SSS flags employers with delinquencies in contributions | ABS-CBN

ADVERTISEMENT

Welcome, Kapamilya! We use cookies to improve your browsing experience. Continuing to use this site means you agree to our use of cookies. Tell me more!

Business

SSS flags employers with delinquencies in contributions

SSS flags employers with delinquencies in contributions

Jervis Manahan,

ABS-CBN News

Published Jul 08, 2022 06:02 PM PHT

MANILA - The Social Security System (SSS) has issued show-cause orders to several employers who have delinquencies in contributions.

MANILA - The Social Security System (SSS) has issued show-cause orders to several employers who have delinquencies in contributions.

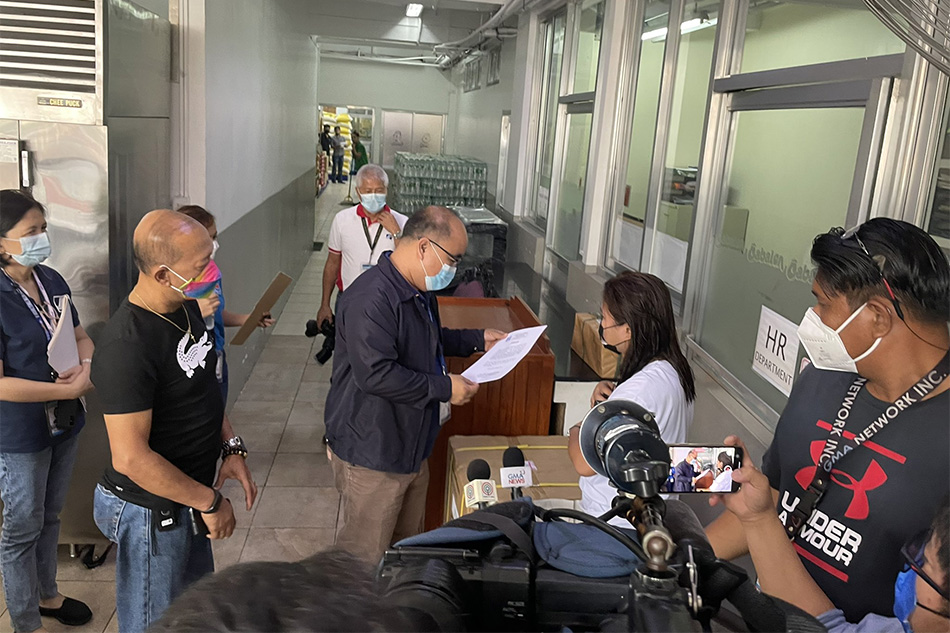

The agency conducted on Friday the "Run After Contribution Evaders" or RACE program in Cubao, Quezon City, where officials of the agency talked to employers to remind them to settle their delinquencies.

The agency conducted on Friday the "Run After Contribution Evaders" or RACE program in Cubao, Quezon City, where officials of the agency talked to employers to remind them to settle their delinquencies.

"Ito'y hindi naman para pwersahin sila, we're not putting them to shame. Ito ay pagbibigay ng relief affordable to challenged employers dahil nalaman namin maraming employers na naapektuhan ng pandemic," said Voltaire Agas, EVP for Branch Operations Sector of the agency.

"Ito'y hindi naman para pwersahin sila, we're not putting them to shame. Ito ay pagbibigay ng relief affordable to challenged employers dahil nalaman namin maraming employers na naapektuhan ng pandemic," said Voltaire Agas, EVP for Branch Operations Sector of the agency.

(This is not to force them, we're not putting them to shame. This is to give relief to challenged employers because we know many of them were affected by the pandemic.)

(This is not to force them, we're not putting them to shame. This is to give relief to challenged employers because we know many of them were affected by the pandemic.)

ADVERTISEMENT

Among those who were served orders were a restaurant group, a salon, an industrial supply company, and a franchise of a popular convenience store.

Among those who were served orders were a restaurant group, a salon, an industrial supply company, and a franchise of a popular convenience store.

The erring employers have delinquencies in employee contribution ranging from P63,000 to P2.8 million. Some had gaps in contribution since 2007.

The erring employers have delinquencies in employee contribution ranging from P63,000 to P2.8 million. Some had gaps in contribution since 2007.

Agas said they are merely reminding employers to follow the law.

Agas said they are merely reminding employers to follow the law.

"Gusto lang mapaalalahanan ang emloyers na nakakalimot maghulog para magtuloy na ang hulog kasi apektado sa pagkuha ng benefits ang members," he said.

"Gusto lang mapaalalahanan ang emloyers na nakakalimot maghulog para magtuloy na ang hulog kasi apektado sa pagkuha ng benefits ang members," he said.

(We just want to remind employers who forget to make contributions because this will affect members' benefits.)

(We just want to remind employers who forget to make contributions because this will affect members' benefits.)

Two representatives of the employers received the order but declined to comment, one representative assured SSS officials that they will be fixing contributions, while the business of one employer was closed.

Two representatives of the employers received the order but declined to comment, one representative assured SSS officials that they will be fixing contributions, while the business of one employer was closed.

SSS Head of Public Affairs Fernan Nicolas said the non-payment of contributions will mean employees will not be able to apply for loans, and will have trouble accessing their benefits, as the eligibility for loans is based from their monthly contributions.

SSS Head of Public Affairs Fernan Nicolas said the non-payment of contributions will mean employees will not be able to apply for loans, and will have trouble accessing their benefits, as the eligibility for loans is based from their monthly contributions.

"Ang epekto nito, hindi makakapagloan ang mga empleyado, o madedelay ang benepisyo, kasi nakabase ito sa contribution nila sa records namin," Nicolas said.

"Ang epekto nito, hindi makakapagloan ang mga empleyado, o madedelay ang benepisyo, kasi nakabase ito sa contribution nila sa records namin," Nicolas said.

(The effect of this is employees can't avail of loans or their benefits will be delayed because it's based on their contributions on our records.)

(The effect of this is employees can't avail of loans or their benefits will be delayed because it's based on their contributions on our records.)

The employers were given 15 days to coordinate with the SSS office.

The employers were given 15 days to coordinate with the SSS office.

SSS offered the delinquent employers relief, with their enhanced installment program.

SSS offered the delinquent employers relief, with their enhanced installment program.

Under this program, SSS will provide employers a scheme where they can pay their delinquencies for a period of 60 months, or 5 years.

Under this program, SSS will provide employers a scheme where they can pay their delinquencies for a period of 60 months, or 5 years.

"Mas pinalawig yung payment period, mas hinabaan ang payment term to 60 months para mas maluwag sa pagbabayad ng employers," he said.

"Mas pinalawig yung payment period, mas hinabaan ang payment term to 60 months para mas maluwag sa pagbabayad ng employers," he said.

(The payment period was extended. The payment term was extended to 60 months so employers have leeway.)

(The payment period was extended. The payment term was extended to 60 months so employers have leeway.)

Repeated failure to coordinate with SSS to settle delinquencies could lead to legal action. If found guilty, employers face 6-12 years of jail time.

Repeated failure to coordinate with SSS to settle delinquencies could lead to legal action. If found guilty, employers face 6-12 years of jail time.

Nicolas encouraged employees to be vigilant if their employers have been regularly settling contributions. They can track contributions online, through the SSS website.

Nicolas encouraged employees to be vigilant if their employers have been regularly settling contributions. They can track contributions online, through the SSS website.

If they find out that their employers are not settling their dues, they can ask for assistance in SSS offices.

If they find out that their employers are not settling their dues, they can ask for assistance in SSS offices.

This is the 78th nationwide RACE program SSS conducted. Of the 50 employers served notices by the North Division in the past, 90% or 45 employers actually settled delinquencies.

This is the 78th nationwide RACE program SSS conducted. Of the 50 employers served notices by the North Division in the past, 90% or 45 employers actually settled delinquencies.

The social security agency has 41 million members, with 16 million actively paying, and 3 million pensioners.

The social security agency has 41 million members, with 16 million actively paying, and 3 million pensioners.

FROM THE ARCHIVES

ADVERTISEMENT

ADVERTISEMENT