Inflation holds steady in October, below government target | ABS-CBN

ADVERTISEMENT

Welcome, Kapamilya! We use cookies to improve your browsing experience. Continuing to use this site means you agree to our use of cookies. Tell me more!

Inflation holds steady in October, below government target

Inflation holds steady in October, below government target

ABS-CBN News

Published Nov 05, 2019 09:10 AM PHT

|

Updated Nov 05, 2019 11:12 AM PHT

MANILA -- Inflation held below the government's target range for the third straight month in October, giving monetary authorities space to cut borrowing costs further.

MANILA -- Inflation held below the government's target range for the third straight month in October, giving monetary authorities space to cut borrowing costs further.

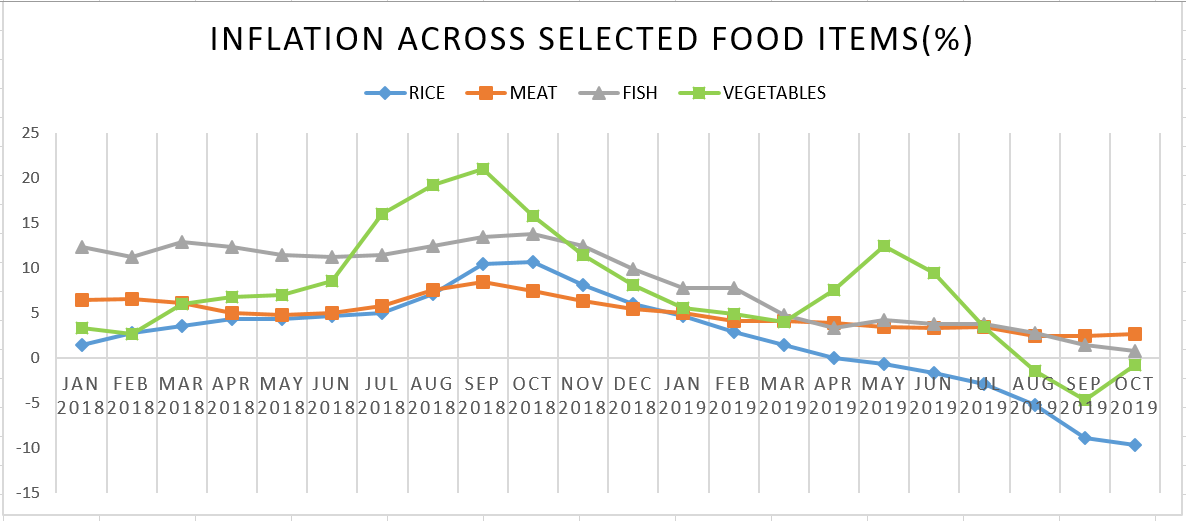

The consumer price index rose 0.8 percent in October, compared to 0.9 percent in September and the Bangko Sentral ng Pilipinas' 2 to 4 percent target. The BSP's think tank gave a 0.5 percent to 1.3 percent forecast for October.

The consumer price index rose 0.8 percent in October, compared to 0.9 percent in September and the Bangko Sentral ng Pilipinas' 2 to 4 percent target. The BSP's think tank gave a 0.5 percent to 1.3 percent forecast for October.

Inflation will remain "benign" due to relatively good weather conditions and government's efforts to address the drivers of record inflation in 2018, said ING economist Nicholas Mapa.

Inflation will remain "benign" due to relatively good weather conditions and government's efforts to address the drivers of record inflation in 2018, said ING economist Nicholas Mapa.

However, inflation could pick up to 2 to 2.3 percent next year, with oil prices and shifting demand due to African swine fever as possible drivers, said BDO Unibank chief market strategist Jonathan Ravelas.

However, inflation could pick up to 2 to 2.3 percent next year, with oil prices and shifting demand due to African swine fever as possible drivers, said BDO Unibank chief market strategist Jonathan Ravelas.

ADVERTISEMENT

The effects of a high base compared to the previous year will also ease starting in November, Ravelas said. October inflation at 0.8 percent was computed based on the 6.7-percent base recorded during the same month in 2018.

The effects of a high base compared to the previous year will also ease starting in November, Ravelas said. October inflation at 0.8 percent was computed based on the 6.7-percent base recorded during the same month in 2018.

Prices of chicken and beef started to increase, especially in swine-fever-stricken areas such as Central Luzon and Metro Manila, National Statistician Claire Dennis Mapa said.

Prices of chicken and beef started to increase, especially in swine-fever-stricken areas such as Central Luzon and Metro Manila, National Statistician Claire Dennis Mapa said.

“We were seeing that it will continue because initial data in November is still seeing upward prices particularly for chicken,” Mapa said.

“We were seeing that it will continue because initial data in November is still seeing upward prices particularly for chicken,” Mapa said.

Governor Benjamin Diokno of the Bangko Sentral said Monday there would be no more cuts in the benchmark interest rate and the reserve requirement ratio or RRR for banks for the rest of 2019.

Governor Benjamin Diokno of the Bangko Sentral said Monday there would be no more cuts in the benchmark interest rate and the reserve requirement ratio or RRR for banks for the rest of 2019.

Diokno had cut the overnight borrowing rate thrice this year, for a total 75 basis points, bringing it to 4 percent. He also brought the RRR down to 14 percent, with the aim of bringing it to "single digit" by 2023.

Diokno had cut the overnight borrowing rate thrice this year, for a total 75 basis points, bringing it to 4 percent. He also brought the RRR down to 14 percent, with the aim of bringing it to "single digit" by 2023.

ADVERTISEMENT

Mapa said monetary policy easing could resume in 2020 to help the domestic economy weather the global slowdown. ING Bank forecasts another 50-basis point cut in the first quarter, he said.

Mapa said monetary policy easing could resume in 2020 to help the domestic economy weather the global slowdown. ING Bank forecasts another 50-basis point cut in the first quarter, he said.

Diokno earlier said that an outbreak of African swine fever, which hurt pork sales, would have minimal impact on inflation.

Diokno earlier said that an outbreak of African swine fever, which hurt pork sales, would have minimal impact on inflation.

Inflation returned to target this year largely due to the implementation of a tariff-based regime to manage rice imports in place of quotas, which pushed down the price of the staple grain.

Inflation returned to target this year largely due to the implementation of a tariff-based regime to manage rice imports in place of quotas, which pushed down the price of the staple grain.

Read More:

inflation

consumer

economy

interest rates

Bangko Sentral ng Pilipinas

Benjamin Diokno

rice

pork

African swine fever

ADVERTISEMENT

ADVERTISEMENT