BIR files 24 tax evasion cases vs 3 individuals, 18 companies | ABS-CBN

Welcome, Kapamilya! We use cookies to improve your browsing experience. Continuing to use this site means you agree to our use of cookies. Tell me more!

News

BIR files 24 tax evasion cases vs 3 individuals, 18 companies

BIR files 24 tax evasion cases vs 3 individuals, 18 companies

Mike Navallo,

ABS-CBN News

Published Nov 29, 2018 07:47 PM PHT

MANILA - The Bureau of Internal Revenue (BIR) on Thursday filed before the Department of Justice (DOJ) 24 tax evasion cases against 3 individuals and 18 companies based in Makati and Quezon City for over P1.1 billion in alleged tax liabilities.

MANILA - The Bureau of Internal Revenue (BIR) on Thursday filed before the Department of Justice (DOJ) 24 tax evasion cases against 3 individuals and 18 companies based in Makati and Quezon City for over P1.1 billion in alleged tax liabilities.

The BIR accused Marivic Carlos, Philipp Santiago II, and Rene Santos, who run their respective tire retail, construction, and convenience store businesses, of failing to pay their taxes.

The BIR accused Marivic Carlos, Philipp Santiago II, and Rene Santos, who run their respective tire retail, construction, and convenience store businesses, of failing to pay their taxes.

Carlos’ alleged liability for 2009 reached more than P12 million, while Santiago's was estimated at P75 million and Santos P19 million for 2012.

Carlos’ alleged liability for 2009 reached more than P12 million, while Santiago's was estimated at P75 million and Santos P19 million for 2012.

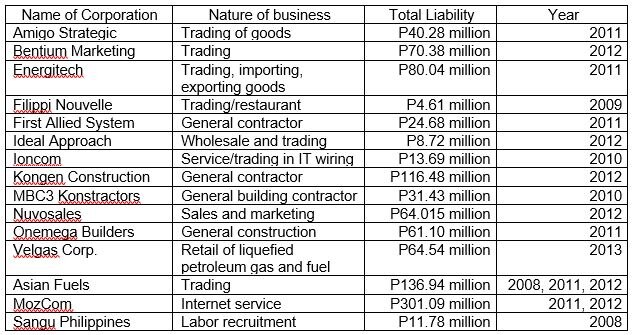

The BIR also accused the following companies of not paying their taxes:

The BIR also accused the following companies of not paying their taxes:

ADVERTISEMENT

Three other companies – Events.Work, Goodwill Trading, and Stone of David Tactical Equipment – were also accused of failing to pay taxes despite filing electronic returns.

Three other companies – Events.Work, Goodwill Trading, and Stone of David Tactical Equipment – were also accused of failing to pay taxes despite filing electronic returns.

Events.Works’ alleged liability for 2006 to 2018 reached P8.33 million. Goodwill supposedly owes the BIR P37.93 million from 2009 to 2016, while Stone's allegedly liability for 2016 and 2017 is at P5.10 million.

Events.Works’ alleged liability for 2006 to 2018 reached P8.33 million. Goodwill supposedly owes the BIR P37.93 million from 2009 to 2016, while Stone's allegedly liability for 2016 and 2017 is at P5.10 million.

Officers of the corporations were also charged.

Officers of the corporations were also charged.

If found guilty of violating the National Internal Revenue Code, the sole proprietors and the firms' officers could be jailed for up to 10 years and fined at least 10,000.

If found guilty of violating the National Internal Revenue Code, the sole proprietors and the firms' officers could be jailed for up to 10 years and fined at least 10,000.

The companies could also be ordered to pay fines ranging from P50,000 to P100,000, aside from paying their taxes due.

The companies could also be ordered to pay fines ranging from P50,000 to P100,000, aside from paying their taxes due.

ADVERTISEMENT

ADVERTISEMENT