Inflation quickens further to 6.4 percent in July | ABS-CBN

Welcome, Kapamilya! We use cookies to improve your browsing experience. Continuing to use this site means you agree to our use of cookies. Tell me more!

Inflation quickens further to 6.4 percent in July

Inflation quickens further to 6.4 percent in July

ABS-CBN News

Published Aug 05, 2022 09:10 AM PHT

|

Updated Aug 05, 2022 02:18 PM PHT

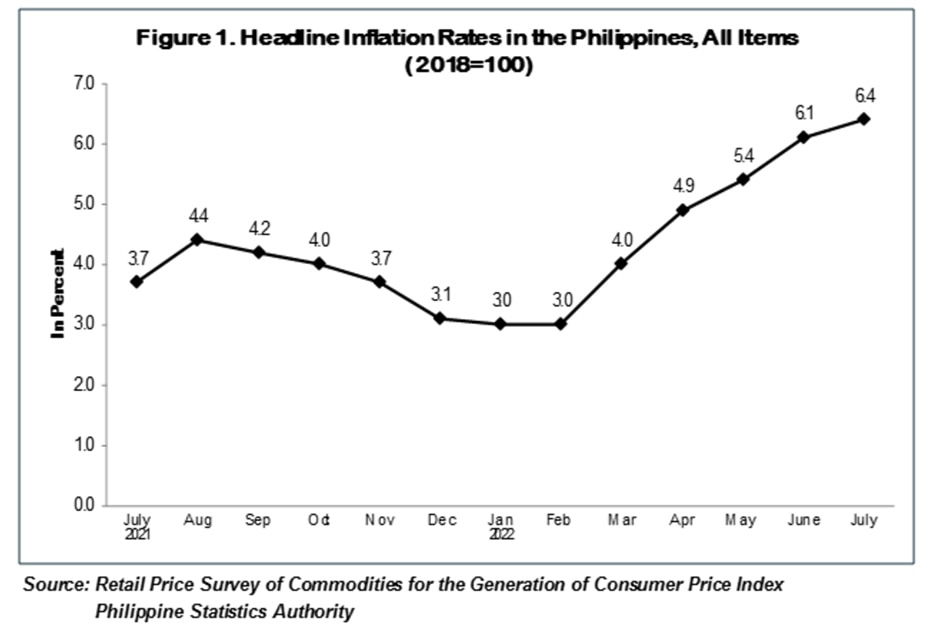

MANILA (3rd UPDATE) — Inflation in July accelerated further to 6.4 percent due to higher transport costs and select food prices, among others, the state statistics bureau said Friday.

MANILA (3rd UPDATE) — Inflation in July accelerated further to 6.4 percent due to higher transport costs and select food prices, among others, the state statistics bureau said Friday.

July's inflation was higher than June's 6.1 percent but within the top band of the Bangko Sentral ng Pilipinas' forecast of 5.6 to 6.4 percent, according to data released by the Philippine Statistics Authority.

July's inflation was higher than June's 6.1 percent but within the top band of the Bangko Sentral ng Pilipinas' forecast of 5.6 to 6.4 percent, according to data released by the Philippine Statistics Authority.

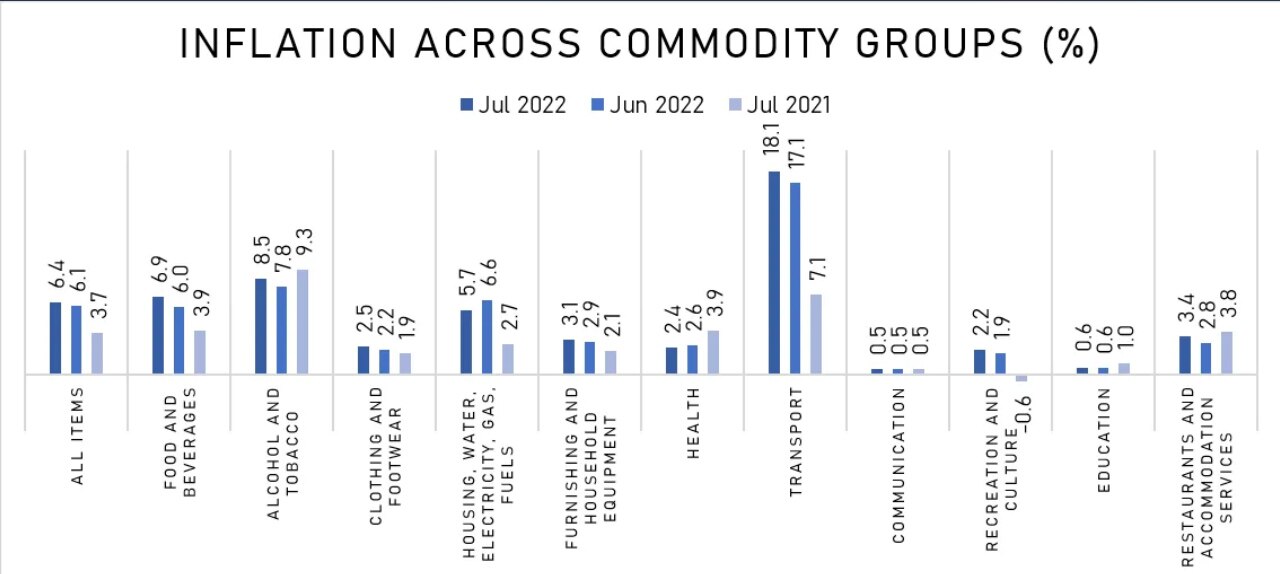

"Ang dahilan ng mas mataas na inflation ngayong Hulyo 2022 ay ang mabilis na pagtaas ng presyo ng food and non-alcoholic beverages," National Statistician Dennis Mapa said in a briefing.

"Ang dahilan ng mas mataas na inflation ngayong Hulyo 2022 ay ang mabilis na pagtaas ng presyo ng food and non-alcoholic beverages," National Statistician Dennis Mapa said in a briefing.

(The reason for the rise in inflation in July is the faster increase in prices of food and non-alcoholic beverages)

(The reason for the rise in inflation in July is the faster increase in prices of food and non-alcoholic beverages)

ADVERTISEMENT

"Ang pangalawang commodity group na nagpakita ng mas mataas na inflation ay ang transport...ang pangatlong commodity group ay restaurant and accommodation services," he added.

"Ang pangalawang commodity group na nagpakita ng mas mataas na inflation ay ang transport...ang pangatlong commodity group ay restaurant and accommodation services," he added.

(The second commodity group that showed faster increase in inflation was transport, the third group was restaurant and accommodation services.)

(The second commodity group that showed faster increase in inflation was transport, the third group was restaurant and accommodation services.)

Food and beverage registered 6.9 percent inflation and a 64 percent share in the overall headline inflation, Mapa said. Transport posted 18.1 inflation while restaurant and accommodation services had 3.4 percent inflation, he added.

Food and beverage registered 6.9 percent inflation and a 64 percent share in the overall headline inflation, Mapa said. Transport posted 18.1 inflation while restaurant and accommodation services had 3.4 percent inflation, he added.

From January to July, the average inflation is at 4.7 percent, above the government target of 2 to 4 percent.

From January to July, the average inflation is at 4.7 percent, above the government target of 2 to 4 percent.

July's figure is consistent with the BSP's assessment of elevated price pressures over the near term, the central bank said in a statement.

July's figure is consistent with the BSP's assessment of elevated price pressures over the near term, the central bank said in a statement.

ADVERTISEMENT

"The BSP recognizes the broadening of price pressures amid the emergence of second-round effects, including the approved wage and fare hikes as well as elevated inflation expectations," it said.

"The BSP recognizes the broadening of price pressures amid the emergence of second-round effects, including the approved wage and fare hikes as well as elevated inflation expectations," it said.

Inflation could remain elevated for the rest of the year due to price pressures from global uncertainties such as the Ukraine war, the slowdown in China, disruptions in the global supply chain, and the US Federal Reserve's aggressive tightening of policy rates, the BSP earlier said.

Inflation could remain elevated for the rest of the year due to price pressures from global uncertainties such as the Ukraine war, the slowdown in China, disruptions in the global supply chain, and the US Federal Reserve's aggressive tightening of policy rates, the BSP earlier said.

Some analysts said inflation could even breach the 7 percent mark in the second half of the year. Mapa said it's difficult to say if the July figure was the peak.

Some analysts said inflation could even breach the 7 percent mark in the second half of the year. Mapa said it's difficult to say if the July figure was the peak.

BPI lead economist Jun Neri said inflation could remain a challenge until first half of 2023.

BPI lead economist Jun Neri said inflation could remain a challenge until first half of 2023.

"We have yet to see the peak in inflation near 7 percent in October should global price pressures from oil, energy and food remain substantial," Neri said.

"We have yet to see the peak in inflation near 7 percent in October should global price pressures from oil, energy and food remain substantial," Neri said.

ADVERTISEMENT

Another interest rate hike is also seen as prices remain elevated, both Neri and Fitch Ratings Fitch Ratings Director for APAC Banks Willie Tanoto said Friday.

Another interest rate hike is also seen as prices remain elevated, both Neri and Fitch Ratings Fitch Ratings Director for APAC Banks Willie Tanoto said Friday.

The BSP has so far hiked its benchmark rate by 125-basis points to tame inflation. The off-cycle adjustment in July brought the key policy rate to 3.25 percent.

The BSP has so far hiked its benchmark rate by 125-basis points to tame inflation. The off-cycle adjustment in July brought the key policy rate to 3.25 percent.

BSP Governor Felipe Medalla has said another 50 or 75 bps hike is possible in the Monetary Board's Aug. 18 meeting.

BSP Governor Felipe Medalla has said another 50 or 75 bps hike is possible in the Monetary Board's Aug. 18 meeting.

Socioeconomic Planning Secretary Arsenio Balisacan said the P4.1 billion fund for the Targeted Cash Transfer (TCT) was meant to ease the burden for the poor Filipinos.

Socioeconomic Planning Secretary Arsenio Balisacan said the P4.1 billion fund for the Targeted Cash Transfer (TCT) was meant to ease the burden for the poor Filipinos.

“In our near-term socioeconomic agenda, we want to ensure that there’s sufficient and healthy food on the table of every Filipino. We are also helping reduce energy, transport, and logistics costs, especially for vulnerable sectors of our population," he said during the inflation briefing.

“In our near-term socioeconomic agenda, we want to ensure that there’s sufficient and healthy food on the table of every Filipino. We are also helping reduce energy, transport, and logistics costs, especially for vulnerable sectors of our population," he said during the inflation briefing.

ADVERTISEMENT

"It is our urgent priority to ease price pressures and protect the public’s purchasing power through the implementation of programs that will help Filipinos cope with the effects of higher inflation rate," he added.

"It is our urgent priority to ease price pressures and protect the public’s purchasing power through the implementation of programs that will help Filipinos cope with the effects of higher inflation rate," he added.

Meanwhile, both Medalla and Finance Secretary Benjamin Diokno said the economy was robust enough to absorb the impact of the recent interest rate hikes.

Meanwhile, both Medalla and Finance Secretary Benjamin Diokno said the economy was robust enough to absorb the impact of the recent interest rate hikes.

BPI lead economist Jun Neri earlier said the economy grew at an average of 6 percent for 10 years prior to the pandemic even though the average interest rate was close to 4 percent.

BPI lead economist Jun Neri earlier said the economy grew at an average of 6 percent for 10 years prior to the pandemic even though the average interest rate was close to 4 percent.

— With a report from Jessica Fenol and Warren De Guzman, ABS-CBN News

RELATED VIDEO:

Read More:

inflation

food and drinks

fuel prices

oil prices

consumer price index

CPI

transport fare

interest rate

ADVERTISEMENT

ADVERTISEMENT