'As cheap as a haircut': 'Paperless' insurance to help consumers amid pandemic | ABS-CBN

ADVERTISEMENT

Welcome, Kapamilya! We use cookies to improve your browsing experience. Continuing to use this site means you agree to our use of cookies. Tell me more!

'As cheap as a haircut': 'Paperless' insurance to help consumers amid pandemic

'As cheap as a haircut': 'Paperless' insurance to help consumers amid pandemic

Jessica Fenol,

ABS-CBN News

Published Sep 05, 2020 06:19 AM PHT

|

Updated Sep 07, 2020 10:30 AM PHT

MANILA - Consumers seeking the help of digital tools during the COVID-19 pandemic can now use their mobile phones to buy select insurance products that are as cheap as a haircut or for just P30 per month, said GCash and insurer Singlife which launched their partnership on Friday.

MANILA - Consumers seeking the help of digital tools during the COVID-19 pandemic can now use their mobile phones to buy select insurance products that are as cheap as a haircut or for just P30 per month, said GCash and insurer Singlife which launched their partnership on Friday.

The partnership aims to make insurance less complicated and accessible to clients 24/7, Singlife Philippines president and CEO Rein Hermans said in a virtual briefing.

The partnership aims to make insurance less complicated and accessible to clients 24/7, Singlife Philippines president and CEO Rein Hermans said in a virtual briefing.

"Unlike all the insurance companies our distribution is direct to customers, mobile-first, using mobile phone you can buy the policy and manage it…By being digital people have accessibility 24/7," Hermans said.

"Unlike all the insurance companies our distribution is direct to customers, mobile-first, using mobile phone you can buy the policy and manage it…By being digital people have accessibility 24/7," Hermans said.

Mobile wallet operator GCash will add insurance to its rosters of services to reach the unserved and underserved Filipinos, Mynt CEO Martha Sazon said.

Mobile wallet operator GCash will add insurance to its rosters of services to reach the unserved and underserved Filipinos, Mynt CEO Martha Sazon said.

ADVERTISEMENT

The partnership will not only make micro-insurance less complicated but it will also eliminate paperworks, shorten policy application to just 5 minutes without the need for agents or to fill up forms, she said.

The partnership will not only make micro-insurance less complicated but it will also eliminate paperworks, shorten policy application to just 5 minutes without the need for agents or to fill up forms, she said.

"No complicated documentation, no going back and forth with agents, no need to invest a lot of money. Just a few taps and you’re ready to go and its the same price of a cheap haircut per month," Sazon said.

"No complicated documentation, no going back and forth with agents, no need to invest a lot of money. Just a few taps and you’re ready to go and its the same price of a cheap haircut per month," Sazon said.

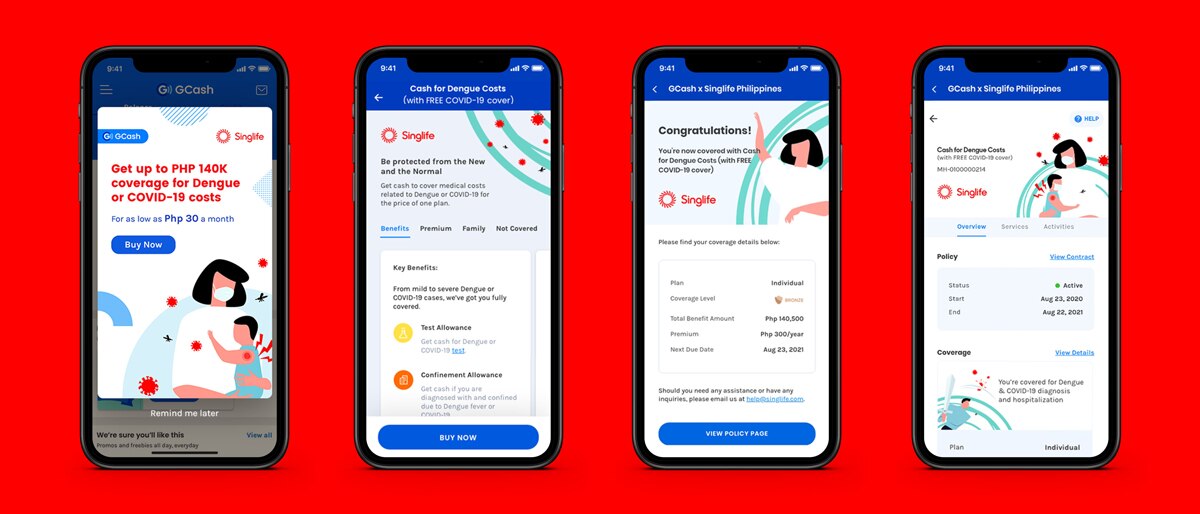

GCash and Singlife will launch their first product called "Cash for Dengue Costs" this September, an insurance product for mild to severe dengue cases, which could be purchased directly through the app.

GCash and Singlife will launch their first product called "Cash for Dengue Costs" this September, an insurance product for mild to severe dengue cases, which could be purchased directly through the app.

For its initial offer, the groups said they would add a free COVID-19 coverage which gives customers the same cash benefit as the dengue plan.

For its initial offer, the groups said they would add a free COVID-19 coverage which gives customers the same cash benefit as the dengue plan.

It has a 3-tier coverage plan at Bronze for P30 per month, Silver for P55 per month and Gold for P70 per month, said Singlife head of Digital Networks Kame Amado Gomez.

It has a 3-tier coverage plan at Bronze for P30 per month, Silver for P55 per month and Gold for P70 per month, said Singlife head of Digital Networks Kame Amado Gomez.

Plans are also "highly customizable" and flexible, Singlife said.

Plans are also "highly customizable" and flexible, Singlife said.

The product will be rolled out first to select verified GCash users this month before offering it to all verified users this year, GCash said.

Since the product is integrated into to the GCash app, consumers can just tap their phones to pay, manage, and file claims.

More products will be rolled out soon, they said. Those interested, they only need to be verified GCash users to avail. No other documents are required, GCash said.

The product will be rolled out first to select verified GCash users this month before offering it to all verified users this year, GCash said.

Since the product is integrated into to the GCash app, consumers can just tap their phones to pay, manage, and file claims.

More products will be rolled out soon, they said. Those interested, they only need to be verified GCash users to avail. No other documents are required, GCash said.

Singlife is a subsidiary of Singlife in Singapore with partners Di-Firm and Aboitiz Equity Ventures. GCash, meanwhile, is one of the country's leading mobile wallet providers with over 25 million users and over 73,000 partner merchants.

Singlife is a subsidiary of Singlife in Singapore with partners Di-Firm and Aboitiz Equity Ventures. GCash, meanwhile, is one of the country's leading mobile wallet providers with over 25 million users and over 73,000 partner merchants.

Read More:

ANC

ANC Top

GCash

Singlife

GCash partners with Singlife

Cash for Dengue Costs

mobile-first insurance

insurance

microinsurance

buy insurance via GCash

ADVERTISEMENT

ADVERTISEMENT