Duterte wants new bill after vetoing parts of Tax Amnesty Act | ABS-CBN

Welcome, Kapamilya! We use cookies to improve your browsing experience. Continuing to use this site means you agree to our use of cookies. Tell me more!

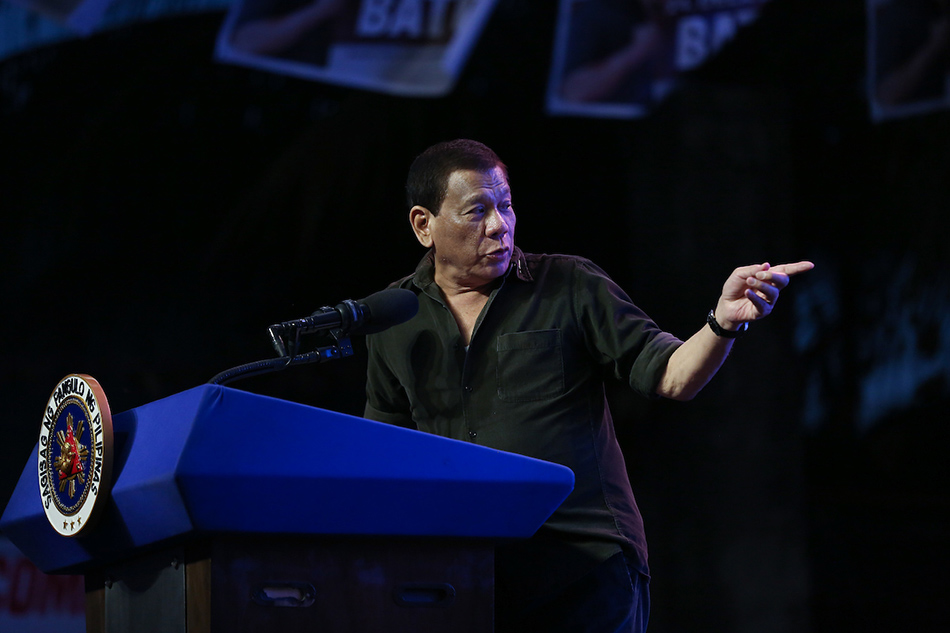

Duterte wants new bill after vetoing parts of Tax Amnesty Act

Duterte wants new bill after vetoing parts of Tax Amnesty Act

Pia Gutierrez,

ABS-CBN News

Published Feb 18, 2019 07:59 PM PHT

MANILA - President Rodrigo Duterte on Monday called on Congress to pass another general tax amnesty bill which would include the lifting of bank secrecy for cases of fraud.

MANILA - President Rodrigo Duterte on Monday called on Congress to pass another general tax amnesty bill which would include the lifting of bank secrecy for cases of fraud.

This comes after the Chief Executive issued a partial veto of the Tax Amnesty Act of 2019.

This comes after the Chief Executive issued a partial veto of the Tax Amnesty Act of 2019.

The President said, "a general amnesty that is overgenerous and unregulated would create an environment ripe for future tax evasion.”

The President said, "a general amnesty that is overgenerous and unregulated would create an environment ripe for future tax evasion.”

President Duterte also called on Congress to include safeguards to ensure the truthfulness of asset or net worth declarations, as well as the automatic exchange of information.

President Duterte also called on Congress to include safeguards to ensure the truthfulness of asset or net worth declarations, as well as the automatic exchange of information.

ADVERTISEMENT

“Without these measures, the government and ultimately the Filipino people will incur long term substantial revenue losses," President Duterte said.

“Without these measures, the government and ultimately the Filipino people will incur long term substantial revenue losses," President Duterte said.

The President also vetoed a provision allowing a one-time declaration and settlement of estate taxes on properties that are in the name of persons who died or donors whose estates remain unsettled.

The President also vetoed a provision allowing a one-time declaration and settlement of estate taxes on properties that are in the name of persons who died or donors whose estates remain unsettled.

He also struck down a provision presuming that estate tax amnesty returns filed in availing of the amnesty are true, correct and final, and complete upon full payment of the amnesty tax.

He also struck down a provision presuming that estate tax amnesty returns filed in availing of the amnesty are true, correct and final, and complete upon full payment of the amnesty tax.

According to Malacanang, the Tax Amnesty Act of 2019 is meant to complement the Tax Reform for Acceleration and Inclusion or TRAIN law, as it will allow the government to raise revenues for priority infrastructure and social programs while unburdening those with past tax liabilities.

According to Malacanang, the Tax Amnesty Act of 2019 is meant to complement the Tax Reform for Acceleration and Inclusion or TRAIN law, as it will allow the government to raise revenues for priority infrastructure and social programs while unburdening those with past tax liabilities.

ADVERTISEMENT

ADVERTISEMENT