Dissecting Data: Remittances defy bleak forecasts but still fall in 2020 | ABS-CBN

ADVERTISEMENT

Welcome, Kapamilya! We use cookies to improve your browsing experience. Continuing to use this site means you agree to our use of cookies. Tell me more!

Dissecting Data: Remittances defy bleak forecasts but still fall in 2020

Dissecting Data: Remittances defy bleak forecasts but still fall in 2020

Warren de Guzman and Edson Guido,

ABS-CBN News

Published Feb 16, 2021 04:23 PM PHT

MANILA - In April 2020, near the height of lockdowns and quarantines ordered to check the spread of COVID-19, the World Bank said “Global remittances are projected to decline sharply by about 20 percent in 2020 due to the economic crisis induced by the COVID-19 pandemic and shutdown.”

MANILA - In April 2020, near the height of lockdowns and quarantines ordered to check the spread of COVID-19, the World Bank said “Global remittances are projected to decline sharply by about 20 percent in 2020 due to the economic crisis induced by the COVID-19 pandemic and shutdown.”

The Asian Development Bank made a similar forecast for the Philippines, assuming a worst case scenario.

The Asian Development Bank made a similar forecast for the Philippines, assuming a worst case scenario.

“Because we see a second wave in many countries, like the Philippines, we feel the most realistic scenario is the worst case scenario,” said ADB senior economist James Villafuerte, who co-authored a study on remittances with economist Aiko Kikkawa Takenaka of the Japan International Cooperation Agency.

“Because we see a second wave in many countries, like the Philippines, we feel the most realistic scenario is the worst case scenario,” said ADB senior economist James Villafuerte, who co-authored a study on remittances with economist Aiko Kikkawa Takenaka of the Japan International Cooperation Agency.

The study forecast remittances falling by 23 to 32 percent in 2020, relative to levels before the pandemic, due to economic shocks in host economies.

The study forecast remittances falling by 23 to 32 percent in 2020, relative to levels before the pandemic, due to economic shocks in host economies.

ADVERTISEMENT

The Philippine Central Bank’s own forecast after considering the impact of the COVID-19 pandemic, was a contraction of 5 percent in remittances. The Department of Labor forecast a contraction of 30 to 40 percent in remittances, to account for hundreds of thousands of overseas Filipinos who would lose their jobs due to the pandemic.

The Philippine Central Bank’s own forecast after considering the impact of the COVID-19 pandemic, was a contraction of 5 percent in remittances. The Department of Labor forecast a contraction of 30 to 40 percent in remittances, to account for hundreds of thousands of overseas Filipinos who would lose their jobs due to the pandemic.

But as the pandemic raged on, remittances proved to be resilient.

But as the pandemic raged on, remittances proved to be resilient.

By October, the World Bank reduced its forecast.

By October, the World Bank reduced its forecast.

“Remittance flows to low and middle-income countries (LMICs) are projected to fall by 7 percent, to $508 billion in 2020, followed by a further decline of 7.5 percent, to $470 billion in 2021. The foremost factors driving the decline in remittances include weak economic growth and employment levels in migrant-hosting countries, weak oil prices; and depreciation of the currencies of remittance-source countries against the US dollar,” the World Bank said.

“Remittance flows to low and middle-income countries (LMICs) are projected to fall by 7 percent, to $508 billion in 2020, followed by a further decline of 7.5 percent, to $470 billion in 2021. The foremost factors driving the decline in remittances include weak economic growth and employment levels in migrant-hosting countries, weak oil prices; and depreciation of the currencies of remittance-source countries against the US dollar,” the World Bank said.

The Bangko Sentral ng Pilipinas would also reduce its forecast, to a much lower contraction of 2 percent for 2020.

The Bangko Sentral ng Pilipinas would also reduce its forecast, to a much lower contraction of 2 percent for 2020.

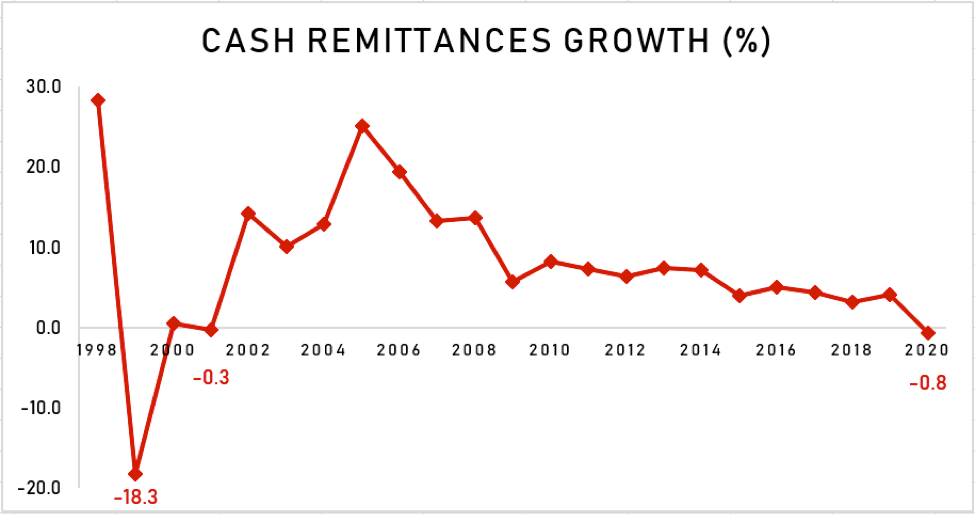

The actual numbers from the BSP for the full year showed all of the forecasts were overstated. Cash remittances from overseas Filipinos coursed through banks contracted by just 0.8 percent for the year.

The actual numbers from the BSP for the full year showed all of the forecasts were overstated. Cash remittances from overseas Filipinos coursed through banks contracted by just 0.8 percent for the year.

The 2020 contraction however was still the first since 2001. It was also the worst contraction in remittances since an 18.3 percent plunge in 1999. The trend line however shows remittance growth has been slowing since 2006, after an expansion of 25 percent the year before.

The 2020 contraction however was still the first since 2001. It was also the worst contraction in remittances since an 18.3 percent plunge in 1999. The trend line however shows remittance growth has been slowing since 2006, after an expansion of 25 percent the year before.

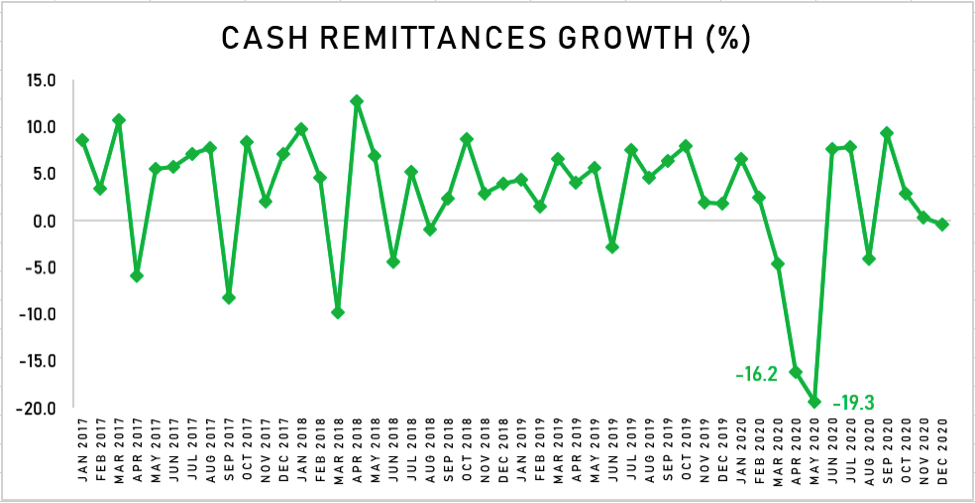

Monthly data going back to 2017 showed remittances are erratic, expanding robustly in certain months, before contracting sharply the next. These peaks and valleys are usually associated with the seasonal needs of an overseas Filipino family. Remittances tend to peak just before enrollment or the start of a school grading period. They also rise sharply ahead of holiday seasons. In 2020, remittances contracted as early as March, before cratering further by 16.2 percent in April, and 19.3 percent in May.

Monthly data going back to 2017 showed remittances are erratic, expanding robustly in certain months, before contracting sharply the next. These peaks and valleys are usually associated with the seasonal needs of an overseas Filipino family. Remittances tend to peak just before enrollment or the start of a school grading period. They also rise sharply ahead of holiday seasons. In 2020, remittances contracted as early as March, before cratering further by 16.2 percent in April, and 19.3 percent in May.

The BSP said many factors contributed to the sharp drop, including lack of access to remittance services due to lockdowns. Later on, retrenchment was added to the possible factors.

The BSP said many factors contributed to the sharp drop, including lack of access to remittance services due to lockdowns. Later on, retrenchment was added to the possible factors.

After the May drop, remittances considerably improved, managing growth in June and July. The growth was attributed by the central bank to pent up demand, as overseas Filipinos found new ways to send money home. Remittances then contracted again in August, before hitting its highest growth rate for 2020 in September. After that peak, remittances gradually declined, falling back into contraction by December.

After the May drop, remittances considerably improved, managing growth in June and July. The growth was attributed by the central bank to pent up demand, as overseas Filipinos found new ways to send money home. Remittances then contracted again in August, before hitting its highest growth rate for 2020 in September. After that peak, remittances gradually declined, falling back into contraction by December.

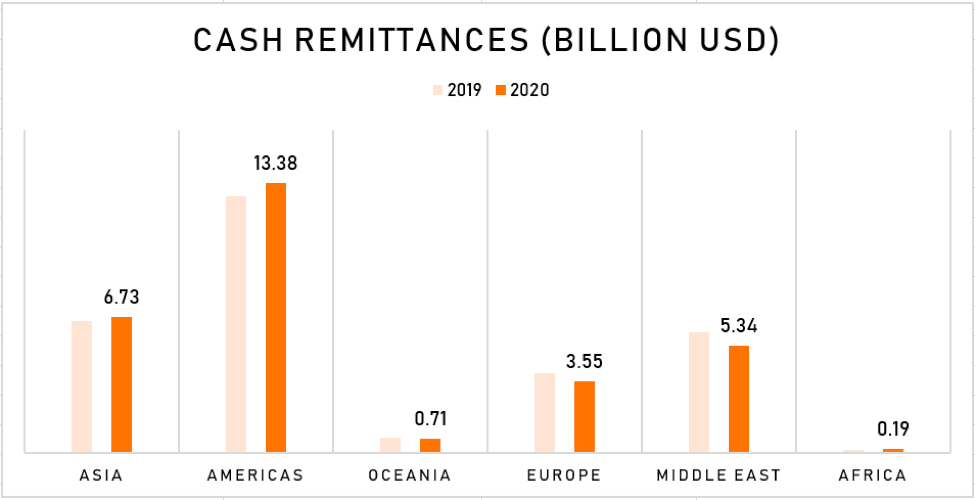

Cash remittances from Asia and America actually grew in 2020. Remittances from the Middle East, classified separately from Asia due to its significant contribution to remittances, declined for a third straight year.

Cash remittances from Asia and America actually grew in 2020. Remittances from the Middle East, classified separately from Asia due to its significant contribution to remittances, declined for a third straight year.

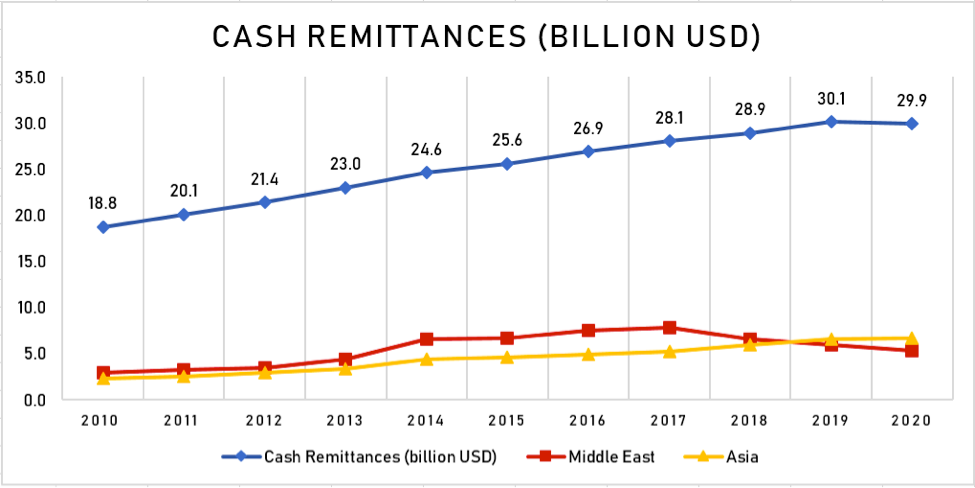

The trend in Middle East remittances has been attributed to multiple circumstances, including a long-running Saudization program aimed at giving more jobs to locals in the Kingdom of Saudi Arabia, and multiple geopolitical events that forced mass repatriation from different parts of the region.

The trend in Middle East remittances has been attributed to multiple circumstances, including a long-running Saudization program aimed at giving more jobs to locals in the Kingdom of Saudi Arabia, and multiple geopolitical events that forced mass repatriation from different parts of the region.

Cash remittances from Europe meanwhile declined for a second consecutive year. The rise of protectionism and public anger toward migrant workers over the last few years is one key factor affecting remittances from the continent. Brexit has also disrupted European supply chains, while changing the rules on who is allowed to work where.

Cash remittances from Europe meanwhile declined for a second consecutive year. The rise of protectionism and public anger toward migrant workers over the last few years is one key factor affecting remittances from the continent. Brexit has also disrupted European supply chains, while changing the rules on who is allowed to work where.

Remittances from both the Middle East and Europe contracted by double digits in 2020.

Remittances from both the Middle East and Europe contracted by double digits in 2020.

Asia, excluding the Middle East, now contributes more remittances to the Philippines than the Arabian Peninsula. Remittances from overseas Filipinos in the Middle East usually outperform the rest of Asia, and had in fact widened the gap from 2014 to 2017. The rest of Asia has caught up.

Asia, excluding the Middle East, now contributes more remittances to the Philippines than the Arabian Peninsula. Remittances from overseas Filipinos in the Middle East usually outperform the rest of Asia, and had in fact widened the gap from 2014 to 2017. The rest of Asia has caught up.

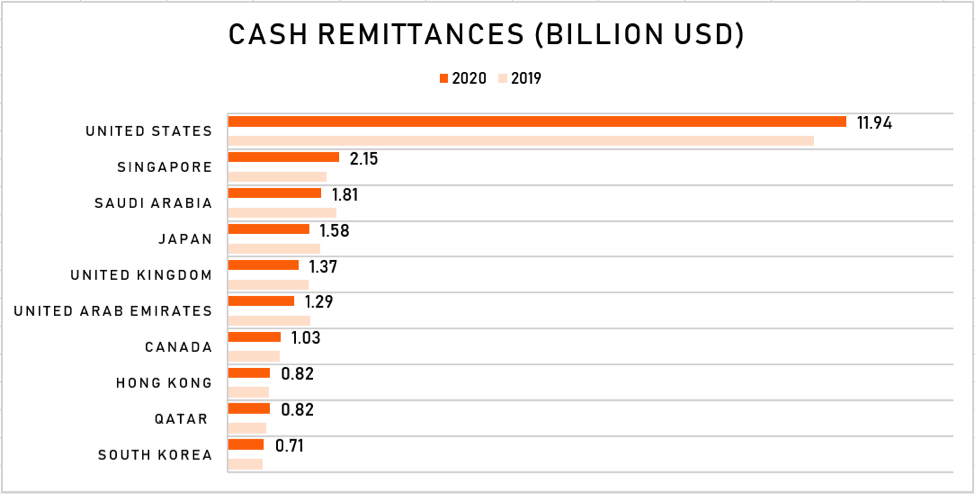

The dominant source of remittances for the Philippines has always been the United States. From that country alone, the Philippines received $11.94 billion in 2020. That is 5.5 percent higher year-on-year, and accounted for nearly 40 percent of the annual total.

The dominant source of remittances for the Philippines has always been the United States. From that country alone, the Philippines received $11.94 billion in 2020. That is 5.5 percent higher year-on-year, and accounted for nearly 40 percent of the annual total.

The data however can be misleading. A common practice of remittance centers in various cities abroad is to course remittances through correspondent banks, most of which are located in the US. Also, remittances coursed through money couriers cannot be disaggregated by actual country source, and are lodged under the country where the main offices are located, which in many cases is the US. All of this contributes to the large sums of remittances labeled US in the data.

The data however can be misleading. A common practice of remittance centers in various cities abroad is to course remittances through correspondent banks, most of which are located in the US. Also, remittances coursed through money couriers cannot be disaggregated by actual country source, and are lodged under the country where the main offices are located, which in many cases is the US. All of this contributes to the large sums of remittances labeled US in the data.

If the data is ever disaggregated and properly labeled, we might find that Asia is the number one source of remittances for the Philippines. Just adding up the remittances from Singapore, Saudi Arabia, Japan, the United Arab Emirates, Hong Kong, Qatar, and South Korea gives us a total of $9.17B in 2020. Those are just the Asian countries in the top 10 remittance sources for last year.

If the data is ever disaggregated and properly labeled, we might find that Asia is the number one source of remittances for the Philippines. Just adding up the remittances from Singapore, Saudi Arabia, Japan, the United Arab Emirates, Hong Kong, Qatar, and South Korea gives us a total of $9.17B in 2020. Those are just the Asian countries in the top 10 remittance sources for last year.

Some of the key contributors in Asia however are reeling. Remittances from Saudi Arabia, Japan, and the UAE all fell by double-digits in 2020.

Some of the key contributors in Asia however are reeling. Remittances from Saudi Arabia, Japan, and the UAE all fell by double-digits in 2020.

COVID-19 was the clear culprit in 2020, causing the first contraction in OF remittances in nearly two decades. But this lifeline of the Philippine economy is also afflicted with other problematic symptoms, such as geopolitical tensions and social upheaval in the Arabian Peninsula, and Europe.

COVID-19 was the clear culprit in 2020, causing the first contraction in OF remittances in nearly two decades. But this lifeline of the Philippine economy is also afflicted with other problematic symptoms, such as geopolitical tensions and social upheaval in the Arabian Peninsula, and Europe.

ADVERTISEMENT

ADVERTISEMENT