Inflation eases to 4.9 percent in October | ABS-CBN

Welcome, Kapamilya! We use cookies to improve your browsing experience. Continuing to use this site means you agree to our use of cookies. Tell me more!

Inflation eases to 4.9 percent in October

Inflation eases to 4.9 percent in October

ABS-CBN News

Published Nov 07, 2023 09:16 AM PHT

|

Updated Nov 07, 2023 04:44 PM PHT

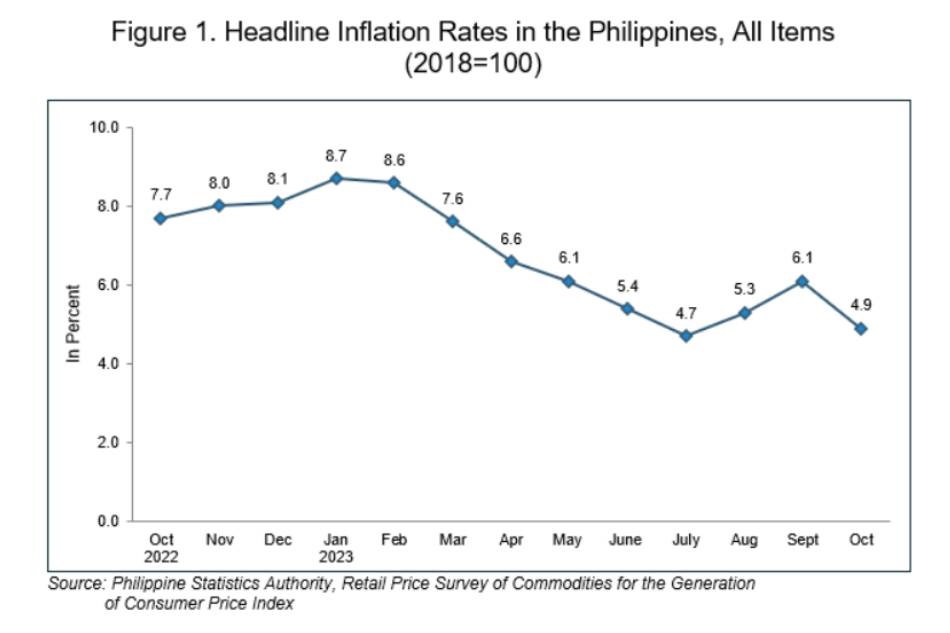

MANILA (UPDATE) -- Inflation eased in October to 4.9 percent, slower than the 6.1 percent recorded in September, according to the Philippine Statistics Authority.

MANILA (UPDATE) -- Inflation eased in October to 4.9 percent, slower than the 6.1 percent recorded in September, according to the Philippine Statistics Authority.

This was even lower than the Bangko Sentral forecast of 5.1 to 5.9 percent.

This was even lower than the Bangko Sentral forecast of 5.1 to 5.9 percent.

The PSA said this was primarily due to slower increases in prices of food and non-alcoholic drinks.

The PSA said this was primarily due to slower increases in prices of food and non-alcoholic drinks.

The PSA said this was primarily due to slower increases in the prices of food and non-alcoholic drinks.

The PSA said this was primarily due to slower increases in the prices of food and non-alcoholic drinks.

ADVERTISEMENT

“Food inflation at the national level slowed down to 7.1 percent in October 2023 from 10 percent in the previous month. In October 2022, food inflation was higher at 9.8 percent.

“Food inflation at the national level slowed down to 7.1 percent in October 2023 from 10 percent in the previous month. In October 2022, food inflation was higher at 9.8 percent.

National Statistician and Undersecretary Dennis Mapa noted that rice prices had gone down in October with the regular milled variety retailing at P45.40 per kilo compared to P47.50 in September.

National Statistician and Undersecretary Dennis Mapa noted that rice prices had gone down in October with the regular milled variety retailing at P45.40 per kilo compared to P47.50 in September.

Well-milled rice meanwhile averaged P51 a kilo in October compared to P52.70 in September.

Well-milled rice meanwhile averaged P51 a kilo in October compared to P52.70 in September.

Mapa said rice inflation was at 13.2 percent in October versus 17.9 percent in September.

Mapa said rice inflation was at 13.2 percent in October versus 17.9 percent in September.

But Mapa also acknowledged that the slower inflation last month was also partly due to “base effects” from last year when inflation was at a faster clip.

But Mapa also acknowledged that the slower inflation last month was also partly due to “base effects” from last year when inflation was at a faster clip.

ADVERTISEMENT

“So may base effect particular dun sa vegetables, mataas yung vegetables last year,” Mapa said.

“So may base effect particular dun sa vegetables, mataas yung vegetables last year,” Mapa said.

The PSA said the national average inflation from January to October was now at 6.4 percent.

The PSA said the national average inflation from January to October was now at 6.4 percent.

Core inflation, which strips out food and energy items prone to wild price swings, meanwhile fell further to 5.3 percent in October 2023 from 5.9 percent in the previous month, the agency added.

Core inflation, which strips out food and energy items prone to wild price swings, meanwhile fell further to 5.3 percent in October 2023 from 5.9 percent in the previous month, the agency added.

“This brings the average core inflation from January to October 2023 to 7 percent.”

Mapa said barring any surprises, they expect inflation to continue easing.

“This brings the average core inflation from January to October 2023 to 7 percent.”

Mapa said barring any surprises, they expect inflation to continue easing.

“Unless there is another shock, the expectation is that it will go down,” he said.

“Unless there is another shock, the expectation is that it will go down,” he said.

ADVERTISEMENT

RCBC chief economist Mike Ricafort said he shares this view.

RCBC chief economist Mike Ricafort said he shares this view.

"For as long as the better weather conditions continue on, as long as we don’t see large storm damage into the holiday season, that would still augur well for headline inflation," he said.

"For as long as the better weather conditions continue on, as long as we don’t see large storm damage into the holiday season, that would still augur well for headline inflation," he said.

"For instance, for November-December, there’s a chance that we may even see year-on-year inflation to ease a bit, to a little over 4 percent."

"For instance, for November-December, there’s a chance that we may even see year-on-year inflation to ease a bit, to a little over 4 percent."

The BSP made an off-cycle move last month, raising its benchmark rate by 25 basis points in a bid to tame inflation, which had quickened for the second straight month.

The BSP made an off-cycle move last month, raising its benchmark rate by 25 basis points in a bid to tame inflation, which had quickened for the second straight month.

The central bank is set to meet again on Thursday next week to decide if further rate hikes are needed, or if it will hit pause on further adjustments.

The central bank is set to meet again on Thursday next week to decide if further rate hikes are needed, or if it will hit pause on further adjustments.

ADVERTISEMENT

Inflation and high interest rates have been blamed for weighing down the Philippine economy, whose growth slowed below expectations in the second quarter.

Inflation and high interest rates have been blamed for weighing down the Philippine economy, whose growth slowed below expectations in the second quarter.

Ricafort said he doesn't think more rate hikes are needed at this point.

Ricafort said he doesn't think more rate hikes are needed at this point.

"There’s no urgency to hike rates for now because it’s a delicate balance. Of course, the recovery is still fragile as the economy’s dealing with the adverse effects of higher prices or inflation, so the tightening mode or the restrictive monetary policy needs to be balanced very well," he explained.

"There’s no urgency to hike rates for now because it’s a delicate balance. Of course, the recovery is still fragile as the economy’s dealing with the adverse effects of higher prices or inflation, so the tightening mode or the restrictive monetary policy needs to be balanced very well," he explained.

"And well, it may have done its part in terms managing both inflation and inflation expectations."

"And well, it may have done its part in terms managing both inflation and inflation expectations."

The National Economic and Development Authority (NEDA) said the government will continue assisting the most vulnerable sectors as El Niño lingers until mid-2024 to cushion the impacts of supply-side shocks.

The National Economic and Development Authority (NEDA) said the government will continue assisting the most vulnerable sectors as El Niño lingers until mid-2024 to cushion the impacts of supply-side shocks.

ADVERTISEMENT

"As inflation eases, it is crucial to continue monitoring the prices of commodities, particularly food, transportation, and energy, amid global challenges such as geopolitical uncertainties and El Niño," said NEDA Secretary Arsenio Balisacan.

"As inflation eases, it is crucial to continue monitoring the prices of commodities, particularly food, transportation, and energy, amid global challenges such as geopolitical uncertainties and El Niño," said NEDA Secretary Arsenio Balisacan.

Meanwhile, the Department of Finance said the government also continues to address non-competitive market behavior to help ensure that rice and vegetable inflation will further decelerate.

Meanwhile, the Department of Finance said the government also continues to address non-competitive market behavior to help ensure that rice and vegetable inflation will further decelerate.

"Efforts on warehouse investigations and forfeiture procedures, the filing of charges against market players on alleged reports of anti-competitive practices, and strict price monitoring of imported rice in the logistics chain are being doubled by the government to ensure that the lowered tariff rates do not translate to higher profit margins for importers, traders, and middlemen," the DOF said.

"Efforts on warehouse investigations and forfeiture procedures, the filing of charges against market players on alleged reports of anti-competitive practices, and strict price monitoring of imported rice in the logistics chain are being doubled by the government to ensure that the lowered tariff rates do not translate to higher profit margins for importers, traders, and middlemen," the DOF said.

Read More:

inflation

consumer price index

prices

inflation

presyo ng bilihin

core inflation

rice prices

PSA

Dennis Mapa

ADVERTISEMENT

ADVERTISEMENT