How online shopping behavior of Filipinos changed during pandemic | ABS-CBN

Welcome, Kapamilya! We use cookies to improve your browsing experience. Continuing to use this site means you agree to our use of cookies. Tell me more!

How online shopping behavior of Filipinos changed during pandemic

How online shopping behavior of Filipinos changed during pandemic

Anna Gabrielle Cerezo,

ABS-CBN News

Published Oct 14, 2020 05:02 PM PHT

MANILA -- In the new normal, the number of individuals deemed safe to gather in an area has shrunk from several thousands to a mere handful as the novel coronavirus is believed to spread primarily from person-to-person contact.

MANILA -- In the new normal, the number of individuals deemed safe to gather in an area has shrunk from several thousands to a mere handful as the novel coronavirus is believed to spread primarily from person-to-person contact.

Thus, people across the globe have turned to online shopping, a contactless alternative, to avoid catching the virus, which has infected at least 37 million citizens worldwide and killed over 1 million individuals.

Thus, people across the globe have turned to online shopping, a contactless alternative, to avoid catching the virus, which has infected at least 37 million citizens worldwide and killed over 1 million individuals.

While COVID-19 can also be acquired from touching contaminated packages and groceries ordered online, transmission can be prevented by not touching your nose, mouth, or eyes, and frequently washing your hands.

While COVID-19 can also be acquired from touching contaminated packages and groceries ordered online, transmission can be prevented by not touching your nose, mouth, or eyes, and frequently washing your hands.

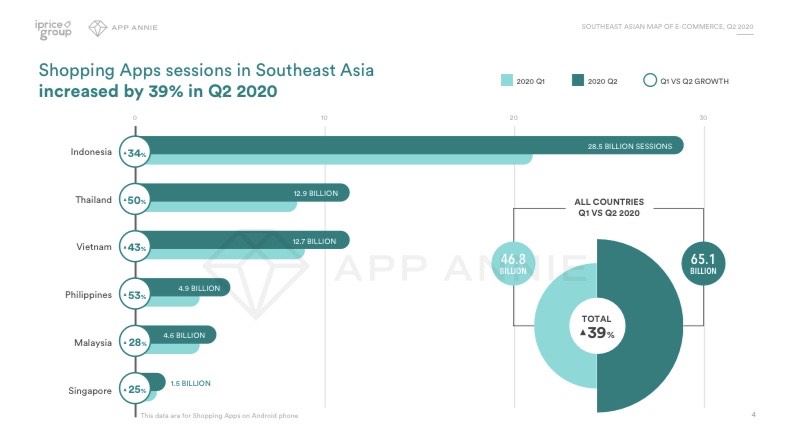

The Malaysia-based firm iPrice Group examined the shopping behavior of Southeast Asians and discovered that it has significantly shifted since the COVID-19 outbreak.

The Malaysia-based firm iPrice Group examined the shopping behavior of Southeast Asians and discovered that it has significantly shifted since the COVID-19 outbreak.

ADVERTISEMENT

IPrice noted the Philippines’ “hastened” move to the virtual landscape, in particular, was evident.

IPrice noted the Philippines’ “hastened” move to the virtual landscape, in particular, was evident.

According to the group, the total sessions or visits to shopping applications in the country climbed to approximately 4.9 billion during the lockdown period.

According to the group, the total sessions or visits to shopping applications in the country climbed to approximately 4.9 billion during the lockdown period.

Although the shopping aggregator admitted the Philippines is not as e-commerce-savvy as its Southeast Asian neighbors such as Indonesia or Singapore, its stringent lockdown accelerated the country's online economy.

Although the shopping aggregator admitted the Philippines is not as e-commerce-savvy as its Southeast Asian neighbors such as Indonesia or Singapore, its stringent lockdown accelerated the country's online economy.

“The Philippines is known to survive with cash-based transactions and brick-and-mortar stores, but perhaps its inevitable adaptation to COVID-19 will allow the country’s digital world to catch up to its more developed Southeast Asian neighbors,” iPrice explained.

“The Philippines is known to survive with cash-based transactions and brick-and-mortar stores, but perhaps its inevitable adaptation to COVID-19 will allow the country’s digital world to catch up to its more developed Southeast Asian neighbors,” iPrice explained.

The e-commerce monitor said among the SEA countries, the Philippines experienced the highest increase in the terms of shopping app usage (53 percent), as well as online spending (57 percent).

The e-commerce monitor said among the SEA countries, the Philippines experienced the highest increase in the terms of shopping app usage (53 percent), as well as online spending (57 percent).

ADVERTISEMENT

The report also stated the shift was most rampant in Filipinos aged 35-44. Data indicated that 44 percent of Pinoys in the age group bought more items online during the quarantine.

The report also stated the shift was most rampant in Filipinos aged 35-44. Data indicated that 44 percent of Pinoys in the age group bought more items online during the quarantine.

NEW NORMAL

IPrice compared the shopping behavior of Southeast Asians during the first half of 2020 and the first half of 2019 and found that the typical basket size (or amount added to an online cart) of consumers across all SEA countries “immensely” surged.

IPrice compared the shopping behavior of Southeast Asians during the first half of 2020 and the first half of 2019 and found that the typical basket size (or amount added to an online cart) of consumers across all SEA countries “immensely” surged.

The metasearch website detailed that the basket size of Filipinos grew by 57 percent — the highest among its neighbors.

The metasearch website detailed that the basket size of Filipinos grew by 57 percent — the highest among its neighbors.

On their platform alone, iPrice said Filipinos now spend an average of P1,311 a month.

On their platform alone, iPrice said Filipinos now spend an average of P1,311 a month.

As millions across the globe continue to stay at home and swap their favorite accessories for a face mask, face shield, or even a PPE, there is no doubt the new strain of coronavirus upended the fashion industry as we know it.

As millions across the globe continue to stay at home and swap their favorite accessories for a face mask, face shield, or even a PPE, there is no doubt the new strain of coronavirus upended the fashion industry as we know it.

ADVERTISEMENT

Among the all online stores in the region, the Malaysia-based firm said clothing and apparel retail sites took the biggest hit from the COVID-19 pandemic.

Among the all online stores in the region, the Malaysia-based firm said clothing and apparel retail sites took the biggest hit from the COVID-19 pandemic.

The shopping aggregator noted the average web visits of online fashion shops in every Southeast Asian nation dropped markedly. In the Philippines, the traffic collectively decreased by as much as 30 percent.

The shopping aggregator noted the average web visits of online fashion shops in every Southeast Asian nation dropped markedly. In the Philippines, the traffic collectively decreased by as much as 30 percent.

Interest in electronic devices also dwindled in most countries, except Singapore and the Philippines.

Interest in electronic devices also dwindled in most countries, except Singapore and the Philippines.

In fact, the Philippines recorded the highest increase in web visits for digital stores selling electronic devices. Figures showed that the traffic of the mentioned online stores leaped by 59 percent.

In fact, the Philippines recorded the highest increase in web visits for digital stores selling electronic devices. Figures showed that the traffic of the mentioned online stores leaped by 59 percent.

Aside from most offices shifting to a work-from-home set-up, the demand for devices may be attributed to the country's shift to a remote educational system. After the Philippine government announced students will remain barred from their classroom until a vaccine is developed, educators and over 24 million students were forced to adjust to an online and modular learning set-up.

Aside from most offices shifting to a work-from-home set-up, the demand for devices may be attributed to the country's shift to a remote educational system. After the Philippine government announced students will remain barred from their classroom until a vaccine is developed, educators and over 24 million students were forced to adjust to an online and modular learning set-up.

ADVERTISEMENT

Data collected by iPrice indicated sports and outdoor products had the highest purchase growth in Southeast Asia.

Data collected by iPrice indicated sports and outdoor products had the highest purchase growth in Southeast Asia.

The aggregator explained that orders for the aforementioned items spiked by 34 percent compared to the previous year.

The aggregator explained that orders for the aforementioned items spiked by 34 percent compared to the previous year.

The e-commerce monitor also added the average amount spent on sports and outdoor units was about US$28 or P1,361.

The e-commerce monitor also added the average amount spent on sports and outdoor units was about US$28 or P1,361.

“With restrictions imposed on outdoor and sports activities, it’s a given that consumers are adapting,” iPrice explained.

“With restrictions imposed on outdoor and sports activities, it’s a given that consumers are adapting,” iPrice explained.

ADAPTING TO THE NEW NORMAL

Since the coronavirus reshaped the consumer trends, e-commerce companies adjusted their 2020 marketing strategies to the changing needs of the public in the new normal.

Since the coronavirus reshaped the consumer trends, e-commerce companies adjusted their 2020 marketing strategies to the changing needs of the public in the new normal.

ADVERTISEMENT

E-commerce giants, for example, offered numerous free-shipping vouchers and added a number of promos on essential goods. Some local players in the Philippines, on the other hand, offered discounts on vitamins and supplements.

E-commerce giants, for example, offered numerous free-shipping vouchers and added a number of promos on essential goods. Some local players in the Philippines, on the other hand, offered discounts on vitamins and supplements.

“E-commerce players then now have a responsibility to keep encouraging this rising trend, while emerging local merchants are now presented with more potential opportunities,” the group reasoned.

“E-commerce players then now have a responsibility to keep encouraging this rising trend, while emerging local merchants are now presented with more potential opportunities,” the group reasoned.

A survey conducted by United Nations Conference of Trade and Development (UNCTAR) and Netcomm Suisse eCommerce Association in nine emerging and developed economies echoed similar results.

A survey conducted by United Nations Conference of Trade and Development (UNCTAR) and Netcomm Suisse eCommerce Association in nine emerging and developed economies echoed similar results.

Data gathered from 3,700 consumers in Brazil, China, Germany, Italy, South Korea, Russian Federation, South Africa, Switzerland and Turkey stated that over half of the participants buy online more often after the pandemic broke out.

Data gathered from 3,700 consumers in Brazil, China, Germany, Italy, South Korea, Russian Federation, South Africa, Switzerland and Turkey stated that over half of the participants buy online more often after the pandemic broke out.

The report showed online purchases surged by approximately 6 to 10 percent in most categories, with ICT/electronics, gardening/do-it-yourself, pharmaceuticals, education, furniture/household products and cosmetics/personal care benefitting the most.

The report showed online purchases surged by approximately 6 to 10 percent in most categories, with ICT/electronics, gardening/do-it-yourself, pharmaceuticals, education, furniture/household products and cosmetics/personal care benefitting the most.

ADVERTISEMENT

However, although more people relied on the digital landscape, figures revealed that actual money spent online dipped. Respondents from emerging and developed economies said they avoided “larger expenditures,” while netizens in emerging economies “focused on essentials.”

However, although more people relied on the digital landscape, figures revealed that actual money spent online dipped. Respondents from emerging and developed economies said they avoided “larger expenditures,” while netizens in emerging economies “focused on essentials.”

According to UNCTAD, the online shopping behavior that stemmed from the fallout of the crisis is likely to remain even after the pandemic ends.

According to UNCTAD, the online shopping behavior that stemmed from the fallout of the crisis is likely to remain even after the pandemic ends.

For iPrice’s full report, click here.

For iPrice’s full report, click here.

For UNCTAD’s COVID-19 and e-commerce survey, click here.

For UNCTAD’s COVID-19 and e-commerce survey, click here.

ADVERTISEMENT

ADVERTISEMENT