From free to a fee: BPI to start charging some online and mobile app transactions | ABS-CBN

Welcome, Kapamilya! We use cookies to improve your browsing experience. Continuing to use this site means you agree to our use of cookies. Tell me more!

From free to a fee: BPI to start charging some online and mobile app transactions

From free to a fee: BPI to start charging some online and mobile app transactions

ABS-CBN News

Published May 31, 2019 10:56 AM PHT

|

Updated Jun 01, 2019 02:01 PM PHT

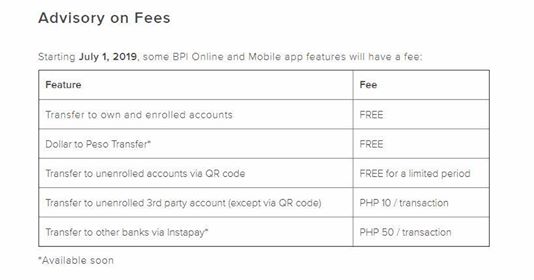

MANILA (UPDATE) - Bank of the Philippine Islands (BPI) on Friday said it would impose fees on select online and mobile app features starting July 1.

MANILA (UPDATE) - Bank of the Philippine Islands (BPI) on Friday said it would impose fees on select online and mobile app features starting July 1.

Bank to bank transfers will now be P50 per transaction and transfers to unenrolled third party account has a P10 charge, BPI said in an advisory.

Bank to bank transfers will now be P50 per transaction and transfers to unenrolled third party account has a P10 charge, BPI said in an advisory.

"Enroll your 3rd party account/s to continue enjoying fund transfers at no cost. Just visit any branch or mail a signed Third Party Account Enrollment Form," BPI added.

"Enroll your 3rd party account/s to continue enjoying fund transfers at no cost. Just visit any branch or mail a signed Third Party Account Enrollment Form," BPI added.

Transfers to unenrolled accounts via QR code is free for a limited period, while dollar to peso transfer and transfer to own and enrolled accounts remain free, it said.

Transfers to unenrolled accounts via QR code is free for a limited period, while dollar to peso transfer and transfer to own and enrolled accounts remain free, it said.

ADVERTISEMENT

BPI said it allows enrollment for up to 99 other BPI accounts for online fund transfers and payments.

BPI said it allows enrollment for up to 99 other BPI accounts for online fund transfers and payments.

“You just have to enroll accounts which you deal with on a regular basis. Ninety-nine accounts is a lot for a regular banking client,” BPI corporate communication head Owen Cammayo told ABS-CBN News.

“You just have to enroll accounts which you deal with on a regular basis. Ninety-nine accounts is a lot for a regular banking client,” BPI corporate communication head Owen Cammayo told ABS-CBN News.

Some users, meanwhile, took to social media to express their disappointment with the new bank policy.

Some users, meanwhile, took to social media to express their disappointment with the new bank policy.

ADVERTISEMENT

ADVERTISEMENT