Philippine inflation quickens to 4.2 percent in January | ABS-CBN

ADVERTISEMENT

Welcome, Kapamilya! We use cookies to improve your browsing experience. Continuing to use this site means you agree to our use of cookies. Tell me more!

Philippine inflation quickens to 4.2 percent in January

Philippine inflation quickens to 4.2 percent in January

ABS-CBN News

Published Feb 05, 2021 09:08 AM PHT

|

Updated Feb 05, 2021 01:23 PM PHT

MANILA (UPDATE 2) - Philippine inflation quickened in January driven by higher food prices, the state statistics bureau said on Friday.

MANILA (UPDATE 2) - Philippine inflation quickened in January driven by higher food prices, the state statistics bureau said on Friday.

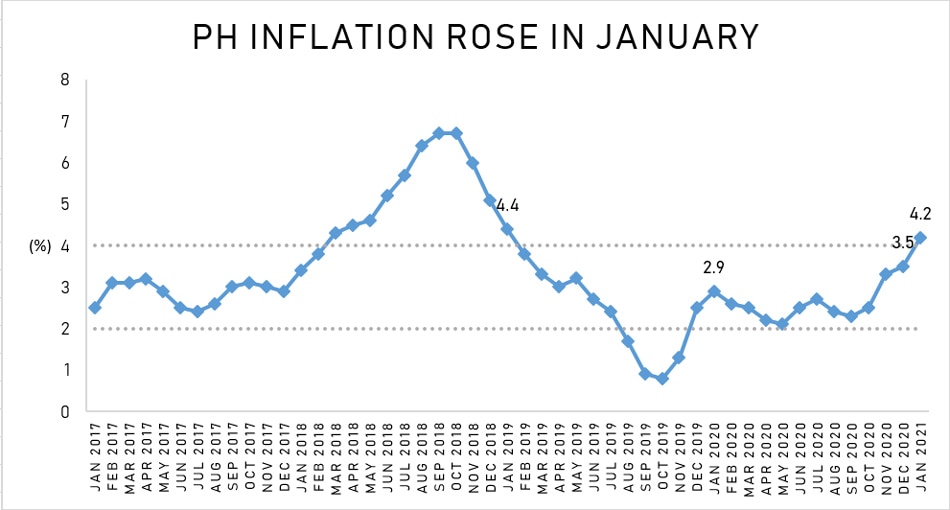

The Philippine Statistics Authority (PSA) said the consumer price index rose at a faster annual pace of 4.2 percent last month, its highest since the 4.4 percent inflation seen in January 2019.

The Philippine Statistics Authority (PSA) said the consumer price index rose at a faster annual pace of 4.2 percent last month, its highest since the 4.4 percent inflation seen in January 2019.

This was above the Bangko Sentral ng Pilipinas' forecast range of 3.3 percent to 4.1 percent.

This was above the Bangko Sentral ng Pilipinas' forecast range of 3.3 percent to 4.1 percent.

Pork prices have risen as the African swine fever (ASF) decimated hog populations across Luzon, while chicken prices have also gone up as supplies dwindled with many poultry farms gone bankrupt last year.

Pork prices have risen as the African swine fever (ASF) decimated hog populations across Luzon, while chicken prices have also gone up as supplies dwindled with many poultry farms gone bankrupt last year.

ADVERTISEMENT

Pork prices rose 17.1 percent in January, PSA said.

Pork prices rose 17.1 percent in January, PSA said.

Prices rose even faster in the National Capital Region, which saw 4.3 percent inflation.

Prices rose even faster in the National Capital Region, which saw 4.3 percent inflation.

The Philippines stands out among major Southeast Asian economies for seeing prices of commodities continue to rise. Other countries are even seeing deflation as the COVID-19 pandemic depressed demand.

The Philippines stands out among major Southeast Asian economies for seeing prices of commodities continue to rise. Other countries are even seeing deflation as the COVID-19 pandemic depressed demand.

The BSP viewed the latest data uptick as "transitory," keeping its 2 to 4 percent target for inflation for this year and next year.

The BSP viewed the latest data uptick as "transitory," keeping its 2 to 4 percent target for inflation for this year and next year.

"The projected uptrend in inflation is seen to be temporary. The sources of near-term inflation pressures are supply-side shocks in nature that should not require a monetary policy response unless they lead to further second-round effects," the central bank said.

"The projected uptrend in inflation is seen to be temporary. The sources of near-term inflation pressures are supply-side shocks in nature that should not require a monetary policy response unless they lead to further second-round effects," the central bank said.

ADVERTISEMENT

Supply-side constraints are best solved by non-monetary interventions, the BSP said, such as measures to ease logistics bottlenecks and make commodities more available to the markets.

Supply-side constraints are best solved by non-monetary interventions, the BSP said, such as measures to ease logistics bottlenecks and make commodities more available to the markets.

The BSP is set to meet on Feb. 11 to make its first monetary policy decision this year.

The BSP is set to meet on Feb. 11 to make its first monetary policy decision this year.

BPI’s chief economist Jun Neri, meanwhile, said the Philippines is at risk of "stagflation" in a recession if inflation remains at 4 percent, above targets, for the whole year.

BPI’s chief economist Jun Neri, meanwhile, said the Philippines is at risk of "stagflation" in a recession if inflation remains at 4 percent, above targets, for the whole year.

Stagflation is a scenario where inflation is high amid slow economic growth and a steadily high unemployment rate.

Stagflation is a scenario where inflation is high amid slow economic growth and a steadily high unemployment rate.

Neri is expecting inflation to rise further throughout 2021 on services, commodities such as corn, and rising global oil prices.

Neri is expecting inflation to rise further throughout 2021 on services, commodities such as corn, and rising global oil prices.

ADVERTISEMENT

This will halt policy rate cuts from the BSP, and instead, a rate hike is now "in the realm of possibility," he said.

This will halt policy rate cuts from the BSP, and instead, a rate hike is now "in the realm of possibility," he said.

Benign inflation last year allowed the BSP to cut its policy rate by 200 basis points to a record low of 2 percent to support the economy, which saw its worst contraction since World War 2.

Benign inflation last year allowed the BSP to cut its policy rate by 200 basis points to a record low of 2 percent to support the economy, which saw its worst contraction since World War 2.

Read More:

January 2021 inflation

2021 inflation

inflation

consumer price index

CPI

prices

basic commodities

Philippines economy

PH economy

PH GDP

ADVERTISEMENT

ADVERTISEMENT