Inflation holds at 5-year high 4.6 percent in May | ABS-CBN

Welcome, Kapamilya! We use cookies to improve your browsing experience. Continuing to use this site means you agree to our use of cookies. Tell me more!

Inflation holds at 5-year high 4.6 percent in May

Inflation holds at 5-year high 4.6 percent in May

ABS-CBN News

Published Jun 05, 2018 09:17 AM PHT

|

Updated Jun 05, 2018 04:42 PM PHT

MANILA - Inflation remained at its highest level in over 5 years in May, with the Bangko Sentral ng Pilipinas flagging it as a "concern" even as there are signs that the price increases are slowing down.

MANILA - Inflation remained at its highest level in over 5 years in May, with the Bangko Sentral ng Pilipinas flagging it as a "concern" even as there are signs that the price increases are slowing down.

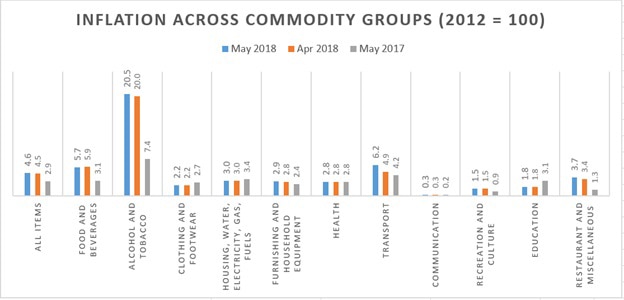

Consumer prices rose 4.6 percent in May from 4.5 percent in the previous month, according to the Philippine Statistics Authority. This was below the 4.9-percent forecast of economists in a Reuters poll and the Department of Finance.

Consumer prices rose 4.6 percent in May from 4.5 percent in the previous month, according to the Philippine Statistics Authority. This was below the 4.9-percent forecast of economists in a Reuters poll and the Department of Finance.

Price increases quickened year-on-year for alcoholic beverages and tobacco, transportation and household equipment, while it slowed for food, non-alcoholic beverages, the PSA said.

Price increases quickened year-on-year for alcoholic beverages and tobacco, transportation and household equipment, while it slowed for food, non-alcoholic beverages, the PSA said.

"The inflation outlook continues to be a concern and requires close attention," Bangko Sentral Governor Nestor Espenilla said.

"The inflation outlook continues to be a concern and requires close attention," Bangko Sentral Governor Nestor Espenilla said.

ADVERTISEMENT

Monetary authorities will "consider what further adjustments are necessary," said Espenilla, who in May raised the benchmark lending rate by 25 basis points for the first time since September 2014.

Monetary authorities will "consider what further adjustments are necessary," said Espenilla, who in May raised the benchmark lending rate by 25 basis points for the first time since September 2014.

Average inflation of 4.1 percent in the first 5 months is still above the BSP's 2 to 4 percent target for the year, "but maybe not going to be as bad as some might think," Espenilla said.

Average inflation of 4.1 percent in the first 5 months is still above the BSP's 2 to 4 percent target for the year, "but maybe not going to be as bad as some might think," Espenilla said.

PRICE HIKES TAPERING OFF

Espenilla said there were signs that inflation was "slowing and may be close to peak." Oil prices "seem to have peaked" while food price inflation appeared to be "slowing down," he said.

Espenilla said there were signs that inflation was "slowing and may be close to peak." Oil prices "seem to have peaked" while food price inflation appeared to be "slowing down," he said.

The National Economic Development Authority is "seeing signs of tapering off of inflation," said NEDA Undersecretary Rosemarie Edillon.

The National Economic Development Authority is "seeing signs of tapering off of inflation," said NEDA Undersecretary Rosemarie Edillon.

The government is addressing the "challenging period" of rising consumer prices, Budget Secretary Benjamin Diokno said.

The government is addressing the "challenging period" of rising consumer prices, Budget Secretary Benjamin Diokno said.

"The government is closely monitoring and taking steps to address the difficulties experienced by Filipino families today arising from higher prices," he said.

"The government is closely monitoring and taking steps to address the difficulties experienced by Filipino families today arising from higher prices," he said.

Higher duties on fuel and sugar sweetened drinks that took effect last Jan. 1 contribute only 0.4 percentage point to the increase in consumer prices, he said.

Higher duties on fuel and sugar sweetened drinks that took effect last Jan. 1 contribute only 0.4 percentage point to the increase in consumer prices, he said.

Rice imports will arrive in June and are expected to bring down food prices. The government is also preparing fuel subsidies, Diokno said.

Rice imports will arrive in June and are expected to bring down food prices. The government is also preparing fuel subsidies, Diokno said.

GOOD 'SURPRISE'

Analysts welcomed the slower than expected inflation figures. The Philippine Stock Exchange Index was down 0.24 percent to 7,561.77 after the official data were announced.

Analysts welcomed the slower than expected inflation figures. The Philippine Stock Exchange Index was down 0.24 percent to 7,561.77 after the official data were announced.

"It's quite a good surprise, especially given the guidance of the BSP," First Metro Securities consultant Aaron Say told ANC's Market Edge.

"It's quite a good surprise, especially given the guidance of the BSP," First Metro Securities consultant Aaron Say told ANC's Market Edge.

The "surprise" was due to month-on-month slowdown in price increases on food, non-alcoholic beverages and utilities, ING Bank said in a statement.

The "surprise" was due to month-on-month slowdown in price increases on food, non-alcoholic beverages and utilities, ING Bank said in a statement.

The BSP is expected to stay vigilant since second-round effects are "uncertain," the bank said.

The BSP is expected to stay vigilant since second-round effects are "uncertain," the bank said.

"We believe that recent developments would mean that inflation is at or near the peak. These developments also cut the pressure on BSP to hike policy rates this month," it said.

"We believe that recent developments would mean that inflation is at or near the peak. These developments also cut the pressure on BSP to hike policy rates this month," it said.

The economy is strong enough to absorb rising consumer prices and another interest rate increase, said Sagarika Chandra, associate director for sovereigns at Fitch Ratings.

The economy is strong enough to absorb rising consumer prices and another interest rate increase, said Sagarika Chandra, associate director for sovereigns at Fitch Ratings.

ADVERTISEMENT

ADVERTISEMENT