Sotto files TRAIN 2 bill | ABS-CBN

Welcome, Kapamilya! We use cookies to improve your browsing experience. Continuing to use this site means you agree to our use of cookies. Tell me more!

Sotto files TRAIN 2 bill

Sotto files TRAIN 2 bill

ABS-CBN News

Published Aug 02, 2018 05:24 PM PHT

|

Updated Aug 03, 2018 12:07 AM PHT

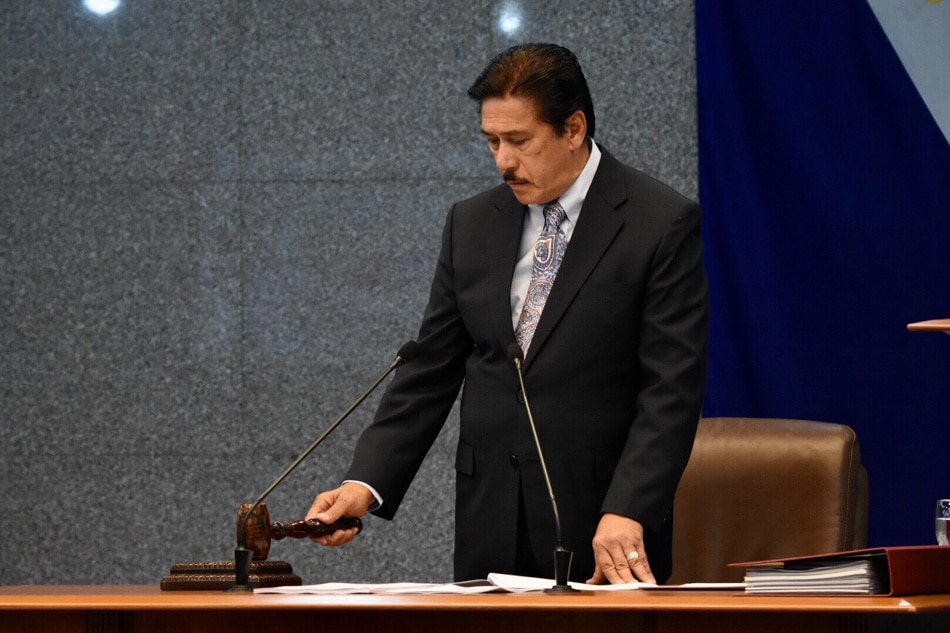

MANILA (UPDATE) - Senate President Vicente Sotto III filed on Thursday a bill for the second tranche of tax reforms that seeks to lower corporate income tax.

MANILA (UPDATE) - Senate President Vicente Sotto III filed on Thursday a bill for the second tranche of tax reforms that seeks to lower corporate income tax.

Senate Bill No. 1906 or the "Corporate Income Tax & Incentives Reform Act" seeks to review and revise existing tax laws being observed by the government with respect to businesses.

Senate Bill No. 1906 or the "Corporate Income Tax & Incentives Reform Act" seeks to review and revise existing tax laws being observed by the government with respect to businesses.

The proposed measure is the second package of the Tax Reform for Acceleration and Inclusion (TRAIN-2) which aims to lower corporate income tax from 30 percent to 25 percent and modernize incentives to attract new and growing industries.

The proposed measure is the second package of the Tax Reform for Acceleration and Inclusion (TRAIN-2) which aims to lower corporate income tax from 30 percent to 25 percent and modernize incentives to attract new and growing industries.

Senate President @sotto_tito files Senate Bill 1906 or the Corporate Income Tax & Incentives Reform Act @ANCALERTS @ABSCBNNews pic.twitter.com/UrKvWGDeRQ

— sherrie ann torres (@sherieanntorres) August 2, 2018

Senate President @sotto_tito files Senate Bill 1906 or the Corporate Income Tax & Incentives Reform Act @ANCALERTS @ABSCBNNews pic.twitter.com/UrKvWGDeRQ

— sherrie ann torres (@sherieanntorres) August 2, 2018

In his bill's explanatory note, Sotto clarified that the proposed measure does not intend to remove corporate tax incentives but is merely aimed at “rationalizing” the tax system.

In his bill's explanatory note, Sotto clarified that the proposed measure does not intend to remove corporate tax incentives but is merely aimed at “rationalizing” the tax system.

ADVERTISEMENT

"...[I]t is high time for the government to come up with a tax incentive system that is performance-based, transparent and time-bound, in order to ensure that the Filipino people will gain from every peso that the government gives to the firms registered in the investment promotion agencies,” Sotto said in the bill.

"...[I]t is high time for the government to come up with a tax incentive system that is performance-based, transparent and time-bound, in order to ensure that the Filipino people will gain from every peso that the government gives to the firms registered in the investment promotion agencies,” Sotto said in the bill.

The first tranche of tax reforms was implemented last January and raised duties on sugar-sweetened drinks, fuel, and cars.- report from Sherrie Ann Torres, ABS-CBN News

The first tranche of tax reforms was implemented last January and raised duties on sugar-sweetened drinks, fuel, and cars.- report from Sherrie Ann Torres, ABS-CBN News

ADVERTISEMENT

ADVERTISEMENT