DOF pushing new taxes, wider VAT, halt to income-tax deductions to pay high debt | ABS-CBN

Welcome, Kapamilya! We use cookies to improve your browsing experience. Continuing to use this site means you agree to our use of cookies. Tell me more!

DOF pushing new taxes, wider VAT, halt to income-tax deductions to pay high debt

DOF pushing new taxes, wider VAT, halt to income-tax deductions to pay high debt

ABS-CBN News

Published May 25, 2022 02:22 PM PHT

|

Updated May 25, 2022 04:54 PM PHT

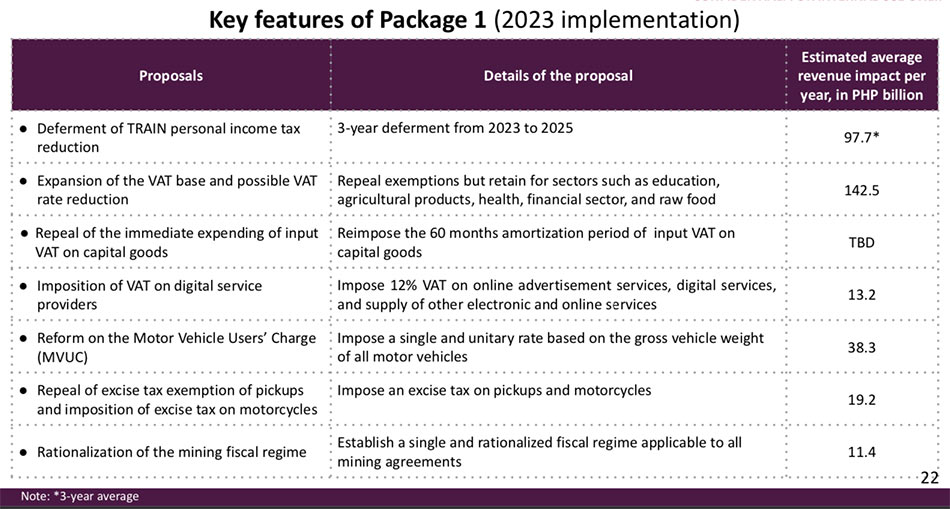

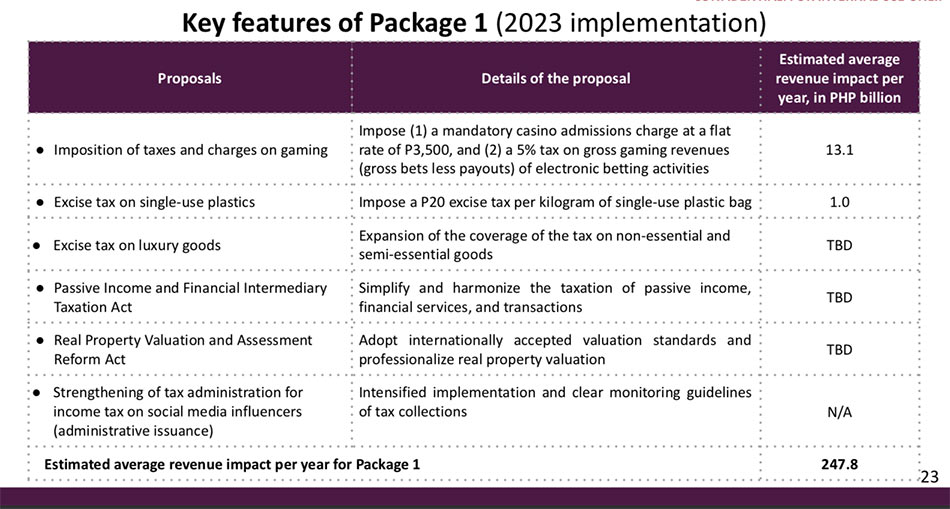

MANILA (UPDATE) - The Department of Finance (DOF) is proposing to raise new taxes, defer personal income tax reductions, and expand Value-Added Tax (VAT) coverage, among a slew of measures, to help pay the country’s ballooning debt.

MANILA (UPDATE) - The Department of Finance (DOF) is proposing to raise new taxes, defer personal income tax reductions, and expand Value-Added Tax (VAT) coverage, among a slew of measures, to help pay the country’s ballooning debt.

As the administration of President Rodrigo Duterte prepares to turn over the reins of government to presumptive President Ferdinand “Bongbong” Marcos Jr, the DOF said these new measures are “critical.”

As the administration of President Rodrigo Duterte prepares to turn over the reins of government to presumptive President Ferdinand “Bongbong” Marcos Jr, the DOF said these new measures are “critical.”

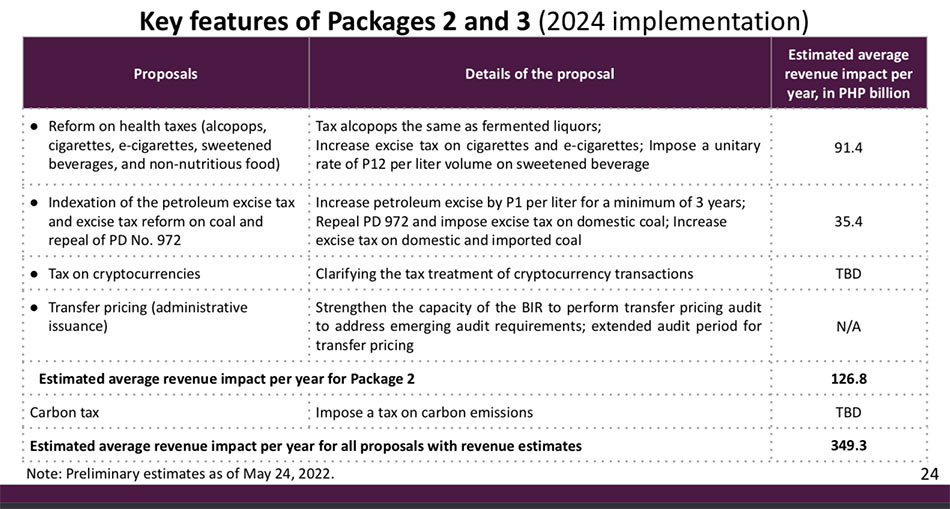

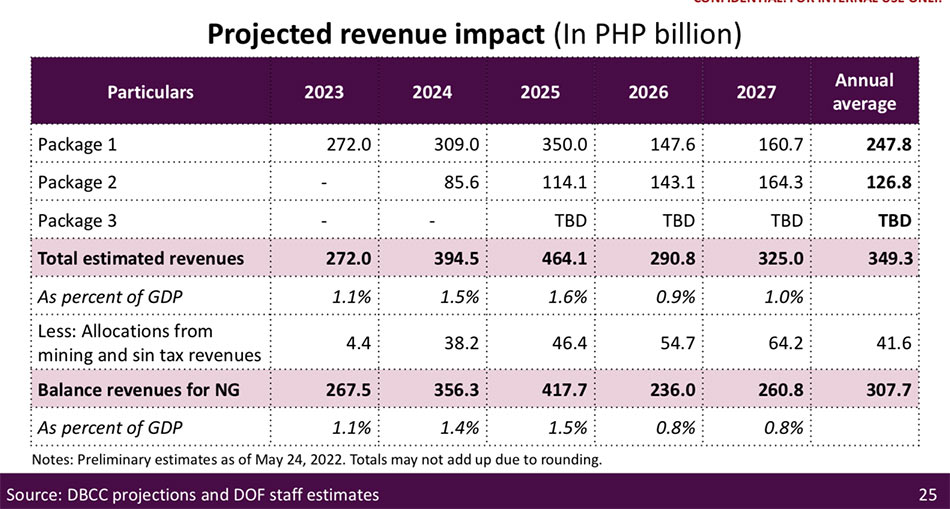

In its "Proposed fiscal consolidation and resource mobilization plan", the DOF said the new tax measures aim to generate an average of at least P349.3 billion in new revenues from 2023 to 2027.

In its "Proposed fiscal consolidation and resource mobilization plan", the DOF said the new tax measures aim to generate an average of at least P349.3 billion in new revenues from 2023 to 2027.

Marcos is set to take over a country whose sovereign debt hit a record P12.68 trillion in March.

Marcos is set to take over a country whose sovereign debt hit a record P12.68 trillion in March.

ADVERTISEMENT

The debt-to-GDP ratio meanwhile has risen to 63.5 percent, which is higher than the internationally prescribed best practice of 60 percent, the DOF noted.

The debt-to-GDP ratio meanwhile has risen to 63.5 percent, which is higher than the internationally prescribed best practice of 60 percent, the DOF noted.

The new measures--which include a carbon tax, taxes on motorcycles, single-use plastics, and cryptocurrencies--aim to to reverse in a span of 10 years the additional P3.2 trillion debt incurred by the government due to the COVID-19 pandemic, the DOF said.

The new measures--which include a carbon tax, taxes on motorcycles, single-use plastics, and cryptocurrencies--aim to to reverse in a span of 10 years the additional P3.2 trillion debt incurred by the government due to the COVID-19 pandemic, the DOF said.

“Pursuing the fiscal consolidation and resource mobilization program as proposed will help us continue to spend on socioeconomic programs, maintain our credit ratings, and grow out of our debt,” said Finance Secretary Carlos Dominguez III in a statement.

“Pursuing the fiscal consolidation and resource mobilization program as proposed will help us continue to spend on socioeconomic programs, maintain our credit ratings, and grow out of our debt,” said Finance Secretary Carlos Dominguez III in a statement.

He added that without these measures, the government may need to cut spending on socioeconomic programs or to finance debts by borrowing more.

He added that without these measures, the government may need to cut spending on socioeconomic programs or to finance debts by borrowing more.

Dominguez warned this could lead to “cascading effects on interest payments that could also ultimately force budget cuts and stifle economic growth.”

Dominguez warned this could lead to “cascading effects on interest payments that could also ultimately force budget cuts and stifle economic growth.”

ADVERTISEMENT

The COVID-19 pandemic has pushed the government to borrow an additional P3.2 trillion on top of its programmed P9.9 trillion. To pay this extra debt, the government needs to raise at least P249 billion every year in incremental revenues for the next 10 years, the DOF said, citing data from the Bureau of Treasury.

The COVID-19 pandemic has pushed the government to borrow an additional P3.2 trillion on top of its programmed P9.9 trillion. To pay this extra debt, the government needs to raise at least P249 billion every year in incremental revenues for the next 10 years, the DOF said, citing data from the Bureau of Treasury.

“The measures proposed by the DOF are estimated to yield an average of roughly P284 billion every year for the national government,” the DOF said.

“The measures proposed by the DOF are estimated to yield an average of roughly P284 billion every year for the national government,” the DOF said.

‘LIVE WITHIN YOUR MEANS’

Budget Secretary Tina Canda earlier said the incoming administration will need to live with a “tight” budget of around P5.268 trillion in 2023.

Budget Secretary Tina Canda earlier said the incoming administration will need to live with a “tight” budget of around P5.268 trillion in 2023.

Socioeconomic Planning Secretary Karl Chua also said the next administration needs to be prudent and “live within its means.”

Socioeconomic Planning Secretary Karl Chua also said the next administration needs to be prudent and “live within its means.”

“You don’t spend if you don’t have revenue, and if you spend, you do it in a targeted manner, and if you spend, you raise the revenue,” he said.

“You don’t spend if you don’t have revenue, and if you spend, you do it in a targeted manner, and if you spend, you raise the revenue,” he said.

ADVERTISEMENT

Prior to the DOF’s presentation of its fiscal consolidation program, Chua said he was not in favor of raising new taxes.

Prior to the DOF’s presentation of its fiscal consolidation program, Chua said he was not in favor of raising new taxes.

"Any tweaking of the present tax system is not our recommendation. They have proven to be effective, to bring down income taxes, for 99 percent of income tax payers, whether you are individual or corporate, and we have expanded the tax base to fund all the human capital and infrastructure programs that we are benefiting from. So we do not recommend at all changing the present tax system,” Chua said earlier.

ANTI-POOR, ANTI-MIDDLE CLASS?

"Any tweaking of the present tax system is not our recommendation. They have proven to be effective, to bring down income taxes, for 99 percent of income tax payers, whether you are individual or corporate, and we have expanded the tax base to fund all the human capital and infrastructure programs that we are benefiting from. So we do not recommend at all changing the present tax system,” Chua said earlier.

ANTI-POOR, ANTI-MIDDLE CLASS?

House Deputy Minority leader and Bayan Muna Rep. Carlos Isagani Zarate meanwhile criticized the DOF’s proposal as an added burden to the poor and the middle class.

House Deputy Minority leader and Bayan Muna Rep. Carlos Isagani Zarate meanwhile criticized the DOF’s proposal as an added burden to the poor and the middle class.

"Bakit ba ang target ng DOF ay palagi na lang ang mga mahihirap at ang middle class ang buwisan? Bakit hindi ang mga malalaking korporasyon at mga super yamang bilyonaryo?" Zarate said.

"Bakit ba ang target ng DOF ay palagi na lang ang mga mahihirap at ang middle class ang buwisan? Bakit hindi ang mga malalaking korporasyon at mga super yamang bilyonaryo?" Zarate said.

He said that instead of the proposed measures, which he called “very regressive and anti-poor”, the government should instead push for a tax on wealth.

He said that instead of the proposed measures, which he called “very regressive and anti-poor”, the government should instead push for a tax on wealth.

ADVERTISEMENT

"A wealth tax of 1 percent, for example, can be levied on every million earned by an individual, family of corporation owns or something to that effect. It can also vigorously go after the Philippine Offshore Gaming Operators (POGOs) and have them pay their billions worth of accrued taxes," said Zarate.

"A wealth tax of 1 percent, for example, can be levied on every million earned by an individual, family of corporation owns or something to that effect. It can also vigorously go after the Philippine Offshore Gaming Operators (POGOs) and have them pay their billions worth of accrued taxes," said Zarate.

The DOF meanwhile said it was ready to brief the incoming administration’s economic team on the details of its proposals.

The DOF meanwhile said it was ready to brief the incoming administration’s economic team on the details of its proposals.

"The next administration is coming in with a strong mandate. We are confident that the soon-to-be President will put it to good use by pursuing critical reforms such as this much-needed program," Dominguez said.

"The next administration is coming in with a strong mandate. We are confident that the soon-to-be President will put it to good use by pursuing critical reforms such as this much-needed program," Dominguez said.

-- With a report from Warren de Guzman, ABS-CBN News

RELATED VIDEO

RELATED VIDEO

Read More:

new taxes

personal income tax

TRAIN

VAT

debt

sovereign debt

national debt

Department of Finance

Finance Secretary Sonny Dominguez

Philippine economy

ADVERTISEMENT

ADVERTISEMENT