Inflation slows for fifth straight month in March | ABS-CBN

ADVERTISEMENT

Welcome, Kapamilya! We use cookies to improve your browsing experience. Continuing to use this site means you agree to our use of cookies. Tell me more!

Inflation slows for fifth straight month in March

Inflation slows for fifth straight month in March

ABS-CBN News

Published Apr 05, 2019 09:08 AM PHT

|

Updated Apr 05, 2019 02:34 PM PHT

MANILA -- Inflation slowed for the fifth straight month in March, below analysts' forecasts as food prices eased, official data released Friday showed.

MANILA -- Inflation slowed for the fifth straight month in March, below analysts' forecasts as food prices eased, official data released Friday showed.

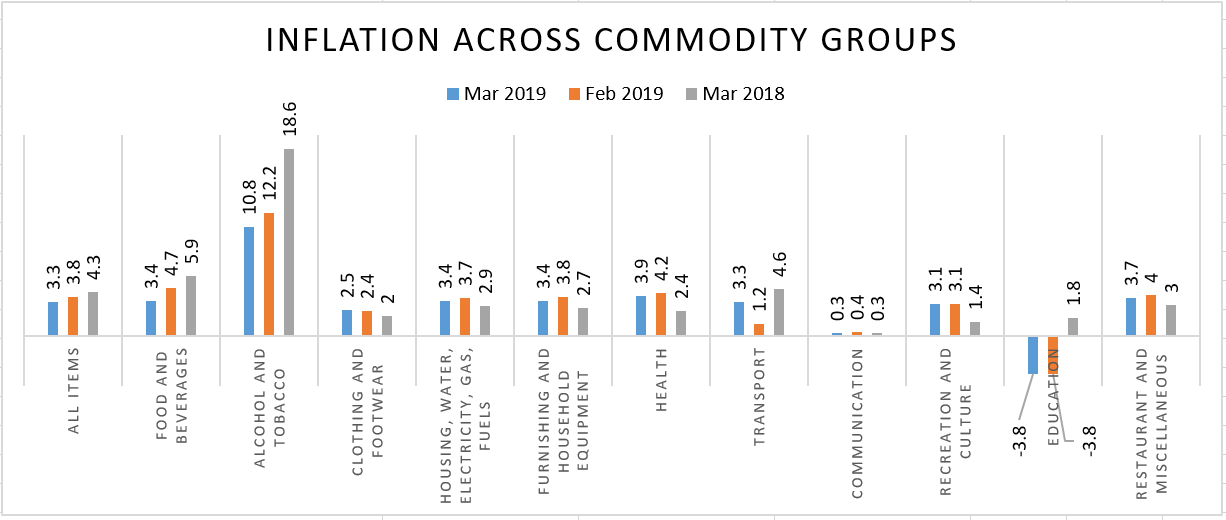

The consumer price index rose 3.3 in March from a year earlier, settling within the Bangko Sentral ng Pilipinas' 2 to 4 percent target for the second straight month. Analysts had predicted the CPI to rise by 3.5 percent.

The consumer price index rose 3.3 in March from a year earlier, settling within the Bangko Sentral ng Pilipinas' 2 to 4 percent target for the second straight month. Analysts had predicted the CPI to rise by 3.5 percent.

Food inflation was "in check" in March with rice prices "well-behaved" even before the implementation of a law that puts tariffs instead of quotas on rice imports, said ING Bank senior economist Nicholas Mapa

Food inflation was "in check" in March with rice prices "well-behaved" even before the implementation of a law that puts tariffs instead of quotas on rice imports, said ING Bank senior economist Nicholas Mapa

"It's a positive surprise that inflation is lower than we were expecting and what the market was expecting," said ATR Asset Management head of equities Julian Tarrobago, who predicted March inflation at 3.5 percent.

"It's a positive surprise that inflation is lower than we were expecting and what the market was expecting," said ATR Asset Management head of equities Julian Tarrobago, who predicted March inflation at 3.5 percent.

ADVERTISEMENT

The Bangko Sentral ng Pilipinas will be more likely to cut the reserve ratio requirement for banks with inflation below forecasts in March. Inflation at 3 percent "builds the case" for an interest rate cut as early as the third quarter of this year, Tarrobago said.

The Bangko Sentral ng Pilipinas will be more likely to cut the reserve ratio requirement for banks with inflation below forecasts in March. Inflation at 3 percent "builds the case" for an interest rate cut as early as the third quarter of this year, Tarrobago said.

With inflation likely to settle at 3 percent in 2019 and 2020, the door to monetary policy easing is "wide open," Mapa said.

With inflation likely to settle at 3 percent in 2019 and 2020, the door to monetary policy easing is "wide open," Mapa said.

"Food prices would remain to be the major catalyst for the continuous easing trend in inflation, even for the coming months," Michael Ricafort, an economist at Rizal Commercial Banking Corp, told Reuters.

"Food prices would remain to be the major catalyst for the continuous easing trend in inflation, even for the coming months," Michael Ricafort, an economist at Rizal Commercial Banking Corp, told Reuters.

The Philippines remains one of Asia's fastest growing economies, but policymakers had to grapple with soaring inflation last year that pushed the central bank to raise its benchmark rate by a total 175 basis points to 4.75 percent.

The Philippines remains one of Asia's fastest growing economies, but policymakers had to grapple with soaring inflation last year that pushed the central bank to raise its benchmark rate by a total 175 basis points to 4.75 percent.

ADVERTISEMENT

ADVERTISEMENT