have been many allegations that ABS-CBN has not paid its proper taxes, but there has been no evidence to that effect,” Tan said.

“To date, there have been many allegations that ABS-CBN has not paid its proper taxes, but there has been no evidence to that effect,” Tan said.

news.abs-cbn.com is the general news website of ABS-CBN Corp.

Read More:

ABS-CBN franchise renewal

ABS-CBN Congressional hearing

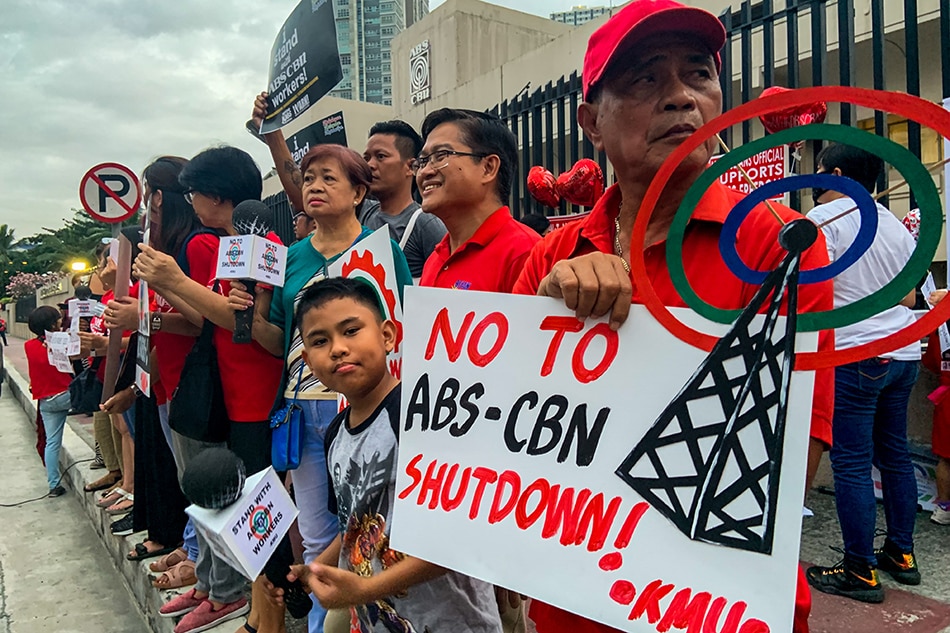

ABS-CBN shutdown

Ricardo Tan

tax liability issue

BIR

ABS-CBN Franchise

Court of Tax Appeals

tax compromise agreement

ABS-CBN taxes

ADVERTISEMENT

ADVERTISEMENT