Aboitiz Power's Japanese partner JERA pioneers new decarbonization tech using ammonia, hydrogen | ABS-CBN

ADVERTISEMENT

Welcome, Kapamilya! We use cookies to improve your browsing experience. Continuing to use this site means you agree to our use of cookies. Tell me more!

Aboitiz Power's Japanese partner JERA pioneers new decarbonization tech using ammonia, hydrogen

Aboitiz Power's Japanese partner JERA pioneers new decarbonization tech using ammonia, hydrogen

Michelle Ong,

ABS-CBN News

Published Jun 22, 2023 10:05 AM PHT

|

Updated Jun 22, 2023 10:14 AM PHT

TOKYO — Aboitiz Power's Japanese partner JERA said achieving net zero emission could be possible through a combination of renewables and decarbonization strategies.

TOKYO — Aboitiz Power's Japanese partner JERA said achieving net zero emission could be possible through a combination of renewables and decarbonization strategies.

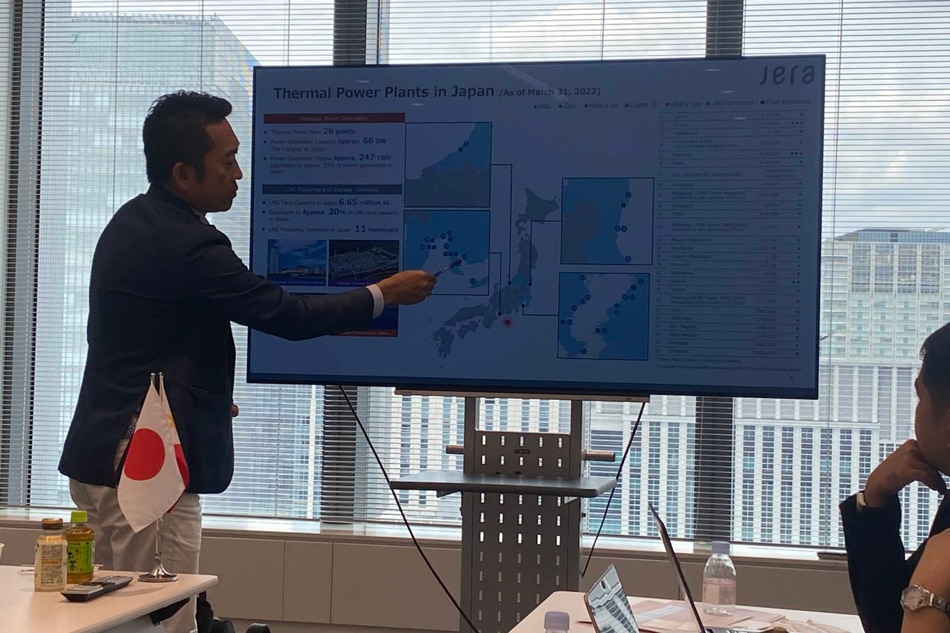

JERA, Japan's largest power generation company, bought a 27 percent stake in Aboitiz Power (AP) in 2020.

JERA, Japan's largest power generation company, bought a 27 percent stake in Aboitiz Power (AP) in 2020.

“We think, maybe net zero emissions combination makes better sense....Instead of solely relying on RE and battery, we believe in utilizing existing power plant assets and use co-firing or 100 percent firing of ammonia and hydrogen makes better economic sense in the case of Japan, I assume the same will apply to market of the Philippines as well. We need to further study. Same concept," said JERA’s head of Asia platform business Shinsuke Nakayama.

“We think, maybe net zero emissions combination makes better sense....Instead of solely relying on RE and battery, we believe in utilizing existing power plant assets and use co-firing or 100 percent firing of ammonia and hydrogen makes better economic sense in the case of Japan, I assume the same will apply to market of the Philippines as well. We need to further study. Same concept," said JERA’s head of Asia platform business Shinsuke Nakayama.

The technology means using existing coal power plants, but instead of fossil fuel, they will be powered by so-called transition fuel like ammonia (NH3) and hydrogen. Scientifically, it’s the hydrogen element that is critical to firing plants, the company said.

The technology means using existing coal power plants, but instead of fossil fuel, they will be powered by so-called transition fuel like ammonia (NH3) and hydrogen. Scientifically, it’s the hydrogen element that is critical to firing plants, the company said.

ADVERTISEMENT

Instead of using 100 percent fossil fuel, they will "co-fire," starting with 20 percent ammonia plus 80 percent fossil fuel mix, then graduate to 50 percent ammonia and 50 percent fossil fuel until they hit 100 percent firing. A hundred percent means zero carbon emissions, JERA said.

Instead of using 100 percent fossil fuel, they will "co-fire," starting with 20 percent ammonia plus 80 percent fossil fuel mix, then graduate to 50 percent ammonia and 50 percent fossil fuel until they hit 100 percent firing. A hundred percent means zero carbon emissions, JERA said.

This ammonia and hydrogen co-firing technology is being pioneered by JERA, which over 50 years ago also pioneered liquefied natural gas (LNG).

This ammonia and hydrogen co-firing technology is being pioneered by JERA, which over 50 years ago also pioneered liquefied natural gas (LNG).

Japan’s current energy mix is composed of 72 percent fossil fuel, 18 percent renewables and 6 percent nuclear.

Japan’s current energy mix is composed of 72 percent fossil fuel, 18 percent renewables and 6 percent nuclear.

The goal is by 2050, renewable energy will comprise 50 to 60 percent of the mix, fossil fuel with carbon capture technology and nuclear at 30 to 40 percent, and 10 to 20 percent on transition using hydrogen and ammonia firing technology.

The goal is by 2050, renewable energy will comprise 50 to 60 percent of the mix, fossil fuel with carbon capture technology and nuclear at 30 to 40 percent, and 10 to 20 percent on transition using hydrogen and ammonia firing technology.

JERA is testing the co-firing strategy this year.

JERA is testing the co-firing strategy this year.

And because JERA is now a shareholder of Aboitiz Power, the Cebu-based tech conglomerate will have first dibs on this technology if it succeeds.

And because JERA is now a shareholder of Aboitiz Power, the Cebu-based tech conglomerate will have first dibs on this technology if it succeeds.

AP’s Thermal Group COO Lino Bernardo said a feasibility study was looking into the technology and supply chain requirements.

AP’s Thermal Group COO Lino Bernardo said a feasibility study was looking into the technology and supply chain requirements.

“Were looking at having that study start next year, 2024 — and assuming everything goes well, our aim is to get it within the decade. If JERA can already test, our next test is 20-50 percent by 2030, hopefully by that time, prices have gone down, thats the time we can do our own 20-30 percent test hopefully in one of or facilities,” he said.

“Were looking at having that study start next year, 2024 — and assuming everything goes well, our aim is to get it within the decade. If JERA can already test, our next test is 20-50 percent by 2030, hopefully by that time, prices have gone down, thats the time we can do our own 20-30 percent test hopefully in one of or facilities,” he said.

Both parties however admitted it would take time before the ammonia supply could catch up and costs come down.

Both parties however admitted it would take time before the ammonia supply could catch up and costs come down.

JERA data showed that the cost of ammonia before processing was averaging between $200 to 400 per ton before the Ukraine invasion. Today its price fluctuates wildly. This is at least double the price of coal which is at around $100 per ton.

JERA data showed that the cost of ammonia before processing was averaging between $200 to 400 per ton before the Ukraine invasion. Today its price fluctuates wildly. This is at least double the price of coal which is at around $100 per ton.

There is also limited supply and in Japan’s case, ammonia is mostly used for agriculture purposes. The whole agriculture industry in Japan consumes around 1 million tons of ammonia per year. Meanwhile, at 20 percent co-firing, in just one power plant by JERA, will require 0.5-million tons.

There is also limited supply and in Japan’s case, ammonia is mostly used for agriculture purposes. The whole agriculture industry in Japan consumes around 1 million tons of ammonia per year. Meanwhile, at 20 percent co-firing, in just one power plant by JERA, will require 0.5-million tons.

JERA said sourcing ammonia was a big challenge and it had to make sure it would not distort the market or cause an imbalance in the agriculture sector.

JERA said sourcing ammonia was a big challenge and it had to make sure it would not distort the market or cause an imbalance in the agriculture sector.

Ammonia also contains toxic material and strict handling will be critical.

Ammonia also contains toxic material and strict handling will be critical.

Some of the world’s biggest producers of ammonia include Norway, US, Australia, India and the Middle east.

Some of the world’s biggest producers of ammonia include Norway, US, Australia, India and the Middle east.

In the meantime, LNG is the short-term solution. This is the send pillar of cooperation between the two companies.

In the meantime, LNG is the short-term solution. This is the send pillar of cooperation between the two companies.

JERA sees big synergies with AP, which is looking to introduce liquefied natural gas into the Philippine market. The others include the operations and maintenance of power plants in the Philippines, and renewables, with JERA building capabilities in offshore wind.

JERA sees big synergies with AP, which is looking to introduce liquefied natural gas into the Philippine market. The others include the operations and maintenance of power plants in the Philippines, and renewables, with JERA building capabilities in offshore wind.

Aboitiz Power is targeting to have 50 percent of its power generation capacity by 2030. It currently has around 4,000 MW (total attributable net sellable capacity) with the goal to double that to 9200 MW by 2030.

Aboitiz Power is targeting to have 50 percent of its power generation capacity by 2030. It currently has around 4,000 MW (total attributable net sellable capacity) with the goal to double that to 9200 MW by 2030.

ADVERTISEMENT

ADVERTISEMENT