BSP to finish probe into BDO hacking by end of January: Diokno | ABS-CBN

Welcome, Kapamilya! We use cookies to improve your browsing experience. Continuing to use this site means you agree to our use of cookies. Tell me more!

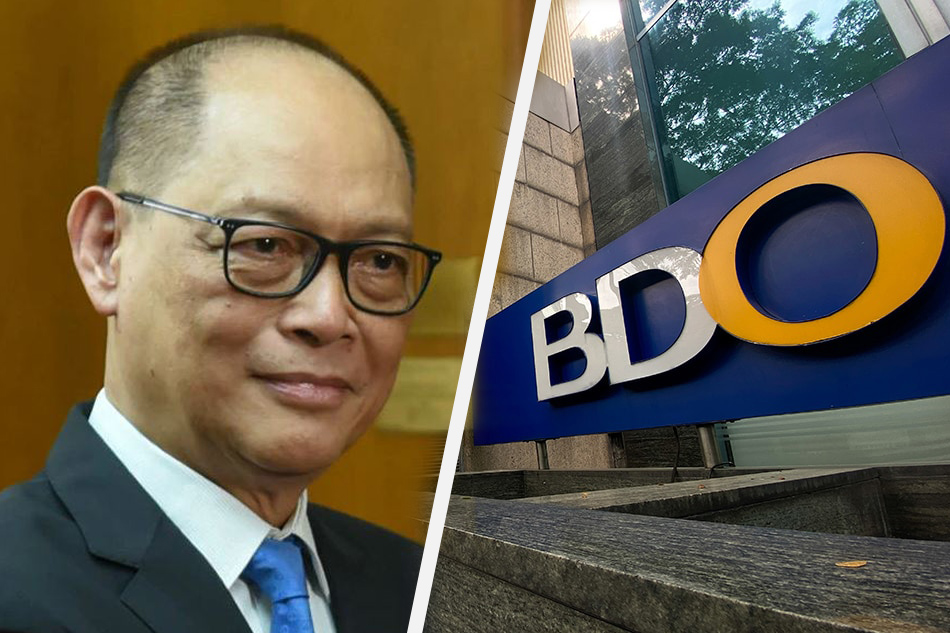

BSP to finish probe into BDO hacking by end of January: Diokno

BSP to finish probe into BDO hacking by end of January: Diokno

Warren de Guzman,

ABS-CBN News

Published Jan 24, 2022 06:35 PM PHT

|

Updated Jan 24, 2022 07:33 PM PHT

MANILA - The Bangko Sentral ng Pilipinas aims to finish its investigation into the BDO hacking incident before the end of January, the BSP said on Monday.

MANILA - The Bangko Sentral ng Pilipinas aims to finish its investigation into the BDO hacking incident before the end of January, the BSP said on Monday.

“The BSP recognizes the role of cybersecurity in fostering digital innovation in the financial services industry, and more importantly in maintaining financial stability,” said BSP Governor Benjamin Diokno.

“The BSP recognizes the role of cybersecurity in fostering digital innovation in the financial services industry, and more importantly in maintaining financial stability,” said BSP Governor Benjamin Diokno.

He said the central bank has issued several advisories on emerging and systemic cyber threats throughout 2021.

He said the central bank has issued several advisories on emerging and systemic cyber threats throughout 2021.

“Now on the BDO cyber attacks, the BSP is targeting to complete the investigation by end of January, this year,” Diokno said.

“Now on the BDO cyber attacks, the BSP is targeting to complete the investigation by end of January, this year,” Diokno said.

ADVERTISEMENT

The National Bureau of Investigation arrested at least 5 last week, including two Nigerians, for their alleged involvement in the "Mark Nagoyo Heist Group," behind the BDO unauthorized transactions.

The National Bureau of Investigation arrested at least 5 last week, including two Nigerians, for their alleged involvement in the "Mark Nagoyo Heist Group," behind the BDO unauthorized transactions.

BDO has said that it is reimbursing around 700 depositors for money lost due to what it called "sophisticated fraud technique" but more than 30 depositors who claim to have also been victimized but were denied refunds.

BDO has said that it is reimbursing around 700 depositors for money lost due to what it called "sophisticated fraud technique" but more than 30 depositors who claim to have also been victimized but were denied refunds.

Diokno said the BSP “continues to aggressively coordinate with law enforcement agencies to arrest and prosecute scammers, and with the relevant government and private sector players, to address emerging cyber-related threats and fraud."

Diokno said the BSP “continues to aggressively coordinate with law enforcement agencies to arrest and prosecute scammers, and with the relevant government and private sector players, to address emerging cyber-related threats and fraud."

The BSP chief meanwhile said lack of confidence in cybersecurity was not the biggest hurdle to people adopting online transactions.

The BSP chief meanwhile said lack of confidence in cybersecurity was not the biggest hurdle to people adopting online transactions.

“The biggest challenges in encouraging Filipinos to adopt digital payments are still financial exclusion, lack of substantial savings to put in an account, lack of awareness of the need to maintain an account, and inability to meet documentary requirements to open an account, which may be used for transacting through digital channels.

“The biggest challenges in encouraging Filipinos to adopt digital payments are still financial exclusion, lack of substantial savings to put in an account, lack of awareness of the need to maintain an account, and inability to meet documentary requirements to open an account, which may be used for transacting through digital channels.

ADVERTISEMENT

He said these problems are further compounded by internet connectivity deficiencies, which are integral in the use of digital financial services.

He said these problems are further compounded by internet connectivity deficiencies, which are integral in the use of digital financial services.

“We have to overcome these challenges to achieve our payments digitalization and financial inclusion objectives."

“We have to overcome these challenges to achieve our payments digitalization and financial inclusion objectives."

The BSP launched on Monday the multiple batch settlement (MBS) facility of the PESONet electronic fund transfer.

The BSP launched on Monday the multiple batch settlement (MBS) facility of the PESONet electronic fund transfer.

RELATED VIDEO

ADVERTISEMENT

ADVERTISEMENT