Bangko Sentral launches InstaPay instant fund transfer system | ABS-CBN

Welcome, Kapamilya! We use cookies to improve your browsing experience. Continuing to use this site means you agree to our use of cookies. Tell me more!

Bangko Sentral launches InstaPay instant fund transfer system

Bangko Sentral launches InstaPay instant fund transfer system

Michelle Ong,

ABS-CBN News

Published Apr 23, 2018 12:58 PM PHT

|

Updated Apr 23, 2018 04:13 PM PHT

MANILA - The Bangko Sentral ng Pilipinas on Monday launched InstaPay, an electronic fund transfer (EFT) system that allows immediate fund transfers in a bid to keep up with the changing times by trying to create a "cashless economy."

MANILA - The Bangko Sentral ng Pilipinas on Monday launched InstaPay, an electronic fund transfer (EFT) system that allows immediate fund transfers in a bid to keep up with the changing times by trying to create a "cashless economy."

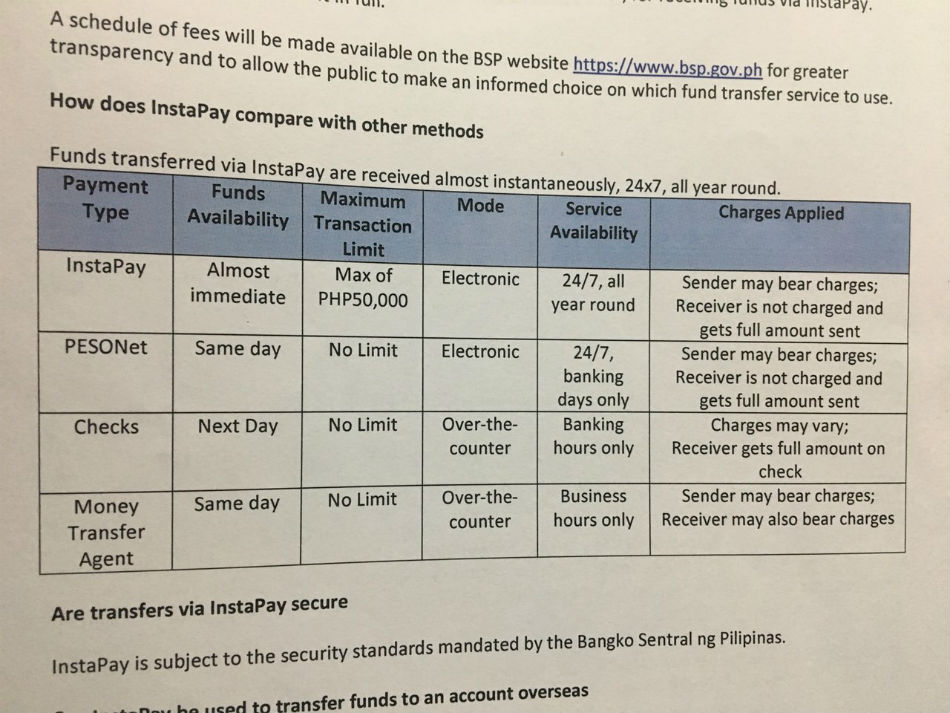

InstaPay, the second automatic payment service under the National Retail Payment System, allows almost immediate transfers and payments across participating institutions compared to more traditional over-the-counter services and money transfer agents, BSP Governor Nestor Espenilla said in a keynote speech.

InstaPay, the second automatic payment service under the National Retail Payment System, allows almost immediate transfers and payments across participating institutions compared to more traditional over-the-counter services and money transfer agents, BSP Governor Nestor Espenilla said in a keynote speech.

Unlike over the counter bank services, InstaPay is 24/7 banking with a P50,000 cash limit and same day fund availability, the BSP said.

Unlike over the counter bank services, InstaPay is 24/7 banking with a P50,000 cash limit and same day fund availability, the BSP said.

"Its launch and operation further improves the Philippines' retail payment system and moves us closer to creating a cashless economy, BSP Governor Nestor Espenilla said in a keynote speech.

"Its launch and operation further improves the Philippines' retail payment system and moves us closer to creating a cashless economy, BSP Governor Nestor Espenilla said in a keynote speech.

ADVERTISEMENT

"The digital transformation of financial services is happening now, the country's financial services industry needs to evolve to remain competitive and relevant," he added.

"The digital transformation of financial services is happening now, the country's financial services industry needs to evolve to remain competitive and relevant," he added.

InstaPay is integrated in the system of partner banks and non-bank partners making it easy for customers to avail. Transaction fees are dictated by competition, he said.

InstaPay is integrated in the system of partner banks and non-bank partners making it easy for customers to avail. Transaction fees are dictated by competition, he said.

Currently, there are 7 BSP-supervised institutions capable of sending and receiving EFTs including Asia United Bank, BDO Unibank, China Banking Corp, China Savings Bank, Equicom Savings Bank, Security Bank and Union Bank of the Philippines.

Currently, there are 7 BSP-supervised institutions capable of sending and receiving EFTs including Asia United Bank, BDO Unibank, China Banking Corp, China Savings Bank, Equicom Savings Bank, Security Bank and Union Bank of the Philippines.

Thirteen more institutions can already receive payments and several more are expected to be on-board by mid 2018, the BSP said.

Thirteen more institutions can already receive payments and several more are expected to be on-board by mid 2018, the BSP said.

Digitizing how cash moves is key since "cash is still king," said Philippine Payment Management Inc (position) Abraham Co.

Digitizing how cash moves is key since "cash is still king," said Philippine Payment Management Inc (position) Abraham Co.

"Cash is king right now, it is the most used, because it is most convenient, universally accepted," he said, adding a digital system could give the unbanked more chance to be a part of the banking community.

"Cash is king right now, it is the most used, because it is most convenient, universally accepted," he said, adding a digital system could give the unbanked more chance to be a part of the banking community.

ADVERTISEMENT

ADVERTISEMENT