How to diversify your investment portfolio | ABS-CBN

Welcome, Kapamilya! We use cookies to improve your browsing experience. Continuing to use this site means you agree to our use of cookies. Tell me more!

How to diversify your investment portfolio

How to diversify your investment portfolio

AIA Philam Life

Published Feb 09, 2021 10:04 AM PHT

A year of trials and fears has just passed and this crisis has put the spotlight on people's financial capabilities and plans.

A year of trials and fears has just passed and this crisis has put the spotlight on people's financial capabilities and plans.

Are your savings secure? Have you gotten insured? Are your investments enough?

Are your savings secure? Have you gotten insured? Are your investments enough?

Surprisingly, instead of being more conservative with their funds, experts saw more people start to invest actively in the last 12 months and they are becoming more aggressive in looking for ways to diversify.1

Surprisingly, instead of being more conservative with their funds, experts saw more people start to invest actively in the last 12 months and they are becoming more aggressive in looking for ways to diversify.1

ANC On The Money's Salve Duplito, Head of Funds for AIA Investment Management Shrikant Bhat, and AIA Philam Life Chief Investment Officer Arleen Guevara brought this topic to light and discussed the investment outlook for 2021 and the diversification options available to Filipinos.

ANC On The Money's Salve Duplito, Head of Funds for AIA Investment Management Shrikant Bhat, and AIA Philam Life Chief Investment Officer Arleen Guevara brought this topic to light and discussed the investment outlook for 2021 and the diversification options available to Filipinos.

ADVERTISEMENT

Investment Landscape for 2021

"During this time, we see that our investors are becoming more discerning and savvier and that is why they really want to look for opportunities to maximize their returns," said AIA Philam Life Chief Investment Officer Arleen Guevara. "And if you will look at what the trend has been, we have seen a very significant downtrend in interest rates, right? So, how do you enhance your returns? I think really the way forward is to go long-term so that we can maximize returns."

"During this time, we see that our investors are becoming more discerning and savvier and that is why they really want to look for opportunities to maximize their returns," said AIA Philam Life Chief Investment Officer Arleen Guevara. "And if you will look at what the trend has been, we have seen a very significant downtrend in interest rates, right? So, how do you enhance your returns? I think really the way forward is to go long-term so that we can maximize returns."

Philippine investors are commonly looking at their long-term needs such as working towards retirement, setting aside funds for the education of their children, or leaving a legacy for the next generation. All these goals include setting their sights on long-term gains instead of quick fixes with low returns.

Philippine investors are commonly looking at their long-term needs such as working towards retirement, setting aside funds for the education of their children, or leaving a legacy for the next generation. All these goals include setting their sights on long-term gains instead of quick fixes with low returns.

On the global stage, fund managers are anticipating industries that declined due to the health situation to catch up with "Covid-19 winners", firms that have done well last year like e-commerce.

On the global stage, fund managers are anticipating industries that declined due to the health situation to catch up with "Covid-19 winners", firms that have done well last year like e-commerce.

Because of this, experts are seeing more curiosity on global investments due to the long-term benefits it can bring.

Because of this, experts are seeing more curiosity on global investments due to the long-term benefits it can bring.

Diversifying your Investments

Especially if you are one who puts importance on long-term investments, the global market is something you may want to look into.

Especially if you are one who puts importance on long-term investments, the global market is something you may want to look into.

ADVERTISEMENT

Diversifying your investments allows you to take advantage of sectors that may not be locally available. When you dip into global markets, you have a wider option to choose from, with varied assets and geography, as well as bigger risk mitigation.

Diversifying your investments allows you to take advantage of sectors that may not be locally available. When you dip into global markets, you have a wider option to choose from, with varied assets and geography, as well as bigger risk mitigation.

The question now is, how do you go about investing in these global markets if you are based in the Philippines?

The question now is, how do you go about investing in these global markets if you are based in the Philippines?

''Whilst the easiest way is to just buy some global stocks or just invest in a global mutual fund, one has to understand the pitfalls with such an approach. One has to understand one's investment profile, investment risk appetite, their investment objectives, and their time horizon. And when these are taken into account and that one is deliberate about combining investment strategies into a long-term approach, the common pitfalls can be avoided to get the maximum benefits when investing globally,'' said Shrikant Bhat, Head of Funds for AIA Investment Management.

''Whilst the easiest way is to just buy some global stocks or just invest in a global mutual fund, one has to understand the pitfalls with such an approach. One has to understand one's investment profile, investment risk appetite, their investment objectives, and their time horizon. And when these are taken into account and that one is deliberate about combining investment strategies into a long-term approach, the common pitfalls can be avoided to get the maximum benefits when investing globally,'' said Shrikant Bhat, Head of Funds for AIA Investment Management.

Pros and Cons of a Global Investment Strategy

Unlike before, Filipinos now have more avenues of investing in global opportunities and there are plenty of reasons why this can be beneficial.

Unlike before, Filipinos now have more avenues of investing in global opportunities and there are plenty of reasons why this can be beneficial.

Investing globally will give you the benefit of tapping into international funds that access global trends such as digitalization, advances in medicine, and innovative technologies that may not be available in local markets.

Investing globally will give you the benefit of tapping into international funds that access global trends such as digitalization, advances in medicine, and innovative technologies that may not be available in local markets.

ADVERTISEMENT

Bhat mentions that this not only diversifies your investment but also the risk. ''So, normally you are exposed to the local Equity Market risk concentration, but by being able to allocate across asset classes and regions, you are able to diversify your risk and hence, by definition, improve your returns.''

Bhat mentions that this not only diversifies your investment but also the risk. ''So, normally you are exposed to the local Equity Market risk concentration, but by being able to allocate across asset classes and regions, you are able to diversify your risk and hence, by definition, improve your returns.''

There is also the fact that you get access to high-quality asset managers who have years of international experience under their belt.

There is also the fact that you get access to high-quality asset managers who have years of international experience under their belt.

All these are great for people looking for long-term investments or those investing in stocks or companies that are in for the long haul and are not reliant on get-rich-quick schemes. But for Filipinos who still have a penchant for short-term deposits and fear going outside the country, there may be some hesitation.

All these are great for people looking for long-term investments or those investing in stocks or companies that are in for the long haul and are not reliant on get-rich-quick schemes. But for Filipinos who still have a penchant for short-term deposits and fear going outside the country, there may be some hesitation.

It all comes down to knowing your time horizon, where your interests and risks lie, and having a reliable partner that can guide you through this new territory.

It all comes down to knowing your time horizon, where your interests and risks lie, and having a reliable partner that can guide you through this new territory.

Global Opportunities with AIA Investment Management

Seeing these changes and opportunities, AIA Philam Life, in partnership with AIA Investment Management, expanded its product offerings to provide a new avenue for the long-term savings needs of its customers.

Seeing these changes and opportunities, AIA Philam Life, in partnership with AIA Investment Management, expanded its product offerings to provide a new avenue for the long-term savings needs of its customers.

ADVERTISEMENT

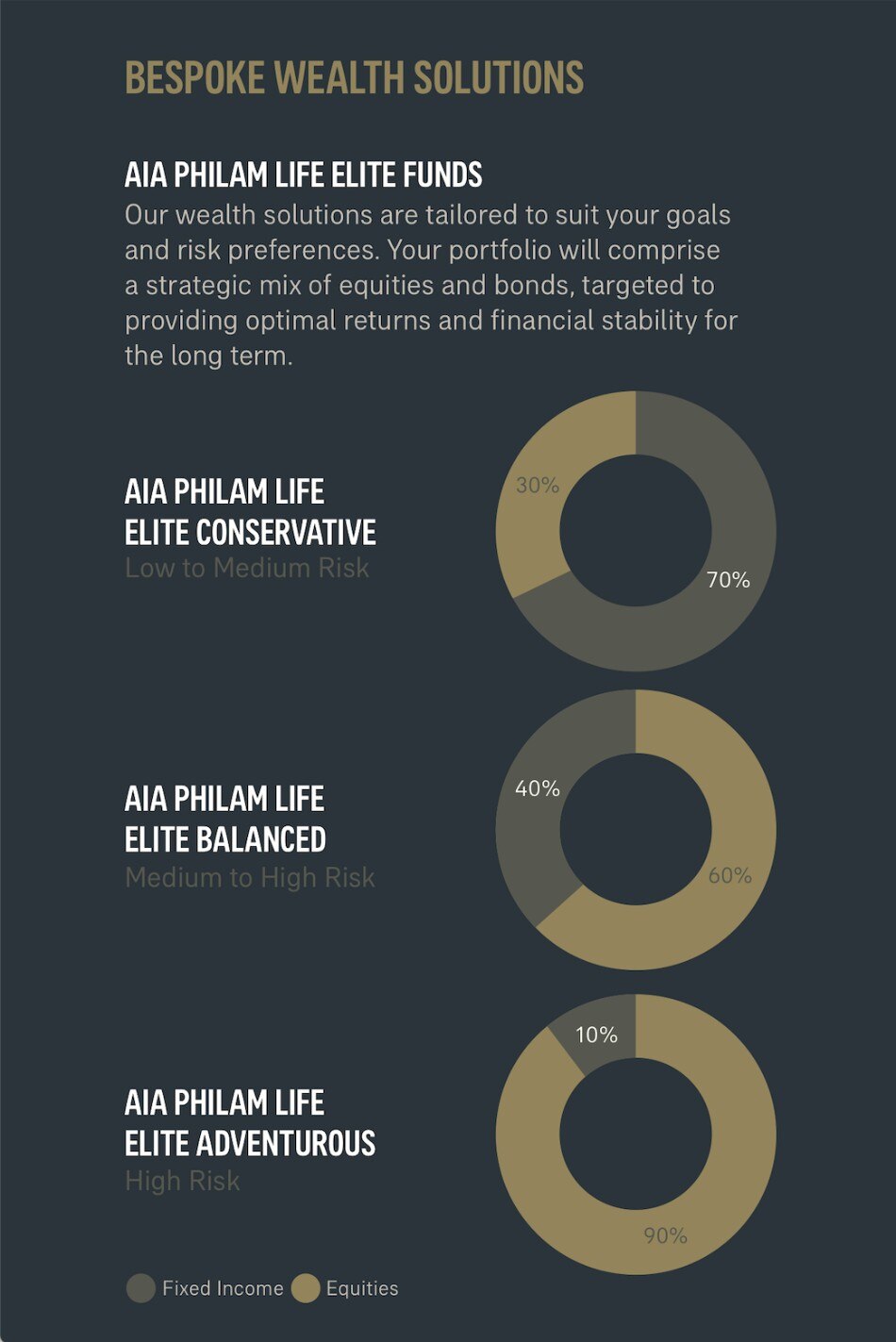

''We have come up with three funds, what we call our Elite Funds, and we customized these funds according to the needs and the risk profile of our policyholders. Through these, they can access global markets and really take advantage of funds that will be managed by globally reputable investment managers,'' said Guevara.

''We have come up with three funds, what we call our Elite Funds, and we customized these funds according to the needs and the risk profile of our policyholders. Through these, they can access global markets and really take advantage of funds that will be managed by globally reputable investment managers,'' said Guevara.

The Elite Funds come in three variants - adventurous, balanced, and conservative – catering to the different needs of customers according to their risk profiles. These are already available through AIA Philam Life's existing products, Family Provider and Moneyworks, and policyholders only need to talk to their financial advisors to learn more about them.

The Elite Funds come in three variants - adventurous, balanced, and conservative – catering to the different needs of customers according to their risk profiles. These are already available through AIA Philam Life's existing products, Family Provider and Moneyworks, and policyholders only need to talk to their financial advisors to learn more about them.

As compared to doing everything on your own, partnering with AIA will allow you to reap all those benefits while mitigating risks and market fluctuations. A professional manager will manage your portfolio, helping you achieve your financial goals with professional oversight, without you having to constantly monitor overseas markets.

As compared to doing everything on your own, partnering with AIA will allow you to reap all those benefits while mitigating risks and market fluctuations. A professional manager will manage your portfolio, helping you achieve your financial goals with professional oversight, without you having to constantly monitor overseas markets.

AIA Investment Management has partnered with elite global fund managers such as BlackRock, Wellington Management, and Baillie Gifford, each of whom has their own expertise and investment styles driven by a shared philosophy of investing for the long-term.

AIA Investment Management has partnered with elite global fund managers such as BlackRock, Wellington Management, and Baillie Gifford, each of whom has their own expertise and investment styles driven by a shared philosophy of investing for the long-term.

With these partners, AIA Philam Life can combine all of these strategies and tailor-fit portfolios to meet the requirements of its customers and maximize long-term returns.

With these partners, AIA Philam Life can combine all of these strategies and tailor-fit portfolios to meet the requirements of its customers and maximize long-term returns.

ADVERTISEMENT

All these opportunities look promising, but Guevara also reminds Filipinos to first look at their current needs. Especially for those just starting, the first thing you have to prioritize is securing what you have with the help of protection solutions like life insurance plans. There is no pressure to suddenly jump into big investments, but once you have a stable income and sizable savings, you may then want to consider long-term savings.

All these opportunities look promising, but Guevara also reminds Filipinos to first look at their current needs. Especially for those just starting, the first thing you have to prioritize is securing what you have with the help of protection solutions like life insurance plans. There is no pressure to suddenly jump into big investments, but once you have a stable income and sizable savings, you may then want to consider long-term savings.

Investing in global funds or diversifying your investments is one way to increase your returns, minimize risks, and meet long-term financial goals, so you are prepared for whatever the future may bring.

Investing in global funds or diversifying your investments is one way to increase your returns, minimize risks, and meet long-term financial goals, so you are prepared for whatever the future may bring.

1.More Pinoys Seen Investing in Stock Amid Pandemic, 3 IPOs Eyed this Year. ABS-CBN News. Published January 14, 2021.

ADVERTISEMENT

ADVERTISEMENT