ANALYSIS: FDI and remittance flows into the Philippines are drying up | ABS-CBN

ADVERTISEMENT

Welcome, Kapamilya! We use cookies to improve your browsing experience. Continuing to use this site means you agree to our use of cookies. Tell me more!

ANALYSIS: FDI and remittance flows into the Philippines are drying up

ANALYSIS: FDI and remittance flows into the Philippines are drying up

Warren de Guzman and Edson Guido,

ABS-CBN Data Analytics

Published Jul 22, 2020 06:59 PM PHT

|

Updated Jul 22, 2020 07:09 PM PHT

MANILA -- Foreign Direct Investments (FDIs) entering into the Philippines are drying up at an alarming rate. Data from the Bangko Sentral ng Pilipinas shows FDI inflows declined by 67.9 percent year on year in April.

MANILA -- Foreign Direct Investments (FDIs) entering into the Philippines are drying up at an alarming rate. Data from the Bangko Sentral ng Pilipinas shows FDI inflows declined by 67.9 percent year on year in April.

April’s drop in FDI inflows is much worse than the 18.5 percent year on year decline in FDI seen in March, and it brings the 4-month total for the January to April period to $1.98 billion, down 32.1 percent year-on-year (YoY).

April’s drop in FDI inflows is much worse than the 18.5 percent year on year decline in FDI seen in March, and it brings the 4-month total for the January to April period to $1.98 billion, down 32.1 percent year-on-year (YoY).

BSP data show foreign investors are shying away from Philippine debt instruments, new direct investment, and reinvestment of earnings. Debt instrument investment inflows fell 73.2 percent in April.

BSP data show foreign investors are shying away from Philippine debt instruments, new direct investment, and reinvestment of earnings. Debt instrument investment inflows fell 73.2 percent in April.

This is in line with the call of global investment management company, BlackRock, which underweight all emerging markets, including the Philippines.

This is in line with the call of global investment management company, BlackRock, which underweight all emerging markets, including the Philippines.

ADVERTISEMENT

This may create a fundraising problem for Filipino companies seeking investors or credit from abroad, as well as the big infrastructure projects of the government under Build Build Build. A dearth in foreign investment would also mean less job creation.

This may create a fundraising problem for Filipino companies seeking investors or credit from abroad, as well as the big infrastructure projects of the government under Build Build Build. A dearth in foreign investment would also mean less job creation.

The BSP puts the blame squarely on the COVID-19 outbreak. It said “the slowdown in FDI inflows reflected the continued weak global and domestic demand prospects prompting many investors to put on hold investment plans amid the unresolved COVID-19 pandemic.”

The BSP puts the blame squarely on the COVID-19 outbreak. It said “the slowdown in FDI inflows reflected the continued weak global and domestic demand prospects prompting many investors to put on hold investment plans amid the unresolved COVID-19 pandemic.”

NET FDI INFLOWS

FDI has never been a strength of the Philippines, but it has made some headway in recent years, with annual FDI hitting a record $10.3 billion in 2017 before regressing over the last two years. 2019’s total FDI inflows amounted to $7.6B.

FDI has never been a strength of the Philippines, but it has made some headway in recent years, with annual FDI hitting a record $10.3 billion in 2017 before regressing over the last two years. 2019’s total FDI inflows amounted to $7.6B.

GDP GROWTH RATE

If we look at this chart with quarterly GDP growth, we see foreign direct investment’s decline over 2018 and 2019 did not directly result in a big drop in economic activity.

If we look at this chart with quarterly GDP growth, we see foreign direct investment’s decline over 2018 and 2019 did not directly result in a big drop in economic activity.

This could be attributed to massive spending by the Philippine government under the Duterte administration, as well as aggressive investment by Filipino businesses.

This could be attributed to massive spending by the Philippine government under the Duterte administration, as well as aggressive investment by Filipino businesses.

ADVERTISEMENT

However, the downtrend in FDI started in February, and the first quarter of the year was when the Philippine economy contracted by 0.2 percent, the first economic contraction since 1998.

However, the downtrend in FDI started in February, and the first quarter of the year was when the Philippine economy contracted by 0.2 percent, the first economic contraction since 1998.

Meanwhile, cash remittances from overseas Filipinos coursed through banks hit $9.448 billion in the January to April 2020 period, 3 percent lower than the $9.739 billion accumulated in the same period in 2019.

Meanwhile, cash remittances from overseas Filipinos coursed through banks hit $9.448 billion in the January to April 2020 period, 3 percent lower than the $9.739 billion accumulated in the same period in 2019.

The decline in April alone was much steeper, at 16.2 percent. Overseas Filipinos remitted $2.046 billion in cash in April 2020 versus $2.441 billion in 2019.

The decline in April alone was much steeper, at 16.2 percent. Overseas Filipinos remitted $2.046 billion in cash in April 2020 versus $2.441 billion in 2019.

The BSP attributes the decline to the unexpected repatriation of overseas Filipinos deployed in countries heavily affected by the pandemic, and the temporary closure/limited operating hours of banks and institutions preventing the sending and receiving of money.

The BSP attributes the decline to the unexpected repatriation of overseas Filipinos deployed in countries heavily affected by the pandemic, and the temporary closure/limited operating hours of banks and institutions preventing the sending and receiving of money.

CASH REMITTANCES

The central bank expects this trend to continue, resulting in a 5 percent drop in total remittances for 2020. That will translate to a $1.5B reduction from the $30.1B cash remittance total of 2019.

The central bank expects this trend to continue, resulting in a 5 percent drop in total remittances for 2020. That will translate to a $1.5B reduction from the $30.1B cash remittance total of 2019.

ADVERTISEMENT

Looking at the unexpected repatriation of overseas Filipino workers, we see the number has exceeded 60,000, as of July 16.

Looking at the unexpected repatriation of overseas Filipino workers, we see the number has exceeded 60,000, as of July 16.

OWWA COVID-10 RELATED ASSISTANCE TO OFWs

That total is small compared to the Philippine Overseas Employment Administration data on total deployment over the last few years, where new hires deployed in just one semester can reach hundreds of thousands.

That total is small compared to the Philippine Overseas Employment Administration data on total deployment over the last few years, where new hires deployed in just one semester can reach hundreds of thousands.

DEPLOYED OVERSEAS FILIPINO WORKERS

The Department of Labor and Employment (DOLE) has its own estimates on just how many OFWs are affected, and how steep the fall in remittances will be due to the COVID-19 pandemic.

The Department of Labor and Employment (DOLE) has its own estimates on just how many OFWs are affected, and how steep the fall in remittances will be due to the COVID-19 pandemic.

“Based on the number of repatriations we are getting and on the number of displaced OFWs, we are expecting a reduction of 30 percent to 40 percent,” Labor Secretary Silvestre Bello said.

“Based on the number of repatriations we are getting and on the number of displaced OFWs, we are expecting a reduction of 30 percent to 40 percent,” Labor Secretary Silvestre Bello said.

Bello told senators in June that around 400,000 overseas Filipinos have been laid off in various countries hit by COVID-19.

Bello told senators in June that around 400,000 overseas Filipinos have been laid off in various countries hit by COVID-19.

ADVERTISEMENT

DOLE’s forecast 30 percent to 40 percent decline in remittances is huge compared to the BSP’s forecast of a 5 percent drop.

DOLE’s forecast 30 percent to 40 percent decline in remittances is huge compared to the BSP’s forecast of a 5 percent drop.

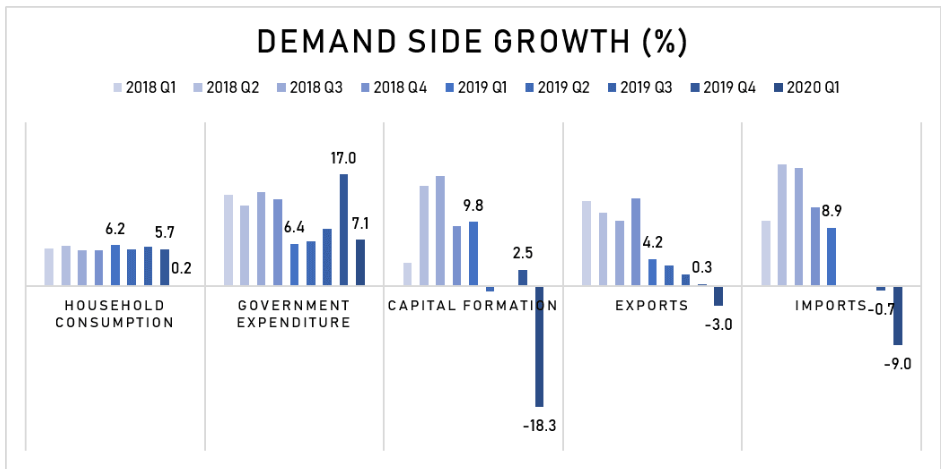

DEMAND-SIDE GROWTH

Going back to demand-side growth in the first quarter of 2020, we see household consumption grew by just 0.2 percent in that period after averaging around 5 percent growth or better over several quarters.

Going back to demand-side growth in the first quarter of 2020, we see household consumption grew by just 0.2 percent in that period after averaging around 5 percent growth or better over several quarters.

Overseas remittances are a big part of that, fueling consumer demand for basic necessities, services such as internet and wireless connectivity, and even real estate.

Overseas remittances are a big part of that, fueling consumer demand for basic necessities, services such as internet and wireless connectivity, and even real estate.

Improving financial literacy among overseas Filipinos also means they are investing their remittances in businesses, creating employment and other positive multiplier effects.

Improving financial literacy among overseas Filipinos also means they are investing their remittances in businesses, creating employment and other positive multiplier effects.

GDP GROWTH RATE

This again helps explain the contraction in the first quarter of 2020 which we saw in the GDP chart. The slowdown in household consumption, coupled with a significant drop in investment, led to the contraction.

This again helps explain the contraction in the first quarter of 2020 which we saw in the GDP chart. The slowdown in household consumption, coupled with a significant drop in investment, led to the contraction.

ADVERTISEMENT

But there is some good news here. The last time remittances from overseas Filipinos contracted was in 2001, when it slipped by 0.3 percent. A bigger contraction in remittances was felt in 1999 when it declined by 18.3 percent.

But there is some good news here. The last time remittances from overseas Filipinos contracted was in 2001, when it slipped by 0.3 percent. A bigger contraction in remittances was felt in 1999 when it declined by 18.3 percent.

These contractions did not register in the chart of Philippine GDP growth. Here 1999 looks like a strong rebound from the aftereffects of the 1997 Asian Financial Crisis. 2001 meanwhile looks a bit stagnant, but the economy did not contract.

These contractions did not register in the chart of Philippine GDP growth. Here 1999 looks like a strong rebound from the aftereffects of the 1997 Asian Financial Crisis. 2001 meanwhile looks a bit stagnant, but the economy did not contract.

This suggests the 18.3 percent contraction in capital formation, or new business investment in the first quarter, played a bigger role compared to sliding remittances.

This suggests the 18.3 percent contraction in capital formation, or new business investment in the first quarter, played a bigger role compared to sliding remittances.

But then again, we don’t know how much remittances were meant for investment in OF family businesses, and Foreign Direct Investment Inflows won’t likely be reliable anytime soon.

But then again, we don’t know how much remittances were meant for investment in OF family businesses, and Foreign Direct Investment Inflows won’t likely be reliable anytime soon.

CASH REMITTANCES GROWTH

The chart above shows remittance growth by itself. Again it doesn’t track GDP growth at all. In fact, the growth has been slower since 2015.

The chart above shows remittance growth by itself. Again it doesn’t track GDP growth at all. In fact, the growth has been slower since 2015.

ADVERTISEMENT

This tells us the 5 percent decline in remittances forecast by the BSP is not likely a big cause of concern for the government, even though there are millions of Filipinos depending on those remittances. Overall, the economy, as demonstrated by the data, can grow even with flat or declining remittances.

This tells us the 5 percent decline in remittances forecast by the BSP is not likely a big cause of concern for the government, even though there are millions of Filipinos depending on those remittances. Overall, the economy, as demonstrated by the data, can grow even with flat or declining remittances.

UNEMPLOYMENT RATE/UNDEREMPLOYMENT RATE

The key here will be unemployment. That metric is already at a record high of 17.7 percent in April, and there are 7.3 million unemployed Filipinos in the country, not counting those who gave up looking for work.

The key here will be unemployment. That metric is already at a record high of 17.7 percent in April, and there are 7.3 million unemployed Filipinos in the country, not counting those who gave up looking for work.

DOLE itself expects the POEA’s running total of 61,000 repatriated overseas Filipinos to swell due to the poor state of the international job market. The International Monetary Fund says the world economy will contract 4.9 percent this year. An influx of unemployed Filipinos from overseas, and the absence of FDI inflows, could result in higher unemployment for a longer period.

DOLE itself expects the POEA’s running total of 61,000 repatriated overseas Filipinos to swell due to the poor state of the international job market. The International Monetary Fund says the world economy will contract 4.9 percent this year. An influx of unemployed Filipinos from overseas, and the absence of FDI inflows, could result in higher unemployment for a longer period.

The government is looking to tackle the employment problem by ramping up government spending and investment in infrastructure through Build, Build, Build.

The government is looking to tackle the employment problem by ramping up government spending and investment in infrastructure through Build, Build, Build.

It expects this will also offset any decline in spending by households and businesses of overseas Filipinos. The government is also leaning on a record high in gross international reserves (GIR) to protect the Philippines from external shocks.

It expects this will also offset any decline in spending by households and businesses of overseas Filipinos. The government is also leaning on a record high in gross international reserves (GIR) to protect the Philippines from external shocks.

ADVERTISEMENT

As of May, the total GIR is at $90.94 billion, good for 8 months of imports. This however was bolstered by foreign borrowings, as well as lower spending on imports due to COVID-19’s effects on global trade.

As of May, the total GIR is at $90.94 billion, good for 8 months of imports. This however was bolstered by foreign borrowings, as well as lower spending on imports due to COVID-19’s effects on global trade.

Other sectors expected to help with employment are business process outsourcing (BPO), which has seen an increase in demand from global corporations looking to cut costs.

Other sectors expected to help with employment are business process outsourcing (BPO), which has seen an increase in demand from global corporations looking to cut costs.

Many of these BPOs however are part of international organizations, and the drop in FDI, specifically reinvestment of earnings, is troubling.

Many of these BPOs however are part of international organizations, and the drop in FDI, specifically reinvestment of earnings, is troubling.

Until we see more data on FDI inflows, remittance and overseas Filipino repatriation, it will be unclear how big of a hole needs filling.

Until we see more data on FDI inflows, remittance and overseas Filipino repatriation, it will be unclear how big of a hole needs filling.

Read More:

BSP

Remittances

Economy

COVID-19

Recovery

Foreign Direct Investment

FDIs

OFWs

Philippine foreign direct investments

ADVERTISEMENT

ADVERTISEMENT