Marcos' alleged refusal to pay estate tax 'an issue of entitlement': Isko's chief strategist | ABS-CBN

ADVERTISEMENT

Welcome, Kapamilya! We use cookies to improve your browsing experience. Continuing to use this site means you agree to our use of cookies. Tell me more!

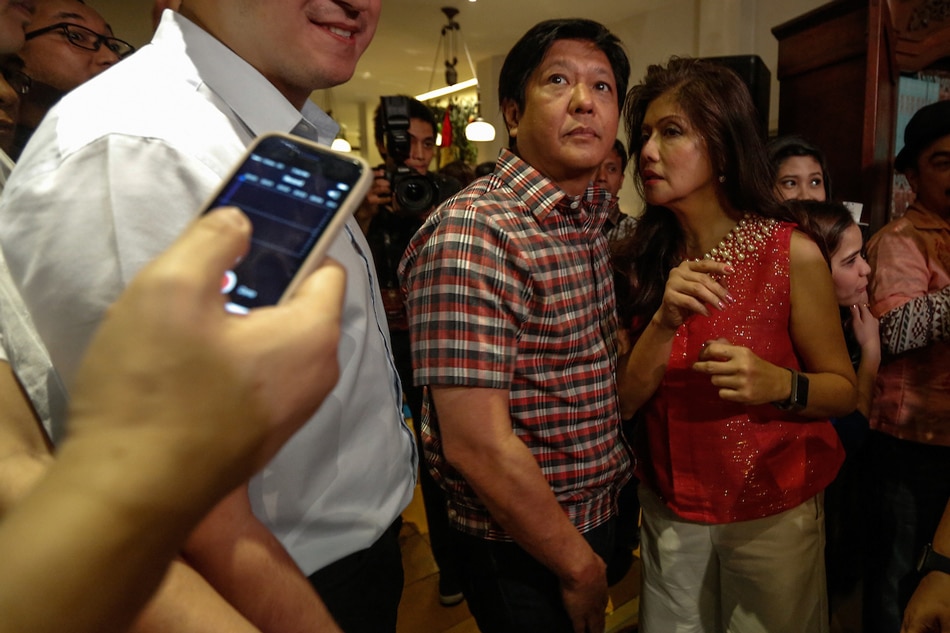

Marcos' alleged refusal to pay estate tax 'an issue of entitlement': Isko's chief strategist

Marcos' alleged refusal to pay estate tax 'an issue of entitlement': Isko's chief strategist

Katrina Domingo,

ABS-CBN News

Published Apr 05, 2022 03:26 PM PHT

MANILA - The alleged refusal of the Marcos family to settle their P203 billion estate tax liability highlights their sense of entitlement, the camp of Aksyon Demokratiko standard bearer Isko Moreno Domagoso said Tuesday.

MANILA - The alleged refusal of the Marcos family to settle their P203 billion estate tax liability highlights their sense of entitlement, the camp of Aksyon Demokratiko standard bearer Isko Moreno Domagoso said Tuesday.

"This is not just an issue of magkano yung (how much they owe in) estate tax. This is an issue of entitlement," said Lito Banayo, Domagoso's chief campaign strategist for Halalan 2022.

"This is not just an issue of magkano yung (how much they owe in) estate tax. This is an issue of entitlement," said Lito Banayo, Domagoso's chief campaign strategist for Halalan 2022.

"Ang paniwala nila sa sarili nila, naghahari-hari sila dito sa ating bansa.

Samantalang yung ordinaryong mamamayan, kailangan magbayad sa BIR (Bureau of Internal Revenue)... kukumpiskahin ang assets o ifri-freeze ang bank deposits," he told reporters.

"Ang paniwala nila sa sarili nila, naghahari-hari sila dito sa ating bansa.

Samantalang yung ordinaryong mamamayan, kailangan magbayad sa BIR (Bureau of Internal Revenue)... kukumpiskahin ang assets o ifri-freeze ang bank deposits," he told reporters.

(They look at themselves as the kings of this country, while ordinary citizens need to settle their dues with the Bureau of Internal Revenue... otherwise their assets will be confiscated or their bank deposits will be frozen.)

(They look at themselves as the kings of this country, while ordinary citizens need to settle their dues with the Bureau of Internal Revenue... otherwise their assets will be confiscated or their bank deposits will be frozen.)

ADVERTISEMENT

Last month, Aksyon Demokratiko reminded tax officials and the public that the family of current presidential race frontrunner former Sen. Ferdinand "Bongbong" Marcos, Jr. has yet to pay some P203 billion in estate taxes, a figure that it said has ballooned from P23 billion due to penalties and surcharges since 1997.

Last month, Aksyon Demokratiko reminded tax officials and the public that the family of current presidential race frontrunner former Sen. Ferdinand "Bongbong" Marcos, Jr. has yet to pay some P203 billion in estate taxes, a figure that it said has ballooned from P23 billion due to penalties and surcharges since 1997.

One of Marcos' lawyers said that the Supreme Court only ordered the family of the late dictator Ferdinand Marcos to pay P23 billion in taxes, while some P180 billion in penalties and surcharges have yet to be finalized by tax officials.

One of Marcos' lawyers said that the Supreme Court only ordered the family of the late dictator Ferdinand Marcos to pay P23 billion in taxes, while some P180 billion in penalties and surcharges have yet to be finalized by tax officials.

A Supreme Court ruling showed that the Marcoses' estate tax assessment of P23 billion became "final and executory" on March 9, 1999. And the Bureau of Internal Revenue in a written demand has asked the Marcos family to settle their tax debt.

A Supreme Court ruling showed that the Marcoses' estate tax assessment of P23 billion became "final and executory" on March 9, 1999. And the Bureau of Internal Revenue in a written demand has asked the Marcos family to settle their tax debt.

Bongbong's spokesman, Vic Rodriguez, has claimed that the tax case was still being litigated, while his sister, Sen. Imee Marcos, said they have no copies of the demand.

Bongbong's spokesman, Vic Rodriguez, has claimed that the tax case was still being litigated, while his sister, Sen. Imee Marcos, said they have no copies of the demand.

"Wala kasing kopya na buo 'yung nanay ko. Hinihingi nga 'yung buong dokumento para upuan na once and for all kasi nakailang beses na rin kami na nakikisuyo sa kanlia na upuan na natin at sumahin ng total," Imee said last April 1.

"Wala kasing kopya na buo 'yung nanay ko. Hinihingi nga 'yung buong dokumento para upuan na once and for all kasi nakailang beses na rin kami na nakikisuyo sa kanlia na upuan na natin at sumahin ng total," Imee said last April 1.

ADVERTISEMENT

(My mother has no full copy. We are asking for the full document to discuss it once and for all because we have asked them several times to sit down and compute the total.)

(My mother has no full copy. We are asking for the full document to discuss it once and for all because we have asked them several times to sit down and compute the total.)

Imee questioned the timing of the controversy, saying it might be politically motivated.

Imee questioned the timing of the controversy, saying it might be politically motivated.

Domagoso had blasted Imee's statement, underscoring that paying taxes is a citizen's "obligation and has nothing to do with politics."

Domagoso had blasted Imee's statement, underscoring that paying taxes is a citizen's "obligation and has nothing to do with politics."

A resolution has been filed in the Senate for the legislative chamber to investigate the non-payment of taxes for nearly 3 decades.

A resolution has been filed in the Senate for the legislative chamber to investigate the non-payment of taxes for nearly 3 decades.

President Rodrigo Duterte has questioned why the BIR has failed to collect the Marcos' tax debt over the years.

President Rodrigo Duterte has questioned why the BIR has failed to collect the Marcos' tax debt over the years.

RELATED VIDEO

Read More:

Isko Moreno

Isko Moreno Domagoso

Ferdinand Marcos Jr

Ferdinand Bongbong Marcos Jr

Bongbong Marcos

Lito Banayo

estate tax

Halalan 2022

politics

Marcos tax

ADVERTISEMENT

ADVERTISEMENT