Bayan Muna urges SC to order refund of Maynilad, Manila Water income taxes passed on to consumers

ADVERTISEMENT

Welcome, Kapamilya! We use cookies to improve your browsing experience. Continuing to use this site means you agree to our use of cookies. Tell me more!

Bayan Muna urges SC to order refund of Maynilad, Manila Water income taxes passed on to consumers

Mike Navallo,

ABS-CBN News

Published Jun 01, 2023 03:48 PM PHT

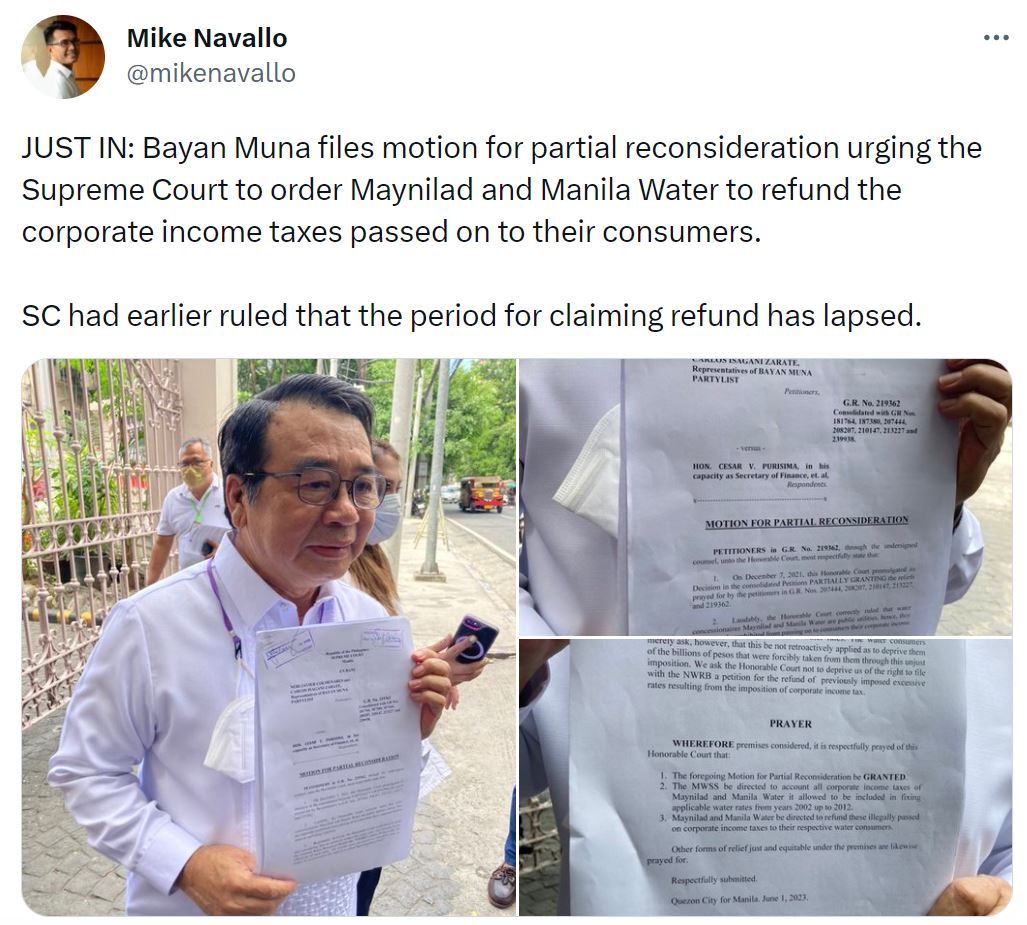

MANILA — The Bayan Muna Partylist group has urged the Supreme Court to order Maynilad and Manila Water to refund the corporate income taxes that the water concessionaires passed on to their consumers.

MANILA — The Bayan Muna Partylist group has urged the Supreme Court to order Maynilad and Manila Water to refund the corporate income taxes that the water concessionaires passed on to their consumers.

In a motion for partial reconsideration filed on Thursday, former Bayan Muna representatives Neri Colmenares and Carlos Isagani Zarate asked the high court to order the MWSS to “account all corporate income taxes of Maynilad and Manila Water it allowed to be included in fixing applicable water rates from years 2002 up to 2012” and order both companies to return these to water consumers.

In a motion for partial reconsideration filed on Thursday, former Bayan Muna representatives Neri Colmenares and Carlos Isagani Zarate asked the high court to order the MWSS to “account all corporate income taxes of Maynilad and Manila Water it allowed to be included in fixing applicable water rates from years 2002 up to 2012” and order both companies to return these to water consumers.

The high court earlier ruled that Maynilad and Manila Water are public utilities which cannot pass on their corporate income taxes to consumers.

The high court earlier ruled that Maynilad and Manila Water are public utilities which cannot pass on their corporate income taxes to consumers.

But in the same ruling, it declared that these amounts can no longer be recovered because the period for claiming the refund has lapsed.

But in the same ruling, it declared that these amounts can no longer be recovered because the period for claiming the refund has lapsed.

ADVERTISEMENT

The court said complaints that seek to contest water rates should be filed within 30 days from the effectivity of the rates with the National Water Resources Board (NWRB).

The court said complaints that seek to contest water rates should be filed within 30 days from the effectivity of the rates with the National Water Resources Board (NWRB).

But Bayan Muna argued that this rule was only laid down by the Supreme Court in its December 7, 2021 ruling, which petitioners received only on May 17, 2023.

But Bayan Muna argued that this rule was only laid down by the Supreme Court in its December 7, 2021 ruling, which petitioners received only on May 17, 2023.

“Hindi kami pwedeng magfile sa NWRB noon kasi hindi pa deklaradong public utility ang Manila Water at Maynilad. At that time...iniinsist ng Maynilad at Manila Water, na hindi sila public utility. Sila daw ay agent lang ng MWSS,” Colmenares told the media shortly after the filing of the motion on Thursday.

“Hindi kami pwedeng magfile sa NWRB noon kasi hindi pa deklaradong public utility ang Manila Water at Maynilad. At that time...iniinsist ng Maynilad at Manila Water, na hindi sila public utility. Sila daw ay agent lang ng MWSS,” Colmenares told the media shortly after the filing of the motion on Thursday.

Before the Supreme Court’s December 2021 ruling, Bayan Muna pointed out that there was no definitive ruling as to where complaints contesting water rates fixed by MWSS and water concessionaires may be filed, with many filing their complaints with the MWSS Regulatory Office (MWSS-RO).

Before the Supreme Court’s December 2021 ruling, Bayan Muna pointed out that there was no definitive ruling as to where complaints contesting water rates fixed by MWSS and water concessionaires may be filed, with many filing their complaints with the MWSS Regulatory Office (MWSS-RO).

“Only in this assailed Decision did the Honorable Court categorically decreed that ‘the National Water Resources Board is the successor of the Public Service Commission with jurisdiction to take cognizance of cases contesting rates fixed by the Metropolitan Waterworks and Sewerage System (MWSS),’” it added.

“Only in this assailed Decision did the Honorable Court categorically decreed that ‘the National Water Resources Board is the successor of the Public Service Commission with jurisdiction to take cognizance of cases contesting rates fixed by the Metropolitan Waterworks and Sewerage System (MWSS),’” it added.

ADVERTISEMENT

Bayan Muna even cited MWSS’ own objections to NWRB’s jurisdiction as proof that there is no definite rule or provision of law vesting NWRB with jurisdiction. It said no law categorically transferred the adjudicatory powers of the Public Service Commission to the NWRB.

Bayan Muna even cited MWSS’ own objections to NWRB’s jurisdiction as proof that there is no definite rule or provision of law vesting NWRB with jurisdiction. It said no law categorically transferred the adjudicatory powers of the Public Service Commission to the NWRB.

“Petitioners argue that in the interest of fair play, equity and justice, this Honorable Court needs to relax the rules in order for the water consumers to recover the overpayments made, in accordance with this Court’s Decision declaring that Maynilad and Manila Water incorrectly passed on to the water consumers the income tax of Maynilad and Manila Water,” it argued.

“Petitioners argue that in the interest of fair play, equity and justice, this Honorable Court needs to relax the rules in order for the water consumers to recover the overpayments made, in accordance with this Court’s Decision declaring that Maynilad and Manila Water incorrectly passed on to the water consumers the income tax of Maynilad and Manila Water,” it argued.

It is unclear yet how much is the total amount of refund Bayan Muna is seeking because Maynilad’s and Manila Water’s published rates do not include a breakdown as to how much went into payment of corporate income taxes.

It is unclear yet how much is the total amount of refund Bayan Muna is seeking because Maynilad’s and Manila Water’s published rates do not include a breakdown as to how much went into payment of corporate income taxes.

“Sinasabi naman sa published rates magkano per cubic meter ang singil. Hindi naman sinasabi doon na 10, 30% nito ay galing sa corporate income tax, 20% ay galing sa advertisement,” he explained.

“Sinasabi naman sa published rates magkano per cubic meter ang singil. Hindi naman sinasabi doon na 10, 30% nito ay galing sa corporate income tax, 20% ay galing sa advertisement,” he explained.

Colmenares hopes the Supreme Court will grant their motion.

Colmenares hopes the Supreme Court will grant their motion.

ADVERTISEMENT

“Kasi ang refund na ‘yan, malaking tulong yan sa taong bayan na naghihikahos ngayon sa taas ng presyo ng bilihin, walang trabaho, mababa ang sahod. Kasi kung bilyon bilyon ang na-refund sa taong bayan, malilibre siguro yan ng ilang buwang konsumo natin. E di malaking ginhawa yun,” he concluded.

“Kasi ang refund na ‘yan, malaking tulong yan sa taong bayan na naghihikahos ngayon sa taas ng presyo ng bilihin, walang trabaho, mababa ang sahod. Kasi kung bilyon bilyon ang na-refund sa taong bayan, malilibre siguro yan ng ilang buwang konsumo natin. E di malaking ginhawa yun,” he concluded.

MWSS-RO, which approves or rejects water rate adjustments of the two water concessionaires, had previously said it did not allow Manila Water and Maynilad to collect corporate income taxes from customers, which led to an arbitration case.

MWSS-RO, which approves or rejects water rate adjustments of the two water concessionaires, had previously said it did not allow Manila Water and Maynilad to collect corporate income taxes from customers, which led to an arbitration case.

Maynilad for its part said it already accepted its status as a public utility when it signed a revised concession agreement and when it applied for and was granted a congressional franchise.

Maynilad for its part said it already accepted its status as a public utility when it signed a revised concession agreement and when it applied for and was granted a congressional franchise.

Manila Water meanwhile said it already excluded corporate income taxes from its operating expenses.

Manila Water meanwhile said it already excluded corporate income taxes from its operating expenses.

RELATED VIDEO:

ADVERTISEMENT

ADVERTISEMENT