All fired up: Pinoy workers leading ASEAN neighbors in bid to retire early | ABS-CBN

ADVERTISEMENT

Welcome, Kapamilya! We use cookies to improve your browsing experience. Continuing to use this site means you agree to our use of cookies. Tell me more!

All fired up: Pinoy workers leading ASEAN neighbors in bid to retire early

All fired up: Pinoy workers leading ASEAN neighbors in bid to retire early

Who doesn’t want to retire early? Given the choice of working until you hit 65 or quitting work sooner because your savings are enough for your golden years, which would you go for?

Who doesn’t want to retire early? Given the choice of working until you hit 65 or quitting work sooner because your savings are enough for your golden years, which would you go for?

Milieu Insight, a Singapore-based consumer research and analytics company with presence across ASEAN including in the Philippines, recently ran a study to look into that small but growing number of people who would say a big yes to the second option.

Milieu Insight, a Singapore-based consumer research and analytics company with presence across ASEAN including in the Philippines, recently ran a study to look into that small but growing number of people who would say a big yes to the second option.

The firm creatively dubbed it the FIRE movement, and the acronym stands for Financial Independence, Retire Early. The survey was conducted in May 2022 with 1,500 employed respondents, aged 18-49 years old, from Thailand, Singapore, Malaysia, Indonesia, and the Philippines.

The firm creatively dubbed it the FIRE movement, and the acronym stands for Financial Independence, Retire Early. The survey was conducted in May 2022 with 1,500 employed respondents, aged 18-49 years old, from Thailand, Singapore, Malaysia, Indonesia, and the Philippines.

Pinoys want early retirement

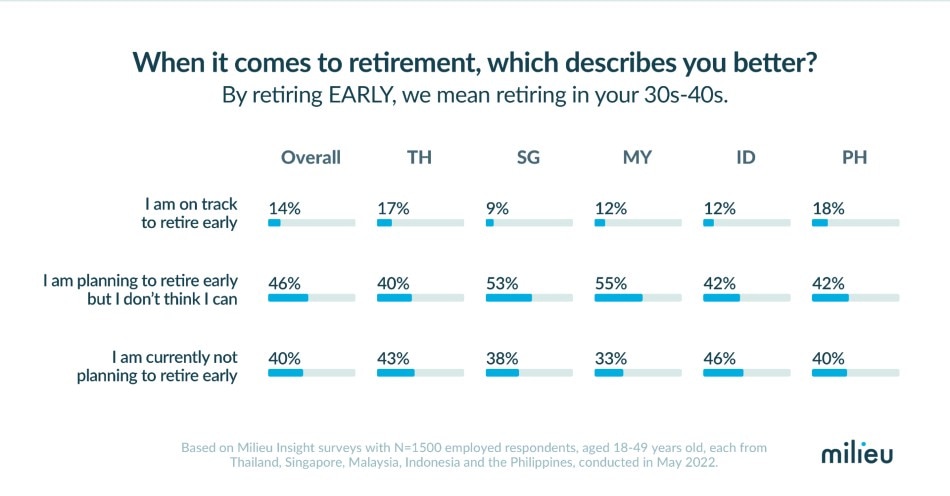

According to the survey, majority or 62 percent of the respondents expect to retire in their 50s or 60s. Among the five countries, Pinoy respondents ranked first (18%) when asked if they are on track to retire early, which the study defined as retiring in their 30s and 40s (now that’s early!).

According to the survey, majority or 62 percent of the respondents expect to retire in their 50s or 60s. Among the five countries, Pinoy respondents ranked first (18%) when asked if they are on track to retire early, which the study defined as retiring in their 30s and 40s (now that’s early!).

ADVERTISEMENT

Are you saving regularly to make it happen?

When asked what actions they are taking to make retirement happen in their 30s and 40s, Pinoy respondents trailed versus all four other countries at 62 percent when it comes to saving regularly. Singaporeans ranked first at 85 percent, followed by Malaysia (72 percent), Indonesia (70 percent) and Thailand (66 percent).

When asked what actions they are taking to make retirement happen in their 30s and 40s, Pinoy respondents trailed versus all four other countries at 62 percent when it comes to saving regularly. Singaporeans ranked first at 85 percent, followed by Malaysia (72 percent), Indonesia (70 percent) and Thailand (66 percent).

Do you have a financial plan?

To get from point A to point B, we all need a roadmap, and the same is true for financial planning. It’s important to set your goal and the means to make it happen so you can track your progress. Here, Malaysians lead with 66 percent having a financial plan, then Thailand at 64 percent, Indonesia at 59%, Philippines with 58 percent and finally Singapore at 54 percent.

To get from point A to point B, we all need a roadmap, and the same is true for financial planning. It’s important to set your goal and the means to make it happen so you can track your progress. Here, Malaysians lead with 66 percent having a financial plan, then Thailand at 64 percent, Indonesia at 59%, Philippines with 58 percent and finally Singapore at 54 percent.

Wise spending counts too

It’s not enough to save, one must also have the money smarts when it comes to spending. Put your needs over wants, and be on the lookout for deals that will get you the most value for your hard-earned money. Here, Pinoy are back at the bottom of the list with 53 percent, while Singaporeans are also back at the top with 74 percent. Malaysia is 2nd with 65 percent, Indonesia is 3rd with 64 percent and Thailand is 4th with 57 percent.

It’s not enough to save, one must also have the money smarts when it comes to spending. Put your needs over wants, and be on the lookout for deals that will get you the most value for your hard-earned money. Here, Pinoy are back at the bottom of the list with 53 percent, while Singaporeans are also back at the top with 74 percent. Malaysia is 2nd with 65 percent, Indonesia is 3rd with 64 percent and Thailand is 4th with 57 percent.

Time to upgrade from saving to investing

With interest rates well below inflation, the only way your money won’t lose its purchasing power is through wise investments. Singaporeans know this too well and they are top of the list at 69 percent. Pinoys are tied with Malaysians for 2nd place at 66 percent, followed by Indonesia at 59 percent and Thailand at 56 percent.

With interest rates well below inflation, the only way your money won’t lose its purchasing power is through wise investments. Singaporeans know this too well and they are top of the list at 69 percent. Pinoys are tied with Malaysians for 2nd place at 66 percent, followed by Indonesia at 59 percent and Thailand at 56 percent.

When quizzed on their investment products, the respondents provided a wide array of options including the more traditional ones such as investment funds, stocks, real estate and bonds. Quite a number also shared that they invest in Cryptocurreny and NFTs, luxury goods plus currencies/foreign exchange.

When quizzed on their investment products, the respondents provided a wide array of options including the more traditional ones such as investment funds, stocks, real estate and bonds. Quite a number also shared that they invest in Cryptocurreny and NFTs, luxury goods plus currencies/foreign exchange.

ADVERTISEMENT

Ready to get all FIRED up?

When asked how they feel about their FIRE journey, majority of the respondents shared they are very positive and somewhat positive towards achieving early retirement.

When asked how they feel about their FIRE journey, majority of the respondents shared they are very positive and somewhat positive towards achieving early retirement.

If we compare those who are on track to early retirement, and those who are planning to retire early but don’t think they are able to, the former scored themselves as feeling more positively.

If we compare those who are on track to early retirement, and those who are planning to retire early but don’t think they are able to, the former scored themselves as feeling more positively.

Whether you are ready to embrace FIRE, or have a different financial goal in mind, the study underlines the importance of having a goal and taking action steps to make that goal happen. FIRE is not an impossible mountain to climb, in case you are feeling intimidated by having enough savings in your 30s or 40s to retire. FIRE is essentially about aggressively tightening belts, and finding multiple sources of income in order to achieve early financial freedom. Put that way, who can say no?

Whether you are ready to embrace FIRE, or have a different financial goal in mind, the study underlines the importance of having a goal and taking action steps to make that goal happen. FIRE is not an impossible mountain to climb, in case you are feeling intimidated by having enough savings in your 30s or 40s to retire. FIRE is essentially about aggressively tightening belts, and finding multiple sources of income in order to achieve early financial freedom. Put that way, who can say no?

RELATED VIDEO

RELATED VIDEO

Read More:

retirement

early retirement

personal finance

Aneth Ng Lim

Paying It Forward

featured blog

blogroll

ADVERTISEMENT

ADVERTISEMENT