What comes next after being financially aware? | ABS-CBN

ADVERTISEMENT

Welcome, Kapamilya! We use cookies to improve your browsing experience. Continuing to use this site means you agree to our use of cookies. Tell me more!

What comes next after being financially aware?

What comes next after being financially aware?

Metrobank

Published Dec 28, 2020 08:21 AM PHT

There is much to do with your money than just saving and storing it in a bank.

There is much to do with your money than just saving and storing it in a bank.

To be better prepared for whatever life may bring, you will need to be financially aware of your standing and make informed decisions. This can include understanding your debt situation and practicing a balanced budgeting system. But after that, what comes next in your financial journey?

To be better prepared for whatever life may bring, you will need to be financially aware of your standing and make informed decisions. This can include understanding your debt situation and practicing a balanced budgeting system. But after that, what comes next in your financial journey?

For this, you need to seek reliable wealth management tips.

For this, you need to seek reliable wealth management tips.

Metrobank, one of the leading banking institutions in the Philippines, knows how equally important it is to provide solid financial services alongside useful money management tips. As part of its mantra to provide Meaningful Banking to its stakeholders, Metrobank sees value in educating rather than just selling. The company wishes for its customers to know how to handle and grow their wealth, all while providing customizable tools to aid them on their financial journey. One of its ways to help Filipinos is by sharing the bank's guide on financial management.

Metrobank, one of the leading banking institutions in the Philippines, knows how equally important it is to provide solid financial services alongside useful money management tips. As part of its mantra to provide Meaningful Banking to its stakeholders, Metrobank sees value in educating rather than just selling. The company wishes for its customers to know how to handle and grow their wealth, all while providing customizable tools to aid them on their financial journey. One of its ways to help Filipinos is by sharing the bank's guide on financial management.

ADVERTISEMENT

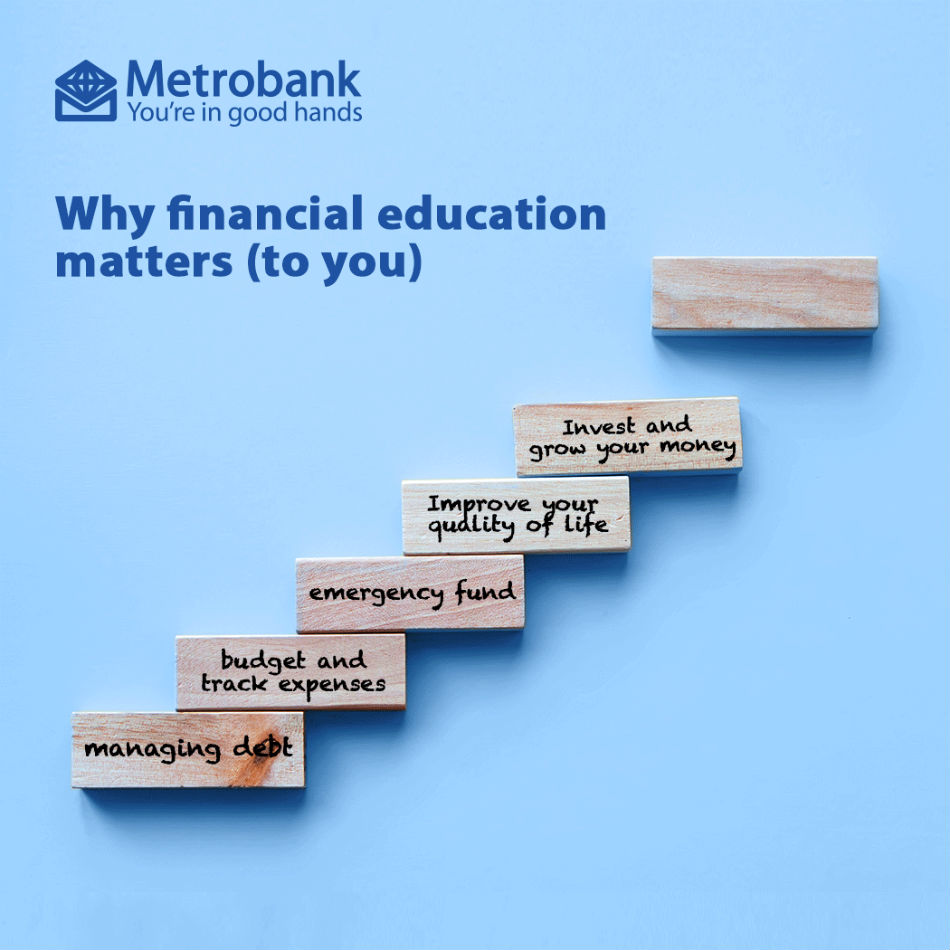

Metrobank's guide on financial education can be broken down into three parts:

1. Be financially aware by managing your debt and budgeting your expenses

2. Be financially secure by building an emergency fund and improving your quality of life

3. Be financially wise by growing your money

Metrobank's guide on financial education can be broken down into three parts:

1. Be financially aware by managing your debt and budgeting your expenses

2. Be financially secure by building an emergency fund and improving your quality of life

3. Be financially wise by growing your money

Understanding personal finance is crucial in building a secure future and being ready for the unexpected. Financial awareness is just the first step. Especially with everything happening in the world right now, what should people do to reach the next step and become financially secure?

Understanding personal finance is crucial in building a secure future and being ready for the unexpected. Financial awareness is just the first step. Especially with everything happening in the world right now, what should people do to reach the next step and become financially secure?

Here are some ways to be financially prepared for anything that may happen.

Here are some ways to be financially prepared for anything that may happen.

Save for an emergency fund

As many people may have discovered during 2020, having an emergency fund is a big help whenever an unexpected crisis happens. It does not have to be a global event; even minor household emergencies can happen anytime such as broken appliances, car repairs, or sudden hospitalization. Having an emergency fund will cushion the expenses and buys you time to get back on your feet when your cashflow becomes rough.

As many people may have discovered during 2020, having an emergency fund is a big help whenever an unexpected crisis happens. It does not have to be a global event; even minor household emergencies can happen anytime such as broken appliances, car repairs, or sudden hospitalization. Having an emergency fund will cushion the expenses and buys you time to get back on your feet when your cashflow becomes rough.

Be sure to include an emergency fund in your budgeting phase. Ideally, you should be saving up 10%-20% of your income every month and putting it away in an emergency fund until you have saved an amount that is equal to three to six months' worth of expenses.

Be sure to include an emergency fund in your budgeting phase. Ideally, you should be saving up 10%-20% of your income every month and putting it away in an emergency fund until you have saved an amount that is equal to three to six months' worth of expenses.

You can try putting your emergency fund in a separate savings account to prevent temptation or accidental spending.

You can try putting your emergency fund in a separate savings account to prevent temptation or accidental spending.

Metrobank tries to help its customers make saving money more beneficial by providing free personal accident insurance through an exclusive partnership with AXA. Through the partnership, eligible new accounts opening get a one-year free AXA Protect Package (Terms and Conditions apply).

Metrobank tries to help its customers make saving money more beneficial by providing free personal accident insurance through an exclusive partnership with AXA. Through the partnership, eligible new accounts opening get a one-year free AXA Protect Package (Terms and Conditions apply).

Another option is to put it in a time deposit. It provides guaranteed returns and remains liquid. At the same time, it will make you think twice before withdrawing your money for unnecessary spending as you may forfeit your interest earnings or incur penalty charges on your interests. Existing Metrobank customers can conveniently set aside their money on time deposit online.

Another option is to put it in a time deposit. It provides guaranteed returns and remains liquid. At the same time, it will make you think twice before withdrawing your money for unnecessary spending as you may forfeit your interest earnings or incur penalty charges on your interests. Existing Metrobank customers can conveniently set aside their money on time deposit online.

It always pays to be prepared for anything and having a hidden stash like this will help protect your life savings in the unfortunate chance that something bad happens.

It always pays to be prepared for anything and having a hidden stash like this will help protect your life savings in the unfortunate chance that something bad happens.

Improve your quality of life

Having a solid emergency fund basically equates to financial security and once you have achieved that, you can now focus on improving your life and saving up for retirement.

Having a solid emergency fund basically equates to financial security and once you have achieved that, you can now focus on improving your life and saving up for retirement.

Being financially secure gives you more freedom to enjoy the life you worked hard for since you no longer have to worry about sudden emergencies or bad debts. You can now look into getting assets that can improve your way of living. This can either be a new car loan for easier transportation or a mortgage for a permanent residence in a better location. Or you can look into growing your money further with several smart investments.

Being financially secure gives you more freedom to enjoy the life you worked hard for since you no longer have to worry about sudden emergencies or bad debts. You can now look into getting assets that can improve your way of living. This can either be a new car loan for easier transportation or a mortgage for a permanent residence in a better location. Or you can look into growing your money further with several smart investments.

Another way to be prepared is to get an insurance plan. This can be a Life Insurance or a Health Insurance that will help your finances and your family in the event of an untimely death or critical illness.

Another way to be prepared is to get an insurance plan. This can be a Life Insurance or a Health Insurance that will help your finances and your family in the event of an untimely death or critical illness.

AXA also offers several customizable health plans that can cover multiple critical illnesses and help with unexpected hospitalization bills. Visit this link to know more about these offerings.

AXA also offers several customizable health plans that can cover multiple critical illnesses and help with unexpected hospitalization bills. Visit this link to know more about these offerings.

If you are not yet insured, you will certainly benefit from looking for insurance policies that will fit whatever needs you may have. Consider this as an investment for the future and an added layer of protection.

If you are not yet insured, you will certainly benefit from looking for insurance policies that will fit whatever needs you may have. Consider this as an investment for the future and an added layer of protection.

Your financial journey does not stop in saving and budgeting. All these are in danger if you do not prepare for any emergency. The next step in your journey is to secure your hard-earned money and prepare your finances for any unexpected event.

Your financial journey does not stop in saving and budgeting. All these are in danger if you do not prepare for any emergency. The next step in your journey is to secure your hard-earned money and prepare your finances for any unexpected event.

The world is filled with uncertainty today, but with proper planning and sound advice from reliable financial partners, you can weather through any storm with your finances intact and work your way towards a meaningful life.

The world is filled with uncertainty today, but with proper planning and sound advice from reliable financial partners, you can weather through any storm with your finances intact and work your way towards a meaningful life.

For more financial tips and better money habits, check out this page.

For more financial tips and better money habits, check out this page.

Read More:

advertorial

BrandNews

life advertorial

Metrobank

savings

emergency fund

insurance

personal finance

ADVERTISEMENT

ADVERTISEMENT